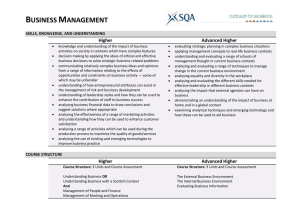

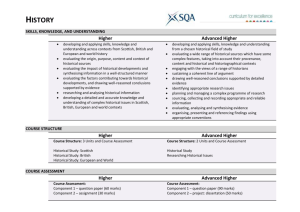

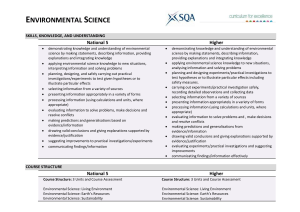

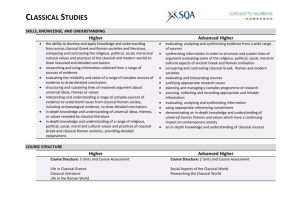

Skills, Knowledge, and Understanding

advertisement

ACCOUNTING SKILLS, KNOWLEDGE, AND UNDERSTANDING Higher using a variety of cost accounting techniques to facilitate decisionmaking in both manufacturing and service related organisations recording, presenting and interpreting complex accounting information to determine business profits and costs using ICT to produce and communicate accounting information in a range of contexts analysing and evaluating a range of accounting procedures which may be used within cost and management accounting analysing complex financial and management accounting information, including drawing conclusions and suggesting solutions where appropriate calculating and interpreting an extensive range of accounting ratios knowledge and understanding of the accounting theory covering partnerships and public limited companies applying and relating the knowledge and understanding of fundamental accounting concepts and theories to a range of accounting layouts Advanced Higher applying knowledge of the accounting regulatory framework applying knowledge of the regulatory framework to produce and analyse income statements, balance sheets and cash flow statements (with associated disclosure notes) for external publication producing consolidated accounting information for multiple company entities demonstrating knowledge and understanding of the accountant’s role in meeting organisational goals, including profit maximisation and social responsibility using management accounting information to produce a range of budgets to aid internal planning applying a wide range of complex cost accounting techniques to help control business performance producing management accounting information to facilitate business decision making using ICT to produce and communicate accounting information in a range of familiar and unfamiliar contexts COURSE STRUCTURE Higher Course Structure: 3 Units and Course Assessment Preparing Financial Accounting Information Preparing Management Accounting Information Analysing Accounting Information Advanced Higher Course Structure: 2 Units and Course Assessment Financial Accounting Management Accounting COURSE ASSESSMENT Higher Advanced Higher Course Assessment: Component 1 – question paper (100 marks) Component 2 – assignment (50 marks) Course Assessment: Component 1 – question paper (140 marks) Component 2 – project (60 marks) Question Paper Question Paper The question paper has two Sections. The question paper has two Sections. Section 1 will have 40 marks and will consist of one mandatory question. Section 2 will have 60 marks and will consist of three mandatory questions. Questions from each section will be sampled from the mandatory Course coverage and will ensure there is no duplication of content and that there is a balanced coverage across the Units. Section 1 (120 marks) will consist of mandatory questions sampled from a full range of mandatory Course coverage. The question paper will be set and marked by SQA and conducted in centres under conditions specified for external examinations by SQA. Learners will complete this in two hours. The question paper will be set and marked by SQA and conducted in centres under conditions specified for external examinations by SQA. Learners will complete this in 2 hours and 30 minutes. Project Assignment The assignment will require learners to demonstrate skills of research, analysis, decision making, use of ICT in an accounting context and application of knowledge and understanding by: researching and selecting appropriate data making appropriate use of spreadsheets and word processing to complete the assignment completing calculations with accuracy comparing and analysing a range of accounting information making decisions based on the analysis preparing a report outlining reasons for the decisions taken The assignment is set by SQA on an annual basis and conducted under some supervision and control. Evidence will be submitted to SQA for external marking. Section 2 (20 marks) will have two optional questions sampled from a full range of mandatory Course coverage. Assessment of underpinning accounting knowledge and understanding will permeate the question paper. The purpose of this project is to allow learners to demonstrate challenge and application. The project will provide learners with an opportunity to investigate and report on a UK-based public limited company, and the disclosure of accounting information, using knowledge of the accounting regulatory framework. The project will require learners to demonstrate skills of research, analysis, report writing and application of knowledge and understanding. The project is set by SQA and conducted under some supervision and control. Evidence will be submitted to SQA for external marking.