Co-operatives and Capital - Co-operative Education Trust Scotland

advertisement

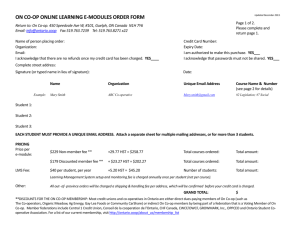

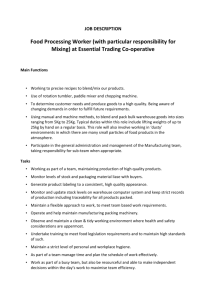

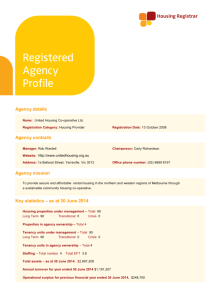

Co-operatives and Capital: A Love/Hate Relationship Diarmuid McDonnell Co-operative Education Trust Scotland 06/03/2013 diarmuid@cets.coop Outline 1. 2. 3. 4. 5. 6. What is a co-operative? Relationship between labour and capital How do you establish a co-op? What are their capital requirements? Case studies Conclusion/Discussion Qs Introduction Despite the wide-ranging successes of cooperatives, in financial terms as well as in the development of sustainable communities, the study of these democratic forms of enterprise remains surprisingly absent from the curricula of most university business schools around the world. The Invisible Giant Co-ops defined Co-operatives are businesses • Member-owned • Democratically controlled • Distribute surplus to members Purpose is not profit maximisation; they serve the needs of members. However, the do generate a surplus. Members Why become a member? It’s about achieving self-interest in a collective manner A group of individuals have a common need that is not being met Types of co-op Typical types: Sectors: 1. Consumer Finance Insurance 2. Producer Agriculture Retail 3. Worker Housing Education Creative ....and pretty much every other you can think of! Co-operatives globally (1) Source: ‘Statistical Information on the Co-operative Movement’ ICA. http://www.ica.coop/coop/statistics.html, accessed 29 September 2011. Co-operatives globally (2) The UK co-operative sector (1) No. of co-operative businesses in the UK: 5,450 No. of members: 12.8m Turnover of co-operatives: No. of people operatives: employed £32.2bn by co- 236,000 Source: Co-operatives UK. The UK co-operative economy 2011: Britain’s return to cooperation (Manchester: Co-operatives UK), 2011. The UK co-operative sector (2) Source: Co-operatives UK. The UK co-operative economy 2012: Alternatives to austerity (Manchester: Co-operatives UK, 2012.) p. 15. The UK co-operative sector (3) Source: Co-operatives UK. The UK co-operative economy 2012: Alternatives to austerity (Manchester: Co-operatives UK, 2012.) p. 13. Value-driven Co-op Values Solidarity Equity Equality Democracy Self-help Self-responsibility Ethical Values Openness Honesty Social responsibility Caring for others BUT... Google, Tesco and Barclays have values as well... Values in action 1. 2. 3. 4. 5. 6. 7. Co-op Principles Voluntary and open membership Democratic member control Member economic participation Autonomy and independence Education, training and information Co-operation amongst co-operatives Concern for community All* co-ops subscribe to these principles – firm ethical foundation Odd one oot! Economic theory Status of Factors of Production Final Authority Tool Conventional Enterprise Capital Labour Worker Co-operative Enterprise Labour Capital Uses of co-op model Share resources Share risk Share reward Knowledge Buildings Capital Equipment Investment Costs Training New clients Work-life balance Share of a larger pie Example: sharing a studio, IT equipment/software Example: joint purchasing of raw materials, insurance policies Example: joint marketing/bidding for contracts Setting up a co-op 1. 2. 3. 4. 5. 6. 7. Shared purpose and objectives Ownership structure Democratic governance Distribution of surplus Membership Capital requirements Legal structure Example Business idea: marketing services for local SMEs Design elements In practice Shared purpose and objectives To allow members to access larger contracts Ownership structure Members will be the individual businesses and selfemployed marketing professionals Democratic governance Each member has one vote to elect the management committee Distribution of surplus 65% retained in business, 25% to members, 10% to charitable donations Membership The majority of members must be businesses/selfemployed and the majority of businesses/selfemployed must be workers Capital requirements Not a capital-intensive business so no need for shares Legal structure Company Limited by Guarantee Finance Co-operatives are heavily reliant on equity provided by members and loans/grants. It is possible to offer non-voting equity shares in the co-operative but is this attractive to investors, especially coupled with the limited return on capital (principle 3)? Mellor and others also argued that the unique financial challenges faced by worker cooperatives resulted in ‘a vicious circle where under capitalisation and lack of access to investment finance relegates them to a marginal existence’. Member equity is vital to the creation and sustainability of the worker co-operative. Implications for expansion and entrepreneurship Capital requirements Initial considerations Selecting the correct mix of finance will allow a co-operative to commence operations on a sustainable platform, prevent over-dependence on one source, and minimise the cost of capital to the business: • The legal structure of the business – can you issue shares?; • The requirements and provisos of the source of finance – do you distribute your profits?; • The amount of capital needed for starting up and maintaining operations (working capital) Capital requirements Source: McDonnell, D., E. Macknight, and H. Donnelly. Co-operative Entrepreneurship: Cooperate for growth. Glasgow: Co-operative Education Trust Scotland, 2012. p. 32. Capital requirements The role of shares in a co-operative A co-operative, depending on its legal structure, can issue one or more classes of shares: • Withdrawable shares (upper limit) • Transferable shares • Preference shares Capital requirements The attitude of banks towards co-ops/employee-owned businesses is not positive: • Unfavourable debt/equity ratio; • Seemingly obscure ownership and governance structure; • The risk of the co-op defaulting on the loan due to other concerns (satisfying members rather than capital). How does this chime with the calls to establish SME specific banks in the UK as well as worker co-op credit unions in the States? Case study 1 – John Lewis Partnership Became employee-owned in 2 stages: 1929 and 1950. Now has 81,000 employee-owners (‘partners’). The original owner gradually sold his shares to a trust, financed by profits. 100% of shares reside in trust which is run for the benefit of partners. Leverages its customer and partner base to raise external finance for projects; this is done through bond issues. http://s.coop/1fu5z Case study 2 – Woollard & Henry Employee-owned engineering business based in Aberdeenshire; manufacture of machinery for paper and paperboard production. Turnover £5m+ and 30+ employees. Succession crisis in 2001 when owners retired. Employee buyout. Utilised a hybrid model: 50% shares in a trust, 50% owned by external financier (Baxi Partnership). Now 100% owned by employees (most of shares in trust, some in employees hands regulated by internal market). http://s.coop/1fu6q Case study 3 – ESOP Employee Stock Ownership Plan US version of an Employee Benefit Trust (EBT). 1. Uses a trust to borrow money with which to purchase shares in the business. 2. The ESOP purchases shares from the owners. These shares are then assigned to individual employee accounts. 3. The debt is repaid via profit contributions from the business. http://s.coop/1fz2u Case study 4 – Bristol Energy Co-op Wave of new community co-operatives utilise share issues to raise finance. Bristol Energy Co-operative’s first community share issue in April 2012 exceeded all expectations and raised over £120,000 from more than 130 investors. Shareholders can invest anything between £50 and £20,000 http://s.coop/jkqm Case study 5 – New Leaf Co-op Recently established (2012) wholefoods worker co-operative in Edinburgh. Needed £40,000 to cover start-up costs. Mainly used community sources of finance (through loan stock offerings) as well as member equity. http://s.coop/1fz7g Get involved In higher/further education: • Join/set up a ‘vegbag’ scheme – http://s.coop/1f35f • Need books or other services? – http://s.coop/1f35j • Freshsight model – http://s.coop/1f35t In the ‘real world’: • Bank/save with a co-op – http://s.coop/8157; http://s.coop/1f36a • Shop with a co-op – http://s.coop/1f36b; http://s.coop/1f36h • Create your own employment – see any of the cases in this presentation! Conclusion Capital works for the benefit of members. Members must take financial responsibility for their coop (‘skin in the game’). Co-ops need to be creative when sourcing finance. Poorly understood by banks, investors, government, academia... Key message Further resources Co-operative Entrepreneurship – an ebook and VLE aimed at students/graduates containing information on how to set up a co-operative enterprise http://s.coop/1fz8v Simply Finance – an online resource by the UK’s trade body for co-operatives http://s.coop/3biv Co-operative and Community Finance – a significant source of funding for co-ops in the UK http://s.coop/23t2 Reading suggestions McDonnell, D., Macknight, E. and Donnelly, H. (2012) Democratic Enterprise: Ethical Business for the 21st Century, Glasgow: Co-operative Education Trust Scotland (see Chapters 5 & 6). Erdal, D. (2011) Beyond the Corporation: Humanity Working, London: The Bodley Head (see Part III). http://www.baxipartnership.co.uk; Discussion Qs 1. If everything I’ve said about co-ops is true and so great, why are there not more of them? 2. Why do traditional financial institutions take such a dim view of lending to co-ops/employee-owned businesses? 3. Why is democracy not widespread in corporations, but is nonetheless something we strive for in society (and for which people in some countries sacrifice their life)?