Vieri Ceriani

advertisement

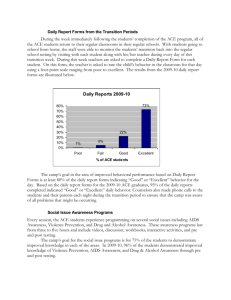

The Italian ACE Vieri Ceriani EC -IMF Conference “Corporate debt bias: Economic Insights and Policy Options” Bruxelles, 24th February 2015 The fiscal package 2012-2014 • December 2011: ACE introduced by the Monti government with the socalled Salva-Italia decree • In Salva–Italia decree tax relief both on capital through the ACE and on labour, increasing the deductibility of labour costs from the local business tax (IRAP) and from income taxes. Benefits financed with increases of consumption and wealth taxes • Measures included in the tax package were broadly in line with the growth-friendly policy recommendations by EU Commission, IMF, OECD i.e. “fiscal devaluation” • The ACE allows the deduction of a notional return on equity 1991) • It is aimed at fostering firms’ capitalisation through new equity capital and retained earnings, hence promoting investment and growth Aiuto alla Crescita Economica (Aid to Economic Growth). (see IFS ACE features/1 The Italian ACE has the following main features: • • • it is of the incremental type, i.e. the ACE base is equal to the flows of net increments to the equity capital existing at the end of 2010; it gives full relief of the notional return set by the Minister of finance considering the government bond rate; for the first three years a 3 percent rate was applied to the ACE base; the Stability Law for 2014 has increased the rate to 4 percent, 4,5 percent and 4,75 percent in 2014, 2015 and 2016 respectively; it can be deducted up to taxable income and excess can be carried forward indefinitely; since 2014, the excess can be transformed in tax credit to offset the local business tax (IRAP) • since 2014 new listed companies can multiply Ace base by a coefficient 1.4 for the first three years since the admission to regulated market • since 2014 incentive to go public by allowing new listed companies to multiply the ACE base by a coefficient equal to 1.4 for the first three years from the admission to the regulated markets. ACE features/2 • • • The ACE base is the algebraic result of some financial “flows”: positive components are the contributions in cash to the equity capital (for permanent establishments, the contributions to the endowment from the parent company) and the profits retained as reserves that can be distributed and /or used to cover losses; decreases of the ACE base are the distributions of profits or reserves from retained profits, in cash or in kind. All components of the ACE base are incremental with respect to the situation at the end of 2010. The ACE is therefore incremental and cumulative for corporations. For new resident companies (incorporated after 2010) the entire initial contribution to equity capital enters the ACE base; for permanent establishments, the initial endowment from the parent company is considered. The ACE deduction cannot exceed the taxable profit: hence, it cannot produce a fiscal loss. Anti-avoidance provisions • In order to avoid cascading effects and easy conversion of “old” capital into “new” capital, the ACE base is reduced for: contributions made to controlled companies; acquisitions of business (or part of a business) which belonged to group companies; increases of financial credit to companies of the same group. • Also contributions to the equity capital received by non resident entities controlled by resident entities are deducted from the Ace base, as well as contributions from entities resident in jurisdictions which do not allow an appropriate exchange of information. • The notion of group is very wide: it comprises indirect control and is not limited to corporations, but considers all relations between corporations, self-employed and partnerships. • The taxpayer may submit an advance ruling to the tax authority and request the disapplication of the anti-avoidance provisions. ACE vs DIT • ACE very similar to DIT, in force from 1997 and abolished in 2004 • The DIT also was of the incremental type, applied to all enterprises and had anti-avoidance provisions, alike the ACE. • Main difference is that under the DIT the notional return on equity was not fully deductible, but taxed at a reduced rate of 19 percent • Until 2000 the ordinary statutory rate of the corporate income tax was 37 percent, whereas since 2008 the rate is 27,5 percent. ACE Take-up Tax year 2011-2012 Legal forms Corporations n. of taxpayers (thousands) ACE beneficiaries (thousands) take-up rate 2011 2012 2011 2012 2011 1,097 1,097 205 239 2012 18.7% 21.8% Source: Department of Finance - Tax returns statistics Note: ACE beneficiaries include also the taxpayers which cannot immediately deduct the ACE due to net taxable income smaller than ACE deduction or due to tax losses. ACE 7 Corporation by revenues classes ACE take-up rate (tax year 2012) Tax year 2012 Revenue classes in euros ACE All corporations Beneficiaries Take-up rate Amount Up to 50,000 414,545 40,731 10% 425,339,423 From 50,000 to 100,000 91,213 17,714 19% 45,594,916 From 100,000 to 200,000 115,939 24,549 21% 66,698,790 From 200,000 to 500,000 164,157 38,693 24% 151,790,080 From 500,000 to 1,000,000 108,884 31,041 29% 122,518,004 From 1,000,000 to 5,000,000 146,952 55,052 37% 411,292,576 From 5,000,000 to 10,000,000 26,624 13,403 50% 225,093,327 From 10,000,000 to 25,000,000 17,190 10,073 59% 325,422,865 From 25,000,000 to 40,000,000 4,480 2,808 63% 165,102,636 From 40,000,000 to 50,000,000 1,453 943 65% 120,259,156 Over 50,000,000 5,994 3,905 65% 2,137,516,425 1,097,431 238,912 22% 4,196,628,198 TOTAL Source: Department of Finance - Tax returns statistics ACE 8 Revenue effects on CIT CIT base (millions) 2011 Corporations 148,604 2012 157,951 ACE amount (millions) Potential tax revenue loss (millions) 2011 2012 2011 1,829 4,197 503 2012 1,154 Potentiale rate reduction 2011 2012 0.34% 0.73% Source: Department of Finance - Tax returns statistics Note: potential tax revenue losses are calculated multiplying the ACE amount by the statutory tax rate (27,5%). The effective revenue losses depend on the possibility to deduct the whole ACE amount from taxable income. In 2011, about 30.000 corporations could not deduct the ACE for an amount of 300 million euros; in 2012, this amount raises to 1 billion euros. This would imply a 420 million euro loss in 2011, and almost 900 million euro in 2012, with a resulting effective reduction in the tax rate of 0.30 and 0.56 pp respectively. Tax revenue and tax rates effects 5-years effects long-run effects beneficiaries (%) 31.4 49.0 average tax rate 24.6 19.0 Rate reduction 2.9 8.5 tax rate reduction tax rate reduction tax rate reduction in 2012 after 5 years in the long run Turnover <1 1-500.000 500.000-2 mln 2-10 mln 10-50 mln >50 mln 2.2 1.7 1.1 1.0 0.8 0.6 6.3 5.9 4.2 3.4 3.0 1.9 9.0 9.9 8.0 7.6 8.1 8.8 Source: Caiumi et al. (2014) Note: 5- years simulation uses 2008-2012 tax years; long run simulation assumes the ACE applies to the entire capital stock. Cost of capital in Italy according to the source of funding Source: Caiumi et al. (2014) Note: Devereux-Griffith forward looking methodology. International comparisons – effective tax rates • Bilicka and Devereux (2012): based on 2012 legislation, Italy’s statutory rate at 30.3% (27th out of 33 countries), but EATR 18th (23 percent) and the EMTR ranks 1st, with a -10% rate. The negative value of the EMTR is mainly the effect of the ACE. • The overall EMTR is negative, implying a net tax subsidy for a marginal investment. • This is because the ACE base depends on retained earnings as measured by accounting rules rather than tax rules. This overcompensates the fact that the rate of return used in calculating the ACE is slightly lower than the risk-free interest rate. • Bilicka, Devereux and Maffini (2012) compare Italy and the UK. In 2011 the UK reduced the statutory tax rate from 28 to 26 percent, while Italy kept its rate at 27,5 percent (31 percent including IRAP) and introduced the ACE. • Although both reforms have reduced the cost of capital, the reduction in the tax rate does not correct the tax bias in favour of debt and against equity financing. • In the UK the reduction has been mainly on very profitable investment, while in Italy the firms that have benefited most are those with lower profitability. The Italian EATR is lower than the UK EATR for levels of profitability up to 25 percent, whilst the UK EATR is lower than the Italian for higher levels.