Weather Derivatives necessity, methods and application

advertisement

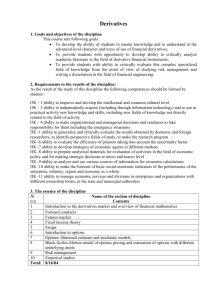

Weather Derivatives necessity, methods and application Reinhard Hagenbrock Seminar of the working group on Climate Dynamics Bonn, 16. Mai 2003 Outline • • • • • • “History” What is a ‘weather derivative’? Idealised example Market: players, -places and requirements Use of meteorology Summary and outlook “History” of weather derivatives • “risk management” of weather risks has always been part of insurance business – storms, crop failure, floods, ... – ‘accident’ caused by weather extremes is insured • starting point for weather derivatives: dependency of profit on ‘weather’ • approx. 20 % of business activities in western economies (partly) dependent on ‘weather’ “History” of weather derivatives • price risk – higher acquisition prices (e.g. for crop) – higher energy consumption – extra costs (e.g. for irrigation) • volume risk – in the production (e.g. agriculture) – in the sales (e.g. ice cream) “History” of weather derivatives • Price risks may generally be managed with options / long term contracts • “weather risk” generally is a volume risk, price risk should by managed independently “History” of weather derivatives • Starting of weather derivatives: dependency of energy sales on temperature “History” of weather derivatives • First weather derivative: Sep 1997 between two energy suppliers – aim: to balance electricity sales caused by temperature fluctuations in winter 1997/98 • concept seemed simple, benefit obvious • new, exotic derivatives dealt at Chicago Mercantile Exchange since Sep. 1999 What is a ‘weather derivative’? • ... “derivative financial instrument in which meteorological data - e.g. temperature - is used as a basis product” • Degree-Day – – – – Heating Degree Day HDD(t) = max(65°-T(t),0) Cooling Degree Day CDD(t) = min(T(t)-65°,0) usually summed up over a month/season sometimes: DD with other reference temperatures, average temperature What is a ‘weather derivative’? • Other indices: – precipitation • Indices are dealt like goods What is a ‘weather derivative’? • 70-80% of the weather derivative deals are ‘options’ – ‘Put’: pay at end of contract if index is small: P = T min((max(X-V),0),C) • • • • T: ‘tick size’ or ‘notional’, e.g. 100 $/HDD V: value of index at end of contract X: ‘strike’ of the option C: ‘cap-strike’: upper limit of pay – ‘Call’: counterpart to ‘Put’ What is a ‘weather derivative’? • ‘Swaps’: Interchange between Put and Call, no premium • more complex contracts: ‘Collars’, ‘spreads’ to chose appropriate chance/risk balance • other contracts – hybrid contracts – non-linear pay function – critical-day contracts What is a ‘weather derivative’? • Differences between weather insurance and weather derivative: – – – – – proof of damage no strict link between index value and damage trade with contracts in a secondary market standardised contracts differences in accounting and fiscal aspects What is a ‘weather derivative’? • Multitude of derivatives: – – – – – Location of measurement (USA: 10, Xelsius: 30) Type of asset (HDD, CDD, precipitation, …) Strike Time period Tick size Idealised example • Risk analysis: – Electricity Enterprises finds out: electricity sales drop by 400 MWh/day if temperature rises by 1°C – monthly loss: (31 400 18) = 223.200 € – ave. 1969-1998: HDD(Frankfurt) = 686.4 – in 18/30 years: HDD(Frankfurt) < 500 • Contract: – – – – Tick size: (400 18) = 7200 € Strike: 500 HDD Cap: 100 HDD 720.000 € premium: 120.000 € Idealised example • if winter is cold (HDD > 500) no payment • if winter moderately warm: option “in the money” • break even: 483.3 HDD • if winter is extremely warm: cap limits payment Market • Hedger: energy, agriculture, food and drink industry, building, tourism, ... management of exogenous risks • Risk taker: (re-)insurance companies, (investment) banks, energy suppliers, ... diversified portfolio, balance of risks Market • Market places: – Chicago Mercantile Exchange – London International Financial Futures and Options Exchange (LIFFE) – Eurex (Frankfurt) ‘xelsius.com’ Market • CME expects that the products are not dealt by end customers but by risk traders secondary market trader (online-) broker stock exchange (re-) insurance companies (investment-) banks Market • price model – Black/Scholes model, accepted for option prices, is not applicable – no other widely accepted price model premiums not transparent, may vary by a factor 10! possible hedgers are discouraged from entering the market – possible ‘widely accepted price model’ must reflect reality, otherwise market prices and economic cost of ‘weather’ differ Market • market needs to be ‘complete’ – “Any payoff vector [...] may be realised.” – number of traded derivatives matches at least the number of uncertainties (meteorological parameter, time period, place of measurement, ...) Use of meteorology • Listed under “problem fields”! • methods require an estimate on the variability of the weather ‘variable’ – generally taken from ‘historic data’ • pricing may depend on length of ‘historic times series’ • 30 years seem to be generally accepted – station data from national weather services is strictly preferred Use of meteorology • Problems like ‘heat islands’ or relocation of stations are known, data needs to be corrected • stationarity of the stochastic of the weather variable not generally given – higher confidence is given to more recent measurements Use of meteorology • Meteorological data needs to be of high quality, cheap and quickly/easily available Germany France Great Britain Netherlands Norway Sweden Spain USA Availability 6 6 9 8 9 9 6 9,5 Cost (ongoing Cost (historic data access) data) 7 4 8 7 9 6 9 6 9 9 7 5 10 10 10 10 Quality 6.-7. 9 9 8 7 7 5 9 Use of meteorology • Problem: connection between DD value and business performance is often only weak • profit dependent on economic factors – external: economic cycles, general social/economic changes, ... – internal: higher efficiency, new markets, ... Use of meteorology • HDD is a “bad” predictor for the predictand business performance • use of additional meteorological information reduces the amount of unexplained variance Unexplained variance: 42 % Unexplained variance: 61 % Use of meteorology • Disadvantage of using additional meteorological data (e.g. model output, objective analysis): number of control variables increases number of different ‘markets’ increases liquidity decreases • Generally no interest in more complex meteorological data than station values. • “Clash of Cultures” Use of meteorology • Specific market traders (e.g. re-insurance companies) may have special interest in more complex meteorological methods – would reduce risk, increase profit (especially, if market prices are based on less appropriate methods) – Methods include seasonal prediction and Monte Carlo modelling – !!!TOP SECRET!!! • Reduces possibility for a generally accepted pricing method Summary and Outlook • Weather derivatives: Measured weather is traded like goods • large market for business activities with a dependency on weather • Most common: HDD and CDD as integrals over period (month, season) • trade market established in Chicago in 1997, difficult start in London, stagnation in Frankfurt Summary and Outlook • Success of trading weather derivatives relies on the simplicity of the products • needed for liquidity of market and accepted pricing method • simple statistical use of plain ‘weather’ measurements hardly appropriate to reflect dependency on weather Summary and Outlook • Trade with weather derivatives in the USA connected with liberalisation of energy market and thus increased competition – need to manage risk of energy suppliers/traders – need to react to energy consumers needs • Energy market in Germany is only partly liberalised, competition is low – little need to compete for the consumers – relatively large regions make it possible to manage risk within the enterprise