PPP# 3 for Bonds

advertisement

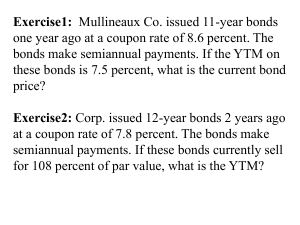

Financial Market Theory I: Rate of Returns on Bonds Dr. J. D. Han King’s College University of Western Ontario 1 1. What are Bonds? • Definition: Fixed Income Securities consist of bonds(debts secured with collaterals) and debentures(unsecured debts). • Examples: 1) Government Bonds: All Levels Treasury Bills Short-term, Medium Term, and Long-term Bonds 2) Corporate Bonds Commercial Papers Mortgage Backed Securities 2 • Coupon Rate: Nominal Interest Rate 2.Rate of Returns on Bond The most important concept of the rate of returns on bond is the Yield To Maturity or YTM: YTM is, “What is the annual average rate of return you will get if you hold the bond until it matures?” It is the ‘one’ ‘average’ ‘constant’ rate of return for this year, and the next year and so on, until the maturity time: Thus one YTM of multiple years contains not only 1) the financial market’s evaluation of the individual borrower’s risk characteristics, but also 2) the current financial market expectations of some relevant macro variables of the future (period up to the corresponding maturity time). 3 • One corollary is that when there is a revision of the financial market’s evaluation of the individual borrower’s risk, or/ad its expectations of future macroeconomic variables, there will be a change in YTM. 4 • The YTM of different terms at any given time is called the ‘Term Structure’. • Its graph is called ‘Yield Curve’. • If we see the changing Term Structure over time, then we may able to unravel the market expectations of the future macro variables. 5 So let’s get the YTM • Rate of returns on Bond come from Coupons as well as capital gains or loss. -“Fixed Income” may be a misnomer -What you see(Coupon) is not all that you get” 6 *YTM 1: Annual Payment of Coupons Face Value FV(100), Market Price MP(% to FV), Semiannual Coupon Payment C(%= coupon rate times 100), Maturity periods n (years), and Annual YTM r (in 0.0x): C 1 MP 1 r (1 r )n 1 FV (1 r )n 7 How have we got this formula? 8 *YTM 2: Semiannual Payment of Coupons Face Value FV(100), Market Price MP(% to FV), Semiannual Coupon Payment C/2(%), Maturity periods 2n (half years), and Annual YTM r(in 0.0x): 1 1 (1 r / 2) 2 n MP C / 2 r/2 1 FV (1 r / 2) 2 n 9 Approximation Formula to get YTM I directly Coupon Payment Annual Changes in Price Average Price Coupon Payment C(%) = coupon rate c(0.00) times FV(=100) Average Price = (FV + MP)/2; And Annual Changes in Prices = (F-MP) / n 10 FV MP C n FV MP 2 where FV = 100 at all times 11 *Example • suppose that newspaper on March 1, 2004 Issue ABC Co. Coupon Rate 10% Maturity Date Bid/Ask 1 March 08/09 92 Yield ? Yield to Maturity = (10 + 8/4) / 96 x 100 = 11.46% * ‘/09’ means that the bonds are extendable for a year. 12 Practice Question • Get the YTM of different terms of bonds n YTM(%) issued byC theMP(% Canadian government: to FV) 1 year - 97 2 years A 4% 100 3 years 5% 97 4 years 5% 94 5 years A 4% 90 5 years B 10% 116 10 years 8% 100 discount 13 Discount or Premium? • Market Price < Face Value: Discount • Market Price > Face Value: Premium 14 For one borrower, there is one equilibrium market interest rate i. For a market-determined/given r(YTM), depending on what Coupon Rate the borrower chooses, there might be discount or premium. • Discount(MP < FV) will happen when C < r • Premium(MP> FV) will happen when C> r : If he chooses the coupon rate which is higher than his YTM, then MP will be higher than the face value. So the bond will be sold at premium. Note that r is exogenously set for the borrower; and C and MP become endogenous. 15 Recall Approximation Formula for Yield to Maturity I FV MP1 FV MP2 C1 C2 n n r FV MP1 FV MP2 2 2 -FV = 100; -C1 and C2 should be in % terms; - i= only one YTM determined for the borrower in the financial market 16 Suppose that Borrower A has to pay 5% per annum on 5 year term in the financial market. -> This is the market equilibrium interest rate for this borrower or the YTM for a 5 year-term bond. Now it offers two different bonds of 5 year-term: Bond A with coupon rate 3%, and Bond B with the coupon rate =10%. Equilibrium in the financial market leads to the equalization of YTMs on these two bonds. This bond should have –5% on the capital gains so that the total effective rate of return = 5%. * Of course, all bonds command differing risk premiums, and thus the discount and premium vary for each bond. 17 Approximation Formula for Yield to Maturity I 100 MP1 100 MP2 3 10 5 5 0.05 100 MP1 100 MP2 2 2 MP1 should be less than 100 (Discount) MP2 should be more than 100 (Premium) *Only when the units of inputs are right, the formula works. 18 We find that • All other things being equal, the coupon rate and the market price of bond are positively related. However, the YTM does not change unless there is a change in borrowing terms or other characteristics. 19 Why do a borrower choose different coupon rates even for the same term? The answer is to manage the overtime features of cash flows (in from the funded/invested project and out from the interest payment) In the above case, from the viewpoint of the borrower’s cash flows, • Bond A has smaller interim interest rate/coupon payment compared to Bond B. • Bond A is suitable for financing a project which may take more time for completion and thus the returns from it come later: • The borrower does not have too high a burden of interest payment while there is no return from the project. eg) Raising funds for Highway toll road as opposed to Massive Hydro dam 20 Time Trends of Discount and Premium on Bond: they decrease as the maturity period come near. • Market Price 21 * Zeros (Zero Coupon Bonds) • Bonds which are stripped of coupons. • Zeros are all sold in the market below the face value: FV MP ; n (1 r ) 1 FV n r 1 P 22 Example) • Different Zero coupon bonds are sold as follows. Calculate the YTM or effective rate of return: (market price quote has been standardized as percentage to the face value) Maturity 1 year 2 year 3 year 4 year Market Price 96.62 92.45 87.63 83.06 YTM 23 Answers) • YTM1 = (100/96.62) -1 = 3.5 % • YTM2= r2= (100/92.45)1/2 -1 = 4.00% because 92.45 = 100/(1+r2)2 Maturity 1 year 2 year 3 year 4 year Market Price 96.62 92.45 87.63 83.06 YTM 3.5 4.00 4.50 4.75 24