Chapter #6 Solutions to Questions and Problems 1. The yield to

advertisement

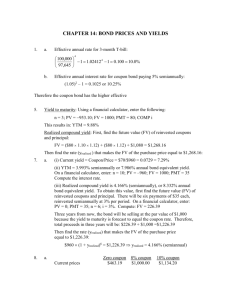

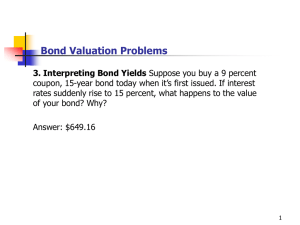

Chapter #6 Solutions to Questions and Problems 1. The yield to maturity is the required rate of return on a bond expressed as a nominal annual interest rate. For noncallable bonds, the yield to maturity and required rate of return are interchangeable terms. Unlike YTM and required return, the coupon rate is not a return used as the interest rate in bond cash flow valuation, but is a fixed percentage of par over the life of the bond used to set the coupon payment amount. For the example given, the coupon rate on the bond is still 10 percent, and the YTM is 8 percent. 2. Price and yield move in opposite directions; if interest rates rise, the price of the bond will fall. This is because the fixed coupon payments determined by the fixed coupon rate are not as valuable when interest rates rise–hence, the price of the bond decreases. 3. P = $1,052.06 4. P = $910.85 R = YTM = 9.52% Approximate YTM = .0941 or 9.41% 5. P = $1,086 C = $77.72 Coupon rate = .0772 or 7.72% 6. P = $1,040.95 7. P = $920 R = 4.42% YTM = 8.85% 8. P = $1,080 C = $43.60 Coupon rate = .0872 or 8.72% 9. Approximate r = .06 –.028 Approximate r =.032 or 3.20% Exact r = .0311 or 3.11% 10. R = .0858 or 8.58% 11. h = .0273 or 2.73% 12. r = .0821 or 8.21% 13. Bid price = $994.375 Previous day’s dollar price = $993.125 14. Current yield = .0517 or 5.17% Bid-Ask spread = 1/32 15. X: Y: P0 P1 P3 P8 P12 P13 P0 P1 P3 P8 P12 P13 = $1,177.05 = $1,167.68 = $1,147.20 = $1,084.25 = $1,018.87 = $1,000 = $841.92 = $849.28 = $865.80 = $920.15 = $981.48 = $1,000 16. PBill = $948.42 PTed = $815.98 ∆PBill% ∆PTed% = –5.16% = –18.40% If the YTM suddenly falls to 5 percent: PBill = $1,055.08 PTed = $1,251.03 ∆PBill% = +5.51% ∆PTed% = +25.10% 17. PJ = $879.06 PS = $1,241.88 PJ = $775.32 PS = $1,112.34 ∆PJ% = – 11.80% ∆PS% = – 10.43% If the YTM declines from 7 percent to 5 percent: PJ PS = $1,000.000 = $1,391.65 ∆PJ% = + 13.76% ∆PS% = + 12.06% 18. Current yield = 7.41% P0 = $1,080 R = 3.50% YTM = 7.00% Effective annual yield = 7.13% 20. Accrued interest = $12 And we calculate the clean price as: Clean price = Dirty price – Accrued interest Clean price = $1,108 21. Accrued interest = $72/2 × 3/6 Accrued interest = $18.00 And we calculate the dirty price as: Dirty price = Clean price + Accrued interest Dirty price = $883.00 25. Dollar price = $1,195.625 P = $1,195.625 R = 3.29% YTM = 6.59% 26. P = $671.15 Bid price = $670.52 28. P = $816.584 R = 4.76% YTM = 9.53% 29. P = $1,130.77 Current yield = .0743 or 7.43%