'Plane' - Prof. Dennis Pantin

advertisement

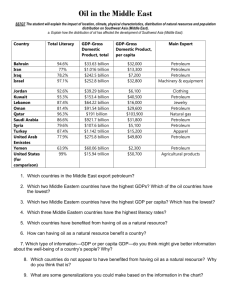

Challenges in managing the T&T Economic ‘Plane’ COTE Conference Dennis Pantin October 09, 2008 Content of Presentation What type of Economic ‘Plane’? Type of ‘Engine’ Type of ‘fuel’ ‘ Clear air Turbulence’ already at hand ‘Turbulence’ within ‘Turbulence’ down the road Proposals for managing turbulence/avoidance of another crash landing as in 1980s/early 1990s Type of ‘Engine’? 1. Oil Exports 2.Natural Gas Exports and their dominant role in Export earnings, Government Revenue, GDP How Dependant ? 4 Figure Hydrocarbon Exports as % of Total Exports 1981-2006 160.00 140.00 $billion TT 120.00 100.00 Total Exports Hydro-Carbon Exports 80.00 60.00 40.00 20.00 19 81 19 83 19 85 19 87 19 89 19 91 19 93 19 95 19 97 19 99 20 01 20 03 20 05 0.00 Source: Table A 3 Years How Dependant ? Figure 2 Hydrocarbon Share of Government Revenue 19812006 100 90 80 Hydrocarbon Rev.% Other Revenue% 70 60 % 50 40 30 20 10 0 1981 1984 1987 1990 1993 Y ear s Source: Appendix Table 2 1996 1999 2002 2005 Petroleum’s Contribution % ITEM 2002 2003 2004 2005 2006 r 2007p GDP 26.2 33.9 37.1 42.9 46.8 43.0 Gov’t Revenues 27.8r 42.8r 42.4r 53.6r 61.9 56..5 M’dise Exports 75.9 83.3 85.8 85.9 91.0 86.7 Employment 3.4 3.2 3.6 3.4 3.3 3.3 Notes: p- provisional , r – revised Source: Annual Economic Survey, 2006: www.central-bank.org.tt Growth in the Energy and Non Energy Sectors 35 30 per cent 25 20 15 10 5 0 2001 2002 Energy 2003 2004 2005 Non Energy Source: Central Statistical Office How Dependant ? Figure 1 Changes in Total GDP Energy and GDP 40 40 % change in GDP at Constant Prices % Change in BOE 30 20 20 10 10 % 30 0 -10 Source: Appendix Table A 1 years 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 0 -10 Types of ‘fuel’ 1. Foreign Direct Investment and behind this foreign technology and know how 2. Together with Foreign Demand and hence Prices How Dependant Figure 7 Oil Share of Foreign Direct Investment 140.00% 120.00% 100.00% % share 80.00% 60.00% 40.00% 20.00% 0.00% -20.00% -40.00% Years FDI Petroleum Industries Source: Appendix Table 4 FDI All other Industries Map of T&T Gas Market Nominal Oil Prices: 1986-2008 120 100 US$/bbl 80 60 40 20 0 86 87 88 89 90 91 92 93 94 95 96 97 98 99 0 Source: Appendix table 6 Years 1 2 3 4 5 6 7 8 Real Oil prices Real Oil Prices 1980-2008 ( 2006 dollars) 90.0 80.0 70.0 50.0 40.0 30.0 20.0 10.0 Source: US EIA. Annual Energy Outlook 08 Ye ars 20 07 20 04 20 01 19 98 19 95 19 92 19 89 19 86 19 83 0.0 19 80 US$/bbl. 60.0 Rising Gas Prices 12 Figure 6 US Natural Gas Prices 1994-08 ( Henry Hub) US$/MMbtu US$/MMbtu 10 8 6 4 2 0 94 95 96 97 98 99 Source: Table 6 0 1 Years 2 3 4 5 6 7 8 Methanol & Ammonia Prices 500 450 400 Ammonia Methanol 300 250 200 150 100 50 0 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 US$/Tonne 350 Years ‘Clear-air’ Turbulence US/Canada, Europe/OECD recession and with outside probability of a global depression as a result of: A. the US financial crisis and its spread effects internationally; B. Its coincidence with a US Pres. Elections and the role of partisan politics; C. Fact that ‘greed’ has long overwhelmed regulation Turbulence Within ‘Extremists’ on the ‘plane’ who threaten to ‘crash land’ it as a result of ‘Mr. Big’ and the drug lords and the impact of the space made available to them by : A. weaknesses in security system; And B. failure to fully grasp and treat as an emergency the underlying neglect of communities and groups which create the substrate for guns, gangs and a culture of violence and death Turbulence Ahead but on the ‘Radar’ Climate Change Ageing of the T&T Population exacerbated by impact of HIV-AIDs on working age population now and to come Decline in Reserves of Oil and natural Gas Inadequate National Savings in light of above projected forms of turbulence and End of this hydrocarbon boom Long Term Production Decline Figure 13 Crude Oil Production (000bbls/d) 250 "000 bbls/day 200 150 100 50 Source Table A8 Years 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 0 Oil Producers 2008 (YTD) Crude Oil Producers (2008 YTD) Others 10% Repsol 10% Petrotrin 44% BHP 17% BP 19% Refinery Output Figure 14 Refinery Product Slate ( 2006) Other 4% Fuel Oil 32% Gasoline 17% Reg Gasoline 7% Unf Gas/Ref Feed 6% Kerosene 11% Source: Petrotrin Gas Oil / Diesel 23% Petrotrin Sales Figure 15 Petrotrin's Sales By Channel 2006 In'national 31% Local 13% Caricom 31% Non Caricom Extra Regional 25% Souce: Petrotrin How Long? Figure 9 Crude Oil Proved Reserves and RTP ( 1976 - 2006) 1200 800 Proved Reserves 20 RTP Years 15 600 10 400 5 200 0 19 76 19 79 19 82 19 85 19 88 19 91 19 94 19 97 20 00 20 03 20 06 0 Years Source: Appendix Table 7 years MMbbls 1000 25 Natural Gas Demand History & Projections(1965-2016) 2000 Projected 1800 1600 1400 Bcf p.a. 1200 1000 800 600 400 Total Gas Production Total Consumption w /Lng Total Consumption w /o Lng 200 0 1959 1962 1965 1968 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 2016 Gas Reserves 1993 1996 2003 2007 Proven 8.2 12.3 20.76 17.05 Probable 4.6 3.7 8.12 7.76 Possible 1.1 2 5.85 6.23 Total 13.9 18 34.73 31.04 Source: http://www.ryderscott.com Gas .How Long? Figure 10 Natural Gas Proved Reserves and RTP (1976-2006) 300.0 25.00 20.00 200.0 15.00 150.0 10.00 100.0 5.00 50.0 RTP Years Proved Reserves TCF Source: Appendix Table 8 2006 2004 2002 2000 1998 Years 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 0.00 1976 0.0 TCF(Reserves) Years( RTP) 250.0 Oil and Gas RTP Compared 300 25 Gas RTP Oil RTP 15 150 10 100 5 50 Years( Time) 06 20 03 20 00 20 97 19 94 19 91 19 88 19 85 19 82 19 79 0 19 76 0 Oil Years ( RTP) 20 200 19 Gas Years( RTP) 250 Medium Term Demand Outlook Mmscfd Existing Projects 4000 New Projects( Inclusive of Train X) 1800 Total 6000 Do we have the resources to satisfy this level of demand over the next 20 years??? Gas Reserves discovery needed to maintain 12 year RTP Optimal Depletion Scenario 4 8000 27 7000 26.5 Total Demand 26 Reserves 5000 25.5 4000 25 3000 24.5 2000 24 1000 23.5 30 29 20 28 20 27 20 26 20 20 25 24 20 23 20 20 22 21 20 20 20 19 20 18 20 17 20 16 20 15 20 20 14 13 20 12 20 11 20 10 20 09 20 20 20 20 08 23 07 0 Years To maintain an RTP of say 12 years. The Optimistic Scenario requires reserves addition at rate of 2.27 TCF/yr to 2030. We need to find 50.6 TCF over the next 20 years!!!!!! TCF MMSCFD 6000 Inadequate Savings Year US $million Sept 2002 162.66 1015 Sept 2003 249.12 1566.9 Sept 2004 449.23 2830.2 Sept 2005 640.33 4034.1 Sept 2006 1354.13 8544.6 Sept2007 1,680.0 10,617.6 April 2008 1, 996 12,375.2 TT$ Million Top Ten Oil and Gas Funds Country Fund Name Assets US$ B Source Inception Year UAE-Abu Dhabi Abu Dhabi Investment Authority $875.5 Oil 1976 Norway Government Pension Fund-( Global) $396.5 Oil 1990 Saudi Arabia SAMA Foreign Holdings $365.2 Oil Kuwait Kuwait Investment Authority $264.4 Oil 1953 Russia National Wealth Fund* $162.5 Oil/ Gas 2008 Qatar Qatar Investment Authority $ 60 Oil/ Gas 2003 Libya Libyan Investment Authority $ 50 Oil / Gas 2006 Algeria Revenue Regulation Fund $47 Oil &Gas 2000 Alaska Alaska Permanent Fund $39.8 Oil 1976 Brunei Brunei Investment Agency 30.0 Oil 1983 Notes: *In 2008 Russia separated the National Wealth Fund from the Stabilization Fund. It is estimated that at the time of separation the asset value was around US$ 300 billion Source: Sovereign Wealth Institute www.swfinstitute.org Definitions in H&Stab Fund Petroleum revenues means the aggregate of the supplemental petroleum tax, petroleum profits tax and royalties collected under the Petroleum Taxes Act .IT DOES NOT INCLUDE UNEMPLOYMENT LEVY, THE OIL IMPOST AND SIGNATURE BONUSES Petroleum Business means the business of exploration for and the winning of petroleum and natural gas-IT DOES NOT INCLUDE THE LIQUEFACTION OF NATURAL GAS. Rules of Withdrawal Withdrawals may be made from the FUND when petroleum revenues collected in any financial year fall below the estimated petroleum revenues for that financial year by at least 10% Amount limited to – – 60% of the amount of shortfall of petroleum revenues for that year or 25% of the credit balance of the FUND. Rules of Withdrawal No withdrawals may be made from the Fund in any financial year where the balance standing to the credit of the Fund would fall below US$ one (1) billion if such withdrawal were made. Fund Update1 Board has approved an Investment Plan. – – – Short term investments- US/Treasury bills Longer term US Fixed income securities US./developed countries’ equities First Audited Report submitted to Minister and Parliament 1. Source: Governor Central Bank speech to Rotary Club of POS – May 8th 2008 . Proposals for Managing Turbulence Revision of oil price forecast to US $40-45. Multi-stakeholder Advisory Group drawn from business, labour, NGOs, the university together with Central Bank and public service technocracy with mandate to prepare ‘Turbulence’ preparedness plan; All party Committee to draw up consensus plan based on report of Advisory Group