Student HW Solutions Chap 3 Day 1

advertisement

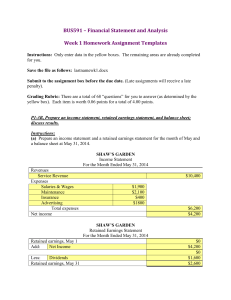

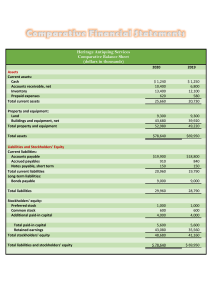

ANSWERS TO QUESTIONS 3. Accounting transactions are the economic events of the company recorded by accountants because they affect the basic accounting equation. (a) The death of a major stockholder of the company is not an accounting transaction as it does not affect the basic accounting equation. (b) Supplies purchased on account is an accounting transaction because it affects the basic accounting equation. (c) An employee being fired is not an accounting transaction as it does not affect the basic accounting equation. (d) Paying a cash dividend to stockholders is an accounting transaction as it does affect the basic accounting equation. SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 3-2 Cash (1) +$60,000 (2) –9,000 (3) +13,000 (4) Assets = Liabilities + Stockholders’ Equity Accounts Accounts Bonds Common Retained + Receivable + Supplies = Payable + Payable + Stock + Earnings +$60,000 –$9,000 –$13,000 +$3,100 +$3,100 Paid div. Assets = Liabilities + Stockholders’ Equity EXERCISE 3-3 SOLUTIONS TO EXERCISES Cash (1) +$100,000 (2) +45,000 (3) –60,000 (4) +16,000 Accounts + Receivable + Supplies + (9) Accounts Payable + Bonds Payable + Common Stock Retained Earnings + Revenues – Expenses – Dividends Issued Stock +$45,000 +$60,000 +$16,000 +$4,700 Service Revenue +$4,700 –5,200 (7) (8) = +$100,000 (5) (6) Equipment –$5,200 +$10,000 Rent Expense +10,000 –28,000 Service Revenue –28,000 Salaries and Wages Expense –11,000 $ 56,800 + –$11,000 $10,000 + $4,700 $131,500 + $60,000 $4,700 + $45,000 + $100,000 + +$26,000 – $131,500 $33,200 – $11,000 Dividends