Chapter 7--Learning Objectives

advertisement

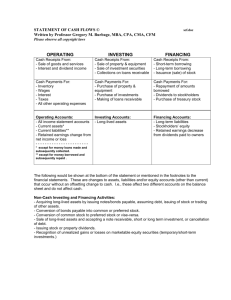

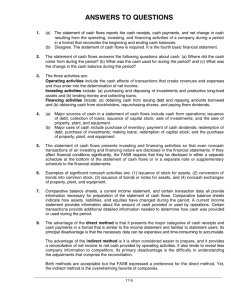

Chapter 7--Learning Objectives 1. Understand how the statement of cash flows assists users in evaluation of firm performance Current operating cash flows a major user need Current operating cash flows (COCF) is cash available from normal operations Current operating cash flows must be adequate for: 1. Permanent working capital 2. Seasonal working capital 3. Net fixed (and other long-term) assets 4. Repayment of debt principal & interest 5. Payment of dividends Permanent working capital a firm’s permanent investment in net operating asset receivables and inventory less the amount of this investment financed by trade creditors through accounts payable Seasonal working capital increases in inventory levels required by seasonally increased demands for the firm’s product or service Adequacy ratios The following ratios help assess the adequacy of COCF to meet firm needs: Capital acquisition ratio Debt coverage ratio Dividend coverage ratio Cash flow adequacy ratio Adequacy ratios (cont.) Capital Financing Reinvestment Cash-Interest Coverage Dividend Payout Performance and quality ratios Cash flow return on assets Cash flow return on common equity Quality of sales ratio Quality of income ratio (2) Cash flow per share Cash flow return on assets COCF before interest and taxes * Average total assets * inclusion of taxes varies in practice Cash flow return on common equity COCF - preferred dividends Average common equity Quality of sales ratio Cash from sales Sales Quality of income ratio # 1 Current operating cash flows Operating income Quality of income ratio # 2 C O C F before interest and taxes Income before interest, taxes & deprec. Cash flow per * share C O C F - preferred dividends Average number of common shares *explicitly prohibited from disclosure in annual report Chapter 7--Learning Objectives 2. Interpret the format and content of the statement of cash flows Statement of cash flows The purpose of the cash flow statement is to show the sources and uses of cash Where did the cash come from ? Where did it go ? Statement of cash flows The statement has three principal sections: 1. Operating activities 2. Investing activities 3. Financing activities And two ancillary sections 1. Noncash investing / financing 2. Reconciliation Statement of cash flows The statement can be prepared two ways 1. 2. The indirect method The direct method Operating activities Routine inflows and outflows from regular operations Net income used as a starting point in indirect method Net income must be adjusted for items which affect income but not cash and for noncash items Adjustments to net income in the operating section Items which affect income but not cash -- Depreciation and amortization Noncash items -- Changes in current asset accounts (except certain investments) -- Changes in current liability accounts Relationships to remember An increase in another asset account results in a decrease in cash ANOTHER ASSET UP -- CASH DOWN ANOTHER ASSET DOWN -- CASH UP Relationships to remember Similarly, a decrease in a liability account results in a decrease in cash LIABILITY DOWN -- CASH DOWN LIABILITY UP -- CASH UP Investing activities Investments in our own business Purchase of operational assets Sale of operational assets Investments in other businesses Purchase of securities Sale of securities Making loans to other entities Collecting such loans Financing activities Transactions involving owners Sale of stock Payment of dividends Treasury stock transactions Transactions involving creditors Borrowing long-term Repaying long-term debt Some special cases Purchase and sale of investments, whether short-term or long-term are INVESTING activities Dividends and interest received from investments are considered to be OPERATING activities More special cases Interest paid to creditors is considered to be an OPERATING activity Dividends paid to stockholders are considered to be a FINANCING activity Noncash investing and financing activities Transactions in which no cash is involved Example: Purchase of equipment with no down payment by issuing a long-term note payable The direct method Starts with cash received from customers Subtracts cash paid to Suppliers Employees Creditors (interest payments) Governments (taxes) Others (for operations) A separate reconciliation from net income to net cash flow from operating activities is required when the direct method is used The indirect method Begins with net income Adjusts for items which affect income but not cash and for noncash items Only the operating section is different between the indirect and direct methods The investing and financing sections are identical Chapter 7--Learning Objectives 3. Derive cash flow information analytically from accrual information Accrual based financial statements do not reveal cash received from customers or cash paid to suppliers We have to dig this information out for ourselves What do we know ? From the income statement, we know sales revenue From the balance sheet, we know beginning and ending accounts receivable These numbers can be used to work toward cash received from customers Cash received from customers Sales revenue Plus: Beginning accts. receivable Less: Ending accts. receivable Less: Accts. receivable written off Equals: Cash recd. from customers (Now how do we get accounts written off?) Account receivable write-offs Beginning Allow. for Bad Debts Plus: Bad Debt Expense Less: Ending Allow. for Bad Debts Equals: Accounts written off What about cash paid to suppliers ? Plus: Less: Equals Purchases Beginning Accts. Payable Ending Accts. Payable Cash paid to suppliers If necessary, Purchases is calculated Cost of Goods Sold Plus: Ending Inventory Less: Beginning Inventory Equals: Purchases Chapter 7--Learning Objectives 4. Differentiate between the direct and indirect method of presentation East-West Industries Statement of Cash Flows - Direct Method For the year ended June 30, 1995 Cash flows from operating activities Collections from customers $200,000 Payments to vendors (60,000) Payments to employees (40,000) Payments to creditors (20,000) Payments to utilities (20,000) Payments to governments (30,000) Cash flow from operations $30,000 East-West Industries Statement of Cash Flows - Direct Method (continued) Cash flows from investing activities Proceeds from sale of PP&E Proceeds from sale of land Proceeds from sale of patents Purchase of PP&E Purchase of land Purchase of intangibles Cash flow from investing 100,000 110,000 70,000 (200,000) ( 50,000) ( 20,000) 10,000 East-West Industries Statement of Cash Flows - Direct Method (continued) Cash flows from financing activities Sale of stock 30,000 Issuance of bonds 100,000 Repurchase of stock (90,000) Retirement of debt (10,000) Payment of dividends Cash flow from financing Net increase in cash Balance, June 30, 1994 Balance, June 30, 1995 (20,000) 10,000 50,000 120,000 170,000 Operating Section - Indirect Method Cash flows from operating activities Net income $97,000 Depreciation expense 48,000 Amortization of patents 4,000 Depletion of natural res. 6,000 Deferred income taxes 17,000 Noncash interest expense 19,000 Gain on sale of land (47,000) Loss on sale of PP&E 12,000 Gain on debt retirement (40,000) 19,000 Operating Section - Indirect Method-continued Cash flows from operating activities Gain on debt retirement (40,000) Decrease in accts. receivable Increase in AFBD Increase in inventory Decrease in accts. payable Decrease in wages payable Increase in utilities payable Net cash flow from operations 19,000 9,000 3,000 (60,000) (30,000) (12,000) 4,000 $30,000 Chapter 7--Learning Objectives 5. Prepare a statement of cash flows