Steps in Preparing Statement of Cash Flows

advertisement

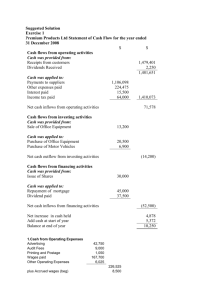

Chapter 12 ` 1 Chapter 12 Statement of Cash Flows After studying Chapter 12, you should be able to: Indicate the primary purpose of the statement of cash flows. Distinguish among operating, investing, and financing activities. Explain the impact of the product life cycle on a company's cash flows. Prepare a statement of cash flows using one of two approaches: (a) the indirect method, or (b) the direct method. 2 Use the statement of cash flows to evaluate a company. The Primary Purpose of the Statement of Cash Flows Is... To provide information about: cash receipts, cash payments, and the net change in cash resulting from: operating, investing, and financing activities of a company during a period. 3 Operating Activities... Include: The cash effects of transactions that create revenues and expenses and Enter into determination of net income. Involve Income Statement Items 4 Investing Activities... Include: Purchasing and disposing of investments and productive long-lived assets using cash and Lending money and collecting the loans. Involve Investments and Noncurrrent Asset Items 5 Financing Activities... Include: Obtaining cash from issuing debt and repaying the amounts borrowed and Obtaining cash from stockholders and paying dividends. Involve Noncurrent Liability and Stockholders’ Equity Items 6 Illustration 12-1 Types of Cash Flows Operating Activities Cash inflows: From sale of goods or services From interest on loans (interest received) and dividends on equity security investments Cash outflows: To suppliers for inventory To employees for services To government for taxes To lenders for interest To others for expenses 7 Illustration 12-1 Types of Cash Flows Investing Activities Cash inflows: From sale of property, plant, and equipment From sale of debt or equity securities of other entities From collection of principal on loans to other entities Cash outflows: To purchase property, plant, and equipment To purchase debt or equity securities of other entities To make loans to other entities 8 Illustration 12-1 Types of Cash Flows Financing Activities Cash inflows: From sale of equity securities (company's own stock) From issuance of debt (bonds and notes) Cash outflows: To stockholders as dividends To redeem long-term debt or reacquire capital stock 9 Operating Activities - ALERT Some cash flows relating to investing or financing activities are classified as operating activities. For example... Receipts of investment revenue (interest and dividends) and Payments of interest to lenders are classified as operating activities because these items are reported in the income statement. 10 Format of the Statement of Cash Flows Three activities: operating investing Body of Statement financing PLUS noncash investing and financing activities 11 Statement of Cash Flows Helps Users Evaluate 1. The entity's ability to generate future cash flows 2. The entity's ability to pay dividends and meet obligations 3. The reasons for the difference between net income and net cash provided (used) by operating activities 4. The investing and financing transactions during the period 12 COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31, 2003 Assets Cash Accounts receivable Equipment Total Liabilities and stockholders’ equity Accounts payable Common stock Retained earnings Total Dec. 31, Jan.1, 2003 2003 $34,000 $0 30,000 0 10,000 $74,000 Increase/Decrease $34,000 increase 30,000 increase 0 $0 10,000 increase $4,000 50,000 20,000 $0 0 0 $4,000 increase 50,000 increase 20,000 increase $74,000 $0 13 Income Statement and Additional Information COMPUTER SERVICES COMPANY Income Statement For the Year Ended December 31, 2003 Revenues Operating expenses Income before income taxes Income tax expense Net income $85,000 40,000 45,000 10,000 $35,000 Additional Information: (a) Examination of selected data indicates that a dividend of $15,000 was declared and paid during the year. (b) The equipment was purchased at the end of 2003. 14 No depreciation was taken in 2003. Indirect and Direct Methods Convert net income from an accrual basis to a cash basis. This conversion may be done by two methods: indirect direct 15 Indirect and Direct Methods Both methods arrive at the same total amount for “Net cash” provided by operating activities. The methods differ in disclosing the items that make up the total amount. The choice of methods affects only the operating activities section; the investing and financing activities sections are the same. 16 Indirect Method The indirect method is used extensively in practice. Most companies favor the indirect method for the following reasons: it is easier to prepare it focuses on the differences between net income and net cash flow from operating activities it tends to reveal less company information to competitors. 17 Direct Method The FASB prefers the direct method but allows the use of either method. When the direct method is used, the net cash flow from operating activities as computed using the indirect method must also be reported in a separate schedule. 18 Steps in Preparing Statement of Cash Flows $34,000 - 0 = $34,000 19 Statement Of Cash Flows Indirect Method The transactions of Computer Services Company for the year ended 2003 are used to illustrate the preparation of a statement of cash flows . Computer services Company started in January 1, 2003, when it issued 50,000 shares of $1 par value common stock for $50,000 cash. The company rented its office space and furniture and performed consulting services throughout the first year. 20 Steps in Preparing Statement of Cash Flows 21 Determine Net Cash Provided/Used By Operating Activities Adjust net income for items that did not affect cash. Net income must be converted because earned revenues may include credit sales that have not been collected in cash and expenses incurred that may not have been paid in cash. 22 Determine Net Cash Provided/Used By Operating Activities Receivables, payables, prepayments, and inventories must be analyzed for their effects on cash. 23 Determine Net Cash Provided/Used By Operating Activities Computer Services Company had revenues of $85,000 in its first year of operations. However, CSC collected only $55,000 in cash. Accrual basis revenue was $85,000, cash basis revenue would be $55,000. The increase in accounts receivable of $30,000 must be deducted from net income. If accounts receivable decrease, the decrease must be added to net income. 24 COMPUTER SERVICES COMPANY Statement of Cash Flows--Indirect Method (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income $35,000 Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable $(30,000) 25 Determine Net Cash Provided/Used By Operating Activities Accounts payable - When accounts payable increase during a year, operating expenses on an accrual basis are higher than they are on a cash basis. For CSC, operating expenses reported in the income statement were $40,000. Since Accounts Payable increased $4,000, $36,000 ($40,000 – $4,000) of the expenses were paid in cash. To convert net income to net cash provided by operating activities, an increase in accounts payable must be added to net income, a decrease subtracted. 26 COMPUTER SERVICES COMPANY Statement of Cash Flows--Indirect Method (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income $35,000 Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable $(30,000) Increase in accounts payable 4,000 (26,000) Net cash provided by operating activities $ 9,000 27 Steps in Preparing Statement of Cash Flows 28 Determine Net Cash Provided/Used By Investing and Financing Activities No data are given for the increases in Equipment of $10,000 and Common Stock of $50,000. Assume any differences involve cash. The increase in equipment is from a purchase of equipment for $10,000 cash. This purchase is reported as a cash outflow in the investing activities section. The increase of common stock results from the issuance of common stock for $50,000 cash. It is reported as an inflow of cash in the financing activities section of the statement of cash flows. 29 COMPUTER SERVICES COMPANY Comparative Balance Sheet December 31, 2003 Assets Cash Accounts receivable Equipment Total Liabilities and stockholders’ equity Accounts payable Common stock Retained earnings Total Change Increase/Decrease Dec. 31, 2003 $34,000 30,000 Jan. 1, 2003 $0 0 10,000 $74,000 0 $0 10,000 increase $4,000 50,000 20,000 $0 0 0 $4,000 increase 50,000 increase 20,000 increase $74,000 $0 $34,000 increase 30,000 increase 30 Determine Net Cash Provided/Used By Investing and Financing Activities Reasons for the increase of $20,000 in the Retained Earnings. Net income increased retained earnings by $35,000. REPORTED IN THE OPERATING ACTIVITIES SECTION. The additional information indicates that a cash dividend of $15,000 was declared and paid. REPORTED IN THE FINANCING ACTIVITIES SECTION. 31 COMPUTER SERVICES COMPANY Statement of Cash Flows--Indirect Method (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Net income $35,000 Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable $(30,000) Increase in accounts payable 4,000 (26,000) Net cash provided by operating activities $ 9,000 Cash flows from investing activities Purchase of equipment (10,000) Cash flows from financing activities Issuance of Common Stock $50,000 Payment of cash dividends (15,000) Net cash provided by financing activities 35,000 32 Net increase in cash $34,000 Major Classes of Cash Receipts and Payments -- Direct Method 33 COMPUTER SERVICES COMPANY Statement of Cash Flows--Direct Method (Partial) For the Year Ended December 31, 2003 Cash flows from operating activities Cash receipts from customers $ 765,000 Cash payments To supplier $550,000 For operating expenses 158,000 For income taxes 48,000 756,000 Net cash provided by operating activities $ 9,000 34 Free Cash Flow Cash Provided By Operations – Capital Expenditures – Dividends Paid Free Cash Flow 35 Assessing Liquidity, Solvency, and Profitability Using Cash Flows Rather than using numbers from the income statement for assessment purposes, we use numbers from the statement of cash flows. The ratios are cash-based instead of accural-based. 36