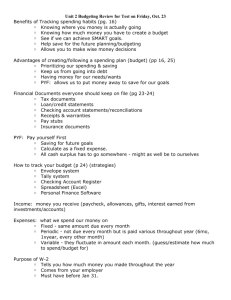

Ch02 sec 6

advertisement

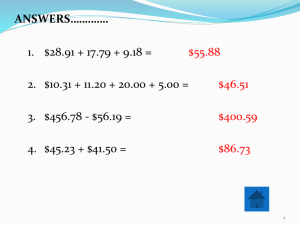

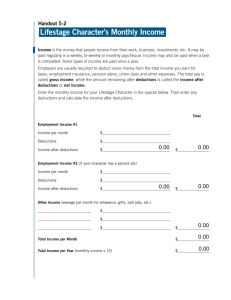

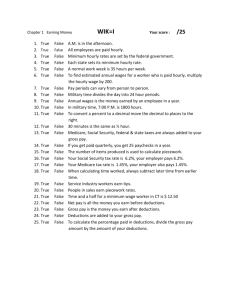

Take-Home Pay The deductions taken out of your paycheck help support schools, roads, national parks, and more. Why do you think you have to pay taxes? Lesson Objective Calculate net pay per pay period. Content Vocabulary net pay net pay The amount of money you have left after your employer subtracts all tax withholdings and personal deductions from your gross pay, also called net income or take-home pay. Example 1 Alysha Moore’s gross weekly salary is $600. She is married and claims 3 allowances. The Social Security tax is 6.2 percent. The Medicare tax is 1.45 percent. The state tax is 1.5 percent. Each week she pays $12.40 for medical insurance and $2.50 for charity. Is Moore’s earnings statement correct? Figure 2.4 Example 1 Answer: Step 1 Find the total deductions. a. Federal withholding b. Social Security: 6.2% of $600.00 $27.00 37.20 c. Medicare: 1.45% of $600.00 8.70 d. State tax: 1.5% of $600.00 9.00 e. Medical insurance f. Charity 12.40 2.50 Total $96.80 Example 1 Answer: Step 2 Find the net pay. Gross Pay – Total Deductions $600.00 – $104.80 = $503.20 Her statement is correct. Practice 1 Find the deductions and the net pay. Social Security is 6.2 percent of the first $90,000. Medicare is 1.45 percent of all income. Use the tax tables on pages 788-791 in your textbook for federal tax. Round to the nearest cent. Practice 1 (cont.) Pierre Lamont is married and claims 4 allowances. His gross weekly salary is $628. Each week he pays federal, Social Security, and Medicare taxes, as well as $28 for medical insurance and $12 for union dues. What are his deductions and his net pay? Practice 1 Answer Federal: $23 Social Security: $38.94 Medicare: $9.11 Net pay: $516.95 Practice 2 Find the deductions and the net pay. Social Security is 6.2 percent of the first $90,000. Medicare is 1.45 percent of all income. Use the tax tables on pages 788-791 in your textbook for federal tax. Round to the nearest cent. Practice 2 (cont.) Michele Sawyer is single and claims 1 allowance. She earns $11.50 per hour as a pest controller and works 40 hours per week. Deductions include federal income tax, Social Security, and Medicare. Practice 2 (cont.) State taxes are 4 percent of gross income, and local taxes are 2 percent of gross income. She pays $42.75 per week for medical insurance. What are her deductions and net pay for the week? Practice 2 Answer Federal: $46 Social Security: $28.52 Medicare: $6.67 State tax: $18.40 Local tax: $9.20 Medical insurance: $42.75 Net pay: $308.46