Understanding Paychecks Where Does Your Money Go?

advertisement

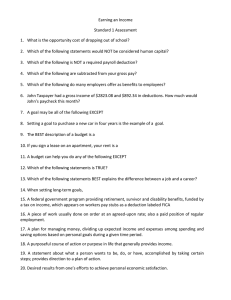

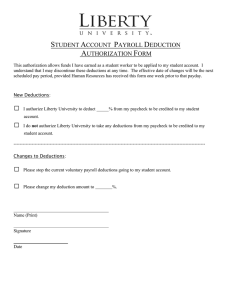

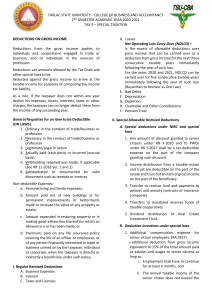

Understanding Paychecks Where Does Your Money Go? Pay Check Stub Check Stub -the part of a paycheck that lists deductions from your salary Personal Information Personal Information: • Name • Social Security Number • Address Pay Period Pay Period – The length of time for which an employee’s wages are calculated; most are weekly, bi-weekly, twice a month, or monthly – The last day of the pay period is not always payday to allow a business to accurately compute wages Gross Pay Gross Pay – The total amount of an employee’s earnings BEFORE deductions are taken out • This is calculated by multiplying the number of hours worked by the hourly rate Net Pay Net Pay – The amount of a paycheck AFTER all deductions are taken out (sometimes referred to as take home pay) Deductions Deduction – The amount of money taken from an employee’s gross pay for taxes, insurance, social security, and other benefits Required Deductions Federal Withholding: taxes taken for federal funding State Withholding: taxes taken for taxes for state funding Social Security: retirement/disability benefits Medicare: health care program for elderly/disabled Income Tax: the part of earnings that people must legally give to the government to pay for government services Optional Deductions (Medical) Insurance: Can get insurance through employer 401K: Personal retirement Current vs. Year to Date Current: the amount paid for each deduction THIS pay period Year-to-Date: the amount paid for each deduction so far THIS YEAR Pay Check Math GROSS PAY: $1,533.33 TOTAL DEDUCATIONS: $250.35 NET PAY: $1,102.98