Domino's Pizza

advertisement

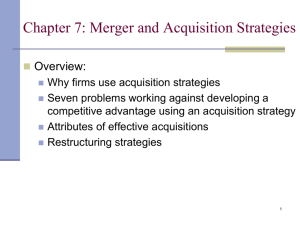

Mergers and Acquisitions Merger A transaction where two firms agree to integrate their operations on a relatively coequal basis because they have resources and capabilities that together may create a stronger competitive advantage Acquisition A transaction where one firm buys another firm with the intent of more effectively using a core competence by making the acquired firm a subsidiary within its portfolio of businesses Takeover An acquisition where the target firm did not solicit the bid of the acquiring firm Ch7-1 Problems in Achieving Success Reasons for Acquisitions Increased market power Integration difficulties Overcome entry barriers Inadequate evaluation of target Cost of new product development Large or extraordinary debt Increased speed to market Acquisitions Inability to achieve synergy Lower risk compared to developing new products Too much diversification Increased diversification Managers overly focused on acquisitions Avoid excessive competition Too large Ch7-2 Reasons for Acquisitions Increased Market Power Acquisition intended to reduce the competitive balance of the industry Example: British Petroleum’s acquisition of U.S. Amoco Overcome Barriers to Entry Acquisitions overcome costly barriers to entry which may make “start-ups” economically unattractive Example: Belgian-Dutch Fortis’ acquisition of American Banker’s Insurance Group Lower Cost and Risk of New Product Development Buying established businesses reduces risk of start-up ventures Example: Watson Pharmaceuticals’ acquisition of TheraTech Ch7-3 Reasons for Acquisitions Increased Speed to Market Closely related to Barriers to Entry, allows market entry in a more timely fashion Example: Kraft Food’s acquisition of Boca Burger Diversification Quick way to move into businesses when firm currently lacks experience and depth in industry Example: CNET’s acquisition of mySimon Reshaping Competitive Scope Firms may use acquisitions to restrict its dependence on a single or a few products or markets Example: General Electric’s acquisition of NBC Ch7-4 Problems with Acquisitions Integration Difficulties Differing financial and control systems can make integration of firms difficult Example: Intel’s acquisition of DEC’s semiconductor division Inadequate Evaluation of Target “Winners Curse” bid causes acquirer to overpay for firm Example: Marks and Spencer’s acquisition of Brooks Brothers Large or Extraordinary Debt Costly debt can create onerous burden on cash outflows Example: AgriBioTech’s acquisition of dozens of small seed firms Ch7-5 Problems with Acquisitions Inability to Achieve Synergy Justifying acquisitions can increase estimate of expected benefits Example: Quaker Oats and Snapple Overly Diversified Acquirer doesn’t have expertise required to manage unrelated businesses Example: GE--prior to selling businesses and refocusing Managers Overly Focused on Acquisitions Managers may fail to objectively assess the value of outcomes achieved through the firm’s acquisition strategy Example: Ford and Jaguar Too Large Large bureaucracy reduces innovation and flexibility Ch7-6 Attributes of Effective Acquisitions + Complementary Assets or Resources Buying firms with assets that meet current needs to build competitiveness + Friendly Acquisitions Friendly deals make integration go more smoothly + Careful Selection Process Deliberate evaluation and negotiations is more likely to lead to easy integration and building synergies + Maintain Financial Slack Provide enough additional financial resources so that profitable projects would not be foregone Ch7-7 Attributes of Effective Acquisitions + Low-to-Moderate Debt Merged firm maintains financial flexibility + Flexibility Has experience at managing change and is flexible and adaptable + Emphasize Innovation Continue to invest in R&D as part of the firm’s overall strategy Ch7-8 Restructuring and Outcomes Alternatives Downsizing Short-Term Outcomes Long-Term Outcomes Reduced Labor Costs Loss of Human Capital Reduced Debt Costs Lower Performance Emphasis on Strategic Controls Higher Performance High Debt Costs Higher Risk Downscoping Leveraged Buyout