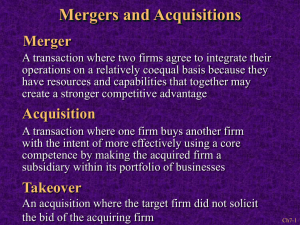

Mergers & Acquisitions

advertisement

Mergers & Acquisitions FINC 446 Financial Decision Making Dr. Olgun Fuat Sahin 1 Mergers and Acquisitions • Vertical merger: forward or backward integration • Horizontal merger: expansion in a particular business line • Conglomerate merger: combination of companies from unrelated business lines 2 Value Related Reasons for M&A • • • • Synergism Taxes Information Asymmetry Agency Costs 3 Synergism • Synergism: Whole is worth more than sum of its parts (M&A math is 2 + 2 = 5) – Economies of scale – lower costs by combining operations • Using excess capacity • Spreading fixed costs over larger volume – Economies of scope – can carry out more activities profitably • Producing similar products • Backward integration – buying a supplier to reduce costs • Forward integration – moving control one step closer to customers 4 Synergism (Continued) – Economies of financing – larger companies can raise money more economically • The more money raised, the lower the issuance costs on • a per dollar raised Higher liquidity for the securities reducing cost of issuance to the firm – Risk reduction – lower unsystematic risk will reduce expected bankruptcy costs – Market power – larger market share allows control over price 5 Taxes • A merger can reduce the tax of a combined firm because: 1. 2. 3. 4. 5. The acquirer has large cash flows with limited opportunities – returning cash to shareholders exposes them to taxes Revaluing assets of the target can create depreciation expense for tax purposes Losses of a target that have been carried forward can be used by the combined firm Alternative Minimum Tax might encourage acquisitions by reducing overall tax payment for firms if they are combined Diversification through M&A can increase debt capacity increasing tax shield 6 Information Asymmetry • Acquiring company posses information that is not available to the investors • Buying another company implies that the acquiring firm managers have found a “bargain” 7 Agency Costs • M&A allows inefficient managers to be replaced • Activities in the takeover market curb the agency cost 8 Management Related Reasons for Mergers • • • • Reduction of Unsystematic Risk Takeover Risk Size Preference Hubris Hypothesis 9 Reduction of Unsystematic Risk • Diversification at the firm level will reduce the unsystematic risk – Previously this was good because lower unsystematic risk reduces expected bankruptcy costs – Managers also benefit form lower unsystematic risk because lower variability in earnings increases job security and stabilizes compensation 10 Takeover Risk • If a company is target for a proposed acquisition then the target can make it difficult by acquiring another – hard to swallow • A defensive acquisition can create a regulatory hurdle for the original suitor as well 11 Size Preference • Managers’ self fulfilling prophecies – bigger is better not necessarily profitable • Larger firm can provide more compensation for managers 12 Hubris Hypothesis • Hubris hypothesis suggest that acquiring firm managers rely too much on their abilities to identify, undertake, and manage potential targets • Usual outcome of such acquisitions is a disaster admitted by divestitures 13 M&A Process • • • • • Identify a Target Valuation Mode of Acquisition Mode of Payment Accounting of Acquisition – Note: Regulators (Federal Trade Commission – FTC) can block a deal or require substantial asset sell off 14 M&A Process (Continued) • Identify a Target: – Based on a sound strategy that can increase shareholders’ wealth – Focus on “Value Related Reasons” – Acquisitions are usually initiated by the acquiring firm – Sometimes a target can announce that it is for sale 15 M&A Process (Continued) • Valuation: • Net Cash Flow: • EBIT x (1 – tax rate) + depreciation and other non-cash expenses – acquisition of new assets + increases in liabilities other than LTD = Net cash flow Equity Residual Cash Flow: Net Income – preferred dividends + depreciation and other non-cash expenses – acquisition of new assets + increases (– decreases) in liabilities + increases (– decreases) in preferred stocks = Equity residual cash flow 16 M&A Process (Continued) • Valuation: – Should not ignore the value of strategic options and payment terms – In general an acquisition creates wealth for the acquirer if: What Acquirer Gets [Target Alone + Synergies + Other] >= What Acquirer Gives [Cash Paid + Stock Paid + Debt Assumed] 17 M&A Process (Continued) • Mode of Acquisition: – Refers to whether a proposed acquisition is friendly or hostile to target managers • Friendly acquisitions are approved by board of directors • • • of each firm Then shareholders vote on the proposal If no negotiation possibility exists then an acquirer can proceed with a tender offer to target shareholders – making it hostile Hostile takeover can be quite time consuming especially when target managers fight against the tender offer 18 M&A Process (Continued) • Mode of Payment: – How an acquisition is paid for: cash, stock or mixed • If the stock is believed to be undervalued, then stock should not be used for payment • If the stock is overvalued then the stock payment should/can be used 19 Takeover Defense • Golden parachute – A contract designed to give executives substantial compensation if they are dismissed following a takeover • Poison pills, flip-over rights allowing holders to receive stock in the acquirer if the bidder acquires 100% of the target • Poison pills, flip-in rights allowing holders to receive stock in the target – It is effective against raiders who seek to acquire controlling interest 20 Takeover Defense (Continued) • Poison puts – Bond issues that become due if unfriendly takeover occurs • Greenmail – Managers of target buys shares purchased by acquirer at a substantial premium • White knight – A third company acquiring the target with friendly terms 21 Accounting Method • There used to be two methods: Pooling of Interest and Purchase method for acquisitions • Pooling of Interest: – It can be used if payment is made in the form of acquirer’s stock – Balance sheet and income statement of the combined company are generated by adding up items 22 Accounting Method (Continued) • Purchase method: – Balance sheet of the combined entity is constructed as follows: If the price paid is same as the net asset value (book value – total liabilities), balance sheet of the combined company is generated by adding up items – If the price paid is less than the net asset value, the assets are written down – If the price paid is more than the net asset value, the assets are appraised. If the price is still more than appraised value of net assets, the difference is an asset called goodwill – The income statement reflect the depreciation expenses adjusted for the revaluation 23 Accounting for Goodwill • The Financial Accounting Standards Board (FASB) • issued two statements changing all that: FASB Statement No. 141 Business Combinations – Requires the purchase method of accounting be used for all business combinations initiated after June 30, 2001 • FASB Statement No. 142 Goodwill and Other Intangible Assets – Changes the accounting for goodwill from an amortization method to an impairment-only approach – “Goodwill will be tested for impairment at least annually using a two-step process that begins with an estimation of the fair value of a reporting unit. The first step is a screen for potential impairment, and the second step measures the amount of impairment, if any.” 24 Target and Acquirer Performance around Announcement • Dodd (1980), “Merger proposals, management discretion and stockholder wealth,” Journal of Financial Economics, Volume 8, Issue 2, June 1980, Pages 105-137 – 151 targets and 126 bidders over 1970-1977 Successful Bidders Targets 2-day AR * -1.09% 13.41% Sample Size 60 71 T-statistics -3.0 23.8 2-day AR -1.24% 12.73 66 80 -2.6 19.1 Unsuccessful Sample Size T-statistics * AR is Abnormal Return = Actual – Expected. Reported AR is average of firm ARs. 25 Target and Acquirer Performance around Announcement (Continued) • Bradley, Desai & Kim (1988), “Synergistic gains from corporate acquisitions and their division between the stockholders of target and acquiring firms”, Journal of Financial Economics, Volume 21, Issue 1, May 1988, Pages 3-40 – 3-day announcement abnormal return for 236 successful tender offers over 1963-1984 Sample Size Bidders Targets Total Sample 236 0.00% 21.6% Single Bidders 163 0.65% 22.0% Multiple Bidders 73 -1.45% 20.8% 26 Target and Acquirer Performance around Announcement (Continued) • Bradley, Desai & Kim (1983), “The gains to bidding firms from merger,” Journal of Financial Economics, Volume 11, Issues 1-4, April 1983, Pages 121-139 – 353 targets: 241 successful, 112 unsuccessful – 94 unsuccessful bidders – 1983-1980 Sample Size Targets 112 35.6% Subsequently Taken Over 86 39.1% Not Subsequently Taken Over 26 23.9% Unsuccessful Targets 27 Acquirer Performance in the Long-Run • Long Run Abnormal Return = Long-Run Actual • Return – Long-Run Expected Return Long-Run Event Studies are very sensitive to “Joint Hypothesis Problem” – They test two hypotheses • There is no abnormal performance after acquisitions – Null • The method of risk adjustment (estimation of expected return) is accurate. This is very important since we do not have an asset pricing model that can explain security returns well 28 Acquirer Performance in the Long-Run (Continued) Study Sample Expected Returns AR Calculation Major Results Franks, Harris and Titman (1991) 399 acquisitions, January 1975December 1984 (1) CRSP equal-weighted market index (2) CRSP value-weighted market index (3) Ten-factor model (4) Eight portfolio benchmark Jensen’s α in eventtime and calendar-time portfolios Jensen’s α: Average Abnormal Returns are (1) -0.2, (2) 0.29, (3) -0.11, and (4) -0.11 per month over 36 months. (1) and (2) are significant. Calendar-time portfolios: (2) 0.37 per month and significant (4) does not detect any abnormal performance with sub-samples as well Agrawal Jaffe, and Mandelker (1992) 1,164 acquisitions, January 1955December 1987 (1) Beta and size (2) Returns Across Time and Securities (RATS) with size adjustment CAAR, starting with AD CAAR for (1) is -10.26 for (+1, +60) and significant. CAAR for model (2) is similar. No abnormal performance during Franks, Harris and Titman (1991) study period Loderer and Martin (1992) 1,298 acquisitions, 1955-1986 Similar to RATS CAAR, starting with effective date (ED) Abnormal Returns are negative and significant over 3 years after acquisitions but insignificant over 5 years Loughran and Vijh (1997) 947 acquisitions, 1970-1989 Matching firm based on size and book-to-market Buy-and-Hold Abnormal Return (BHAR) starting with ED BHAR over five years is -6.5 and insignificant. Cash BHAR is 18.5 and insignificant and Equity BHAR is -25 and significant Rau and Vermaelen (1998) 3,517 acquisitions, January 1980December 1991 Size and book-to-market matching portfolios CAAR, starting with CD CAARs for mergers and tender offers are -4.04 and 8.85, respectively. Both figures are statistically significant Mitchell and Stafford (2000) 2,193 acquisitions, 1958-1993 Size and book-to-market matching portfolios BHAR and CalendarTime Abnormal Return (CTAR) BHAR is zero for all acquisitions after adjusting for cross-sectional dependence, CTAR is negative and significant for equity financed acquisitions. 29