Acquisition strategies of Indian software companies

advertisement

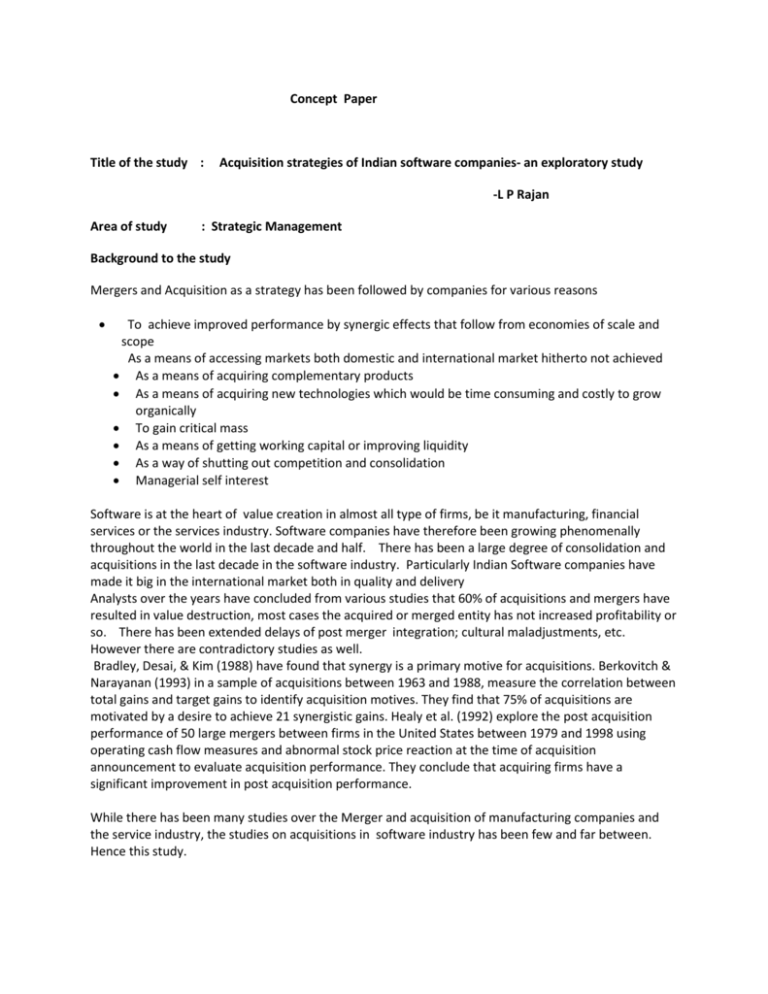

Concept Paper Title of the study : Acquisition strategies of Indian software companies- an exploratory study -L P Rajan Area of study : Strategic Management Background to the study Mergers and Acquisition as a strategy has been followed by companies for various reasons To achieve improved performance by synergic effects that follow from economies of scale and scope As a means of accessing markets both domestic and international market hitherto not achieved As a means of acquiring complementary products As a means of acquiring new technologies which would be time consuming and costly to grow organically To gain critical mass As a means of getting working capital or improving liquidity As a way of shutting out competition and consolidation Managerial self interest Software is at the heart of value creation in almost all type of firms, be it manufacturing, financial services or the services industry. Software companies have therefore been growing phenomenally throughout the world in the last decade and half. There has been a large degree of consolidation and acquisitions in the last decade in the software industry. Particularly Indian Software companies have made it big in the international market both in quality and delivery Analysts over the years have concluded from various studies that 60% of acquisitions and mergers have resulted in value destruction, most cases the acquired or merged entity has not increased profitability or so. There has been extended delays of post merger integration; cultural maladjustments, etc. However there are contradictory studies as well. Bradley, Desai, & Kim (1988) have found that synergy is a primary motive for acquisitions. Berkovitch & Narayanan (1993) in a sample of acquisitions between 1963 and 1988, measure the correlation between total gains and target gains to identify acquisition motives. They find that 75% of acquisitions are motivated by a desire to achieve 21 synergistic gains. Healy et al. (1992) explore the post acquisition performance of 50 large mergers between firms in the United States between 1979 and 1998 using operating cash flow measures and abnormal stock price reaction at the time of acquisition announcement to evaluate acquisition performance. They conclude that acquiring firms have a significant improvement in post acquisition performance. While there has been many studies over the Merger and acquisition of manufacturing companies and the service industry, the studies on acquisitions in software industry has been few and far between. Hence this study. Research Methodology 1) 2) 3) 4) 5) 6) Research questions: Is the process, effect and application of acquisition principles same for software Industry and other industries where acquisition process and strategy are followed? Has the rapid growth of software industry in the last decade contributed to the acquisition process in the industry? Has the valuation done in Software industry follow the same principles followed in other industry? What is common with other industry and what are some of the unique features in software industry? Software development and application involves working close with customers. Has this led to spate of acquisitions? How has been the post merger/acquisition integration been with the software industry? Has it led to better integration than in the manufacturing industry? Research objectives: 1. To discover the extent of acquisitions made by Indian software companies in the last decade, both in size and scope. 2) To estimate the contribution the acquired company has contributed to the profitability and stability of the acquiring company 3) To understand the motives for acquiring company and to zone in on the critical factors considered when acquiring. Research outcomes expected : 1. A well documented discovery of objectives, strategy and techniques followed by Indian software companies 2. This is expected to provide a road map for companies in the acquiring mode; and also provide tips for aspiring small companies and startups to scale up. 3. The study also would throw light for small companies on how to create better value addition for a better bargaining power . strategies for both acquiring company and company aspiring for being acquired by a bigger company. Research Design 1. Exploratory research done by analyzing the takeovers of 3 major companies. The taking over company and the taken over company will be studied in depth. A pilot study to be done will indicate what indicators are critical to the study. Indicators such as increase in profits , increase in return on investment, increase in profitability ,increase in share value, sales revenue per employee pre and post , and the level of cultural integration , all look relevant presently. Research papers downloaded and referred The synergy Trap - Mark Sirover Boston Consulting Group Inorganic growth strategies; who profits from whom - Latha Chari Software Acquisition: a business strategy analysis Barbara Farbey & Anthony Finkelstein Corporate Strategies for Software Globalization - Alok Aggarwal, Orna Berry*, Martin Kenney*, Stefanie Ann Lenway, and Valerie Taylor