Chapter 9

advertisement

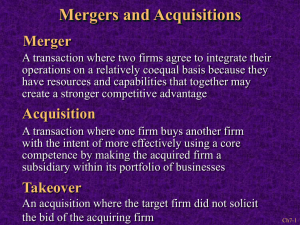

Competing For Advantage Part III – Creating Competitive Advantage Chapter 9 – Acquisition and Restructuring Strategy The Strategic Management Process Insert Figure 1.6 Mergers, Acquisitions, and Takeovers: What Are the Differences? Key Terms Merger - strategy through which two firms agree to integrate their operations on a relatively co-equal basis. Acquisition - strategy through which one firm buys a controlling, 100 percent interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio. Mergers, Acquisitions, and Takeovers What Are the Differences? – Key Terms Takeover – special type of acquisition strategy wherein the target firm did not solicit the acquiring firm's bid Hostile Takeover – unfriendly takeover strategy that is unexpected and undesired by the target firm Reasons for Acquisitions Insert Figure 9.1 Sources of Market Power Size of the firm Resources and capabilities to compete in the market Share of the market Types of Acquisitions to Increase Market Power Horizontal Acquisitions Vertical Acquisitions Related Acquisitions Horizontal Acquisitions Acquisition of a company competing in the same industry The increase of market power by exploiting cost-based and revenuebased synergies Character similarities between the firms lead to smoother integration and higher performance Vertical Acquisitions Acquisition of a supplier or distributor of one or more products Increase of market power by controlling more of the value chain Related Acquisitions Acquisition of a firm in a highly related industry Increase of market power by leveraging core competencies to gain a competitive advantage Entry Barriers that Acquisitions Overcome Economies of scale in established competitors Differentiated products by competitors Enduring relationships with customers that create product loyalties with competitors Cross-Border Acquisitions Acquisitions made between companies with headquarters in different countries New Product Development Significant investments of a firm’s resources are required to: Develop new products internally Introduce new products into the marketplace Acquisition of a Competitor – Outcomes Lower risk compared to developing new products Increased diversification Reshaping the firm’s competitive scope Learning and developing new capabilities Faster market entry Rapid access to new capabilities Increase Speed to Market Acquisitions are used for rapid market entry critical to successful competition in the highly uncertain and complex global environment faced by firms today Reshaping the Firm’s Competitive Scope Acquisitions quickly and easily: Change a firm's portfolio of businesses Establish new lines of products in markets where the firm lacks experience Alter the scope of a firm’s activities Create strategic flexibility Reshaping the Firm’s Competitive Scope Acquisitions are often used: In reaction to reduced profitability in a competitive environment of intense rivalry To reduce overdependence on a single product or market Learn and Develop New Capabilities Acquisitions are used to: Gain capabilities that the firm does not possess Broaden the firm’s knowledge base Reduce inertia Reasons for Acquisitions Insert Figure 9.1 Integration Challenges Integration involves a large number of activities Two disparate corporate cultures must be melded Effective working relationships must be built Different financial and control systems must be linked The status of the acquired firms employees and executives must be determined Turnover of key personnel must be minimized to retain crucial knowledge Acquired capabilities must be merged into internal processes and procedures Private Synergy Occurs when the combination and integration of acquiring and acquired firms' assets yields capabilities and core competencies that could not be developed by combining and integrating the assets with any other company Is possible when the two firms' assets are complimentary in unique ways Yields a competitive advantage that is difficult to understand or imitate Transaction Costs Transaction costs – direct and indirect expenses incurred when firms use acquisition strategies to create synergy These costs must be added to the purchase price of an acquisition to adequately evaluate its potential value Firms tend to underestimate these costs, which negatively impacts anticipated revenue projections and expected cost-based synergies Transaction Costs Direct costs include legal fees and charges from investment bankers who complete due diligence for the acquiring firm Indirect costs include managerial time to evaluate target firms and complete negotiations, as well as the loss of key managers after an acquisition Additional costs include the actual time and resources used for integration processes Due Diligence Due diligence – process through which a potential acquirer evaluates a target firm for acquisition Failure to complete an effective due-diligence process may easily result in the acquiring firm paying an excessive premium for the target company Due Diligence Evaluation requires that hundreds of issues be closely examined, including: Financing for the intended transaction Differences in cultures between the acquiring firm and target firm Tax consequences of the transaction Actions that would be necessary to successfully meld the two workforces Large or Extraordinary Debt High debt can: Increase the likelihood of bankruptcy Lead to a downgrade in the firm’s credit rating Preclude needed investment in activities that contribute to the firm’s long-term success Too Much Diversification Diversified firms must process more information of greater diversity Scope created by diversification may cause managers to rely too much on financial rather than strategic controls to evaluate performance of business units Acquisitions may become substitutes for innovation Managers Too Focused on Acquisitions Activities managers undertake when executing an acquisition strategy: Searching for viable acquisition candidates Completing effective due-diligence processes Preparing for negotiations Managing the integration process after the acquisition is completed Managers Too Focused on Acquisitions Managerial attention can be diverted from other matters necessary for long-term competitive success (such as identifying other activities, interacting with important external stakeholders, or fixing fundamental internal problems) A short-term perspective and greater risk aversion can result for target firm's managers Firms Become Too Large Key Terms Bureaucratic Controls – formalized supervisory and behavioral rules and policies designed to ensure that decisions and actions across different units of a firm are consistent Firms Become Too Large Additional costs may exceed the benefits of the economies of scale and additional market power Larger size may lead to more bureaucratic controls Formalized controls often lead to relatively rigid and standardized managerial behavior Firm may produce less innovation Effective Acquisitions Insert Table 9.1 Restructuring Key Terms Restructuring – strategy through which a firm changes its set of businesses or its financial structure Restructuring – Three Strategies Downsizing Downscoping Leveraged Buyouts Downsizing Key Terms Downsizing – strategy that involves a reduction in the number of a firm's employees (and sometimes in the number of operating units) that may or may not change the composition of businesses in the company's portfolio Downscoping Key Terms Downscoping – strategy of eliminating businesses that are unrelated to a firm's core businesses through divesture, spin-off, or some other means Leveraged Buyouts Key Terms Leveraged Buyouts (LBOs) – restructuring strategy whereby a party buys all of a firm's assets in order to take the firm private (or no longer trade the firm's shares publicly) Leveraged Buyouts Management buyouts Employee buyouts Whole-firm buyouts Outcomes from Restructuring Insert Figure 9.2 Ethical Questions What are the ethical issues associated with takeovers, if any? Are mergers more or less ethical than takeovers? Why or why not? Ethical Questions One of the outcomes associated with market power is that the firm is able to sell its good or service above competitive levels. Is it ethical for firms to pursue market power? Does your answer differ based on the industry in which the firm competes? For example, are the ethics of pursuing market power different for firms producing and selling medical equipment compared with those producing and selling sports clothing? Ethical Questions What ethical considerations are associated with downsizing decisions? If you were part of a corporate downsizing, would you feel that your firm had acted unethically? If you believe that downsizing has an unethical component to it, what should firms do to avoid using this technique? Ethical Questions What ethical issues are involved with conducting a robust due-diligence process? Ethical Questions Some evidence suggests that there is a direct relationship between a firm’s size and the level of compensation its top executives receive. If this is so, what inducement does this relationship provide to top-level managers? What can be done to influence this relationship so that it serves shareholders’ best interests?