Document

advertisement

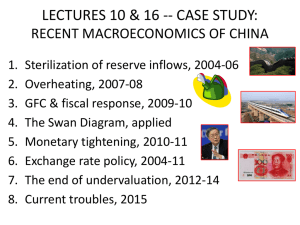

LECTURE 4: THE MUNDELL-FLEMING MODEL -MONETARY & FISCAL POLICY, AND ADJUSTMENT Question 1: What are the implications of monetary & fiscal policy for income & the balance of payments, at a given exchange rate? Question 2: Mechanisms of adjustment. How does a country adjust to BoP imbalance? What further implications for the economy? Key parameter: κ, degree of capital mobility The Monetary Approach to the Balance of Payments -- One result: under fixed E, κ contributes to offset of money expansion. The Mundell-Fleming Model IS curve: Y= slopes down 𝐴 − 𝑏𝑖 + 𝑋 𝑠+𝑚 An increase in spending, e.g., fiscal expansion, shifts IS right, by the multiplier, 1/(s+m). slopes up LM curve: 𝑀1 𝑃 Recap LM′ = L(i, Y) Monetary expansion shifts LM right. BP curve: (i-i*) = 1 κ slopes up 𝑚 κ slope = m/κ [−𝐾𝐴 − 𝑋 ] + ( ) Y . API-120 - Prof. J.Frankel 𝐴↑ 0 m / • 0 0 m / 0 • API-120 - Prof. J.Frankel, Harvard • m / 0 𝑀/𝑃 ↑ 0 m / 0 0 m / 0 m / 0 • • API-120 - Prof. J.Frankel, Harvard • Monetary & fiscal policy in the Mundell-Fleming model with a fixed exchange rate -- Summary • Fiscal expansion shifts out IS curve. 𝐴↑ – Result: Y↑ , – though by less than simple Keynesian multiplier because i ↑ => crowding out. Result for external balance i) Y↑ => TB ↓ ii) With an open KA: • Fiscal expansion => i ↑ => KA ↑ • Monetary expansion shifts out LM curve. – Result i ↓ => Y↑. 𝑀/𝑃↑ • Magnitudes of ∆Y do not depend on degree of capital mobility, κ. API-120 - Prof. J.Frankel, Harvard • Monetary expansion => i ↓ => KA ↓ Effect on overall BP (=CA+KA) depends on degree of capital mobility. Automatic mechanisms of adjustment Indebtedness -- Rising debt will eventually force a reduction in spending. We omit this factor from the course for now. Price level P – We assume for the moment that price adjustment is very slow. Exchange rate E – Important if the rate is flexible. Reserve flows R -- Important under the MABP. MABP (The Monetary Approach to the Balance of Payments) Defining assumption: Reserve flows are not sterilized. Definitions: BP ≡ dR/dt Monetary Base: Liabilities of CB assets held by CB MB R + NDA where R ≡ International Reserves & NDA ≡ Net Domestic Assets. Broad Money Supply (M1): Liabilities of entire banking system M1 = a multiple of MB <= fractional reserve banking. Sterilization: Changes in reserves (i.e., BP) counteracted by NDA , dNDA/dt = - dR/dt, so MB unchanged. Non-sterilization: dMB /dt = dR /dt. MABP: If reserve outflow is not sterilized, then MB falls, LM shifts back, Without sterilizing reserve flows and i rises over time, until in the long run we are back where we started. 𝑀/𝑃↑ 0 •• 0 •• 0 •• This offset to the increase in MB happens more quickly, the higher is κ . API-120 - Prof. J.Frankel, Harvard A country at point B • -- as were many developing countries in 1990-96, 2003-08, or 2010-13 -- has a BoP surplus. The authorities must choose among several options for managing inflows. (Each option has its own drawback). Alternative ways to manage inflows (with disadvantages) A. Allow money to flow in. (Can be inflationary) B. Sterilize intervention. (Artificially prolongs disequilibrium) C. Allow currency to appreciate. (Lose competitiveness) D. Reimpose capital controls. (Lose financial integration gains) API-120 - Prof. J.Frankel, Harvard An example of attempts to sterilize reserve inflows • China began in 2003 to run large balance of payments surpluses • and tried to sterilize the reserve inflows … successfully for several years. API-120 - Prof. J.Frankel, Harvard In 2003, forex inflows accelerated rapidly. (Both TB & KA >> 0.) Initially, the PBoC had no trouble sterilizing the inflows. => The MB growth rate was kept down to the growth rate of the API-120 - Prof. J.Frankel, Harvard was little inflationary pressure. real economy (≈ 10%/year), so there Appendix: To be continued when we pick up the past decade of China’s macroeconomy in Lecture 16 API-120 - Prof. J.Frankel, Harvard The Balance of Payments ≡ rate of change of foreign exchange reserves (largely $), rose rapidly in China from 2004 on, due to all 3 components: trade balance, Foreign Direct Investment & portfolio inflows Reserves BoP Source: HKMA, Half-Yearly Monetary and Financial Stability Report, June 2008 13 FX reserves of the PBoC climbed higher than any central bank in history API-120 - Prof. J.Frankel, Harvard http://viableopposition.blogspot.com/2012/03/chinas-holdings-of-us-treasuries-what.html http://qz.com/171645/the-invisible-man-managing-chinas-3-8-trillion-in-reserves-just-stepped-down Sterilization of foreign reserves: People’s Bank of China sold sterilization bills, thereby taking RMB out of circulation. Data: CEIC Source: Zhang, 2011 , ITF-220 - Prof.J.Frankel Fig.4, p.45.