Macroeconomic definitions & identies

advertisement

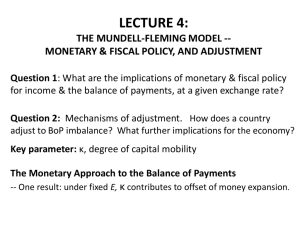

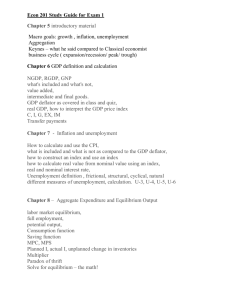

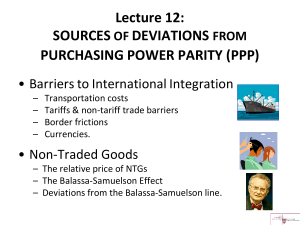

Macroeconomic Review in preparation for API-120 Prof. Jeffrey Frankel MPA/ID program August 20-21, 2015 • Lecture (i) -- GDP definitions Reading on growth accounting: Krugman, 1994, “The Myth of the Asian Miracle.” • Lecture (ii) -- More identities: • Balance of Payments accounting • The National Saving identity Reading on BoP accounting: WTP, Chapter 15. • Lecture (iii) -The Keynesian multiplier model. Reading on the Keynesian model: WTP, Ch. 17.1-17.3. Lecture (i) - GDP • • • • • Definitions of national output Potential output 𝑌 Growth decomposition Some historic theories, as examples How are 𝑌 & the output gap measured in practice? Definition of Gross Domestic Product • GDP ≡ The value of all goods & services produced in the economy in the year. o GNP ≡ GDP + income from investments abroad. o Gross National Income ≡ GNP + income from unilateral transfers. o Net National Income ≡ GNI – depreciation of capital stock. • Real GDP ≡ Nominal GDP / GDP deflator. • We will use Y to denote real GDP or real income. • GDP is not a comprehensive welfare measure: – It omits environmental externalities, leisure, & lots more. Potential output and the output gap • 𝑌 ≡ Potential output ≡ A F(K, N, Land); – F( ) ≡ an aggregate neoclassical production function; – K ≡ the capital stock • when operating at the capacity it was designed for; – N ≡ labor force • when employed fully or at least at the natural rate; – A ≡ Total Factor Productivity. • Output gap ≡ (𝑌 - Y), as a percentage. • 𝑌 is in the realm of growth theory or economic development. • (𝑌 - Y) is in the realm of macroeconomics (API-120): – Goods and labor markets may not clear in the short run. A simple functional form: Cobb-Douglas • 𝑌 ≡ F( ) ≡ A (Kα Nβ Landγ). • Most common special case -– – Constant returns to scale: α + β + γ = 1. Diminishing returns to each factor of production: α < 1; β <1; γ <1. • Growth decomposition: – Growth rate 𝑑𝑦 𝑑𝑡 ≡ 𝑑𝑎 𝑑𝑡 + α 𝑑𝑘 𝑑𝑡 + β 𝑑𝑛 𝑑𝑡 . Growth decomposition, continued • K grows through fixed investment (net of depreciation). • N grows through population growth, • • • • including immigration. Also rises in labor force participation (e.g., women entering); rural-urban migration; and human capital accumulation (education & training). • Total Factor Productivity • grows through technological progress & economic efficiency. Some historic theories, as examples • Malthus (1798): A fixed supply of arable land & γ>0 => Y rises more slowly than population. – But he underestimated TFP growth. • Solow (1957): Growth decomposition numbers say TFP explains far more than capital accumulation does. • Endogenous growth theory, – e.g., P. Romer (1986): α = 1. – Technical change is embodied in capital. • “The Myth of the Asian Miracle” – A.Young (1994, 1995) & Krugman (1994): – The success of Singapore & other Asian countries can be explained by factor accumulation, not TFP growth. How is potential output 𝑌 computed in practice ? Three ways: 1. Aggregate production function Y = F(K,N) – Plug in the labor force employed at natural rate: N=𝑁, – " capital stock K working at full capacity. – Conceptually the right definition. • But not practical for annual data. 2. Time trend – E.g., H-P filter. 3. Estimate 𝑌 as value of Y above which inflation tends to accelerate. IMF estimates of output gap, as percentage of GDP, 2009 Jpn UK US France Ir In 2009, after the global financial crisis, advanced countries suffered much larger output gaps than in preceding recessions: Y << Y . Source: IMF, via Economicshelp, 2009 API-120 - Prof.J.Frankel, Harvard University Inflation everywhere fell in 2008-09, in response to the output gap of the great recession. World Bank, June 2014. “Exchange rate passthrough and inflation trends in developing countries,” Global Ec. Prospects. Other ways to decompose GDP • To whom the goods & services are sold (expenditure side of GDP): – – – – C +I +G + X-M . • How the income is used: – Taxes net of transfers, T, leaving disposable income : – Consumption C Yd – + Saving S. } • Allocation of income shares according to factors of production: – Wages & salaries – Capital income. End of Review Lecture (i): • GDP definitions To be followed by: • (ii) More identities – Balance of payments accounting – The National Saving Identity • (iii) The Keynesian multiplier model Lecture (ii) – More identities • Balance of Payments accounting • The National Saving identity Balance of payments accounts • Definition: The balance of payments is the year’s record of economic transactions between domestic and foreign residents. • The rules: – If you have to pay a foreign resident -normally in exchange for something that you bring into the country -- then the something counts as a debit. – If a foreign resident has to pay you for something, then the something counts as a credit. “Primary income,” mainly investment income ≡ “secondary income” NOW CALLED “FINANCIAL ACCOUNT” Examples of a debit on the current account: • You, an American, buy DVDs from India => import appears as debit on US merchandise account. • You import services (electronically) of an Indian software firm => debit appears on US services account (“overseas outsourcing”). • You buy the services, instead, from a subsidiary that the Indian software firm set up last year in the US. This is not an international transaction, and so does not appear in the accounts. – But assume the subsidiary then sends profits back to India => US reports payments of investment income. It is as if the US is paying for the services of Indian capital. • Employees of the subsidiary in the US (or any other US resident entities) send money to relatives back in India => US reports paying unilateral transfers . API-120 - Prof.J.Frankel, Harvard University Examples of debits on the financial account (previously “capital account”), long-term Instead of buying DVDs from India, you buy the company in India that makes them. => acquisition of assets (debit) under Foreign Direct Investment (FDI). Instead of buying the entire company in India, you buy some stock in it => acquisition of portfolio investments (equities). Instead of buying stock in the company, you lend it money for 2 years => acquisition of portfolio investments (bonds or bank loans). API-120 - Prof.J.Frankel, Harvard University Examples of debits on the financial account, short term: You lend to the Indian company in the form of 30-day commercial paper or trade credit => acquisition of short term assets (Debit: You have “imported” a claim against India.) You lend to the Indian company in the form of cash dollars, which it doesn’t have to pay back for 30 days => acquisition of short term assets . You are the Central Bank, and you buy securities of the Indian company (an improbable example for the Fed – but some central banks now diversify international investments) => increase in US official reserve assets. API-120 - Prof.J.Frankel, Harvard University The rules, continued • Each transaction is recorded twice: – an import of a good or security has to be paid for. E.g., when an importer pays cash dollars, the import on the merchandise account is offset under short-term capital: the exporter in the other country has, at least for the moment, increased holdings of US assets, which counts just like any other portfolio investment in US assets. • At the end of each quarter, credits & debits are added up within each line-item; • and line-items are cumulated from the top to compute measures of external balance. API-120 - Prof.J.Frankel, Harvard University Some balance of payments identities • CA ≡ Rate of increase in net international investment position. – A CA surplus country accumulates claims against foreigners – A CA deficit country borrows from foreigners. • BoP ≡ CA + KA • => BoP ≡ excess supply of FX coming from private sector, which central banks absorb into reserves (if they intervene in the FX market, e.g., to keep exchange rate fixed). – A BoP surplus country adds to its FX reserves (esp. US T bills). – A BoP deficit country runs down its FX reserves, unless it is lucky enough (US) that foreign central banks finance its deficit. • A floating country does not intervene in the FX market • => BP ≡ 0; • Exchange rate E adjusts to clear private market FX supply & demand. API-120 - Prof.J.Frankel, Harvard University The National Saving identity • Useful for many purposes. • In lecture (iii) we will use it to express the Keynesian multiplier model. • To derive the national saving identity, – first, consider two ways of decomposing GDP. Two ways to decompose GDP • To whom the goods & services are sold (expenditure side of GDP): –C – +I – +G – + X-M. • How the income (Y) is used: – Taxes net of transfers, T, – leaving disposable income Yd: • Consumption C • + Saving S. } = Yd Derivation of National Saving Identity Income ≡ Output (assuming no transfers or investment income) Y ≡ GDP /C + S + T ≡ C/ + I + G + X -M S + (T-G) ≡ I + X – M NS ≡ S + BS ≡ I + CA API-120 - Prof.J.Frankel, Harvard University National Saving Identity Household savings Corporate savings Government savings* * Excludes govt. investment spending Eswar Prasad, 2009, “Rebalancing Growth in Asia,” Finance and Development, IMF, December, p.21. API-120 - Prof.J.Frankel, Harvard University End of: Definitions & Accounting API-120 - Prof.J.Frankel, Harvard University Lecture (iii) – The Keynesian multiplier model • • • • Consumption function. Trade balance. Determination of income Y. The multipliers in an open economy • for an increase in spending 𝐴 , – • e.g., due to a fiscal expansion; for an increase in exports 𝑋, – e.g., due to a devaluation. The Keynesian consumption function: Consumption depends less-than-proportionately on income • C = 𝐶 + cY. • What determines 𝐶 ? Three approaches -– Financial approach: Wealth, spread over a lifetime. – Intertemporal optimization: An estimate of permanent income ≡ Y in a normal year. – Behavioral economics (e.g., habit formation): • Level of consumption to which one has become accustomed. • Marginal propensity to consume, c, can be derived – from the probability that observed fluctuations are Y is permanent, – an impatience parameter, – and perhaps the interest rate. Imports depend similarly on income: M = Md(E, Y) = 𝑀 + mY X = Xd(E) =𝑋 assuming E fixed, for now. => TB = 𝑋 − (𝑀 +mY) TB + 0 - …and rises in contractions Y TB falls in expansions… where slope = -m ≡ - marginal propensity to import That is, the trade balance is counter-cyclical. Prof. J. Frankel, Harvard University Determination of equilibrium income in open-economy Keynesian model Y ≡ A + TB ≡ (C + I + G) + (X – M) = (𝐶+cY + 𝐼 + 𝐺) + (𝑋 - 𝑀 - mY). Now solve: Y - cY + mY = 𝐶 + 𝐼 + 𝐺 + (𝑋 - 𝑀) 𝐶+𝐼+𝐺 + 𝑋 − 𝑀 𝑌= 1−𝑐+𝑚 𝐴+𝑋−𝑀 𝑌= 𝑠 + 𝑚 where 𝐴 = 𝐶+𝐼+𝐺 and s ≡ 1 – c. Prof. J. Frankel, Harvard University Keynesian Consumption Function: C = 𝐶 + cYd . or, expressed as a saving function: S = Yd - C = Yd - 𝐶 - cYd . = - 𝐶 + sYd where s ≡ 1 – c. }I ITF220 - Prof. J. Frankel, Harvard University Closed economy: NS – I = 0 Fiscal Expansion 1 < Closed-economy multiplier 1/s < ∞ Prof. J. Frankel, Harvard University Open economy: NS – I = TB =X–M Imports: M = Md(E, Y), or = 𝑀+mY for simplicity Exports: X = Xd(E), or = 𝑋 for simplicity. => TB = 𝑋 − (𝑀+mY ) Prof. J. Frankel, Harvard University Open economy Fiscal Expansion slope = s G ΔY = 1 𝑠+𝑚 Δ𝐺 1 𝑠 < Δ𝐺 Prof. J. Frankel, Harvard University Fiscal multiplier 𝑨↑, e.g., due to fiscal stimulus: 𝑮 ↑. “Twin deficits”: ΔG leads to both a fiscal deficit & trade deficit (US in 1980s & 2001-07). But if the exogenous rise is ΔI, BD & TD move opposite directions (US in 1990s). Example: Eurozone fiscal austerity has been contractionary. Source: P.Krugman May 10, 2012. What about the critique that fiscal policy responded endogenously to the magnitude of the countries’ difficulties? See Blanchard graph in Appendices. Export multiplier 𝑿 ↑, e.g., due to a devaluation: 𝑬 ↑. ΔE shifts the X-M line up by Δ𝑿, the elasticities answer. But the rise in TB is partially offset by higher imports. SUMMARY OF MULTIPLIERS NS I X M + Keynesian model of S + M AXM Y sm => where A C I G Fiscal Expansion Devaluation 1 Y A sm 1 Y X sm open-ec. multiplier = 1/(s+m)<1/s ΔTB ΔM - m Y m ΔA . sm ΔTB ΔX m Y s Δ X ΔX . sm Note misprint in Equation (17.11), 10th ed. of WTP. End of Macro Review Lecture (iii): The Keynesian Multiplier Model Prof. J. Frankel, Harvard University Appendix 1: EU fiscal austerity, continued The bigger the fiscal contraction, the bigger the GDP loss relative to what had been officially forecast => true multipliers > than multipliers that IMF had been using. Europe: Growth Forecast Errors vs. Fiscal Consolidation Forecasts Source: Olivier Blanchard & Daniel Leigh, 2014, “Learning about Fiscal Multipliers from Growth Forecast Errors,” fig.1, IMF Economic Review 62, 179–212. Note: Figure plots forecast error for real GDP growth in 2010 and 2011 relative to forecasts made in the spring of 2010 on forecasts of fiscal consolidation for 2010 and 2011 made in spring of year 2010; and regression line. Appendix 2: Goals & instruments Policy Goals • Internal balance: Y = Y Y < Y ≡ ES ≡ “output gap” => unemployment > u Y > Y ≡ ED => “overheating” => inflation or asset bubbles. • External balance: e.g., CA=0 or BP=0. Policy Instruments • Expenditure-reduction, e.g., G ↓ • Expenditure-switching, e.g., E ↑ . API-120 - Prof.J.Frankel, Harvard University The principle of goals & instruments • Can’t normally hit 2 birds with 1 stone • Do you have n targets? • => Need n instruments, and they must be targeted independently. • Have 2 targets: CA = 0 and Y = 𝑌? • => You need 2 independent instruments: expenditure-reduction & expenditure-switching. API-120 - Prof.J.Frankel, Harvard University ADJUSTMENT DILEMMA Starting from current account deficit at point N, policy-makers can adjust either by (a) cutting spending, or (b) devaluing. ● A ● X Achieving both goals, CA & Y, would require both instruments. API-120 - Prof.J.Frankel, Harvard University ● ●