L23

advertisement

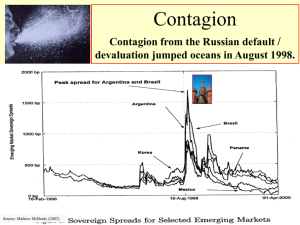

Lecture 23: Forward Market Bias & the Carry Trade Motivations: • Efficient markets hypothesis • Does rational expectations hold? • Does the forward rate reveal all public information? • Does Uncovered Interest Parity hold? Or is there a risk premium? • The carry trade: Does “borrow at low i & lend at high i* ” make money? Outline of lecture 1. Specification of the test of unbiasedness. 2. Answer: F is biased. 3. How should we interpret the bias? ● Risk premium: Introduction to the portfolio balance model. API-120 - Macroeconomic Policy Analysis I, Professor Jeffrey Frankel, Kennedy School of Government, Harvard University Sample page of spot and forward exchange rates, Spot rate | Forward rates local per $ (but $/₤ and $/€). Financial Times Jan. 30, 2009 API-120 - Macroeconomic Policy Analysis I Professor Jeffrey Frankel, Kennedy School of Government, Harvard University Tests of Unbiasedness in the Forward Exchange Market OVERVIEW OF CONCEPTS H0: Et ( St+1 ) = Ft . • Specification of unbiasedness equation H0: st 1 fdt t 1 t+1 ≡ prediction error Et ( t+1 ) = 0 . Would unbiasedness H0 => accurate forecasts? No. <= ( t+1 0). API-120 - Macroeconomic Policy Analysis I: Prof. J.Frankel, Harvard University Et st 1 f t Et st 1 st f t st We proceed in logs. (See appendix on Siegal Paradox.) Et st 1 fdt st 1 ( fdt ) t 1 Most popular test: Unbiasedness of the fx market: H0 : 1 No time-varying risk premium: s e t fdt + } s e t Et st 1 st 1 t 1 , Rational expectations: where Et εt+1 =0 => conditional on info at time t. H0: st 1 fdt t 1 But usual finding: β<<1, e.g., ≈ 0. • Does EMH => Et st+1 = fd t ? Not necessarily. <= Could be rp 0. • UIP version of unbiasedness st 1 (i i*)t t 1 . Finding: rejection of H0 . One can make money, on average, betting against the forward discount or, equivalently, doing the carry trade. How to interpret? (i) exchange risk premium, or (ii) expectations biased in-sample Tests of forward market bias extended to emerging markets: A majority of currencies show a rejection of unbiasedness and an inability to reject a coefficient of zero (same as advanced countries). Statistical significance levels † ‡ † probability that rejection of β=0 (random walk) is just chance. ‡ probability that rejection of β=1 (unbiasedness) is just chance. Brian Lucey & Grace Loring, 2013, “Forward Exchange Rate Biasedness Across Developed and Developing Country Currencies: Do Observed Patterns Persist Out of Sample?” Emerging Markets Review, vol.17, pp. 14-28. Applications of the forward discount bias (or interest differential bias) strategy • The Convergence Play in the European Monetary System (1990-92): Go short in DM; long in £, Swedish kronor, Italian lira, Finnish markka & Portuguese escudo. • The Carry Trade – (1991-94) Go short in $, – (1995-98) Go short in ¥; long in Mexican pesos, etc. long in $ assets, in Asia or US – (2002-07) Go short $, ¥, SFr; long in Australia, Brazil, Iceland, India, Indonesia, Mexico, New Zealand, Russia, S. Africa, & Turkey. • New convergence play (2007): – Go short in €; long in Hungary, Baltics, other EMU candidates. • New carry trade (2009-12): Go short in $. API-120 - Macroeconomic Policy Analysis I; Professor Jeffrey Frankel, Harvard University Carry trade: A strategy of going short in the (low-interest rate) ¥ and long in the (high interest rate) A$ made a little money every month 2001-08: the 5% interest differential was not offset by any depreciation of the A$ during these years. } interest differential = 500 basis points ”How to trade the carry trade,” Futures Magazine, www.futuresmag.com, Sept. 2011 Suddenly in 2008, the strategy of going short in ¥ and long in A$ lost a lot of money, as risk concerns rose sharply, the carry trade “unwound,” and the A$ plunged against the ¥. Unwinding of the carry trade ”How to trade the carry trade,” Futures Magazine, www.futuresmag.com, Sept. 2011 Unanswered question: Is the systematic component of -- the fd bias -- due to: « a risk premium rp? or « a failure of Rational Expectations? Three possible approaches: 1) Find a measure of ∆se. (See Appendix 4 on survey data.) 2) Model rp theoretically. See if prediction errors depend systematically on variables rp should depend on. ―> Subject of Lecture 23: Optimal portfolio diversification. 3) Cast a wider net, with respect to countries or horizons. API-120 - Macroeconomic Policy Analysis I; Professor Jeffrey Frankel, Harvard University Introduction to the portfolio-balance model: Each investor at time t allocates shares of his or her portfolio to a menu of assets, as a function of expected return, risk, & perhaps other factors (tax treatment, liquidity...): xi, t = βi (Et rt+1 , risk) . Sum across investors i to get the aggregate demand for assets, which must equal supply in the market. We will invert the function to determine what Et rt+1 must be, for supplies xt to be willingly held. xt = A + B rpt . Now invert: rp t = B-1 x t - B-1 A . We see that asset supplies are a determinant of the risk premium. Special case : | B-1 | = 0 , • perfect substitutability ( |B|=∞ ), • no risk premium (rpt = 0), and so • no effect from sterilized forex intervention. How the supply of debt x determines the risk premium rp in the portfolio balance model A large x forces up the expected return that portfolio holders must be paid. API-120 - Macroeconomic Policy Analysis I; Professor Jeffrey Frankel, Kennedy School of Government, Harvard University Appendix 1: TESTS OF UNBIASEDNESS IN THE FORWARD EXCHANGE MARKET, OVERVIEW OF CONCEPTS (continued) Definition: Random Walk (∆s t+1 = ε t+1 ). Does unbiasedness => RW? No. <= (fdt 0), so Et ∆s t+1 0. Def.: Rational Expectations Set = Et (St+1) Def.: Efficient Markets Hypothesis F reveals all info Does RE => EMH ? Not necessarily. <= There could be transactions costs, capital controls, missing markets... Appendix 2: Technical econometrics regarding error term: • Overlapping observations => MA error process • “Peso problem:” small probability of big devaluation => error term not ~ iid normal. • The Siegal paradox: Is H0 Ft = Et(St+1)? or 1/Ft = Et(1/St+1)? API-120 - Macroeconomic Policy Analysis I ; Professor Jeffrey Frankel, Harvard University Appendix, cont.: The Siegal Paradox -- an annoying technicality– an instance of “Jensen’s inequality.” One would think that if the forward rate is unbiased when one currency is defined to be the domestic currency, it would also be unbiased when the other is. Unfortunately this is not the case, unless spot & forward rates are defined in logs. (A justification for using logs -- a Siegal paradox resolution – is available as an Addendum to this lecture.) API-120 - Macroeconomic Policy Analysis I; Professor Jeffrey Frankel, Harvard University Appendix 3: Tests of unbiasedness in the forward discount for individual countries Results reported in Engel survey are typical: On average, not only does S fail to move in the direction indicated by the forward discount, but it tends, if anything, to move opposite. Pooling slope estimates across all emerging countries, the sign > 0 => much less bias than the estimates for rich countries. Even so, β<<1 => unbiasedness still rejected. (See below for results on individual countries.) Source: J.Frankel & Jumana Poonawala, 2010, “Are Forward Exchange Rates Biased Indicators of Spot Exchange Rates in Emerging Market Economies?” JIMF. For each industrialized country, the slope β is negative. Source: Frankel & Poonawalla, JIMF, 2010 For emerging markets, some currencies have negative slopes, but some have positive slopes. Source: Frankel & Poonawalla, 2010 The estimates for the emerging countries show less bias than the estimates for rich countries. Source: J.Frankel & Jumana Poonawala, “Are Forward Exchange Rates Biased Indicators of Spot Exchange Rates in Emerging Market Economies?” 2010 . API-120 - Macroeconomic Policy Analysis I Professor Jeffrey Frankel, Kennedy School of Government, Harvard University Lucey & Loring, “Forward Exchange Rate Biasedness Across Developed and Developing Country Currencies: Do Observed Patterns Observed Patterns Persist Out of Sample? “ Emerging Markets Review, 2013. Appendix 4 Survey data to measure expectations: sˆ t s t u t e e Test for risk premium: sˆe t 2 2 ( fd ) u t t H 0 : 2 1, no time-varying risk premium. Finding: Failure to reject H0 . (Allows for a constant risk premium α2.) API-120 - Macroeconomic Policy Analysis I ; Professor Jeffrey Frankel, Harvard University Coefficient on fd (β2) is insignificantly different from 1. => time-variation in fd is variation in ∆se, not in rp. API-120 - Macroeconomic Policy Analysis I; Professor Jeffrey Frankel, Kennedy School of Government, Harvard University