IS' i Y

advertisement

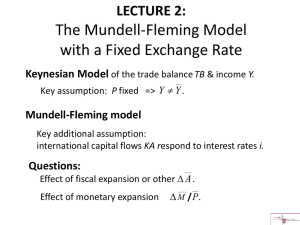

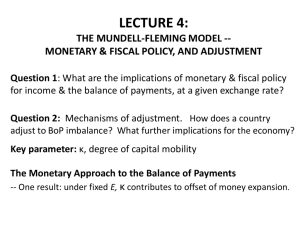

(II) THE MUNDELL-FLEMING MODEL LECTURE 3: THE MODEL WITH A FIXED EXCHANGE RATE Keynesian Model of the trade balance TB & income Y. . Key assumption: P fixed => Y ≠ 𝑌. Mundell-Fleming model Key additional assumption: international capital flows KA respond to interest rates i. Questions: Effect of fiscal expansion or other Δ𝐴 . Effect of monetary expansion. Recall the Keynesian model of the trade balance TB is a function of the exchange rate & income: TB = 𝑋 𝐸 - mY. We now embody E effects (whether via exports or imports) in 𝑋; and we assume the Marshall-Lerner condition holds: 𝑑𝑋 𝑑𝐸 > 0. Determination of income Trade Balance: TB = 𝑋(E) – mY. Aggregate output = domestic Aggregate Demand + net foreign demand: Y = A(i, Y) where 𝑑𝐴 𝑑𝑖 <0 and + 𝑑𝐴 𝑑𝑌 TB(E, Y), > 0. More specifically, let A(i, Y) = Ā - b(i) + cY , where the function -b( ) captures the negative effect of the interest rate i on investment spending, consumerdurables, etc. Combining equations, Y = A(i, Y) + TB(E, Y ) = Ā - b(i) + cY + 𝑋 𝐸 - mY. Now solve to get the IS curve: Y = Ā − b(i) + 𝑋 𝐸 𝑠+𝑚 where s 1–c is the marginal propensity to save. IS curve: An inverse relationship between i and Y consistent with supply = demand in the goods market. IS: Y = i IS 𝐴 − 𝑏𝑖 + 𝑋 𝑠+𝑚 IS' Δ𝐴/(𝑠 + 𝑚) Y An increase in spending, Ā, e.g., a fiscal expansion, shifts IS to the right by the multiplier 1/(s+m). The LM curve: Money supply = money demand. 𝑀1 = 𝑃 i L(i, Y) where LM → 𝑑𝐿 𝑑𝑖 < 0, 𝑑𝐿 𝑑𝑌 >0. LM´ A monetary expansion (M1↑) shifts the LM curve to the right. Y • Do central banks actually set the money supply? • Supposedly in the 1980s heyday of monetarism they set M1. • Also the monetary base made a comeback after 2008: Quantitative Easing. Y The Mundell-Fleming equations with a fixed exchange rate IS: Y = 𝐴 − 𝑏𝑖 + 𝑋 𝑠+𝑚 LM: IS 𝑀1 = 𝑃 L(i, Y) LM i Y Prof.J.Frankel Monetary expansion in the Mundell-Fleming model: M1↑ IS: Y = 𝐴 − 𝑏𝑖 + 𝑋 𝑠+𝑚 LM: IS 𝑀1 𝑃 = L(i, Y) LM i LM' Or think of the central bank setting i directly. Y Prof.J.Frankel Spending expansion in the Mundell-Fleming model: 𝐴↑ IS: Y = IS 𝐴 − 𝑏𝑖 + 𝑋 𝑠+𝑚 IS' LM: 𝑀1 𝑃 = L(i, Y) Taylor rule i LM Or the central bank may follow a Taylor Rule: setting i systematically in response to Y & inflation. Y Prof.J.Frankel The Mundell-Fleming model introduces capital flows IS LM BP=0 i Y BP ≡ TB + KA TB = 𝑋 − mY BP=0: New addition: capital flows respond to interest rate differential KA = 𝐾𝐴 + κ (𝑖−𝑖 ∗) where κ 𝑑(𝐾𝐴) , capital mobility. 𝑑(𝑖−𝑖∗) 𝑋 − mY + 𝐾𝐴 + κ 𝑖−𝑖 ∗ = 0 We want to graph BP = 0. Solve for interest differential: (i-i*) = Prof.J.Frankel 1 κ [(−𝐾𝐴−𝑋] + 𝑚 ( )Y. κ BP=0: (i-i*) = 1 κ [(−𝐾𝐴 − 𝑋−𝑀 ] + 𝑚 ( )Y κ . The slope is (m/𝜿). κ=0 i 𝜿>0 i BP=0 𝜿 >> 0 i BP=0 Surplus BP=0 Deficit Y Y Y Capital mobility gives some slope to the BP=0 line:. A rise in income and the trade deficit is consistent with BP=0 … if higher interest rates attract a big enough capital inflow. Prof.J.Frankel Application: Why did many developing countries find themselves with BoP surpluses during 2003-08 & 2010-13? • Strong economic performance (especially Asia) -- IS shifts right. • Easy monetary policy in US and other major industrialized countries (low i*) -- BP shifts down. • Boom in mineral & agricultural commodities (esp. Africa & Latin America) -- BP shifts right. Causes of BoP Surpluses in Developing Countries I. 1990-1997, 2003-08 & 2010-13 “Pull” Factors (internal causes) 1. Monetary stabilization => LM shifts up 2. Removal of capital controls => κ rises 3. Spending boom => IS shifts out/up II. “Push” Factors (external causes) 1. Low interest rates in rich countries => i* down => 2. Boom in export markets => • } BP shifts out/ down