Chapter 5 Concept Questions

advertisement

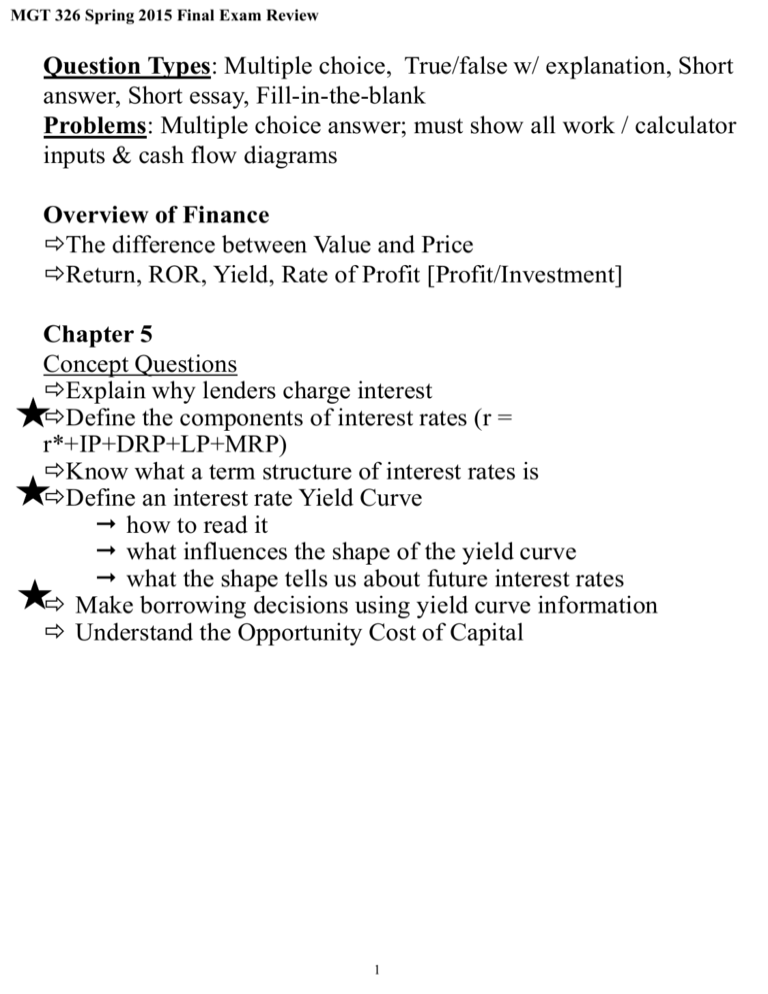

MGT 326 Spring 2015 Final Exam Review Question Types: Multiple choice, True/false w/ explanation, Short answer, Short essay, Fill-in-the-blank Problems: Multiple choice answer; must show all work / calculator inputs & cash flow diagrams Overview of Finance The difference between Value and Price Return, ROR, Yield, Rate of Profit [Profit/Investment] Chapter 5 Concept Questions Explain why lenders charge interest Define the components of interest rates (r = r*+IP+DRP+LP+MRP) Know what a term structure of interest rates is Define an interest rate Yield Curve how to read it what influences the shape of the yield curve what the shape tells us about future interest rates Make borrowing decisions using yield curve information Understand the Opportunity Cost of Capital 1 MGT 326 Spring 2015 Final Exam Review Chapter 4 Concept Questions Future value (definition) Present value (definition) Compounding (definition) Discounting (definition) Explain Effective Annual Rate Use Effective Annual Rate To Make a Boorowing or Investing Decision The #1, all-important, never-to-be-forgotten process used to determine the theoretical/fair market value of any financial asset Explain why this is true rnominal, rperiodic Types of Problems (work them any way you know how) Find FV Find PV Find r Find n Annuities (ordinary & due) →Find PMT Un-even cash flows Perpetuities EAR Do all of the above using other-than-annual compounding Perform All of the Above with Fractional (non-integer) Time Periods Perform All of the Above in Cases Where Compounding Periods Per Year Aren't Equal To Payments Per Year Be able to solve the above without the financial functions on your calculator (i.e. do the math) 2 MGT 326 Spring 2015 Final Exam Review Chapter 6: Bonds Concept Questions: Explain Selling At Par, At a Discount & At a Premium Understand Bond Price Behavior wrt Changes in Market Interest Rates Understand Bond Price Sensitivity wrt Maturity Make Bond Investing Decision Using a Yield Curve Information Types of Problems: Find retail price of a bond →Calculator Financial Functions (at coupon) (no date given) →Bond Worksheet (between coupons) (date given) Given 2 bonds, which is most fairly priced Find bond YTM Find realized total return / yield for bonds Chapter 7: Stock Valuation Concept Questions: Understand Fundamental Stock Concepts, Terms & Characteristics Stock valuation concept: zero dividend growth, constant dividend growth, non-constant dividend growth (wrt corporate life cycle) The cost of stock what does it mean how do firms meet the cost of stock Types of Problems: Find fair market value/theoretical value of a non-constant dividend growth Stock Chapter 13: Cost of Capital Explain why WACC is considered a firm’s required ROR 3 MGT 326 Spring 2015 Final Exam Review Chapter 8: Investment Decision Rules Concept Questions: Types of projects and their relative risk The principle behind: payback period & discounted payback period, NPV, IRR Strengths & weaknesses of the above Disadvantage of IRR technique vs. NPV reinvestment rate assumption unconventional cash flows NPV profiles what they are slope: sensitivity to change in discount rate why they might cross implications of NPV sensitivity to change in discount rate; what this tells you about the riskiness of a project Risk Adjusted Discount Rate What to do if projects have unequal lives Why the WACC is used as the discount rate in NPV computations: Why WACC is considered a project’s required ROR Types of Problems: Discounted payback period, NPV, IRR Find NPV of projects with unequal lives Use Risk Adjusted Discount Rate in NPV Calculation 4 MGT 326 Spring 2015 Final Exam Review Chapters 11&12 Explain Systematic Risk and Unsystematic Risk Describe the Causes of Systematic Risk and Unsystematic Risk Explain Coefficient of Variation and Use It To Make An Investment Decision Describe Diversification and How It Reduces the Riskiness of a Portfolio Describe the CAPM Concept Explain the Concept of Risk Aversion and Its Effects on Security Valuation and Return Explain What Beta Is Explain the Difference Between Rqd ROR of a Stock Computed with CAPM and Rqd ROR Derived From the Average of Historical Returns 5 MGT 326 Spring 2015 Final Exam Review Formulas ROR = Profit/Investment = (Sales Price –COGS)/COGS = (End Price – Begin Price) / Begin Price = (New – Old) / Old Cost of Money Nominal Interest Rate = r = r* + IP + DRP + LP + MRP Time Value of Money rperiodic = rnominal/m n=mxT FV = PV(1 + rnominal/m)n PV = FV / (1 + rnominal/m)n EAR = (1 + rnominal/m)m – 1 PVperpetuity = PMT / rperiodic Bonds Cpn = FV(rCPN/m) Capital Gains Yield = ROR Bond Total Yield = EARCoupon + Capital Gains Yield Real ROR = [(1 + rnominal )/(1 + Inflation)] - 1 Stocks P0 = D/ rs (zero growth dividend) P0 = D0(1 + g) = D1 (constant growth dividend) rs – g rs - g P0 = PV0(CFst1-tx) + PV0(PVt=x, CFs 4-infinity) (non-constant growth dividend) rs = D0/P-1 + (P0 - P-1)/P-1 rs = D1/P0 + g OR D1/P0 + (P1 - P0)/P0 P1 = P0(1 + g/m)n OR Vhorizon Coefficient of Variation s /E(r) ≈ S/rrealized CAPM rs = rRF + (rM – rRF)s rp = rRF + (rM – rRF)p = Cost of Capital rdt: rdt = rd(1 – T) rs = rRF + (rM – rRF) rPS: rPS = DPS / (P0 – Float Cost) WACC = wdrdT + wpsrps + wsrs 6