IPFM Formula Sheet

advertisement

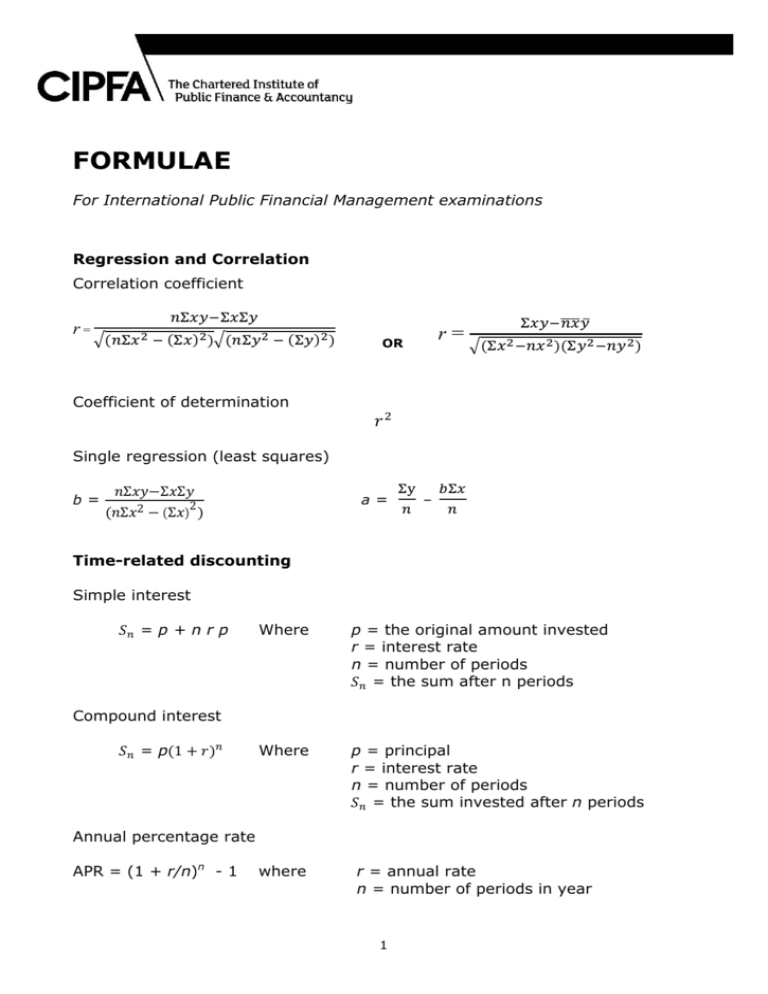

FORMULAE For International Public Financial Management examinations Regression and Correlation Correlation coefficient r= Coefficient of determination r= OR Single regression (least squares) b= ΣΣΣ 2 Σ2Σ a= – Time-related discounting Simple interest = p + n r p Where p = the original amount invested r = interest rate n = number of periods = the sum after n periods Where p = principal r = interest rate n = number of periods = the sum invested after n periods Compound interest = p1 Annual percentage rate APR = (1 + r/n)n - 1 where r = annual rate n = number of periods in year 1 Daily percentage rate K = 1 – 1 Where K is the daily interest rate R is the rate given D is the number of days it relates to Where PV = present value Discount factor PV = r = interest rate n = number of periods !the sum invested after n periods Internal rate of return by interpolation IRR = A+ " "# x (B-A) Where A = lower discount rate B = higher discount rate C = NPV at lower discount rate D = NPV at higher discount rate Real rate of interest ()*+,+-. $%&%'$ ! -/.*0,+-*(+-. 1 Equity cost of capital Dividend valuation model: ! 1 Where 23 r= shareholder’s cost of capital d = annual dividend per share MV = ex dividend share price Dividend growth model: = 1(4 23 +g Where r = the shareholders cost of capital do = current dividend (net) g = expected annual growth in dividend payments (%) MV = current ex div market price 2 Cost of debt capital and preference shares i= 5 8( = current market price of debt capital Where 67 K = the interest (dividend) received i = the cost of debt (preference share) capital Capital asset pricing model 9 = 0 + β() -0 9 or :; 0 or 0 ) or :) β or B Where :; = 0 + (:) - 0 )B or = = = = the the the the expected return/cost of capital risk free rate of return return on the market portfolio Beta factor of the individual security Stock control and cash management Economic Order Quantity q=< "# Where = q = Economic Order Quantity C = order cost D = annual demand H = stock holding cost per unit per annum Reorder level model Reorder level (ROL) = Lead time x Demand per time unit + safety stock Miller-Orr model B z= < >?@ A5 +L Where K = daily opportunity cost of cash F = transaction cost G = variance of net daily cash flows Z = target balance C ! 3E 2F W= AHI H = upper limit > L = Lower limit W = average balance 3 Baumol Model - Optimal cash injection C=< * Where C = cash injection b = brokers’ fees t = net cash flow over the period i = opportunity cost of interest forgone or cost of borrowing to provide funds 4