An Opportunity to Fund Retirement with a Roth IRA

advertisement

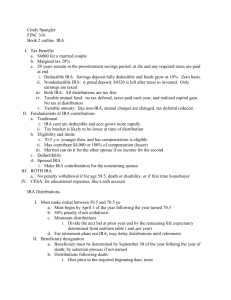

An Opportunity to Fund Retirement with a Roth IRA 1/16 E24043-16A Please note that this presentation has been designed to provide general information. Neither Pacific Life nor its representatives offer legal or tax advice. Clients should consult their attorneys and tax advisers as to the applicability of this information to their specific circumstances and for complete up-to-date information concerning federal and state tax law. [Name of Financial Professional] and [Company] are not affiliated with Pacific Life or its affiliated companies. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. No bank guarantee • Not a deposit • May lose value • Not FDIC/NCUA insured • Not insured by any federal government agency Agenda Funding Distributions Planning Roth IRAs Established 1/1/98 Governed by IRA rules, except: – No deductible contributions – Tax-free qualified distributions – Owner has no required distributions Funding Contributions Conversions FOUR WAYS Rollovers from Employer Plans Rollovers from Roth 401(k)/403(b) Contributions for 2016 $5,500 (or $6,500 if 50 or older by end of year) Two requirements – Earned income at least equal to amount contributed – Below modified adjusted gross income (MAGI) thresholds MAGI Phase-Out Ranges Married Filing Jointly Single $184,000 – $194,000 $117,000 – $132,000 What Is MAGI for Roth IRA? Adjusted Gross Income (From IRS Form 1040 Series) •Roth Conversion Amounts •Roth Rollovers from Employer Plans Certain Deductions & Exclusions For example: •Traditional IRA •Qualified Bond Interest Conversions Rollover of assets from a traditional IRA, SEP-IRA or SIMPLE IRA to a Roth IRA – Two-year period must be met if converting a SIMPLE IRA IRA owner pays taxes on pretax dollars Additional 10% federal tax does not apply Conversion Process 1. Redesignation • 1099R reporting 2. Direct rollover • 1099R reporting • No 60-day rule 3. Indirect rollover • 1099R reporting • 60-day rule applies • No 12-month restriction All Conversions in 2010 and Onward Convert traditional IRA to Roth IRA IRA Roth IRA No MAGI limits Anyone can convert regardless of income level Tax Changes for Top Income Earners American Taxpayer Relief Act of 2012 Makes permanent for 2013 and beyond the lower Bush-era income-tax rates (for most individuals) Top income-tax rate 39.6% Year Single Married Filing Jointly 2013 $400,000 $450,000 2014 $406,750 $457,600 2015 $413,200 $464,850 2016 $415,050 $466,950 Conversion Caution Using assets outside of the IRA to pay tax: – Reduces taxable estate – Maximizes long-term tax deferral Using IRA assets to pay tax may: – Subject some assets to income taxation – Incur an additional 10% federal tax Converting IRAs After Age 70½ Required minimum distribution (RMD) amounts cannot be converted or rolled to a Roth IRA IRA 1. RMD 2. Roth IRA 1. Distribute RMD amount from IRA 2. Convert balance to Roth IRA Converting from an Employer Plan Beginning 1/1/08 Two sets of rules: 1. Conversion rules 2. Rollover rules of the plan from which rollover occurred Converting from an Employer Plan IRS Notice 2014-54 Description: The IRS issued notice 2014-54 that addresses the question “If my 401(k) has both pre-tax money and post-tax money, can I just take the post-tax money and convert to a Roth IRA tax-free?” Impacted Areas: Qualified Retirement Plans, IRAs, and Roth IRAs Changes: Clarifies the IRS’s prior position of applying the pro-rata rule Effective Date: January 1, 2015 Converting from an Employer Plan IRS Notice 2014-54 Details: Permits participants to direct the pre-tax and post-tax when disbursements are made to multiple destinations (e.g., to an IRA and Roth IRA) and not require application of the pro-rata rule Converting from an Employer Plan Examples: Pre-IRS Notice 2014-54 Post-IRS Notice 2014-54 • $100,000 401(k) Plan • $100,000 401(k) Plan • $80,000 pre-tax • $20,000 post-tax • Receives pro-rata treatment when converting to Roth IRA • If you convert $20,000 into a Roth IRA, then $16,000 would be subject to tax • $80,000 pre-tax • $20,000 post-tax • Can pick which bucket of assets (pretax or post-tax) to convert/distribute • If you convert $20,000 into a Roth IRA, then you can choose that all $20,000 come from the post-tax bucket and process a tax-free conversion Who Let the Roth Out? Converting inherited accounts Applies only to eligible rollover distributions from employer plans May be rolled to an inherited Roth IRA Distributions must be taken from a Roth IRA Does it make sense to convert? Are You Looking to Accelerate a Deduction? Section 691(c) deduction Itemized deduction for estate taxes paid Conversion causes you to pay income taxes sooner, BUT also accelerates use of this deduction, potentially reducing tax bill in half According to the American Taxpayer Relief Act of 2012, the federal estate, gift, and generationskipping transfer (GST) tax exemption amounts are all $5,000,000 (indexed for inflation effective for tax years after 2011); the maximum estate, gift, and GST tax rates are 40%. The exemption amount for 2016 is $5,450,000. Conversion Do-Overs Recharacterization – By tax return due date, including extensions (October 15) Reconversion (later of) Doing over the do-over – In year following year of conversion, or – 30 days after recharacterization Do-Over Timeline Scenario Conversion Recharacterization Reconversion 1 4/1/15 8/1/15 1/1/16 2 4/1/15 12/25/15 1/24/16 3 4/1/15 4/15/16 5/15/16 Roth 401(k) and 403(b) Established 1/1/06 No MAGI limits for contributions Required distributions Tricky rollover rules Roth IRA Distributions Qualified Nonqualified Required (for beneficiaries) Qualified (Tax-Free) Distributions Two requirements: 1. Five years since you established a Roth IRA 2. Distribution is made for one of the following reasons: – Age 59½ or older – Disability – Death of owner – First-time home buyer Nonqualified Distributions If you take a distribution but fail to meet requirements for a qualified distribution, then the distribution is made in the following order: Regular contributions Conversion and rollover contributions – Additional 10% federal tax if within five years Earnings – Taxes and 10% if no exception Tricky Rollover Rules Roth 401(k)/403(b) Roth IRA New Roth IRA, then new five-year period Existing Roth IRA, then rollover tracks Roth IRA five-year period Tricky Rollover Rules Qualified Distribution Nonqualified Distribution Rollover amount treated as basis in Roth IRA Rollover amount divided into basis and earnings in Roth IRA DRAC Rollover Example Amount includes $65,000 after-tax contributions and $35,000 earnings Qualified distribution – $100,000 included as Roth IRA basis Nonqualified distribution – Basis and earnings track to the Roth IRA You May Wish to Get Started In anticipation of a DRAC rollover, establish a Roth IRA now with either: Contributory Roth IRA Nondeductible IRA that is then converted to Roth IRA – BUT beware of the aggregation rule Required Distributions at Death Death before required beginning date (RBD) rules – Designated beneficiary (DB) ▪ May use five-year rule or life expectancy – No DB ▪ Must use five-year rule Nonqualified Death Distributions Roth IRA owner dies before end of five-year period beginning with: First taxable year for which a contribution was made Year of conversion contribution from traditional IRA or rollover Qualified Death Distributions Spousal rollover – Earlier of spouse’s or decedent’s five-year holding period All others – Decedent’s five-year holding period Who’s Your Beneficiary? Designated beneficiary (DB) – Spouse – Non-spousal individual – Qualifying trusts Non-DB—estates, charities, etc. Spouse Lump sum Five-year rule Inherited Roth IRA – Annuitization – Spouse’s recalculated life expectancy ▪ Delayed until owner would have reached age 70½ Rollover Non-Spousal Individual Lump sum Five-year rule Inherited Roth IRA – Annuitization – Life expectancy of beneficiary Qualifying Trusts and Designated Beneficiaries (DBs) Valid under state law Irrevocable at death Identifiable beneficiaries Trust documentation by 10/31 of the year following the year of death Qualifying Trusts Lump sum Five-year rule Trust-owned inherited Roth IRA – Life expectancy of oldest trust beneficiary Non-Designated Beneficiaries Lump Sum Five-Year Payout Important Dates for the Year AFTER Death 9/30 10/31 12/31 DB Determination Trust Document Separate Accounts Case Study $750,000 Roth IRA 75-year-old owner dies having named two beneficiaries Son Granddaughter Age 50 Age 25 Begins Distributions Begins Distributions Opportunity for Separate Accounts Separate accounts established by 12/31 of the year following the year of the owner’s death Son has 34.2 years during which to take distributions Granddaughter has 58.2 years during which to take distributions Thanks, but No Thanks Disclaimers Son executes a qualified disclaimer His sons, ages 22 and 20, may inherit his interest Separate accounts established by 12/31 deadline 22-year-old son’s distribution period is 61.1 years 20-year-old son’s distribution period is 63 years Managing the 3.8% Net Investment Income Tax (NIIT) Beginning in 2013, the Health Care Reform Act created a new 3.8% federal tax on net investment income 3.8% federal tax will apply to the LESSER of: 1. 2. Net investment income The excess of MAGI thresholds–$200,000 for single taxpayers; $250,000 for married taxpayers filing a joint tax return Roth IRA Advantages Potential for earnings without tax No required lifetime distributions Not included in definition of income for taxation of Social Security benefits Management of NIIT Roth IRA Disadvantages No deduction for contributions Pay tax on conversions Additional Considerations Before moving assets from qualified plan to a Roth IRA consider: Investment options (may vary) Fees and expenses (may vary) Services offered (may differ) Loan access (Roth IRA does not allow Loans) Creditor protection (may differ) Do the Math Analysis is required, because everyone’s situation is different Conversion calculators Tools to help analyze a Roth IRA conversion Assumptions include: When distributions will be taken What tax rates will be at the time of distributions Earnings during the interim Possible Opportunities You don’t need your traditional IRA for income and wish to leave it to someone You need your IRA to fund a trust You are willing to pay income tax on conversion to reduce your estate (and thus your estate tax) You have charitable deduction carryovers, investment tax credits, etc., that will offset income on conversion In Summary Better understanding of funding Roth IRAs Roth conversions Distributions and beneficiary options Decisions should be reviewed with your tax and legal advisors before making any changes This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state, or local tax penalties. This material is written to support the promotion or marketing of the transaction(s) or matter(s) addressed by this material. Pacific Life, its affiliates, their distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney. Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues. Pacific Life Insurance Company In New York, Pacific Life & Annuity Company P.O. Box 2378 P.O. Box 2829 Omaha, NE 68103-2378 Omaha, NE 68103-2829 (800) 722-4448 (800) 748-6907 www.PacificLife.com