Cindy Spangler - Westminster College

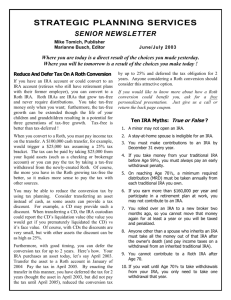

advertisement

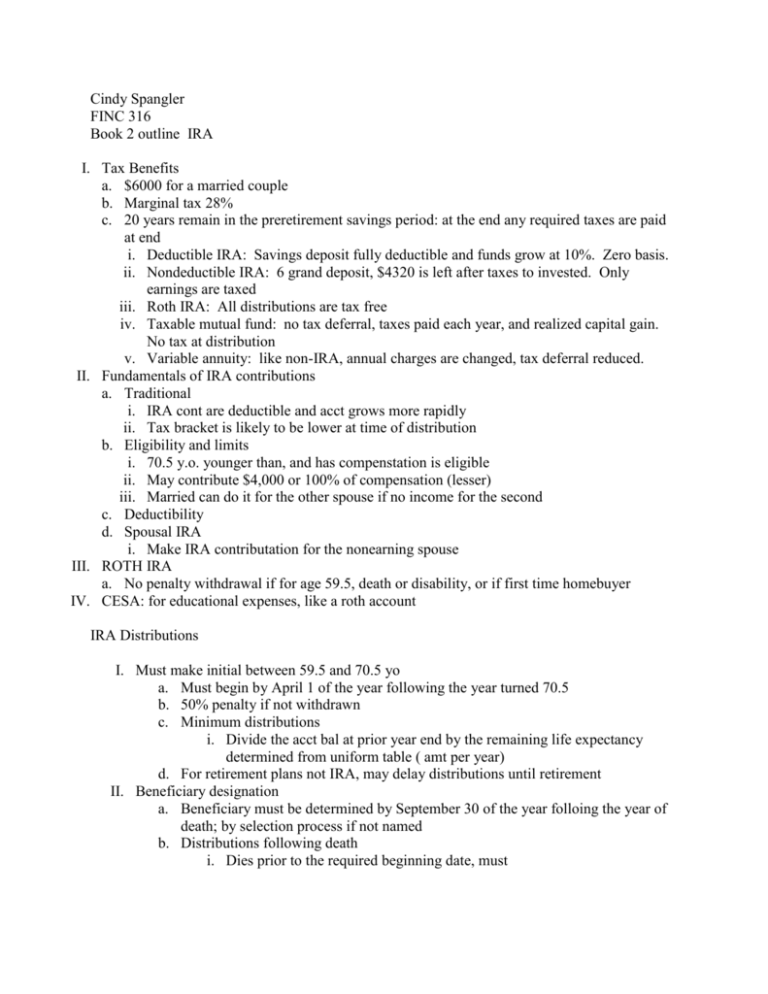

Cindy Spangler FINC 316 Book 2 outline IRA I. Tax Benefits a. $6000 for a married couple b. Marginal tax 28% c. 20 years remain in the preretirement savings period: at the end any required taxes are paid at end i. Deductible IRA: Savings deposit fully deductible and funds grow at 10%. Zero basis. ii. Nondeductible IRA: 6 grand deposit, $4320 is left after taxes to invested. Only earnings are taxed iii. Roth IRA: All distributions are tax free iv. Taxable mutual fund: no tax deferral, taxes paid each year, and realized capital gain. No tax at distribution v. Variable annuity: like non-IRA, annual charges are changed, tax deferral reduced. II. Fundamentals of IRA contributions a. Traditional i. IRA cont are deductible and acct grows more rapidly ii. Tax bracket is likely to be lower at time of distribution b. Eligibility and limits i. 70.5 y.o. younger than, and has compenstation is eligible ii. May contribute $4,000 or 100% of compensation (lesser) iii. Married can do it for the other spouse if no income for the second c. Deductibility d. Spousal IRA i. Make IRA contributation for the nonearning spouse III. ROTH IRA a. No penalty withdrawal if for age 59.5, death or disability, or if first time homebuyer IV. CESA: for educational expenses, like a roth account IRA Distributions I. Must make initial between 59.5 and 70.5 yo a. Must begin by April 1 of the year following the year turned 70.5 b. 50% penalty if not withdrawn c. Minimum distributions i. Divide the acct bal at prior year end by the remaining life expectancy determined from uniform table ( amt per year) d. For retirement plans not IRA, may delay distributions until retirement II. Beneficiary designation a. Beneficiary must be determined by September 30 of the year folloing the year of death; by selection process if not named b. Distributions following death i. Dies prior to the required beginning date, must 1. death occurs on or after RMD: year of death distribution must be made or no beneficiary, must be made over the life expectqancy of the owner using the RMD table. 2. death before RMD: Table 6 pg 41 III. Premature distributions a. 10% penalty except for: i. Death of owner ii. Disability iii. Medical expenses iv. Medical insurance premium while unemployed v. Higher education expenses vi. First time home buyer vii. A series of substantially equal periodic payments Qualified Retirement plans I. Beneficial for everyone Qualified plan benefits and contributions and taxes II. Helps small businesses and everyone compete for workers and provides tax break. Issues in discrimination III. Favor group status a. When only key or top employees receive the benefits of the plans b. Coverage test i. Ratio percentage test: percentage of eligible nonhighly compensated employees benefited by the plan must be at least 70% of the percentage of eligible highly compensated employees benefited by plan ii. Average benefits test c. Minimum participation (50/40) test i. Benefit the at least the lesser of 1. 50 employees 2. greater of a. 40% of all the company’s ERISA eligible employees b. 2 employees IV. Vesting