View Slides - FutureAdvisor Blog

advertisement

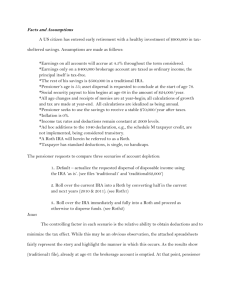

Personal Finance for Engineers …Keep coding, our algorithm has it under control! Wi-Fi Name: FutureAdvisor Guest Password: Would you rather…. Have 3.5 million dollars up front? or Start with a penny and have your balance double every day for one month? Who I am Where my approach/advice comes from Who I’m not (Disclaimer) Although I have a passion for these topics, the views expressed are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities. This should not be interpreted as tax advice and please consult your personal tax advisors if you have any questions. Housekeeping Topics Behavioral Finance Understanding your current situation Credit Scores Retirement, the time value of money, & 401k / 403b Investing 101 Savings accounts & fees Love & Money Home ownership, mortgages, refinancing, & renting Tax strategy Life insurance / Health Insurance Tactical next steps Happiness Happiness & Wealth Wealth Why we need an automatic plan… People are not rational with financial decisions (susceptible to framing, prospect theory, anchoring, choice architecture, & the default option) Study: the more often you check your portfolio the worse you do We don’t like losing! (Prospect Theory) (DMR) Commitment devices! Google’s anchoring experiment (3% increase) Why we need an automatic plan (cont.) “Save More Tomorrow” (12% vs 4%) Allocation decisions & 1/n: Scenario 1: Scenario 2: Scenario 3: Fund A: Stocks Fund B: Bonds Fund A: Stocks Fund B: ½ Bonds ½ Stocks Fund A: ½ Bonds ½ Stocks Fund B: Bonds 54% allocation to stocks 73% allocation to stocks 35% allocation to stocks Prior to the talk 20 mins - capture your “Net Worth” (all assets & debts) Use Mint.com; connect banking & investment accounts, student/car loans Include property (homes & cars) Homes: zillow.com Cars: edmunds.com 10 mins - understand your credit score Signup for CreditKarma Pull a free credit report from annualcreditreport.com; Experian in Jan, TransUnion in Apr, Equifax in Aug 15 mins – analyze your current investments and get free advice: www.FutureAdvisor.com (optional) 30 mins - create a spending plan (aka budget) Can be in Mint or even Excel Savings must be a part of your plan Understanding your current situation Check Mint often Spend < make Save xx% of your income “Pay yourself first” – schedule savings Debts Credit Cards & student loans BT offers Understand your current allocation & fees “I’ll worry about retirement later…” Time Value of Money is HUGE! Frick & Frack brothers The “Rule of 72” $$ saved from 25-35 > $$ saved 35 on Everyone should have a (ROTH) IRA & 401k! Are you on-track? ~75% of ending salary per year 1x by 35, 3x by 45, 5x by 55 See handout Retirement Accounts IRA 401(k) / 403(b) • 2014 Limit: $5,500 • 2014 Limit: $17,500 • No matching • May get matching • Hold at any institution • Hold at company’s chosen firm • Thousands of investment options • Limited choices • Only contribute cash • Only contribute from payroll • Income limits • Different for Roth vs Trad • No income limits • May get a Roth option • Jan 1 – Apr 15 (of following year) open period • Jan 1 – Dec 31 open period Uncle Sam will always get paid Roth • After-tax contributions (pay tax now) Traditional • Pre-tax contributions (get a tax break now) • • Earnings grow tax-free • Roth IRA’s have no RMD’s • • $120k salary, contribute max amount of $17,500 Taxable income now $102,500 28% x $17,500 = $4,900 • Roth IRA income limit: < $114k • Taxed on the way out • “Backdoor Roth” option • Traditional IRA’s have RMD’s • Really depends on tax bracket now vs. retirement • Beliefs on long-term tax brackets / code / law • Solution: have some in each Investing 101 & active vs. passive Stocks, Mutual Funds, ETF’s, Bonds Write down your financial principles / guidelines 20-25% for “fun” if you must Active vs. Passive Investing: research shows ~80-90% of active funds underperform their benchmark 8,000 2,000 500 125 20% most actively traded accounts performed much worse -men worse than women Past fund performance has very little predictive power to future performance! In fact, expense ratios are the best predictor Expense Ratios (the enemy) Industry average (0.80% 2.50%) Low cost options (0.06% 0.50%) Get angry…it’s your money! Use the calculator Why rollover an old 401k “It is difficult to get a man to understand something, when his salary depends on his not understanding it.” – Upton Sinclair Asset allocation & rebalancing With proper allocation, you should reduce risk (volatility) and outperform the S&P 500 Rebalancing: meeting long-term policy target weights Use it as a disciplined way of buying low and selling high “..shunning the loved & embracing the unloved. Most people do the opposite.” (Swensen) Example: 1990-2012 portfolio: +0.5% difference in return, -2% difference in volatility My target allocation: Balancing w/ Equity Being compensated w/ equity is normal (& good!) Minimize your exposure to one company Be aware it correlates with job, house, life! EPP (Stock Plans) – be careful Don’t hold it in your 401k too! How to proxy it in the algorithm Precedence of Saving 1. Matching 401(k) or 403(b) – Max it! 2. Emergency fund (~6-9 months) 3. Pay down debt(s) 4. Roth IRA / Roth 401(k) or TSP 5. Taxable account Invest in yourself too! Automated Portfolio Management Single optimization model for multiple trading scenarios ● Rebalance ● Invest new cash ● Tax loss harvesting ● Generate cash for withdrawals Runs nightly on every user’s portfolio Problem formulated as an Integer Linear Program Solved with GNU Linear Programming (GLPK) in a fraction of a second Problem Formulation Maximize diversification and Minimize fees, tax inefficiency, number of trades Subject to: ● No small trades (e.g. don’t sell $30 of a fund) ● No small leftover positions (e.g. don’t sell $970 of a $1,000 holding) ● Only buy pre-selected best investments ● Don’t sell recently purchased mutual funds ● Avoid frequent trading fees ● Do not realize excessive capital gains ● Invest cash Home ownership & mortgages Up to a $300/month because of credit score Real estate is a key component Consider NOT holding your mortgage with the same bank as your investments Typically 20% down, qualify for a home 3x your annual gross income Closing costs, points Refinancing Being a landlord can be tough! Rent Rent : Income < 30% (rule of 36) Impact in high-rent markets (SF / NYC) Have rental package ready Credit pull Ask for a copy of credit report Security deposit & interest Zillow’s “zestimate” Tax strategy Look for ways to reduce your taxes Traditional TSP/ 401k / IRA Mortgage interest (& property management fees) Education expenses Consider capital gains (realize gains if you ever find yourself in the 10 or 15% tax bracket. 0% long term gains) IRA conversions Donate to charity with appreciated stock Hire a professional – taxes are “grey” – ask questions! Other random advice… Never go without health insurance! “Exotic” or “alternative” asset classes Careful with your contracts Always look for discounts Cell phone bills (15%-20%) AAA, movies, restaurants, museums, parks Driving habits Avoid buying a new car Remember: smart investing is not very exciting, but it is very rewarding! Fatwallet Cash Back Company stock plans Tactical next steps Automate your savings (pay yourself first) “Hack human biases” Open a (ROTH) IRA Enroll in your company’s 401k Stick to low-cost index funds Help a friend (ER) or 19 yr old cousin Don’t be over-weighted in your company! Don’t let inaction win! Student loans vs. saving Paying down student loans vs. saving for retirement Max matching contributions Consider interest rates loan rate: <2% Invest >10% pay down 2%-10% calculate Both are urgent! Save some to build the habit Consider tax deduction Windows are closed for good! Grandma’s inheritance My favorite personal finance resources Fatwallet Finance Forums Bogleheads Blogs: Mr. Money Mustache, Oblivious Investor Networth IQ | Investopedia *Bonus Material* Tax Loss Harvesting the Credit Card game Questions? What is FutureAdvisor? Free product – analysis & advice Premium product – does it all for you + Tax-Loss Harvesting – for 0.5% How do you differ from the competition? We are holistic – they are not! Where you have to hold your $$ Why would I pay 0.5% for this service? Because it’s 1/2 to 1/3 the price of a traditional advisor Because it will actually get done! (80% fact) What funds do you use & are there commissions? Sign up for a FREE account for a diagnosis! www.FutureAdvisor.com