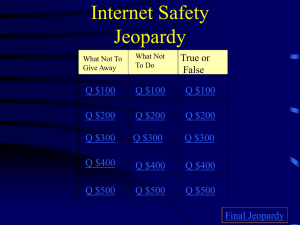

Unit 1 Jeopardy

advertisement

Jeopardy Category 1 Category 2 Category 3 Q $100 Q $100 Q $100 Q $100 Q $100 Q $200 Q $200 Q $200 Q $200 Q $200 Q $300 Q $300 Q $300 Q $300 Q $300 Q $400 Q $400 Q $400 Q $400 Q $400 Q $500 Q $500 Q $500 Q $500 Q $500 Final Jeopardy! Category 4 Category 5 $100 Question To Spread Around $100 Answer from Category 1 Diversification $200 Question from Category 1 Average one of these has 90-200 companies in it $200 Answer from Category 1 Mutual Fund $300 Question from Category 1 You should _______________ your 401k when you leave a compnay $300 Answer from Category 1 Roll Over $400 Question from Category 1 Percentage by which your money grows $400 Answer from Category1 Rate of Return $500 Question from Category 1 The tax treatment on virtually any type of investment $500 Answer from Category 1 IRA $100 Question from Category 2 Investors pooling their money $100 Answer from Category 2 Mutual Funds $200 Question from Category 2 A piece of ownership in a company $200 Answer from Category 2 Share $300 Question from Category 2 Whatever can go wrong will go wrong $300 Answer from Category 2 Murphy’s Law $400 Question from Category 2 Which of the following funds would be most risky? International, Growth, Aggressive Growth, Large Cap $400 Answer from Category 2 Aggressive growth. These companies are a little younger and are growing. $500 Question from Category 2 The availability of your money $500 Answer from Category 2 Liquidity $100 Question from Category 3 An after tax investment that grows tax-free $100 Answer from Category 3 Roth IRA $200 Question from Category 3 How long will it take your money to double at 6% interest rate? $200 Answer from Category 3 12 years $300 Question from Category 3 Typical retirement plan found in most companies $300 Answer from Category 3 401(k) $400 Question from Category 3 Profits that a company distributes $400 Answer from Category 3 Dividends $500 Question from Category 3 Use this approach instead of borrowing to purchase things $500 Answer from Category 3 Sinking Fund $100 Question from Category 4 Save for college using a $100 Answer from Category 4 Educational Savings Account (ESA) $200 Question from Category 4 What really makes your money grow over time $200 Answer from Category 4 Compound Interest $300 Question from Category 4 The government allows you to invest money before tax is taken out $300 Answer from Category 4 Pre-tax $400 Question from Category 4 The correct order of priorities for your money $400 Answer from Category 4 Give, Save, Pay Bills $500 Question from Category 4 The primary difference between a Roth IRA and a traditional IRA $500 Answer from Category 4 Roth grows tax free $100 Question from Category 5 With investments, as the risk goes up, so should the hopeful return $100 Answer from Category 5 Risk Return Ratio $200 Question from Category 5 Helps you build discipline in saving $200 Answer from Category 5 Pre-authorized checking $300 Question from Category 5 Which of the following is not a key to saving money? Making savings a habit and a priority, discipline, how much you earn, focus. $300 Answer from Category 5 How much you earn $400 Question from Category 5 Type of account you should place your emergency fund $400 Answer from Category 5 Money Market $500 Question from Category 5 Oil and gold are examples of these $500 Answer from Category 5 Commodities Final Jeopardy If your company does not provide any type of 401(k) match, what is the best investment option? Final Jeopardy Answer Invest the maximum amount allowed in a Roth IRA, and then go back and fund the 401(k) to complete 15% of your income.