Financial Statement Analysis * Chapter 4

advertisement

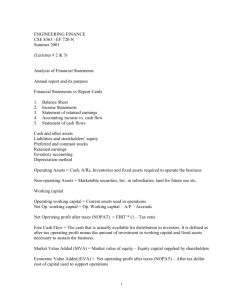

Ryan Williams Learning Objectives Prepare common-sized Income Statements and Balance Sheets. Compute financial ratios listed in Table 4.1. Discuss uses and limitations of the financial ratios in Table 4.1. Who does this? Creditors • Firm’s ability to repay borrowed funds, i.e., creditworthiness Stockholders/owners • Firm’s future prospects (cash flows ) Managers • Identify strengths & weaknesses • Improve firm performance Two companies: Three Months Ended April 3, 2009 NET OPERATING REVENUES $ Cost of goods sold 2,590 GROSS PROFIT 4,579 Selling, general and administrative expenses June 27, 20 10 7,169 2,624 REVENUES Sales $ Franchise fees and royalties 1,255 License royalties 1,799 Interest income Other operating charges OPERATING INCOME Interest income 92 1,863 12,350 208 Other income 14 Total revenues 15,626 60 COSTS AND EXPENSES Interest expense Equity income — net 85 17 Cost of sales 9,488 Restaurant operating expenses 825 Depreciation and amortization 232 General and administrative expenses Other income (loss) — net INCOME BEFORE INCOME TAXES Income taxes (40) 2,564 Total costs and expenses 13,109 1,815 456 Income before provision for income taxes 2,517 Provision for income taxes CONSOLIDATED NET INCOME 1,359 Net income 857 $ 1,660 Step 1 -Common Size Statements Why common size? Allow comparisons through time • -e.g., did company improve on last year’s performance Allow comparisons among firms in same industry • -did company do better or worse than similar firms in same industry Common Size Statements – cont. How to create common size: Balance sheet • Divide each item by total assets and express the result in percent Income statement • Divide each item by net sales and express the result in percent Common Size Statement - Cont Note: In common size income statement, profit measures are renamed. • Gross profit becomes gross profit margin • Operating income becomes operating profit margin • Net income becomes net profit margin Interpretation: Gross profit margin = gross profit per unit sold Similar interpretation for operating profit margin, net profit margin. Step 2 – Financial Ratios Examine relationships between • Balance sheet accounts E.g., compare current assets to current liabilities • Balance sheet accounts and values on the income statement E.g., compare net income to total assets What ratios do we use? Liquidity ratios Activity ratios Debt utilization ratios Profitability ratios Liquidity Ratios Measure how well company can meet short-term obligations Current ratio Quick ratio • Same denominator as current ratio • But numerator excludes inventory • Higher ratios mean firm is better able to meet obligations on time Activity Ratios Also called ‘asset utilization’ ratios or ‘efficiency’ ratios Unused or inactive assets are nonearning assets Either utilize assets more effectively or eliminate them Activity Ratios Average collection period (ACP) Measures how fast company collects payments from credit sales. In number of days. Denominator uses credit sales. If not reported, use total sales. Inventory turnover ratio Measures how efficiently company is employing inventory. Larger ratio more efficient. Industry specific. If COGS not available, use sales as numerator. Activity Ratios Inventory conversion period Measures the time period that an inventory item is in stock before it is sold. In number of days Total asset turnover Measures how productive a firm’s total assets are at producing final sales. Higher ratio means firm is more efficient in using total assets. Industry specific. Activity Ratios Payables period Measures how quickly company pays its trade accounts (suppliers) In number of days Activity Terms, A/R and A/P industry credit terms usually include discount for early payment Typical: 2/10 net 30 • For 2/10 net 30, effective cost is 29-45% per year Debt Utilization Ratios Measures the extent to which firm uses borrowed funds to finance operations. Leverage: using debt to finance assets/operations Debt utilization ratios also known as leverage ratios Debt Utilization Ratios Debt ratio • Measures proportion of all assets financed with debt • Higher the ratio, higher the risk of default. Debt to equity ratio • Ratio of total liabilities to equity Debt Utilization Ratios Times interest earned (TIE) Measures how many times the firm’s annual operating earnings cover its debt-servicing charges (mainly interest). Larger ratio means firm is more likely to pay debtservicing charges despite a drop in sales. Profitability Ratios Compare a firm’s earnings to various factors that are needed to generate the earnings (assets, sales, equity) Return on assets Return on equity Gross profit margin Operating profit margin Net profit margin Cash conversion cycle The length of time (in days) between cash expenditures and cash collections • Cash expenditures: spending money to produce goods for sale or to buy goods for resale • Cash collections: collecting money from customers • Firm should shorten CCC without harming business operations Cash expenditure Cash conversion cycle Cash collection Time passes DuPont Equation Breaks down ROE into three components: Activity (total asset turnover) Profitability (net profit margin) Leverage (equity multiplier = total assets/equity) ROE = net profit margin x total asset turnover x Equity multiplier If ROE changes, DuPont equation helps you to identify the reason for the change. DuPont Equation - 2 Another way to calculate equity multiplier Equity multiplier = 1 1 – debt ratio (use the balance sheet identity: Total assets = Total liabilities + Equity) What are the limitations? 1) Balance sheet values are stock measures • Capture values of assets & liabilities on a specific date • Ratios using balance sheet values may not reflect company’s situation during rest of the year • Example: A company that reports $1 million in cash on last day of fiscal year may have only $100k two days later, after paying salaries and suppliers Limitations - 2 2) Financial ratios are calculated using accounting data not market values Accounting data is based on an asset’s historical costs. Market values are based on the asset’s market value. Example: if inventory value declines below historical cost but management did not adjust for this – every ratio involving total assets will be inaccurate. Limitations - 3 3) Lack of a standard for each ratio. Example: current ratio. What is a good current ratio value? How about using industry average ratio as standard? Not necessarily useful. Deviations from industry average not always bad. What did we look at today? Reasons for conducting financial statement analysis Common size financial statements 4 types of ratios: liquidity, activity, debt utilization, profitability Cash conversion cycle Extended DuPont Equation Limitations of financial ratios Class activity