Interdependence in Comparative & International Political Economy

advertisement

Spatial Econometric Models

of Interdependence

Theory & Substance; Empirical Specification,

Estimation, Evaluation; Substantive

Interpretation & Presentation

Talk prepared for Blalock Lecture on

7 August 2008 at the ICPSR Summer School

based on the joint work of

Robert J. Franzese, Jr., The University of Michigan

Jude C. Hays, The University of Illinois

Overview

• Motivation: Integration & Domestic Policy-Autonomy

– Does economic integration constrain govts from redistributing

income, risk, & opportunity through tax & spending policies?

– In answering this & related questions, scholars have overlooked

spatial interdependence of domestic policies as important evidence.

– Economic integration generates externalities across political

jurisdictions, which implies strategic policy interdependence, so

policy of one govt will be influenced by policies of its neighbors.

• Interdependence Substance, Theory, & Empirics: Use

contexts econ integration (& related) to explore & explain:

– Substance: i’s actions depend on j’s. Examples.

– Theory:

• General: externalitiesstrategic policy complements/substitutesrace-tobottom/top/elseearly/late-mover advantagesstrategic delay/rush-for-1st

• Specific: a model of inter-jurisdictional tax-competition (P&T ch. 12)

– Empirics: “Galton’s Problem”; Estimation, Inference,

Interpretation, & Presentation

A Motivating Context:

Globalization & Domestic-Policy Autonomy

• Standard Argument:

– ↑ capital mobility & trade integration sharpen capital’s threat vs. domestic govts

to flee excessive/inefficient tax & public policy; forces welfare-state retrench &

tax shift from more-mob. cap. (esp. finance) to less-mob. lab. (esp. skilled-man.)

• Recent counter-arguments & findings:

– Some empirical Q whether constrained or ° constraint from trade/capital integ.

– Counter-arguments (e.g.):

• Rodrik (Cameron): Demand (contra supply) SocPol may ↑ w/ integ indeterminate

• Garrett ’98/Boix ’98: Left/active govt more/as efficient capital not flee

• Hall-Soskice ‘01/Franzese-Mosher ’02: comparative institutional advantage tradeinteg foster divergence; (liquid) cap-integ may foster race to bottom (not nec’ly) zero

• Swank ’02 (& many others): political & economic barriers &/or advantages

considerable maneuvering room

• Standard & all counter arguments spatial interdependence b/c

whatever pressures may arise from globalization depend on what

neighbors, competitors, partners, substitutes, & complements do

– Accordingly, appropriate model places others’ policies on right-hand side

– Basinger-Hallerberg ’04 maybe 1st in C&IPE to notice & incorporate explicitly

• Interdependence (def): yi=f(yj≠i); note: not merely that yi & yj≠i corr

The Broad Range of Spatial Interdependence

• Theoretical Contexts (ubiquitous):

–

–

–

–

–

ANY Strategic Decision-making: sisj

Externalities & Spillovers

Learning/Emulation, Demonstration

Networks/Epistemic Communities

Literal Diffusion, Contagion, Migration

• Substantive Contexts (ubiquitous):

–

–

–

–

–

–

Security Policy (e.g., alliances, wars)

Environmental (e.g., air-pollution reg)

Regulatory (e.g., telecomm stds)

Legis reps’ votes depend on others’

Elects., cand. qualities or strategies

p(∙)&outs coups (Li&Thompson 75), riots

(Govea&West 81), revolts (Brinks&Copp 06)

– Contextual effects in micro-behavior:

•

Braybeck&Huckfeldt 02ab, Cho 03, Huckfeldt et al.

05, Cho&Gimpel 07, Cho&Rudolph 07, Lin et al 06

• (Simmons et al.’s 06) Mechanisms:

–

–

–

–

–

Competition

Coercion

Learning

Emulation

[Migration/Contagion (F&H Add)]

– Policy, instit’s, regimes diffusion:

• Policy: Schneider&Ingram‘88, Rose ‘93,

Meseguer ‘04,‘05, Gilardi ‘05

• Institutional or regime: Implicit/Informal:

Dahl’s Polyarchy, Starr’s Democratic Dominoes,

Huntington’s 3rd Wave. Explicit/Formal:

O’Loughlin et al. ‘98, Brinks & Coppedge ‘06,

Gleditsch & Ward ‘06, ’07

– Int’l diffusion of liberalization:

• Simmons&Elkins 04, 06a, 06b, Eising 02,

Brune et al. 04, Brooks 05…

– Globalization & interdependence:

• Genschel 02, Basinger&Hallerberg 04, Knill

05, Jahn 06, Swank 06, F&H 06,07, Kayser 07

• Tobler’s Law: ‘‘I invoke the first law of geography: everything is related to

everything else, but near things are more related than distant things’’ (1970).

– Plus: “Space More Than Geography” (Beck, Gleditsch, & Beardsley 2006)

Substantive & Theoretical Ubiquity & Centrality (1)

•US State Policy-innovation diffusion: deep roots & much

contemporary interest, & sustained attention between:

–

Crain 1966; Walker 1969, 1973; Gray 1973; Knoke 1982; Caldiera 1985; Lutz 1987; Berry & Berry 1990; Case et al. 1993; Berry 1994; Rogers 1995;

Mintrom 1997ab; Brueckner 1998; Mintrom & Vergari 1998; Mossberger 1999; Berry & Berry 1999; Godwin & Schroedel 2000; Balla 2001; Mooney

2001; Wejnert 2002; Coughlin et al. 2003; Bailey & Rom 2004; Boehmke & Witmer 2004; Daley & Garand 2004; Grossback et al. 2004; Mencken 2004;

Berry & Baybeck 2005; Garrett et al. 2005; Costa-Font & Ons-Novell 2006; Karch 2006; Rincke 2006; Shipan & Volden 2006; Volden 2006; Werck et al.

2006; Woods 2006; Volden et al. 2007.

•Similar policy-learning mechanisms underlie some comparative

studies of policy diffusion:

–

Schneider & Ingram 1988; Rose 1993; Bennett 1997; Dolowitz & Marsh 2000; True & Mintrom 2001; Tews et al. 2003; Jensen 2004; Meseguer 2004,

2005; Brooks 2005, 2007; Gilardi 2005; Gilardi et al. 2005; Murillo & Schrank 2005; Weyland 2005; Braun & Gilardi 2006; Linos 2006; Parys 2006;

Ermini & Santolini 2007; Moscone et al. 2007.

•Institutional or regime diffusion likewise long-standing &

recently much reinvigorated:

–

Dahl’s 1971 Polyarchy (1 of 8 causes dem listed); center-stage Starr’s 1991 “Democratic Dominoes”; Huntington’s 1991 Third Wave; Beissinger 2007;

Bunce & Wolchik 2006, 2007; et al. in E. Eur. Transitions; Hagopian & Mainwaring 2005 et al. in LA; O’Loughlin et al. 1998, Brinks & Coppedge 2006,

Gleditsch & Ward 2006, 2007 estimated empirically extent, paths, &/or patterns dem diffuse. Kelejian et al. 2007 give institutional diffusion general

theoretical & empirical treatment.

•C&IPE, e.g. globalization≈interdependence:

– Diffusion of “Liberalization” & Related: Simmons & Elkins 2004, Simmons et al. 2006, Eising 2002; Brune et

al. 2004; Brooks 2005, 2007; Jordana & Levi-Faur 2005; Way 2005; Lazer 2006; Prakash & Potoski 2006; Brune & Guisinger 2007; and many others.

– Glob/Interdep/TaxComp & Dom Policy Auton: Genschel 2002; Guler et al. 2002; Franzese & Hays 2003,

2004b, 2005a, 2007abc, 2008c; Badinger et al. 2004; Basinger & Hallerberg 2004; Heichel et al. 2005; Henisz et al. 2005; Holzinger & Knill 2005; Knill

2005; Polillo & Guillén 2005; Elkins et al. 2006; Jahn 2006; Lee & Strang 2006; Manger 2006; Swank 2006; Baturo & Grey 2007; Cao 2007; Cao et al. 2007;

Coughlin et al. 2007; Garretsen & Peeters 2007; Mosley & Uno 2007; Mukherjee & Singer 2007.

Substantive & Theoretical Ubiquity & Centrality (2)

• Representatives’ votes (Lacombe & Shaughnessy 2005), citizens’ votes (Huckfeldt & Sprague 1991; O’Laughlin et al.

1994; Pattie & Johnston 2000; Beck et al. 2003; Calvo & Escolar 2003; Kim et al. 2003; Schofield et al. 2003; Lacombe & Shaughnessy 2007), election

outcomes (Shin & Agnew 2002, 2007; Hiskey & Canache 2005; Wing & Walker 2006; Kayser 2007), candidate qualities,

contributions, or strategies (Goldenberg et al. 1986; Mizruchi 1989; Krasno et al. 1994; Cho 2003; Gimpel et al. 2006)

• Probabilities & outcomes of coups (Li & Thompson 1975), riots (Govea & West 1981), civil wars

(Murdoch & Sandler 2004, Buhaug & Rød 2006) &/or revolutions (Brinks & Coppedge 2006)

• IR: interdep≈definition of subject:

– States’ entry into wars, alliances, treaties (Murdoch et al. 2003), or organizations.

– Empirical attention to inherent spat-dep IR greatest in: Shin & Ward 1999; Gleditsch &

Ward 2000; Gleditsch 2002; Ward & Gleditsch 2002; Hoff & Ward 2004; Gartzke & Gleditsch 2006; Salehyan & Gleditsch 2006; Gleditsch 2007,

and, in different way, Signorino 1999, 2002, 2003; Signorino & Yilmaz 2003; Signorino & Tarar 2006

• In micro-behavioral work, too, long-standing & surging interest

“contextual” or “neighborhood” effects:

–

Huckfeldt & Sprague 1993 review, some of which stress interdep: Straits 1990; O’Loughlin et al. 1994; Knack & Kropf 1998; Liu et al. 1998;

Braybeck & Huckfeldt 2002ab; Beck et al. 2002; McClurg 2003; Huckfeldt et al. 2005; Cho & Gimpel 2007; Cho & Rudolph 2007. Sampson et al. 2002

and Dietz 2002 review the parallel large literature on neighborhood effects in sociology

• At & beyond other disciplinary borders, subjects include:

– Social-movements: McAdam & Rucht 1993; Conell & Cohn 1995; Giugni 1998; Strang & Soule 1998; Biggs 2003; Browning et al.

2004; Andrews & Biggs 2006; Holmes 2006; Swaroop & Morenoff 2006.

– Microeconomic preferences: Akerloff 1997; Postlewaite 1998; Glaeser & Scheinkman 2000; Manski 2000; Brock &

Durlauf 2001; Durlauf 2001; Glaeser et al. 2003; Yang & Allenby 2003; Sobel 2005; Ioannides 2006; Soetevent 2006

– Macroeconomic performance: Fingleton 2003; Novo 2003; Kosfeld & Lauridsen 2004; Maza & Villaverde 2004;

Kelejian et al. 2006; Mencken et al. 2006

– Technology, marketing, and other firm strategies: Abramson & Rosenkopf 1993; Geroski 2000;

Strang & Macy 2001; Holloway 2002; Bradlow 2005; Autant-Berard 2006; Mizruchi et al. 2006

– Violence and crime: Grattet et al. 1998; Myers 2000; Baller et al. 2001; Morenoff et al. 2001; Villareal 2002; Baker & Faulkner

2003; Oberwittler 2004; Bhati 2005; Mears & Bhati 2006; Brathwaite & Li 2008

– Fertility, birthweight, child development, & child poverty: Tolnay 1995 and

Montgomery & Casterline 1996; Morenoff 2003; Sampson et al. 1999; Voss et al. 2006

– Not to mention public health and epidemiology (contagion!).

• More exotic topics: ordainment of women (Chaves 1996), right-wing extremism

(Rydgren 2005), marriage (Yabiku 2006), national identity (Lin et al. 2006), & faculty (Weinstein 2007).

Policy Interdependence:

A General Theoretical Model (Brueckner ‘03)

• i’s utility depends pi & pj b/c interdep (& vv): U i U i pi , p j

• Accordingly, i’s optimal policy, pi*, depends j’s action, pj:

Max U

pi

i

p ,p

i

j

U

pj

i

pi

0

0

p U

*

i

i

pi

1

R pj

• So slope best-response function depends on effect of pj on

marginal utility of pi: p* R p j U ip p

1

nd

i

p j

p j

i

U

j

i

pi pi

; 2 -order cond. -

• Therefore: Diminishing returns and…

– …negative externalities =>strategic complements: U

• Negative slope: neg. feedback/opposite-signed reactions

U

0

i

pi p j

pi*

0

0

p j

i

pi p j

pi*

0

0

p j

• Positive slope: positive feedback/same-signed reactions

– …positive externalities => strategic substitutes:

U

i

pi pi

Policy Interdependence:

General Theory & Substantive Implications

• Dimin returns & neg externalities Strategic Complements

– Race-to-Bottom (RTB) (or -Top). Examples:

• Tax Competition

j

• Labor Regulation

• Trade Barriers (politically)

Uii j ( marg cost i ) i

– Early-mover advantage “race to go first”

• E.g.: Exch.Deprec., tech.stds. (& other focal pts. in coord. or battle sexes)

• Dimin returns & pos externalities Strategic Substitutes

– Free-Riding Incentives

i

S

U

j

(b/c securityi ) Si

• E.g., Alliance Security:

• E.g., ALMP: ALMPj U Ai A (b/c Empi ) ALMPi

– Late-mover advantage strategic delay & Wars of Attrition

i j

i

j

• DimRet & both +&– externs: R j environi

Ri (Free - Ride)

– Environmental Reg’s (& CHIPs?): R j cost Ri Ri (RTB)

•p2

Figure 2. Best Response Functions: Strategic Substitutes

p 2 R( p1 )

p1 R( p 2 )

•p1

An International Tax-Competition Model as a

Specific Substantive Example of Interdependence

• Stylized Theoretical Model Cap-Tax Comp. (P&T ‘00, ch.12)

– 2 jurisdicts, dom & for cap-tax, τk & τk* to fund fixed spend. For-invest mobility costs, M.

– Inds’ lab-cap endow, ei, & choose lab-leisure, l & x, & save-invest, s=k+f to max

ω=U(c1)+c2+V(x), over l, c1, & c2, s.t. time-c., 1+ei=l+x, & b.c.’s, 1–ei=c1+k+f+≡c1+s

& c2=(1–τk)k+(1–τk*)f–M(f)+(1–τl)l.

1

– equilibrium economic choices of citizens: s S ( k ) 1 U c (1 k )

f F ( k , k* ) M f 1 ( k k* ) k K ( k , k* ) S ( k ) F ( k , k* )

– indirect utility, W, defined over policy variables, τl, τk, & τk*:

W ( l , k ) U 1 S ( k ) 1 k S ( k ) k k* F ( k , k* ) M F ( k , k* ) 1 l L( l ) V 1 L( l )

– Besley-Coate (‘97) citizen-candidate(s) face(s) electorate w/ these prefs.

• Stages: 1) elects, 2) cit-cand winners set taxes, 3) all private econ decisions made.

• Ebm win cand has endow eP such that desires implement this Modified Ramsey Rule:

p

p

S ( kp ) e p

L

(

)

e

p

l

1

(

)

l

k

S ( kp )

L( lp )

S ( kp ) 2F* ( kp* , kp ) k

1

p

S

(

)

k

• Best-Response Functions: τk=T(eP,τk*) & τk*=T*(eP*,τk) for dom & for pm.

– Slopes: ∂T/∂τk* & ∂T*/∂τk, pos or neg b/c ↑τk* cap-inflow; can use ↑tax-base to ↓τk or

to ↑τk (seizing upon ↓elasticity base).

– Background of this slide plots case both positively sloped; illustrated comparative static

is of leftward shift of domestic government.

Empirical Models of Interdependence:

Galton’s Problem in C&IPE

• Interdependence yi=f(yj)

• Generic (linear) dynamic spatial-lag model of C&IPE:

yit wij y jt dit βd st βs dit st βds it

j i

• Galton’s Problem: Extremely difficult disting why C(yi,yj) b/c...

– 1. Correlated domestic/unit-level conditions, d (CPE)

– 2. Common/corr’d exposure exog-external shocks/conditions, s (open-CPE)

– 3. Responses to these 2 may be context-conditional, sd (CC-CPE)

• 40. Correlated stochastic component (Beck-Katz), nuisance C&IPE

– 4. Interdependence/diffusion/contagion: yi=f(yj,CC-CPE), substance C&IPE

• Upshot Empirically (Franzese & Hays ‘03,‘04,‘06ab,‘07abcd,‘08ab):

– ° omit or mis-specify CPE, tend over-estimate IPE (interdependence) & v.v.

– yiyj => textbook endogeneity/simultaneity problem w/ spatial lag; analogous:

• ° fail redress endog sufficiently mis-est (usu. over-est.) ρ (under)mis-est. β

– Most Important Conclusion: Model It!TM Insofar as omit or rel’ly mis-spec

spatial interdep, tend over-est impact domestic & exog-ext factors & v.v. most

crucial, regardless of CPE/IPE emphasis: well-spec model & measure both.

• S-OLS may suffice. OVB >> simultaneity bias in any of practical examples we’ve

considered, & S-OLS did OK our MCs provided interdep remained modest (|ρ|<.3±).

The Terms of Galton’s Problem:

Omitted-Variable vs. Simultaneity Biases in

Spatial- and Spatio-Temporal-Lag Models

y Qδ ε, where Q Wy x and δ

• OVB (rel. mis-spec.) v. simultaneity:

ˆ cov( Wy, x) ;

plim

OLS

(OLS):

var(x)

– OVB

– SimB (S-OLS):plim δˆ

S-OLS

ˆOLS 0

1 cov Wy, ε var( x)

QQ

where

Ψ

plim

n

Ψ cov Wy, ε cov( Wy, x)

– In S-T, little more complicated, but:

0

ˆ

Wy

y Qδ ε where Q Wy My X and δ β

OVB: ˆ FMy,X

1

1

QQ Qε

βˆ

Wy

plim δˆ δ plim

,

which,

with

X

=

x

,

β

F

My,X

n

n

2

With all positive S-T dep, ρ

cov Wy, ε var My var x

1

space-dep over-est’d &

plim δˆ

cov

Wy

,

ε

cov

Wy

,

My

var

x

Ψ

cov Wy, ε cov Wy, x var My time-dep & β under-est’d

Estimating Spatial/Spatio-Temporal-Lag Models

• Inconsistent Estimators:

– Omit spatial-dep (e.g., OLS): bad idea if ρ non-negligible

– Ignore simultaneity (e.g., S-OLS): could be OK (in MSE)

if ρ not too large & sample-dims benevolent

• Simplest Option, if Available:

– Time-Lagged Spatial-Lag OLS easy & unbiased iff…

• No contemporaneous (i.e., w/in obs period) interdependence.

• Model of temporal dynamics sufficiently accurate (see Achen)

• 1st obs pre-determined; if not, spatial-Hurwicz bias (order 1/T)

• Consistent Estimators

– S-IV/2SLS/GMM: Use WX to instrument Wy, etc.

– S-ML: Specify system for Max-Likelihood estimation

Estimating Spatial- & Spatio-TemporalDynamic Models by S-ML

• S-ML for Spatial-Lag Model:

NT

2

1

εε

y Wy XB ε ε I W y Xβ Ay Xβ L(ε) 2 exp 2

2

2

– Std, but ε → y by |A| not 1 computational issues, plus

NT

1 2

1

L(y ) | A | 2 exp 2 Ay Xβ Ay Xβ

2

2

• Conditional S-ML S-T (ie., given 1stobs, Nx1 form);

(unconditional is messy but exists; won’t show):

1

1 T

2

ln f yt ,yt 1 ,...,y 2 y1 N T 1 ln 2 T 1 ln I W 2 εt εt

2

2 t 2

where εt y t WN y t Xt β I N y t 1 ; was just: ε t y t WN y t Xt β

• Stationarity (if row-stdzd, & ρ,>0): ρ+<1

• Spatial Probit: complicated but doable (show if time)

• m-STAR & Est’d W; endog W: doable (show if…)

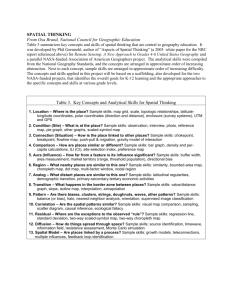

Figure 1: Estimated Bias in ̂ Plotted Against True

Across Representative NxT Sample-Dimensions

Notes: Dashed Line: S-OLS. Dotted Line: S-2SLS-IV. Dashed-Dotted Line: S-ML

Figure 2: Estimated ̂ S Plotted Against True

Across Representative NxT Sample-Dimensions

Notes: Solid Line: Non-spatial OLS. Dashed Line: S-OLS. Dotted Line: S-2SLS-IV. DashedDotted Line: S-ML. Non-Spatial OLS results plotted against the larger-scale 2nd y-axis on the right.

Figure 3: RMSE ̂ Plotted Against True Across Representative

NxT Sample-Dimensions (BIAS+EFFICIENCY)

Notes: Dashed Line: S-OLS. Dotted Line: S-2SLS-IV. Dashed-Dotted Line: S-ML.

Figure 4: RMSE ̂ S Plotted Against True Across Representative

NxT Sample-Dimensions (BIAS+EFFICIENCY)

Notes: Solid line: Non-spatial OLS. Dashed Line: S-OLS. Dotted Line: S-2SLS-IV. Dashed-Dotted

Line: S-ML. Non-spatial OLS results plotted against the larger-scale 2nd y-axis on the right.

Figure 5: Standard-Error ̂ Accuracy Plotted Against True

Across Representative NxT Sample-Dimensions

Notes: Dashed Line: S-OLS. Dotted line: S-2SLS-IV. Dashed-Dotted Line: S-ML. Standard error

accuracy is gauged by the ratio of the average estimated standard error to the true standard deviation

of the sampling distribution. Values less than one indicate overconfidence.

Figure 6: Standard-Error ̂ S Accuracy Plotted Against True

Across Representative NxT Sample-Dimensions

Notes: Solid Line: Non-spatial OLS. Dashed Line: S-OLS. Dotted line: S-2SLS-IV. DashedDotted Line: S-ML. Standard error accuracy is gauged by the ratio of the average estimated

standard error to the sampling-distribution standard deviation. Values less than one indicate

overconfidence.

APPLICATIONS

• Globalization, Tax Competition, & Domestic Policy

– Replicates: Swank&Steinmo 02, Hays 03, Basinger&Hallerberg 04

• ALMP: Active-Labor-Market Policy in EU (F&H ‘06)

– DepVar: LMT spend per unemployed worker

– Hypoth: Positive spillovers (@ borders) effective member-state ALMP freeriding & underinvest. Appreciable?

– IndVars: rGDPpc, UE, UDen, Deindustrialization (Iversen-Soskice), Trade, FDI,

Pop65, LCab, CDemCab, LLibVote, GCons

• MIDs & Trade: Beck, Gleditsch, & Beardsley ’06

– DepVar: Directed trade data;

– Hypoth: MIDs affect trade in & beyond dyad

– IndVars: GDPab, POPab, Distance, tau-b, MutualDem, MID, Bi/MultiPoleSys

• AFDC & CHIPs in U.S. States (Volden ’06)

– AFDC: Hypoth—“states as laboratories”≈diffusion by learning

• DepVar: max monthly AFDC benefit

• Ind Vars: state’s poverty rate, avg monthly wage in retail, govt ideology (0-100, RL), º interparty competition (.5-1.0, comp-non), tax effort (rev as % tax capacity), &

% AFDC bens paid by fed govt.

– CHIPs: Hypoth—“states as laboratories”≈diffusion by learning

• DepVar: 1 if state’s CHIP includes monthly premium; IndVars same.

Practical Model Specification & Estimation

• Most convenient to work in (Nx1) vector form:

y t y t 1 Wy t Xt β εt

• WN=an NxN of (time-invariant) spatial wts, wij, & WNIT gives W.

• E.g., 15x15 binary-contiguity from ALM paper:

W

AUT

BEL

DEN

FIN

IRE

NTH

NOR

PRT

ESP

SWE

CHE

GBR

AUT

0

0

0

0

FRA DEU GRE

0

1

0

0

0

0

0

0

0

1

0

BEL

0

0

0

0

1

1

0

0

1

0

0

0

0

0

1

DEN

0

0

0

0

0

1

0

0

0

0

0

0

1

0

0

FIN

0

0

0

0

0

0

0

0

0

1

0

0

1

0

0

FRA

0

1

0

0

0

1

0

0

0

0

0

1

0

1

1

DEU

1

1

0

0

1

0

0

0

1

0

0

0

0

1

0

GRE

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

IRE

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1

NTH

0

1

0

0

0

1

0

0

0

0

0

0

0

0

1

NOR

0

0

0

1

0

0

0

0

0

0

0

0

1

0

0

PRT

0

0

0

0

0

0

0

0

0

0

0

1

0

0

0

ESP

0

0

0

0

1

0

0

0

0

0

1

0

0

0

0

SWE

0

0

1

1

0

0

0

0

0

1

0

0

0

0

0

CHE

1

0

0

0

1

1

0

0

0

0

0

0

0

0

0

GBR

0

1

0

0

1

0

0

1

1

0

0

0

0

0

0

– N.b., row-stdz typ., convenient, but not nec’ly subst’ly neutral

– Ideally, substance, which not nec’ly geography, in W.

• Beware of extant software: critical bug in LeSage’s MatLab code;

likelihood in some third-party Stata SAR code seems flat wrong.

Swank & Steinmo APSR ’02 Replication

Table 2. Reanalysis of Swank and Steinmo (2002, Appendix Table 2)

Temporal Lag

Spatial Lag

Liberalization

Trade

Structural Unemployment

Public Sector Debt

Elderly Population

Growth

Percent Change in Profits

Domestic Investment

Effective Tax Rate on Capital

Swank and

Reanalysis

Reanalysis

Steinmo

(1)

(2)

0.809**

0.808**

0.864**

(0.05)

(0.048)

0.104*

0.126**

(0.054)

(0.054)

1.146

1.235*

0.629

(0.725)

(0.702)

-0.018

0.009

0.005

(0.064)

(0.061)

-1.147**

-1.218**

-1.033**

(0.306)

(0.283)

0.089**

0.099**

0.046

(0.036)

(0.032)

1.264**

1.011

-0.08

(0.615)

(0.481)

0.230*

0.242

0.307**

(0.151)

(0.147)

0.127**

0.136**

0.174**

(0.055)

(0.054)

0.066

0.045

0.059

(0.055)

(0.049)

Effective Tax Rate on Labor

Swank and

Reanalysis

Reanalysis

Steinmo

(3)

(4)

0.671**

0.66**

0.711**

(0.054)

(0.054)

0.017

0.05

(0.058)

(0.055)

-.261**

-0.255**

-0.168*

(0.102)

(0.091)

-0.009

0.001

-0.001

(0.023)

(0.023)

-0.359**

-0.38**

-0.148

(0.189)

(0.189)

0.053**

0.056**

0.038**

(0.014)

(0.013)

-0.018

0.03

0.171

(0.23)

(0.184)

-0.008

-0.009

0.009

(0.051)

(0.051)

Inflation

0.115**

Unemployment

0.280**

Left Government

0.018**

Christian Dem. Government

0.041**

0.018*

(0.01)

0.035

(0.028)

0.012

(0.01)

0.01

(0.026)

0.008**

0.001

0.115**

(0.05)

0.296**

(0.084)

0.008**

(0.004)

0.002

(0.011)

0.063

(0.043)

0.144*

(0.079)

0.007*

(0.004)

0.009

(0.01)

Fixed Effects

Country

Yes

Yes

Yes

Yes

Yes

Yes

1

1

Year

Yes

Yes

No

Yes

Yes

No

R2

.928

.922

.914

.989

.989

.988

1

Biannual Period Effects. Parentheses contain standard errors. **Significant at the 5% Level; *Significant at the 10% Level.

Hays IO ‘03 Replication

Table 1. Capital Tax Rates and International Capital Mobility (Capital Account Openness)

Capital Account

Openness

Capital Account

Openness

Capital Account

Openness

Capital Account

Openness

Capital Account

Openness

Capital Account

Openness

1.918**

(.919)

2.223**

(.930)

2.159**

(1.045)

1.620*

(.859)

1.695*

(.996)

1.729*

(1.013)

-.070*

(.040)

-.069*

(.040)

-.069**

(.033)

-.033

(.039)

-.0425

(.030)

-.048

(.040)

.484

(.431)

.746*

(.434)

.691

(.472)

1.245***

(.428)

1.053**

(.485)

1.121**

(.534)

Corporatism

-1.186

(1.339)

-2.229

(1.359)

-2.008

(1.399)

-3.047**

(1.318)

-2.578*

(1.357)

-2.453

(1.641)

Left Government

.370*

(.196)

.286

(.195)

.304

(.209)

.304

(.186)

.321

(.196)

.331

(.215)

-1.79e-07

(3.49e-06)

-9.77e-06**

(3.98e-06)

-7.74e-06*

(4.03e-06)

5.79e-07

(3.30e-06)

3.88e-07

(3.60e-06)

.001

(.004)

-.204

(.161)

-.465***

(.170)

-.410**

(.185)

-.520***

(.161)

-.440**

(.176)

-.442***

(.168)

.834***

(.034)

.754***

(.039)

.771***

(.028)

.686***

(.043)

.723***

(.031)

.706***

(.038)

.237***

(.035)

465

Spatial 2SLS

Non-uniform

.267***

(.044)

465

Spatial ML

Non-uniform

Independent Variables

Capital Mobility

Capital Mobility

Interacted with:

Capital Endowment

Consensus Democracy

Population

European Union

Temporal Lag

Spatial Lag

.280***

.221***

.316***

(.066)

(.048)

(.049)

Obs.

465

465

465

465

Estimation

Non-spatial OLS

Spatial OLS

Spatial 2SLS

Spatial OLS

Diffusion

Uniform

Uniform

Non-uniform

Notes: The regressions were estimated with fixed country effects. (Coefficients for country dummies not shown.)

Parentheses for the OLS estimates contain panel corrected standard errors.

Parentheses for the 2SLS estimates contain robust standard errors clustered by year.

Parentheses for the ML estimates contain robust standard errors.

** * Significant at 1%, ** Significant at 5%, * Significant at 10%

Basinger & Hallerberg APSR ’04 Replication

Table 1. Replication and Reanalysis of Basinger and Hallerberg

Partisanship

Partisanship world

Capital controls

Capital controls world

Ideological distance

Ideological distance world

Change in capital taxation

in competitor countries

Control Variables

Intercept

APSR

-2.17

(1.58)

-11.2**

(3.39)

1.30

(2.70)

6.35*

(3.50)

-3.05**

(1.46)

9.11*

(4.72)

.20*

(.09)

16.94**

(3.05)

Tax Ratet-1

-.29**

(.06)

Growtht-1

.27**

(.10)

Inflationt-1

-.00

(.01)

N

269

R2 / LL

.34

Estimator

S-OLS

Incorrect

Weights Matrix

GDP

Weights

Notes: The country dummy variable

-1.83

(2.05)

-11.88*

(5.32)

1.84

(2.49)

27.15*

(13.39)

-2.47

(1.77)

2.65

(3.30)

.03

(.28)

-1.83

(1.93)

-11.87*

(5.01)

1.84

(2.34)

27.27*

(12.53)

-2.47

(1.67)

2.63

(3.10)

.02

(.18)

-1.71

(1.91)

-10.23*

(5.03)

2.02

(2.32)

23.18*

(12.53)

-2.85*

(1.67)

2.55

(3.07)

.10*

(.05)

18.18**

18.16**

17.42**

(3.40)

(3.19)

(3.17)

-.29**

-.29**

-.29**

(.04)

(.04)

(.04)

.32**

.33**

.30**

(.12)

(.11)

(.11)

-.00

-00

-.00

(.02)

(.01)

(.01)

269

269

269

.32

-670.83

-668.99

S-OLS

S-ML

S-ML

Correct

Correct

Binary

GDP

GDP

Contiguity

Weights

Weights

Weights

coefficients are omitted to save space.

Beck, Gleditsch, Beardsley ISQ ‘06 Replication

LN GDP A

LN GDP B

LN POP A

LN POP B

LN Distance

LN Tau-b

LN Democracy

LN MID

LN Multipolar

LN Bipolar

Temporal Lag

Spatial Lag

Beck et al.

0.03**

(.01)

0.04**

(.01)

0.02

(.02)

0.02

(.02)

-0.03**

(.01)

0.13**

(.06)

0.13**

(.03)

-0.20**

(.04)

-0.30**

(.05)

-0.06

(.05)

0.92**

(.01)

Beck et al.

0.02**

(.01)

0.03**

(.01)

0.04**

(.02)

0.03

(.02)

-0.04**

(.01)

0.11

(.06)

0.14**

(.03)

-0.20**

(.04)

-0.28**

(.05)

-0.04

(.05)

0.91**

(.01)

0.02**

(.01)

No

Reanalysis (1)

-0.001

(.012)

-0.001

(.012)

0.064**

(.023)

0.056**

(.023)

-0.043**

(.009)

0.05

(.058)

0.155**

(.031)

-0.19**

(.037)

-0.229**

(.053)

-0.011

(.048)

0.901**

(.007)

0.07**

(.012)

No

Reanalysis (2)

0.029**

(.015)

-0.015

(.015)

0.012

(.06)

0.031

(.055)

0.014

(.073)

-0.053

(.06)

0.143**

(.034)

-0.186**

(.039)

-0.157**

(.053)

0.054

(.053)

0.795**

(.01)

0.18**

(.014)

Dyad

Reanalysis (3)

0.028*

(.016)

-0.003

(.016)

0.056

(.065)

0.059

(.059)

-0.004

(.072)

-0.063

(.06)

0.089**

(.037)

-0.157**

(.039)

-0.055

(.056)

0.032

(.055)

0.825**

(.01)

.097**

(.039)

Dyad, Yr

No

Fixed Effects:

Contemporaneous

No

No

Yes

Yes

Yes

Spatial Lag

OLS

OLS

ML

ML

ML

Estimator

2565

2565

2565

2565

2565

Observations

—

—

31.57

140.71

282.68

Log-Likelihood

218.28**

283.94**

LR Statistic

Notes: Parentheses contain standard errors. **, * = significant at 5%, 10% levels, respectively. The Likelihood

Ratio (LR) Statistics evaluate the null hypotheses that the coefficients on the dyad dummies (41) and year

dummies (67) are jointly zero with 5% critical values of 56.94 (

d2. f . 41 ) and 87.11 ( d2. f .67 ) respectively.

Franzese & Hays EUP ‘06

Volden AJPS ‘06 AFDC Replication

Table 1. State Welfare Policy (Maximum AFDC Benefit)

ependent Variables

Constant

Poverty Rate

Retail Wage

vernment Ideology

-party Competition

Tax Effort

Federal Share

OLS

54.519

(531.830)

-6.560

(11.262)

-.121

(.226)

1.513

(1.030)

621.799**

(290.871)

3.357**

(1.587)

-4.405

(5.001)

Spatial AR

Moran I-statistic

Spatial AR Lag

(S-OLS)

-246.76

(450.75)

8.04

(10.022)

.016

(.193)

1.397

(.863)

368.65

(250.55)

2.022

(1.364)

-5.818

(4.20)

.767***

(.178)

Spatial AR Lag

(S-2SLS)

-422.09

(437.74)

13.205

(9.977)

.089

(.187)

1.359*

(.825)

286.98

(243.72)

1.553

(1.328)

-6.012

(4.014)

1.069***

(.232)

Spatial AR Lag

(S-GMM)

-500.05

(413.02)

7.29

(8.452)

-.008

(.201)

1.655**

(.761)

438.9**

(197.47)

2.397

(1.493)

-3.654

(3.415)

.840***

(.237)

Spatial AR Lag

(S-MLE)

-156.282

(429.130)

3.657

(8.917)

-.025

(.181)

1.432*

(.806)

444.677*

(226.911)

2.423*

(1.262)

-5.393

(3.901)

.537***

(.122)

Spatial AR Error

(S-MLE)

676.120

(471.965)

3.239

(10.062)

-.344

(.243)

1.696**

(.822)

263.887

(238.419)

2.936**

(1.213)

-6.882*

(4.099)

.565***

(.131)

3.312***

LM

12.322***

LM

11.606***

LM *

6.477**

LM

5.845***

LM *

.716

Log-likelihood

-270.763

-272.728

Adj.-R2

.461

.622

.595

.606

.510

.588

Obs.

48

48

48

48

48

48

s: The spatial lags are generated with a binary contiguity weighting matrix. All the spatial weights matrices are row-standardized.

***Significant at the 1% Level; **Significant at the 5% Level; *Significant at the 10% Level.

Volden AJPS ‘06 CHIPs Replication

le 2. State Welfare Policy (Monthly CHIP Premium)

Independent Variables

Constant

Poverty Rate

Retail Wage

Government Ideology

Inter-party Competition

Tax Effort

Federal Share

Spatial AR

Pseudo-R2

Obs.

Probit

MLE

-4.978

(6.260)

-.244

(.153)

.004

(.003)

.011

(.013)

2.174

(3.388)

-.014

(.019)

.045

(.063)

.079

(.798)

.222

48

Probit

MCMC

-5.163

(6.292)

-.265**

(.156)

.004*

(.003)

.011

(.013)

2.108

(3.478)

-.014

(.019)

.048

(.064)

.102

(.815)

.220

48

Spatial AR

Lag Probit

-5.606

(10.159)

-.374**

(.231)

.006*

(.004)

.014

(.020)

1.473

(6.134)

-.020

(.034)

.065

(.095)

.200***

(.148)

.607

48

Spatial AR

Error Probit

-5.531

(7.337)

-.243*

(.157)

.004*

(.003)

.014

(.014)

2.636

(3.794)

-.017

(.021)

.043

(.066)

.297***

(.196)

.574

48

Notes: In the first two columns, the models are estimated assuming the spatial lags are exogenous. The model in the first

column is estimated using standard ML techniques. The parentheses in this column contain estimated standard errors and

the hypothesis tests assume that the asymptotic t-statistics are normally distributed. The models in columns two through

four are estimated using MCMC methods with diffuse zero-mean priors. The reported coefficient estimate is the mean of

the posterior density based on 10,000 observations after a 1000 observation burn-in period. The number in parentheses is

the standard deviation of the posterior density. The p-values are also calculated using the posterior density. The last two

models are estimated with true spatial estimators described in the text. In third column, 30 of the 10,000 spatial AR

coefficients sampled from the posterior distribution were negative. In the fourth column, none of the 10,000 sampled

spatial AR coefficients were negative. ***p-value <.01, **p-value<.05, *p-value <.10.

Interpreting Spatial/Spatio-Temporal Effects

• The Model: y

Wy My Xβ ε

– Model may look linear, but is not; as in all beyond purely

linear-additive, coefficients & effects very different things!

– Convenient, for interpretation, to write model this way too:

y t WN y t y t 1 Xt β εt

– Coefficients, βx are just pre-spatial, pre-temporal—and

wholly unobservable!—impulse from some x to y.

• Spatio-Temporal Effects:

– Post-spatial, pre-temporal “instantaneous effect” of x:

I N WN

1

Xt β εt xi for some (set of) i; i.e., I N WN xckiβ

1

y t I N WN

y t 1 Xt β εt

– Spatio-Temporal Response Paths:

– LR Multiplier/LR-SS:y t Wy t y t Xt β εt W I y t Xt β εt

1

I N W I N Xt β ε t

1

Presenting Spatial/Spatio-Temporal Effects

• Standard Errors (Confidence Intervals &

Hypothesis Tests) of Effects:

– Delta Method: V sˆ i ˆk

sˆ i ˆk

sˆ i ˆk

V θˆ

ˆ

ˆ

θ

θ

– …or Simulate!

• Upshot: Cannot see substance clearly from only the

estimated coefficients & their standard errors

• Effective Presentational Options:

– SR/LR-Response Grids

– Spatio-Temporal Response-Paths

– Maps

Swank & Steinmo APSR ’02 Replication

Swank & Steinmo APSR ’02 Replication

Figure 2. Spatio-Temporal Effects on the German Capital Tax Rate from a Positive One-Unit

Counterfactual Shock to Structural Unemployment in Germany (with a 90% C.I.)

0.2

0

-0.2

-0.4

-0.6

Cumulative 15-Period Effect: -6.523

-0.8

-1

-1.2

-1.4

-1.6

-1.8

-2

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Swank & Steinmo APSR ’02 Replication

Figure 3. Spatio-Temporal Effects on the French Capital Tax Rate from a Positive One-Unit

Counterfactual Shock to Structural Unemployment in Germany (with a 90% C.I.)

0.1

0.05

0

Cumulative 15-Period Effect: -.943

-0.05

-0.1

-0.15

-0.2

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Basinger & Hallerberg APSR ’04 Replication

Table 2. Conditional Coefficients for the Effects of a Change in Tax

Rates on Capital in Competitor Countries Given Domestic

Ideological Distance (Mendoza et al. Tax Rates, GDP Weights)

Ideological Distance

Regression Coefficients

Coefficient, change in competitor

countries

Coefficient, change in competitor

countries*distance, party, cap controls

Conditional Coefficients

0 distance

(United Kingdom, 1980-97)

0.1 distance

(Denmark, 1991-92)

0.2 distance

(Netherlands, 1982-88)

0.3 distance

(Italy, 1981)

0.5 distance

(Finland, 1996-97)

Estimator

APSR

.24*

(.12)

-.52

(.60)

.38

(.28)

-1.12

(1.08)

-.13

(.29)

.86

(1.31)

.15*

(.08)

-.24

(.29)

.24*

(.12)

.19*

(.08)

.14*

(.08)

.09

(.11)

-.02

(.21)

.38

(.28)

.27

(.22)

.16

(.20)

.04

(.24)

-.18

(.40)

-.13

(.29)

-.04

(.21)

.04

(.19)

.13

(.25)

.30

(.47)

.15*

(.08)

.13*

(.06)

.10*

(.05)

.08

(.06)

.03

(.10)

S-ML

Correct

GDP

Weights

S-ML

Binary

Contiguity

Weights

S-OLS

S-OLS

Incorrect Correct

Weights Matrix

GDP

GDP

Weights Weights

Notes: See Basinger and Hallerberg (2004), Table 3.

Basinger & Hallerberg APSR ’04 Replication

Table 3. Conditional Coefficients for the Effects of a Change in Tax

Rates on Capital in Competitor Countries Given Domestic

Partisanship Level (Mendoza et al. Tax Rates, GDP Weights)

Partisanship

Regression Coefficients

Coefficient, change in competitor

countries

Coefficient, change in competitor

countries*distance, party, cap controls

APSR

-.24

(.40)

.67

(.63)

1.39*

(.71)

-2.13*

(1.21)

-.83

(.89)

1.47

(1.52)

-.11

(.21)

.40

(.37)

0 partisanship

(no country)

0.2 partisanship

(Norway, 1989)

0.4 partisanship

(Netherlands, 1982-88)

0.6 partisanship

(Austria, 1987-97)

0.8 partisanship

(Ireland, 1990-92)

-.24

(.40)

-.10

(.27)

.03

(.16)

.16*

(.07)

.30*

(.13)

1.39*

(.71)

.96*

(.48)

.53*

(.28)

.10

(.21)

-.32

(.36)

-.83

(.89)

-.54

(.60)

-.24

(.32)

.05

(.19)

.35

(.39)

-.11

(.21)

-.03

(.14)

.05

(.07)

.13*

(.06)

.21*

(.11)

S-ML

Correct

GDP

Weights

S-ML

Binary

Contiguity

Weights

Estimator

S-OLS

S-OLS

Incorrect Correct

Weights Matrix

GDP

GDP

Weights Weights

Notes: See Basinger and Hallerberg (2004), Table 4.

Table 4. Conditional Coefficients for the Effects of a Change in Tax

Rates on Capital in Competitor Countries Given Domestic Use of

Capital Controls (Mendoza et al. Tax Rates, GDP Weights)

Capital Controls

Regression Coefficients

Coefficient, change in competitor

countries

Coefficient, change in competitor

countries*distance, party, cap controls

APSR

.26*

(.10)

-.96

(.76)

.11

(.28)

.60

(1.86)

.16

(.21)

-1.88

(1.51)

.08

(.06)

.20

(.33)

0 capital controls

(United States, 1980-97)

0.25 capital controls

(France, 1980-89)

0.5 capital controls

(Portugal, 1980-85)

0.75 capital controls

(Greece, 1981)

.26*

(.10)

.02

(.14)

-.22

(.32)

-.46

(.50)

.11

(.28)

.26

(.35)

.41

(.77)

.56

(1.23)

.16

(.21)

-.31

(.33)

-.78

(.68)

-1.25

(1.05)

.08

(.06)

.13*

(.07)

.18

(.14)

.23

(.22)

S-ML

Correct

GDP

Weights

S-ML

Binary

Contiguity

Weights

Estimator

S-OLS

S-OLS

Incorrect Correct

Weights Matrix

GDP

GDP

Weights Weights

Notes: See Basinger and Hallerberg (2004), Table 5.

Beck, Gleditsch, Beardsley ISQ ‘06 Replication

Figure 1: Temporal Effects with Spatial Feedback (E.g., US Exports to Russia response to US-Russia MID)

0

-0.05

-0.1

-0.15

-0.2

-0.25

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Beck, Gleditsch, Beardsley ISQ ‘06 Replication

Figure 2: First Order Spatio-temporal Effects (E.g., US Exports to Germany response to US-Russia MID)

0.001

0.0005

0

-0.0005

-0.001

-0.0015

-0.002

-0.0025

-0.003

-0.0035

-0.004

-0.0045

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Beck, Gleditsch, Beardsley ISQ ‘06 Replication

Figure 3: 2nd-Order Spatio-temporal Effects (E.g., German Exports to Russia response to US-Russia MID)

6.00E-04

4.00E-04

2.00E-04

0.00E+00

-2.00E-04

-4.00E-04

-6.00E-04

-8.00E-04

-1.00E-03

-1.20E-03

-1.40E-03

-1.60E-03

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Franzese & Hays EUP ‘06

Table 2. Short-Run Spatial Effects of Labor Market Training Expenditures in Europe (Binary Contiguity Weights Matrix)

AUT

AUT

BEL

0.005*

(.0019)

DEN

0.006

(.0031)

0.003*

(.0014)

FIN

0.000

(.0001)

0.000

(.0000)

0.012*

(.0058)

FRA

0.020*

(.0095)

-0.066*

(.0152)

0.006*

(.0030)

0.000

(.0001)

DEU

-0.135*

(.0317)

-0.064*

(.0142)

-0.148*

(.0383)

-0.002

(.0013)

-0.051*

(.0120)

IRE

0.000

(.0001)

0.005*

(.0021)

0.000

(.0001)

0.000

(.0000)

0.004*

(.0020)

-0.001

(.0005)

NTH

0.006*

(.0029)

-0.065*

(.0144)

0.007*

(.0033)

0.000

(.0001)

0.010*

(.0049)

-0.046*

(.0114)

0.020*

(.0097)

NOR

0.000

(.0001)

0.000

(.0000)

0.012*

(.0058)

-0.134*

(.0314)

0.000

(.0000)

-0.001*

(.0004)

0.000

(.0000)

0.000

(.0001)

PRT

0.000

(.0002)

-0.001*

(.0004)

0.000

(.0001)

0.000

(.0000)

0.009*

(.0044)

0.000

(.0003)

0.000

(.0002)

0.000

(.0001)

0.000

(.0000)

ESP

-0.001

(.0009)

0.004*

(.0019)

0.000

(.0003)

0.000

(.0000)

-0.061*

(.0164)

0.003*

(.0012)

-0.001

(.0009)

-0.001

(.0007)

0.000

(.0000)

-0.298*

(.0788)

SWE

-0.001

(.0007)

0.000

(.0003)

-0.148*

(.0387)

-0.129*

(.0294)

0.000

(.0003)

0.007

(.0036)

0.000

(.0000)

-0.001*

(.0005)

-0.129*

(.0294)

0.000

(.0000)

0.000

(.0001)

CHE

-0.140*

(.0338)

0.006*

(.0029)

0.006*

(.0026)

0.000

(.0001)

-0.057*

(.0143)

-0.040*

(.0081)

-0.001

(.0007)

0.003*

(.0010)

0.000

(.0001)

-0.002

(.0018)

0.008

(.0043)

-0.001*

(.0004)

GBR

-0.002

(.0015)

-0.064*

(.0142)

-0.001

(.0011)

0.000

(.0000)

-0.057*

(.0144)

0.010*

(.0049)

-0.294*

(.0755)

-0.093*

(.0231)

0.000

(.0000)

-0.002

(.0018)

0.008

(.0043)

0.000

(.0001)

0.005*

(.0021)

0.002*

(.0010)

0.006

0.006*

DEN

(.0031)

(.0029)

0.000

0.000

0.012*

FIN

(.0001)

(.0083)

(.0058)

0.008*

-0.053*

0.002

0.000

FRA

(.0038)

(.0122)

(.0012)

(.0000)

-0.045*

-0.043*

-0.049*

-0.001*

-0.043*

DEU

(.0106)

(.0095)

(.0128)

(.0004)

(.0100)

0.000

0.018*

0.000

0.000

0.020*

-0.004

IRE

(.0003)

(.0084)

(.0002)

(.0000)

(.0099)

(.0031)

0.004*

-0.086*

0.004

0.000

0.017*

-0.093*

0.007*

NTH

(.0020)

(.0192)

(.0022)

(.0001)

(.0082)

(.0227)

(.0032)

0.000

0.000

0.012*

-0.134*

0.000

-0.002

0.000

0.000

NOR (.0001)

(.0001)

(.0058)

(.0314)

(.0001)

(.0013)

(.0000)

(.0001)

0.000

-0.002

0.000

0.000

0.043

-0.002

0.000

0.000

0.000

PRT

(.0003)

(.0016)

(.0001)

(.0000)

(.0220)

(.0016)

(.0002)

(.0004)

(.0000)

-0.001

0.008*

0.000

0.000

-0.152*

0.008*

-0.001*

-0.002

0.000

-0.149*

ESP

(.0009)

(.0038)

(.0003)

(.0000)

(.0411)

(.0037)

(.0004)

(.0011)

(.0000)

(.0394)

-0.001*

-0.001*

-0.099*

-0.086*

-0.001*

0.014

0.000

-0.001*

-0.086*

0.000

0.000

SWE (.0005)

(.0004)

(.0258)

(.0196)

(.0004)

(.0073)

(.0000)

(.0005)

(.0196)

(.0000)

(.0000)

-0.093*

0.009*

0.004*

0.000

-0.095*

-0.080*

0.000

0.003

0.000

-0.001

0.006*

-0.001*

CHE

(.0225)

(.0039)

(.0017)

(.0000)

(.0238)

(.0161)

(.0002)

(.0010)

(.0000)

(.0006)

(.0029)

(.0004)

-0.001

-0.064*

-0.001

0.000

-0.071*

0.015

-0.074*

-0.070*

0.000

-0.001*

0.004

0.000

0.003

GBR (.0007)

(.0142)

(.0005)

(.0000)

(.0180)

(.0073)

(.0189)

(.0173)

(.0000)

(.0004)

(.0021)

(.0001)

(.0016)

Notes: The off-diagonal elements of the table report the effect of a one-unit increase in the column country’s labor-market-training expenditures on its European counterparts.

These numbers are calculated using the spatial multiplier matrix (I ρW) 1 and thus reflect all feedback effects. Parentheses contain standard errors calculated by the delta

method.

BEL

Franzese & Hays EUP ‘06

Table 3. Steady-State Spatial Effects of labor Market Training Expenditures in Europe (Binary Contiguity Weights Matrix)

AUT

AUT

BEL

0.027

(.0136)

DEN

0.052

(.0296)

0.023

(.0125)

FIN

0.002

(.0024)

0.001

(.0010)

0.094

(.0505)

FRA

0.159

(.0914)

-0.254*

(.0723)

0.051

(.0305)

0.002

(.0570)

DEU

-0.530*

(.1588)

-0.238*

(.0636)

-0.640*

(.2218)

-0.028

(.2043)

-0.207*

(.0228)

IRE

0.005

(.0050)

0.033

(.0167)

0.003

(.0038)

0.000

(.0096)

0.034

(.0002)

-0.012

(.0209)

NTH

0.050

(.0292)

-0.236*

(.0581)

0.056

(.0335)

0.002

(.0621)

0.082*

(.0026)

-0.191*

(.0466)

0.163

(.0940)

PRT

0.006

(.0067)

-0.009

(.0079)

0.002

(.0022)

0.000

(.0057)

0.080*

(.0001)

-0.006

(.0514)

0.006

(.0074)

0.005

(.0057)

0.000

(.0001)

NOR

0.002

(.0024)

0.001

(.0010)

0.094

(.0505)

-0.520*

(.0076)

0.001

(.1477)

-0.009

(.0010)

0.000

(.0005)

0.002

(.0018)

ESP

-0.021

(.0189)

0.033

(.0204)

-0.007

(.0062)

0.000

(.0149)

-0.286*

(.0004)

0.023

(.1164)

-0.023

(.0212)

-0.018

(.0161)

0.000

(.0004)

-1.345*

(.5073)

SWE

-0.016

(.0134)

-0.007

(.0058)

-0.648*

(.2271)

-0.493*

(.0403)

-0.006

(.1402)

0.065

(.0054)

-0.002

(.0029)

-0.011

(.0099)

-0.493*

(.1402)

-0.001

(.0016)

0.002

(.0025)

CHE

-0.557*

(.1663)

0.047

(.0237)

0.039*

(.0183)

0.002

(.0266)

-0.240*

(.0016)

-0.133

(.0808)

-0.015

(.0127)

0.011

(.0007)

0.002

(.0016)

-0.044

(.0398)

0.079

(.0524)

-0.008

(.0059)

GBR

-0.033

(.0277)

-0.237*

(.0636)

-0.025

(.0211)

-0.001

(.0489)

-0.247*

(.0014)

0.083

(.0910)

-1.257*

(.4242)

-0.390*

(.1319)

-0.001

(.0014)

-0.045

(.0425)

0.082

(.0566)

0.005

(.0056)

0.037

(.0217)

0.013

(.0068)

0.047

0.052

(.0346)

(.0407)

DEN

0.094

0.002

0.002

(.0739)

(.0640)

(.0785)

FIN

0.001

0.020

-0.203*

0.064*

(.2121)

(.0505)

(.0027)

(.0031)

FRA

-0.173

-0.009

-0.213*

-0.158

-0.177*

(.2112)

(.0010)

(.0122)

(.0864)

(.0502)

DEU

-0.069

0.172

0.000

0.007

0.132

0.009

(.0576)

(.1045)

(.0005)

(.0075)

(.0928)

(.0131)

IRE

0.054

-0.382*

0.137

0.002

0.038

-0.314*

0.033

(.0313)

(.1241)

(.0777)

(.0018)

(.0223)

(.1186)

(.0267)

NTH

0.002

0.000

-0.028

0.002

-0.520*

0.094

0.002

0.002

(.0026)

(.0002)

(.0228)

(.0024)

(.1477)

(.0505)

(.0027)

(.0031)

NOR

0.000

0.015

0.006

-0.038

0.398

0.000

0.004

-0.037

0.012

(.0003)

(.0171)

(.0074)

(.0341)

(.2572)

(.0003)

(.0044)

(.0424)

(.0175)

PRT

-0.672*

0.000

-0.027

-0.011

0.068

-0.714*

0.000

-0.007

0.067

-0.021

(.2537)

(.0004)

(.0242)

(.0106)

(.0448)

(.2910)

(.0004)

(.0062)

(.0559)

(.0252)

ESP

0.001

0.000

-0.329*

-0.011

-0.001

0.129

-0.010

-0.432* -0.329*

-0.009

-0.011

(.0016)

(.0005)

(.0935)

(.0099)

(.0010)

(.0805)

(.0090)

(.0935)

(.1514)

(.0103)

(.0119)

SWE

-0.008

0.053

-0.015

0.001

0.011

-0.005

-0.400* -0.266*

0.001

0.026

0.062

-0.371*

(.0059)

(.0350)

(.0133)

(.0011)

(.0007)

(.0042)

(.0532)

(.1346)

(.0011)

(.0122)

(.0439)

(.1644)

CHE

0.028

0.004

0.041

-0.011

-0.001

-0.314* -0.293*

0.125

-0.309*

-0.001

-0.012

-0.237*

-0.017

(.0163)

(.0042)

(.0283)

(.0106)

(.0007)

(.0989)

(.1061)

(.0734)

(.1137)

(.0007)

(.0105)

(.0959)

(.0185)

GBR

Notes: The off-diagonal elements of the table report the effect of a one-unit increase in the column country’s labor-market-training expenditures on its European

1

counterparts. These numbers are calculated using the long-run spatio-temporal-multiplier matrix I (I W) 1 I W1 . Parentheses contain standard errors

calculated by the delta method.

BEL

Some Other Presentations (3)

Figure 1. Short-run Spatial Effects of a Positive Oneunit Shock to German LMT Expenditures

Figure 2. Steady-state Spatial Effects of a Positive Oneunit Shock to German LMT Expenditures

Volden AJPS ‘06 AFDC Replication

Table 4. Spatial Effects on AFDC Benefits from a $100

Counterfactual Shock to Monthly Retail Wages in Missouri

Immediate

Long-Run Steady

Neighbor

Spatial Effect

State Effect

.51

4.26

Arkansas

[.16,.87]

[1.01,7.52]

.62

5.11

Illinois

[.19,1.04]

[1.25,8.97]

0.52

4.37

Iowa

[.15,.88]

[.99, 7.75]

0.77

6.38

Kansas

[.23,1.31]

[1.60,11.17]

0.44

3.68

Kentucky

[.13,.75]

[.87,6.50]

0.52

4.44

Nebraska

[.15,.89]

[.99,7.90]

0.52

4.47

Oklahoma

[.15,.89]

[.96,7.98]

0.38

3.21

Tennessee

[.12,.65]

[.75,5.67]

Notes: Effects calculated using estimates from the spatial AR lag model in

Table 3. Brackets contain a 95% confidence interval.

Volden AJPS ‘06 AFDC Replication

Figure 1. Spatio-Temporal Effects on AFDC Benefits in Missouri from a

$100 Counterfactual Shock to Monthly Retail Wages in Missouri (with 95% C.I.)

30

25

20

15

10

Cumulative 10-Period Effect: $55.75

5

0

1

2

3

4

5

6

7

8

9

10

Volden AJPS ‘06 AFDC Replication

Figure 2. Spatio-Temporal Effects on AFDC Benefits in Nebraska from a

$100 Counterfactual Shock to Monthly Retail Wages in Missouri (with 95% C.I.)

1.4

1.2

1

0.8

Cumulative 10-Period Effect: $4.11

0.6

0.4

0.2

0

1

2

3

4

5

6

7

8

9

10

Conclusion

• Spatial & Spatio-Temporal Interdependence

– Important & Appreciable Substance (e.g., globalization & int’l

cap-tax compete seems quite real & does constrain), not Nuisance.

• Therefore: Model them. Interpret them.

• How specify & estimate models?

– If space-lag is time-lagged, not problem; but if thry & substance

says immediate (w/in an observational period), can handle that too:

– S-OLS not a bad strategy even then, if ρ not too big & smpl-dims

right; S-ML, & in some regards IV-based strategies, seem effective

• Spatio-Temporal Effects not directly read from coefficients:

use graphs & maps & grids

• Information-demands of Galton’s Problem severe

– Standard errors of effects tend big. Suspect delta-method linapprox. maybe part problem; plan explore performance bootstrap.

– Max effort & care theory, measure, specification, to both C&IPE

Spatial QualDep: The Econometric Problem (1)

• Spatial Qualitative/Categorical/Lmtd-Dep-Var Models in the Lit:

– Spatial probit: McMillen 1992,1995; Bolduc et. al. 1997; Pinkse & Slade 1998;

LeSage 1999, 2000; Beron et al. 2003; Beron & Vijverberg 2004

• Spatial logit: Dubin 1997; Lin 2003; Autant-Bernard 2006

• Spatial sample-selection (i.e., s-Tobit/Heckit): McMillen 1995, Smith & LeSage 2004,

Flores-Lagunes & Schnier 2006

• Spatial multinomial-probit: McMillen 1995, Bolduc et al. 1997

• Spatial discrete-duration: Phaneuf & Palmquist 2003

• Survival w/ spatial frailty: Banerjee et al. 2004, Darmofal 2007

• Spatial count: Bhati 2005, including ZIP: Rathbun & Fei 2006

• The Challenge:

yi* wij y*j Xβ i ; p yi 1 yi*

j i

– Not n indep., unidimensional CDF std normals, so (log-)likelihood=product

(sum) thereof, but 1 n-dimensional CDF of non-std (heterosked.) normals

• Spatial Latent-Variable Models: Estimation Strategies

–

–

McMillen 1992: EM algorithm, rendered spatial probit estimable, but no std-errs & arb. parameterization

of induced heteroscedasticity.

McMillen 1995, Bolduc et. al. 1997: simulated-likelihood strategies to estimate spatial-MNP

– Beron et al. ‘03, Beron & Vijverberg ‘04: recursive-importance-sampling (RIS)

estimator

– LeSage 1999, 2000: Bayesian strategy of Markov-Chain-Monte-Carlo (MCMC) by

Metropolis-Hastings-within-Gibbs sampling.

–

–

Fleming 2004: simpler, if approximate, strategies allowing interdep. in (non)linear probability models,

estimable by NLS, GLM, or GLMM

Pinkse & Slade’s 1998: two-step GMM estimator (for spatial-error probit).

The Econometric Problem (2)

• Structural Model: y* Wy * Xβ ε

• Reduced Form:

y* (I W)1 Xβ u

where u (I W)1 ε

• Measurement Equation: yi 1 if yi * 0

•

0 if yi * 0

1

1

p

(

y

1|

X

)

p

(

I

W

)

Xβ

(

I

W

)

ε 0

Probability: i

i

i

– Or: p( yi 1| xi ) p ui (I W)1 Xβ i

i

where u~MVN 0,[(I W)(I W)]1

• For Spatial-Error-Probit:

y* Xβ u; with u (I W) 1 ε, so u~MVN 0,[(I W)(I W)]1

p( yi 1| xi ) p ui xi β i

The Econometric Problem (3)

• Comments:

– Notice that, when we come to interpret p̂ &

same MVN integration

D p̂

DX

, we face the

• We haven’t seen such substantive interpretation yet attempted fully

in the literature, but we suggest an easier way to do it.

– If can order dependence pattern & ensure only antecedent y*

appear on RHS, then std probit ML w/ a spatial-lag works

• We think usu. indefensible subst’ly/thry’ly, but cf. Swank on capitaltax competition, e.g., where argues US exclusively leads & omits US.

– Having y, not y*, on RHS may seem subst’ly or thry’ly

desirable in some cases, but gen’ly not logically possible:

• Problem would be that outcome, yi, would indirectly (via spatial

feedback) determine yi*, but then yi* would directly determine yi. The

stochastic difference b/w them will thus a logical inconsistency.

– Notice similar MVN issue w/ time lags; suggests similar

strategies (but simpler b/c ordered) may allow model temp

dynamics directly rather than nuisance (e.g., BKT splines)

The Estimators: Bayesian Gibbs-MH Sampler (1)

• Basic Idea (See Gill’s intro Bayesian textbook, e.g.):

– Monte Carlo (MC): Given likelihood/posterior, can sample to

estimate any quantity of interest, including density, e.g.

– Markov Chain (MC)MC:

• Each draw depends on previous, so need only conditional like./post.

• Some theorems indicate, under fairly gen’l conditions, distribution

parameter draws converges to distribution under true like./post.

– Gibbs Sampler: simplest of MCMC family:

• Express each parameter like./post. conditional on others.

• Cycle to draw each conditional on others’ starts or previous draw

• After some sufficient “burn-in”, all subsequent param-vector draws

follow true multivariate likelihood/posterior.

– Metropolis-Hastings: useful when cond’l param-dist non-std

• Draws from a seed or jump distribution are accepted or rejected as the

next sampled parameters, depending on how they compare to a

suitably transformed expression of the target distribution

The Estimators: Bayesian Gibbs-MH Sampler (2)

• Bayesian Gibbs-MH (MCMC) Sampler for Spatial Probit:

1

– Likelihood: L y* , W | , β, 2

In W e

1

2 2

εε

, with

2

ε I n W y * Xβ in s-lag; ε I n W y * Xβ in s-err

2( n /2)

– Diffuse Priors => Joint Posterior:

p , β, | y , W I n W

*

– Conditional Priors:

•

•

p | , β

1

( n 1) 2 2 ε ε

e

1

( n 1) 2 2 ε ε

e

, so 2 ~ n2 , which is std, so Gibbs

p β | , ~ N β, 2 ( XCCX) 1

with C I n and β ( XX)-1 X I n W y* for s-lag, and, for s-err:

C I n W & β ( X(I n W)(I n W) X) 1 X(I n W)(I n W)y *

1

( n 1) 2 2 ε ε

–

p | β, I n W

e

,

w/ ε for s-lag & s-err as before. Non-std, so Metropolis-Hastings.

•

f zi | , β, ~ N ( yˆi* , i2 ), left- or right-truncated at 0 as yi 1 or 0

The Estimators: Freq. Recursive Import. Smplr (RIS) (1)

• Basic Idea:

p

x0

f n ( x ) dx

– To approx. n-dim. cumulative std-norm.,

– Re-express as a mean by mult & divide by std dist. truncated

to support of desired integral, (=the Importance dist.): gnc x

x0

f n ( x) c

g n ( x ) dx

– p c

g ( x)

n

•

f n ( x) 1 R f n ( x r )

pˆ E c c

– This gives probability, p, sought as:

gn (x) R r 1 gn (xr )

1

p

(

u

v

),

with

u

~

MVN

0

,

(

I

W

)

(

I

W

)

,

We want:

v Q I W Xβ, with Q a diag mat having qi 2 yi 1

1

– So, Imp. dist. is n-dim. MVN truncated at v. (uh-oh! but…)

– V-Cov u being pos-def => Cholesky decomposition exists s.t.:

Σ 1 AA, with A upper-triangular and η Au independent!

So substituting u A -1 η Bη gives: p Bη v p η B 1 v

The Estimators: Freq. Recursive Import. Smplr (RIS) (2)

• So we want to calc. this set of indep. cum. std.norms:

1

1

b1,1

b1,2

1

0

b

2,2

p Bη v p η B 1 v , where B 1v 0

0

1

b1,3

0

0

b1,n1 v1

1

bn 2,n

1

bn 1,n

bn,1n vn

• Can do so recursively, beginning w/ last obs.

– First, calculate upper bound for truncated-normal dist. of nth

– Draw from this dist & use it to calc upper bound for (n-1)th…

– Since indep., probability of sample observed (0,1) is product

of n univariate cumulative std. norms at these bounds, υ (!)

– Repeat R times & avg => RIS est. of the log-likelihood to max:

n

ˆl

j ,r R

r 1 j 1

R

Evaluating the Estimators (One Quick MC)

• DGF: (n.b., same W, diff. coeffs. For x & y)

1

1

*

y I n W xβ ε , where x I n W z and z, ε ~ N 0,1

• Conditions:

– Row-stdzd contig. wts U.S. 48; =0.5, =1.0, n={48,144},θ={0.0, 0.5}

ML with Wy ML with Wy* Bayesian Gibbs

• You can’t see this, but:

–

–

–

–

–

–

–

–

–

–

Rel’ly poor bias perf. BG Experiment #1: n=48, =0.0

Mean Coefficient Estimate

In fact, std ML w/ Wy

Actual SD of Estimates

Mean of Reported SE

seems dominate, but this

Experiment #2: n=48, =0.5

b/c 2 biases, meas./spec.

Mean Coefficient Estimate

err & simult. Simult incr

Actual SD of Estimates

Mean of Reported SE

in , meas-err decr or flat

#3: n=144, =0.0

in n, so over- to under-est. Experiment

Mean Coefficient Estimate

(Checked & it’s true) B&V ‘04 Actual SD of Estimates

Mean of Reported SE

do MC like #2 for RIS & find

Experiment #4: n=144, =0.5

=-18%, =+10%, so better. Mean Coefficient Estimate

Actual SD of Estimates

Mean of Reported SE

1.02

0.33

0.30

0.32

0.69

0.41

1.13

0.41

0.35

0.74

0.36

0.30

1.23

0.28

0.42

0.30

0.16

0.21

1.22

0.56

0.36

0.35

0.76

0.46

1.13

0.61

0.42

0.69

0.33

0.29

1.21

0.24

0.39

0.28

0.14

0.20

0.94

0.17

0.16

0.42

0.27

0.22

1.01

0.19

0.18

0.68

0.16

0.15

1.14

0.15

0.22

0.34

0.10

0.12

1.08

0.19

0.18

0.48

0.29

0.23

0.97

0.21

0.20

0.64

0.16

0.15

1.13

0.14

0.21

0.32

0.09

0.12

Calculating & Presenting Effects (1)

• If confine discussion to y*, then as prev. F&H:

y* Wy Xβ ε (I n W)-1 ( Xβ ε)

w1,2

1

w

1

2,1

wn ,1

1

wn ,( n 1)

w1,n

w( n 1),n

1

1

Xβ ε S Xβ ε

• And s.e.’s/c.i.’s by delta method as:

V sˆ i ˆk

sˆ i ˆk

sˆ i ˆk

ˆ

sˆ i ˆk sˆ i ˆk

V θˆ

, where θˆ and

ˆ

ˆ

ˆ

ˆ

θ

θ

k

θ ˆ

sˆ i

Calculating & Presenting Effects (2)

• But we (should) want to discuss:

1

(

I

W

)

X1β

p( yi 1)

i

p ui

X

i

(I W) 1 X0β

i

p ui

i

• Note: given probit, must know xi; given spatial

interdependence, must know X (!).

• Given interdep, calc these p̂ will req. MVN cdf!

p

Φ n (I W) 1 X1β i1 Φ n (I W ) 1 X 0β i1

X

• Or… better idea?

Calculate yˆ 1* & yˆ *0 at some X1 & X0 , & draws βˆ , ˆ , ε.

Apply measurement rule to convert these to yˆ 1 and yˆ 0 .

Avg difference=E(dyˆ /dX), & var(diff)=E(V(E(dyˆ /dX))).

An Example Application: US State CHIP Premia

ProbitProbitSpatial-Lag

Spatial-Error

Spatial-Lag

ML

MCMC

Probit (Gibbs)

Probit (Gibbs)

Probit (RIS)

-4.978

-5.163

-5.606

-5.531

-5.186

Constant

(6.260)

(6.292)

(10.159)

(7.337)

(5.944)

-.244

-.265**

-.374**

-.243*

-.171

Poverty Rate

(.153)

(.156)

(.231)

(.157)

(.125)

.004

.004*

.006*

.004*

.004*

Retail Wage

(.003)

(.003)

(.004)

(.003)

(.002)

.011

.011

.014

.014

-.004

Government Ideology

(.013)

(.013)

(.020)

(.014)

(.116)

Inter-party

2.174

2.108

1.473

2.636

1.27

Competition

(3.388)

(3.478)

(6.134)

(3.794)

(31.94)

-.014

-.014

-.020

-.017

.005

Tax Effort

(.019)

(.019)

(.034)

(.021)

(.017)

.045

.048

.065

.043

.041

Federal Share

(.063)

(.064)

(.095)

(.066)

(.056)

Spatial lag or error.079

.102

.200***

.297***

.243

lag

(.798)

(.815)

(.148)

(.196)

(.252)

2

.222

.220

.607

.574

NA

Pseudo-R

48

48

48

48

48

Observations

Notes: The first two columns’ estimators assume the spatial lags exogenous. The first column gives the standard

Notes:

1. Informative

U(0,1)

prior

on helps.

We’ve qualms.

probit

ML estimates.

Its parentheses

contain

estimated

standard-errors,

and its hypothesis tests assume asymptotic

Difference

in Bayesian

significance

also.

normality of 2.

calculated

t-statistics.

The modelsvs.

in frequentist

columns two through

four apply

MCMC methods with diffuse

priors, except3.forNote

a Uniform(0,1)

prior on ρ. The reported coefficientseem

estimates

are posterior-density

based on

measurement/specification-error

to have

dom’d heremeans

for ML.

Example Estimated Spatial Effect, with

Certainty Estimate, in Binary-Outcome Model

In lieu of conclusions…

• S-QualDep (latent-y*) models hard, doable

•We have a lot of work yet to do:

– Illustrate calculation of effects & s.e.’s;

– Explore estimator properties systematically;

– Compare non-spatial probit & spatial-lag

ML-probit & approximate specifications

•Next Crucial Extensions:

– Extend to other QualDep models…

– Estimated-W models… (see next for a start)

– System-of-Equations in Space…

The m-STAR Model as an Approach to Modeled,

Dynamic, Endogenous Interdependence

• Spatial Econometrics and (Political) Economy

& Network Analysis and (Political) Sociology

• Co-Evolution Models in Network Analysis

– (Node) Behaviors/Attributes & Network (Edges)

• Spatial-Statistical Approaches to Est’d-W

• A Simple Spatial-Econometric Proposal:

– Estimated W ≈ Multiple W (m-STAR)

– Endogenize W means W(y)=>S-IV in m-STAR

Spatial Econometrics

• Economists & Political

Economists

• Core Question:

– How alters’ actions affect

ego’s via network & v.v.?

– Contagion v. Common

Exposure (Galton’s Problem)

• Core Tools:

– SAR, STAR, S-QualDep…

– S-GMM, S-ML

Network Analysis

• Sociologists & Political

Sociologists

• Core Questions:

– How do nets form?

– What expl. net struct.?

– How ego’s position in net

& net struct affect?

• Core Tools

– Net stats (measures),

graphics, ERGMs, …

• INTERDEPENDENCE

– Definition: yi=f(yj≠i); i’s actions depend on j’s.

– Seems subset of “Network Effects”, which also:

• Effects of structure network per se (e.g., # transitive triplets)

• Effects of position i in network per se. (e.g., betweenness i)

Where Spatial Econometrics Needs to Go

(& Network Analysis is or Needs to Go also)

• Two Things Always Asked Do Next

– Qualitative & Limited Dependent Variables

• Bigger estimation challenges because:

– Cannot place y itself on RHS, can only place y*.

– N-dimensional integration to get probabilities

• Considerable progress: S-Probit/Tobit etc., S-MNP, S-…

– Estimate/Parameterize &, ideally, Endogenize W:

• This essence of network analysis…

• However, challenges in many contexts (e.g., C&IPE) differ:

–

–

–

–

W not always (or usually) binary or categorical

W not always (or usually) observed.

T not always (or usually) very long.

Temporal precedence not always (or usually) suffice=>causal prec.

Leenders’ (1997) Co-evolution Model

• Selection:

– Arc forms or not in continuous time Markov process:

0ij 0 0 dij ; 1ij 1 1dij ...e.g, dij yi ,t 1 y j ,t 1

• Contagion:

– =STAR model

y Wy y t 1 Xβ ε