Analyzing the Industry Environment

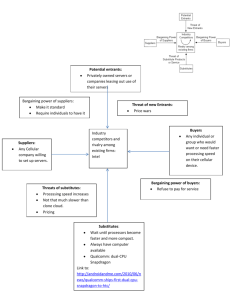

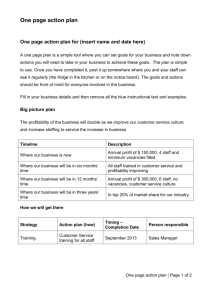

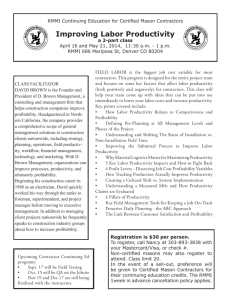

advertisement

Review: Classes 1 - 3 • Objective of Business. Intro. Prisoners’ Dilemma (Game Theory intro) • What is Strategy? IBP: Cost strategy, KSF changed, Constraints on options. • Resources & Capabilities. Starbucks: Customer Buying? Value Chain - internal view, Growth Perils. A-B: Power of consistent, unique strategy; power of leader; potential environmental change? • Tonight: External view From Environmental Analysis to Industry Analysis Context: PEST The national/ international economy Technology Government & Politics THE INDUSTRY ENVIRONMENT Company TJB • Suppliers X TJB • Competitors • Customers The natural environment Demographic structure Social structure •The Industry Environment lies at the core of the Macro Environment. •The Macro Environment impacts the firm through its effect on the Industry Environment. The Spectrum of Industry Structures Perfect Competition Oligopoly Duopoly Monopoly Concentration Many firms A few firms Two firms One firm Entry and Exit Barriers No barriers Product Differentiation Homogeneous Product Potential for product differentiation Perfect Information flow Imperfect availability of information Information Significant barriers High barriers Porter’s Five Forces of Competition ** Framework SUPPLIERS Bargaining power of suppliers INDUSTRY COMPETITORS POTENTIAL Threat of ENTRANTS new entrants Threat of Rivalry among existing firms SUBSTITUTES substitutes Bargaining power of buyers BUYERS Book Threat of Substitutes Extent of competitive pressure from producers of substitutes depends upon: • Buyers’ propensity to substitute • The price-performance characteristics of substitutes. My worksheet The Threat of Entry Entrants’ threat to industry profitability depends upon the height of barriers to entry. The principal sources of barriers to entry are: • Capital requirements • Economies of scale • Absolute cost advantage • Product differentiation • Access to channels of distribution • Legal and regulatory barriers • Retaliation Bargaining Power of Buyers Buyer’s price sensitivity Relative bargaining power • Cost of purchases as % of buyer’s total costs. • How differentiated is the purchased item? • How intense is competition between buyers? • How important is the item to quality of the buyers’ own output? • Size and concentration of buyers relative to sellers. • Buyer’s information . • Ability to backward integrate. Note: analysis of supplier power is symmetric Rivalry Between Established Competitors The extent to which industry profitability is depressed by aggressive price competition depends upon: • Concentration (number and size distribution of firms) • Diversity of competitors (differences in goals, cost structure, etc.) • Product differentiation • Excess capacity and exit barriers • Cost conditions – Extent of scale economies – Ratio of fixed to variable costs Figure 3.5. The Impact of Growth on Profitability 30 25 20 15 10 5 0 Return on sales Return on investment -5 Market Growth Less than -5% -5% to 0 0 to 5% 5% to 10% Cash flow/Investment Over 10% Surprised? Applying Five - Forces Analysis Forecasting Industry Profitability • Past profitability a poor indicator of future profitability. TJB - ?? PharmDrugs v Steel, Airlines • If we can forecast changes in industry structure we can predict likely impact on competition and profitability. Strategies to Improve Industry Profitability • What structural variables are depressing profitability • Which can be changed by individual or collective strategies? POA Profitability of US Industries, 1985-97 INDUSTRY RETURN ON EQUITY (1985-'97) Drugs 20.3 Food and kindred products 14.8 --of which Tobacco products 19.6 Instruments and related products 11.2 Electrical, and electronic equipment 11.0 Rubber and misc. plastics products 10.7 Printing and publishing 10.6 Fabricated metal products 9.9 Aircraft, guided missiles, and parts 9.7 Petroleum and coal products 9.6 Retail trade corporations 8.9 Paper and allied products 8.5 Textile mill products 7.6 Wholesale trade corporations 6.5 Stone, glass and clay products 6.8 Machinery, exc. electrical 6.0 Nonferrous metals 5.6 Motor vehicles and equipment 5.5 Iron and Steel 2.6 Mining corporations 2.7 Airlines 1.1 US Industrial Profitability, 1986-97: EVA, Market Value Added, and ROA Industry Tobacco Computer Software & Services Entertainment Personal Care Medical Products Food Processing IT Consulting Services Drugs & Research Chemicals Beverages Eating Places Textiles Building Materials Metals Telephone Companies Semiconductors & Components Aluminium Paper & Products Broadcasting & Publishing Cars & Trucks Computers & Peripherals Electrical Products Aerospace & Defence Railroads Airlines Construction & Engineering Steel Mean (all industries) EVA/CE 0.0936 0.0590 0.0442 0.0281 0.0276 0.0251 0.0206 0.0065 0.0029 0.0018 0.0014 -0.0012 -0.0056 -0.0101 -0.0124 -0.0126 -0.0128 -0.0149 -0.0149 -0.0150 -0.0306 -0.0327 -0.0331 -0.0340 -0.0416 -0.0458 -0.0647 -0.0110 MV/CE 3.2314 4.0331 2.8240 2.8700 3.0987 1.7090 2.7136 3.3807 1.8195 2.1688 2.3246 1.9392 1.5521 1.7447 1.3680 2.0560 1.4844 1.2902 1.8042 0.9473 1.7332 1.3056 1.3982 1.0257 1.1676 1.6749 1.2967 1.8930 ROA 14.3979 10.3530 8.4403 8.005 9.5384 8.5306 6.5260 7.6439 7.9589 5.5960 6.8867 7.4093 5.6250 4.6181 5.9906 5.2342 6.0059 2.1660 3.1143 4.6276 4.8390 3.7780 0.9866 2.2646 5.5989 X Plant is first entry into the Y Industry Market Attractiveness How much Profit is there to be made? Market Attractiveness & Competitive Strength for various ZZZ markets High Med. Low Strong Average Weak Competitive Strength: What % of profit can WE make? Sector Industry 1 Industry 2 Industry 3 Industry 4 Industry 5 Drawing Industry Boundaries : Identifying the Relevant Market • What industry is BMW in: – World Auto industry – European Auto industry – World luxury car industry? • Key criterion: SUBSTITUTABILITY – On the demand side : are buyers willing to substitute between types of cars and across countries – On the supply side : are manufacturers able to switch production between types of cars and across countries • May need to analyze industry at different levels for different types of decision The Value Net CUSTOMERS COMPETITORS COMPANY SUPPLIERS COMPLEMENTORS Book. Complexity & Tools Five Forces or Six? Introducing Complements The suppliers of complements create value for the industry and can exercise bargaining power SUPPLIERS Bargaining power of suppliers INDUSTRY COMPETITORS POTENTIAL ENTRANTS COMPLEMENTS Threat of new entrants Threat of Rivalry among existing firms Bargaining power of buyers BUYERS SUBSTITUTES substitutes Dynamic Competition Porter framework assumes (a) industry structure drives competitive behavior (b) Industry structure is stable. But---competition also changes industry structure Schumpeterian Competition: A “perennial gale of creative destruction” where innovation overthrows established market leaders Hypercompetition: “intense and rapid competitive moves….creating disequilibrium through continuously creating new competitive advantages and destroying, obsoleting or neutralizing opponents’ competitive advantages Applying Five Forces to Emerging E-commerce Markets • The more unstable is industry structure—the less helpful is analysis based upon industry structure. • Taking account of time—willingness to endure losses today in order to reap profit tomorrow • General structural features of digital, networked industries: Low entry barriers + Extreme scale economies + Network externalities = Winner-take-all markets = Intense competition Identifying Key Success Factors Pre-requisites forsuccess success Pre-requisites for What do customers want? How does the firm survive competition Analysis of competition Analysis of demand • Who are our customers? • What do they want? • What drives competition? What are drives •• What the competition? main • What are the dimensions of main competition? dimensions of competition? •How • Howintense intenseis iscompetition? competition? • Howcan canwe weobtain obtainaasuperior •How superior competitive competitive position? position? KEY SUCCESS FACTORS Identifying Key Success Factors Through Modeling Profitability: The Airline Industry Profitability Income ASMs = Yield = Revenue RPMs • Strength of competition on routes. • Responsiveness to chaanging market conditions • % business travelers. • Achieving differentiation advantage x Load factor - Unit Cost x RPMs ASMs - • Price competitiveness. • Efficiency of route planning. • Flexibility and responsiveness. • Customer loyalty. • Meeting customer requirements. ASM = Available Seat Miles Expenses ASMs • Wage rates. • Fuel efficiency of planes. • Employee productivity. • Load factors. • Administrative overhead. RPM = Revenue Passenger Miles Identifying Key Success Factors by Analyzing Profit Drivers: Retailing Sales mix of products Return on Sales Avoiding markdowns through tight inventory control Max. buying power to minimize cost of goods purchased ROCE Max. sales/sq. foot through: *location *product mix *customer service *quality control Sales/Capital Employed Max. inventory turnover through electronic data interchange, close vendor relationships, fast delivery Minimize capital deployment through outsourcing & leasing SUMMARY: What Have We Learned? Forecasting Industry Profitability • • Past profitability a poor indicator of future profitability. If we can forecast changes in industry structure we can predict likely impact on competition and profitability. Strategies to Improve Industry Profitability • • What structural variables are depressing profitability? Which can be changed by individual or collective strategies? Defining Industry Boundaries • • Key criterion: substitution Working at different levels of aggregation SUMMARY (continued) Game Theory • • • Valuable in analyzing competitive rivalry between small number of players Analysis of cooperation & competition Offers insights into the structure of the game; competitive interaction; use of specific strategic plays. Key Success Factors • Starting point for the analysis of competitive advantage Industry Analysis & The New Economy • • Porter 5 forces analysis less useful when industry structure unstable Key to understanding digital, networked markets is to understand their underlying structure (esp. scale economies and network externalities) Industry Evolution OUTLIN E • The industry life cycle • Industry structure, competition, and success factors over the life cycle. • Anticipating and shaping the future. Industry Sales The Industry Life Cycle Introduction Growth Maturity Time Drivers of industry evolution : • demand growth • creation and diffusion of knowledge Decline Product and Process Innovation Over Time Rate of innovation Product Innovation Process Innovation Time Standardization of Product Features in Autos FEATURE INTRODUCTION Speedometer 1901 by Oldsmobile Automatic transmission 1st installed 1904 GENERAL ADOPTION Circa 1915 Introduced by Packard as an option, 1938. Standard on Cadillacs early 1950s Electric headlamps GM introduces, 1908 Standard equipment by 1916 All-steel body GM adoptes 1912 Standard by early 1920s All-steel enclosed body Dodge, 1923 Becomes standard late 1920s Radio Optional extra 1923 Standard equipment, 1946 Four-wheel drive Appeared 1924 Only limited availability by 1994 Hydraulic brakes Introduced 1924 Became standard 1939 Shatterproof glass 1st used 1927 Standard features in Fords 1938 Power steering Introduced 1952 Standard equipment by 1969 Antilock brakes Introduced 1972 Standard on GM cars in 1991 Air bags GM introduces, 1974 By 1994 most new cars equipped with air bags How Typical is the Life Cycle Pattern? • Technology-intensive industries (e.g. pharmaceuticals, semiconductors, computers) may retain features of emerging industries. Individual products do not. • Other industries (especially those providing basic necessities, e.g. food processing, construction, apparel) reach maturity, but not decline. • Industries may experience life cycle regeneration. Sales Sales B&W Color Portable HDTV ? 1900 ‘50 ‘60 ‘90 MOTORCYCLES 1930 50 60 TV’s 90 • Life cycle model can help us to anticipate industry evolution—but dangerous to assume any common, predetermined pattern of industy development. Tools, Complexity Evolution of Industry Structure over the Life Cycle INTRODUCTION Affluent buyers GROWTH Increasing penetration TECHNOLOGY Rapid product innovation Product and Incremental process innovation innovation PRODUCTS Wide variety, Standardization rapid design change Commoditization Continued commoditization MANUFACTURING Short-runs, skill intensive Deskilling Overcapacity DEMAND TRADE Capacity shortage, mass-production MATURITY Mass market replacement demand DECLINE Knowledgeable, customers, residual segments Well-diffused technology -----Production shifts from advanced to developing countries----- COMPETITION Technology- Entry & exit KSFs Product innovation Process technology. Design for Shakeout & consolidation Cost efficiency Price wars, exit (p. 315) Overhead reduction, rationalization, low cost sourcing The Driving Forces of Industry Evolution BASIC CONDITIONS Customers become more knowledgeable & experienced INDUSTRY STRUCTURE Customers become more price conscious Products become more standardized Diffusion of technology COMPETITION Production becomes less R&D & skill-intensive Production shifts to low-wage countries Quest for new sources of differentiation Price competition intensifies Excess capacity increases Demand growth slows as market saturation approaches Distribution channels consolidate Bargaining power of distributors increases Preparing for the Future : The Role of Scenario Analysis in Adapting to Industry Change Stages in undertaking multiple Scenario Analysis: • Identify major forces driving industry change • Predict possible impacts of each force on the industry environment • Identify interactions between different external forces • Among range of outcomes, identify 2-4 most likely/ most interesting scenarios: configurations of changeforces and outcomes • Consider implications of each scenario for the company • Identify key signposts pointing toward the emergence of each scenario • Prepare contingency plan Tool, POA, Option Value Innovation & Renewal over the Industry Life Cycle: Retailing Mail order, catalogue retailing e.g. Sears Roebuck 1880s Chain Stores e.g. A&P 1920s Warehouse Internet Clubs Retailers e.g. Price Club e.g. Amazon; Sam’s Club Webvan Discount “Category Stores Killers” e.g. K-Mart e.g. Toys-R-Us, Wal-Mart Home Depot 1960s 2000 Review: New tools. Use Insights from to develop POA • 4 C’s, PEST • 5 Forces => Market Attractiveness, can combine w/ Competitive Strength => Corporate Strategy • Key Success Factors • Life Cycle • Scenarios, option value • Value Equivalence Line - next • Strategic Groups & competing w/in and between, p. 127 129 BCG’s Strategic Environments Matrix Many FRAGMENTED SPECIALIZATION apparel, housebuilding pharmaceuticals, luxury cars jewelry retailing, sawmills chocolate confectionery SOURCES OF STALEMATE ADVANTAGE basic chemicals, volume Few VOLUME jet engines, food supermarkets grade paper, ship owning motorcycles, standard (VLCCs), wholesale banking microprocessors Big Small SIZE OF ADVANTAGE BCG’s Analysis of the Strategic Characteristics of Specialization Businesses low ABILITY TO SYSTEMATIZE CREATIVE EXPERIMENTAL fashion, toiletries, magazines general publishing food products PERCEPTIVE ANALYTICAL high tech luxury cars, confectionery paper towels high high low ENVIRONMENTAL VARIABILITY