Capital One Case - Teaching Web Server

advertisement

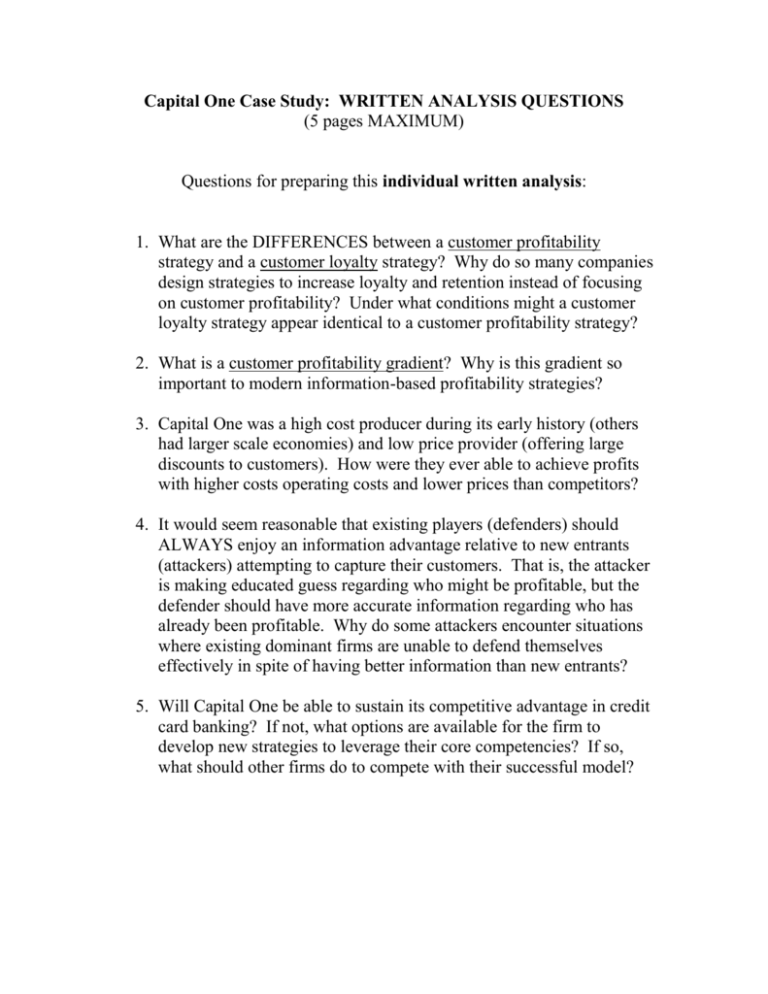

Capital One Case Study: WRITTEN ANALYSIS QUESTIONS (5 pages MAXIMUM) Questions for preparing this individual written analysis: 1. What are the DIFFERENCES between a customer profitability strategy and a customer loyalty strategy? Why do so many companies design strategies to increase loyalty and retention instead of focusing on customer profitability? Under what conditions might a customer loyalty strategy appear identical to a customer profitability strategy? 2. What is a customer profitability gradient? Why is this gradient so important to modern information-based profitability strategies? 3. Capital One was a high cost producer during its early history (others had larger scale economies) and low price provider (offering large discounts to customers). How were they ever able to achieve profits with higher costs operating costs and lower prices than competitors? 4. It would seem reasonable that existing players (defenders) should ALWAYS enjoy an information advantage relative to new entrants (attackers) attempting to capture their customers. That is, the attacker is making educated guess regarding who might be profitable, but the defender should have more accurate information regarding who has already been profitable. Why do some attackers encounter situations where existing dominant firms are unable to defend themselves effectively in spite of having better information than new entrants? 5. Will Capital One be able to sustain its competitive advantage in credit card banking? If not, what options are available for the firm to develop new strategies to leverage their core competencies? If so, what should other firms do to compete with their successful model?