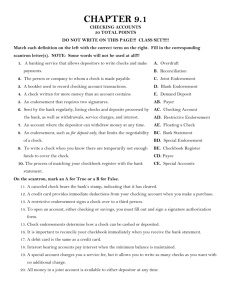

Chapter 9 Notes

Chapter 9

Checking Accounts and

Other Banking

Services

Purpose of a Checking Account

Checking accounts allow depositors to write checks to make payments.

Check –

Demand Deposit -

Life of a Check

________ writes a check to a ________

________ cashes the check at his/her bank

Bank that cashed the check returns it to the

_________ bank

________ bank withdraws $ from _______ account to reimburse the other bank

Check is then cleared and becomes a

___________ __________

Check Clearing

Cancelled check –

Cancelled checks can be used as proof of purchase or payment in the event of a dispute

Outstanding check –

Advantages of Checking Accts.

_____________ way to pay bills

Checks are often _______________

Checking accts have a built in ___ _____

__________ system

Checking acct customers often have access to other bank services (online banking, ATMs, loans, etc.)

Responsibilities of having a checking account

Checks must be ______ ______ and you are responsible for keeping _________ _______

____________________ in your account to cover all purchases.

________ _______ of bank statement each month

Maintaining sufficient funds

Overdraft –

Floating a check –

Postdating –

Opening a Checking Account

Bank will require __ and _________________

Fill out and sign a verification form

-

Submit an ________ ________

-Amounts required vary by bank

Parts of a Check

Check number:

ABA number (American Banker’s Assoc.)

–

–

Maker’s pre-printed name and address:

Parts of a check cont.

Date :

Payee –

–

–

Numeric amount

–

–

Parts of a check cont.

Written amount:

–

–

Write dollar amount in _______

Use “and” to separate dollars and cents

– Express cents in a _______ (over 100)

– Start at the far _____ of the line

– Draw a line to the end to fill in any extra space

– Do not write _________

Parts of a check cont.

Maker’s signature:

Account number:

–

Memo :

–

Writing a Check

1.

2.

3.

4.

5.

Always use _____

Write _______

Sign your name exactly as it appears on

_________ _______

Avoid mistakes (void checks)

Make sure there are adequate funds to cover check.

Paying Bills Online

Bills can be paid electronically using one of two options:

1.

Register your bank’s routing number and your account number with the vendor and pay your bill through the __________ _________ .

2.

Register payee’s (vendors) with your own bank and pay bills using ____________________ .

Online bill pay is _______ and convenient.

Online bill pay eliminates the need for ______ and ________.

Filling out a Deposit Slip

1.

2.

3.

Complete a deposit slip anytime you add money to your account at the bank.

Insert the ______

In “cash” section fill in total __________

In “checks” section ______________ with ABA number and amount.

4.

5.

6.

____ currency and checks and record as _______

If you want _____ ____ fill in “less cash received.”

__________ cash received from subtotal and enter total amount as net deposit.

Using a checkbook register

Checkbook register –

Used for your ___________ record keeping.

Record transactions as they happen.

Add or subtract amounts appropriately and maintain an accurate balance.

Use the register to reconcile your account with the _____ ________at the end of each month.

Reconciling Your Account

Reconciliation –

Most banks enclose cancelled checks with the statement.

The back of bank statement includes a form to help reconcile your account.

The goal is get your ________ balance and the

______ __________ balance to ______ .

2.

3.

4.

Reconciling

1.

Endorsing Checks

Checks cannot be cashed until they are endorsed on the _____ by the ______ .

Blank endorsement –

Special endorsement –

Restrictive endorsement –

Types of Checking Accounts

Joint Account –

Special Accounts

Standard Accounts

Interest-bearing Accounts

Share Accounts

Other Banking Services

___________ banks offer checking accts, savings accts, credit cards, safe deposit boxes, ATM’s, online banking, loans, etc.

Guaranteed payments:

– Certified checks –

–

Cashier’s checks –

– Money orders –

More Banking Services

Debit card –

Credit card –

ATM –

Overdraft protection –

More Banking Services

Stop payment orders –

Safe deposit boxes –

Loans and trusts –

Financial services –

Bank Fees

Banks charge ______ to cover their operating expenses.

Common fees include:

–

–

–

–