CHAPTER 5 STUDY GUIDE Financial Literacy 2014/15 What are

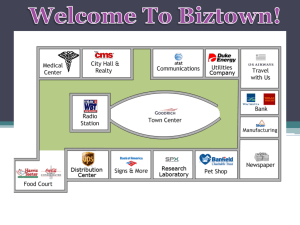

advertisement

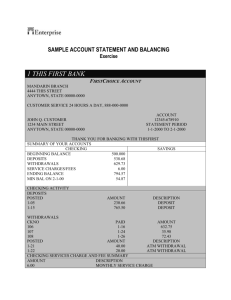

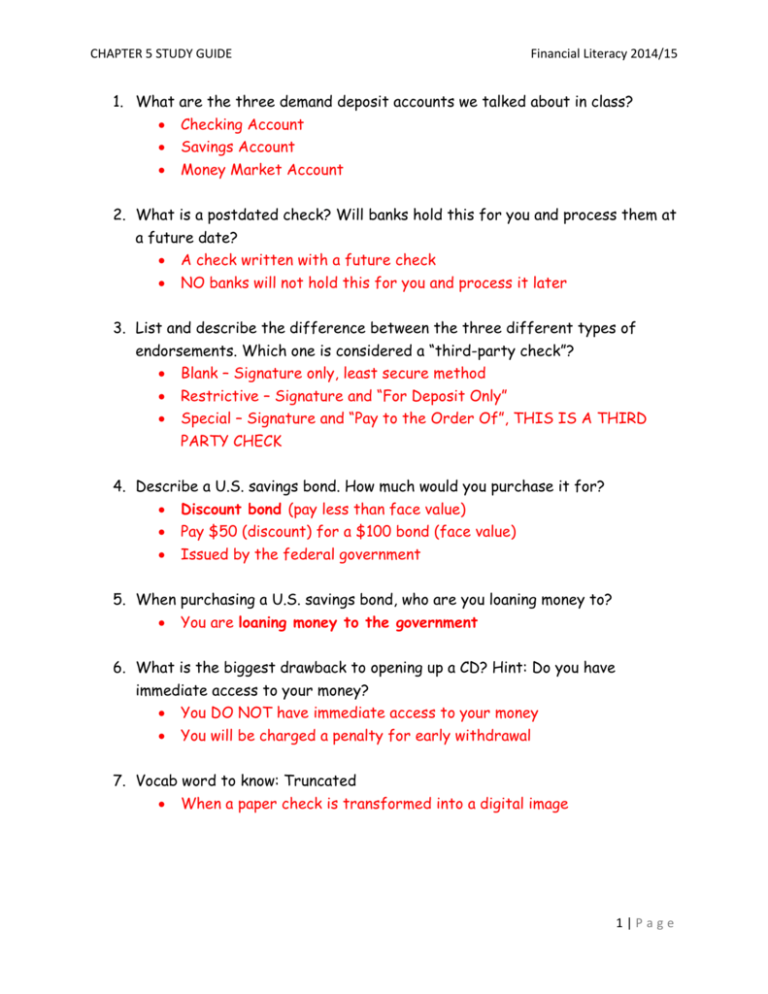

CHAPTER 5 STUDY GUIDE Financial Literacy 2014/15 1. What are the three demand deposit accounts we talked about in class? Checking Account Savings Account Money Market Account 2. What is a postdated check? Will banks hold this for you and process them at a future date? A check written with a future check NO banks will not hold this for you and process it later 3. List and describe the difference between the three different types of endorsements. Which one is considered a “third-party check”? Blank – Signature only, least secure method Restrictive – Signature and “For Deposit Only” Special – Signature and “Pay to the Order Of”, THIS IS A THIRD PARTY CHECK 4. Describe a U.S. savings bond. How much would you purchase it for? Discount bond (pay less than face value) Pay $50 (discount) for a $100 bond (face value) Issued by the federal government 5. When purchasing a U.S. savings bond, who are you loaning money to? You are loaning money to the government 6. What is the biggest drawback to opening up a CD? Hint: Do you have immediate access to your money? You DO NOT have immediate access to your money You will be charged a penalty for early withdrawal 7. Vocab word to know: Truncated When a paper check is transformed into a digital image 1|Page CHAPTER 5 STUDY GUIDE Financial Literacy 2014/15 8. Explain the term liquidity and list the 5 cash management tools reviewed in chapter 5 in order of MOST to LEAST liquid. How quickly and easily assets can be turned into cash o Checking Account o Savings Account o Money Market Account o CD (Certificate of Deposit) o U.S. Savings Bond o 401k 9. Explain the rule of 72. It is an equation that tells you how long it will take you to double your money when investing (72÷Interest Rate) SPECIAL NOTE: do not change the interest rate into a decimal 10. Your bank statement balance is $1,000. You have outstanding checks of $250. You have deposits in transit of $600. You have service fees of $10. You earned interest on the account in the amount of $5. What should be your adjusted bank balance? 1,000 – 250 + 600 = $1,350 11. Your checkbook register balance is $1,050. You have outstanding checks of $250. You have deposits in transit of $640. You have service fees of $8. You earned interest on the account in the amount of $3. What should be your adjusted bank balance? 1,050 – 8 + 3 = $1,045 12. Using the Rule of 72, how many years will it take to double $15,000 earning 6% interest? 72÷6 = 12 Years 2|Page CHAPTER 5 STUDY GUIDE Financial Literacy 2014/15 13. Greg deposits $1000 into an account paying 7% simple interest annually. How much interest will he earn after 7 months? 1000 x .07 x 7÷12 = $40.83 (this is how much money you will earn in interest) Define the following terms: Outstanding Checks: Written checks that have not yet been processed by the bank Checkbook Register: A tool used to track checking account transactions and keep a running balance of your account Bounced Checks: A check marked “NSF” and returned to the payee’s bank unpaid Safe Deposit Box: A secure container located in a bank vault, to store important documents and valuable jewelry 3|Page