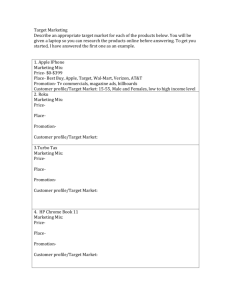

Project Apple

advertisement

Project Apple Part 1: financial statement analysis Outline • Financial Statement Analysis – Income Statement Analysis – Balance Sheet Analysis – Cash Flow Statement Analysis – Free Cash Flow • Valuation • Dividend Policy • Capital Structure Income statement • Discuss the profitability measured by – Gross margin – Operating margin – Profit margin • Discuss the change of profitability for the last 10 years. What is driving the change? Balance Sheet • Is there need to study liquidity of Apple? • Debt management ratios. – How has the debt ratio changed over time. Combine balance sheet with income statement • Efficiency of Apple – Inventory turnover – Fixed assets turnover – Total assets turnover – Use of cash, wasted or needed? • Profitability on assets and equity – ROA – ROE Market Ratio • Peice-to-earnings • Price-to-Book Cash flow statement • Why operation cash flow is different from net income? • FCF: what is Apple’s free cash flow in 2012? How is it different from net income Market ratios • What is the trailing PE ratio for Apple? What does it mean? • What is the market-to-book ratio for Apple? What is the implication? DuPont analysis • Compared with its rivals, what is driving the ROE of Apple? – How to break down ROE into profitability, asset efficiency and equity multiplier Part II: Capital structure • • • • What is Apple’s current capital structure? How to change Apple’s capital structure? How the use of debt would affect net income? How the use of debt would to affect number of shares outstanding? • Calculate EPS under new capital structure • What effect does increasing debt have on cost of equity? • Calculate Apple’s fair value under new capital structure