7(a) Loan Guaranty Program

advertisement

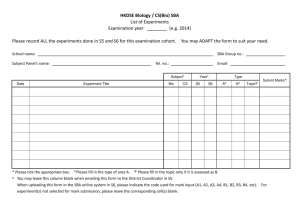

Business Loan Seminar Indiana District Office SBA’s Role in Business Financing SBA does NOT make grants to businesses www.grants.gov No Direct Loans from SBA (except for disasters) Obtain loan from Financial Institution Indiana District SBA Financial Assistance Programs 504 Certified Development Company (CDC) Loan Program 7(a) Loan Guaranty Program Indiana District SBA 504 CDC Loan Program Eligible Business: Operated for profit Size standards • Tangible net worth up to $15 million • Preceding 2 year average net income after taxes up to $5.0 million No speculation or investment in rental real estate Indiana District SBA 504 CDC Loan Program Proceeds may be used for: • • • • • Purchasing land Construction of new facilities Improvements to existing facilities Improvements to real estate Purchase major machinery and equipment Project cost financing • Bank finances 50% • CDC/SBA finances 30 – 40% • Customer finances 10 – 20% Indiana District SBA 504 CDC Loan Program Loan Maximums: $5.0 million – general $5.5 million – manufacturers Maximum Loan Terms: Buildings – 20 years Equipment – 10 years Job Creation or Retention: 1 job for every $65,000 of debenture Indiana District SBA 504 CDC Loan Program Advantages of a SBA 504 loan Low down payment Low fixed rate Low monthly payments Indiana District SBA Indiana Certified Development Companies Business Development Corporation South Bend, IN 574-288-5758 Community Development Corporation of Northeast Indiana Fort Wayne, IN 260-427-1127 Indiana Statewide Certified Development Company Indianapolis, IN 317-844-9810 Premier Capital Corporation Indianapolis, IN 317-974-0504 Regional Development Company Valparaiso, IN 219-476-0504 Indiana District SBA Financial Assistance Programs 7(a) Loan Guaranty Program Indiana District SBA 7(a) Loan Guaranty Program Eligibility requirements • Must qualify as “small” according to the North American Industry Classification System (NAICS) • For Profit • Open to general public • U.S. citizen or permanent residence status • Reasonable investment, usually 10 – 20% • Good character Indiana District SBA 7(a) Loan Guaranty Program What is a small business? “one that is independently owned and operated and which not dominant in its field of operation.” This definition will vary from industry to industry. The business sizes listed below indicates the maximum size a business can be based on major industry type and still be considered a Small Business. Manufacturing Wholesaling 500 – 1,500 employees 100 employees for financial assistance programs (500 for contracting programs) Services $6 million to $29 million in annual receipts OR 1,500 employees Retailing General and Heavy construction Special trade construction Agriculture $6 million to $24.5 million in annual receipts $17 million to $28.5 million in annual receipts $12 million in annual receipts $750,000 to $6 million in annual receipts Indiana District SBA 7(a) Loan Guaranty Program The 7(a) program also has alternative size standards available. They are: 1. Tangible net worth is $15,000,000 or less AND 2. Average income after taxes is $5,000,00 or less for the past 2 years Indiana District SBA 7(a) Loan Guaranty Program Purpose of the 7(a) Loan Working capital • Purchase equipment/ furniture/ fixtures • Acquire land/buildings • Construct new facilities • Debt refinancing • Purchase an existing business • Indiana District SBA 7(a) Loan Guaranty Program Ineligible uses of a 7(a) Loan • • • • • • • Purchase partial ownership of a business Repay owners for their investment in the business Pay for delinquent taxes Refinance of delinquent loans Speculative, lending or investing purposes Real estate held for investment, sale or rent Illegal or gambling activities nor for sexually oriented businesses • Business pyramids • Political, lobbying or religious activities Indiana District SBA 7(a) Loan Guaranty Program Borrower benefits • • • • Funding for start-ups Longer amortizations No balloon payments No prepayment penalties (loans under 15 year maturity) • Reduced owner investment & collateral requirements • The SBA guaranty encourages lenders to loan money Indiana District SBA 7(a) Loan Guaranty Program Maximum Loan Amount $5,000,000 Guaranty fees 2 – 3.75% Guaranty percentages 75 – 85% Indiana District SBA 7(a) Loan Guaranty Program Loan Maturities • Working capital 1 to 10 years depending on cash flow needs • Equipment up to the expected useful life • Building/land up to 25 years Indiana District SBA 7(a) Loan Guaranty Program Interest rates • Negotiated between the borrower and lender • Subject to SBA maximums • May be fixed or variable Indiana District SBA 7(a) Loan Guaranty Program Maximum Interest Rates Loan amount under 7 years 7 years or more up to $25,000 Base rate + 4.25% Base rate + 4.75% $25,001 - $50,000 Base rate + 3.25% Base rate + 3.75% $50,001 or more Base rate + 2.25% Base rate + 2.75% Indiana District SBA 7(a) Loan Guaranty Program Base Rate Options: Variable Rate Options: • • • Wall Street Prime 1 Month LIBOR + 3% SBA Peg Rate Fixed Rate Option: • LIBOR SWAP (1 month LIBOR + 3% + Ave of 5 and 10 year LIBOR) Indiana District SBA 7(a) Loan Guaranty Program January 2016 Interest Rate Maximums (Loans $50,000 and greater; over 7 years) Wall Street Prime = 3.5 + 2.75 = 6.25% 1 month LIBOR = .42 + 3.0 +2.75 = 6.17% SBA Peg Rate = 2.38 + 2.75 = 5.13% Fixed Rate = 5.36 + 2.75 = 8.11% Indiana District SBA 7(a) Loan Guaranty Program What a Lender looks for in an SBA Loan • • • • • • • Management ability A feasible business plan Repayment out of business proceeds Capital injection by owners Collateral Personal guarantees Credit scores Indiana District SBA 7(a) Loan Guaranty Program Business Plan ABC Company Business Plan • Section One: Executive Summary • Section Two: The Business • • • • • • • • Description of business Product/service Marketing information Location Competition Management Personnel Application and expected life of loan • Section Three: Financial Data • Section Four: Supporting Documents Indiana District SBA 7(a) Loan Guaranty Program Financial Information Required New businesses • Detailed estimate of needed capital • Projections of revenues, expenses and profits - 12 month minimum • Cash flow projection - 12 month minimum • Narrative of major assumptions • List of collateral Indiana District SBA 7(a) Loan Guaranty Program Financial Information Required Established businesses • Current balance sheet and 3 full years income (profit/loss statements) • Projections of revenues, expenses and profits - 12 month minimum • Cash flow projection – 12 month minimum • Narrative of major assumptions • Current personal financial statement for each owner, partner or stockholder • List of collateral • Statement of the loan amount and intended uses Indiana District SBA Additional 7(a) Sub Programs SBAExpress • $350,000 maximum • 50% guaranty • Faster processing Indiana District SBA Other SBA Finance Programs International Trade Loans United States Export Assistance Center John O’Gara 211 West Fort Street, Suite 2200 Detroit, MI 48226 Phone: 313-226-3670 Indiana District SBA 7(a) Loan Guaranty Program Entrepreneurial Development Assistance SCORE – Counselors to America’s Small Business • 11 Chapters in Indiana • http://www.score.org Small Business Development Centers • 10 center in the state • http://www.isbdc.org Central Indiana Women’s Business Center •Indianapolis – 317-917-3266 http://www.nsibiz.org Women’s Economic Opportunity Center for Indiana • Fort Wayne – 260-416-3400 http://www.niic.net Additional information can be found on the Indiana SBA website http://www.sba.gov/in/ Indiana District SBA Contracting and Certification Programs First steps for government contracting: • DUNNS number www.dnb.com • System for Award Management www.sam.gov Contracting opportunities www.fedbizopps.gov Contact Marty Anderson or Vernice Mathis 317-226-7272 Indiana District SBA Things to Remember • Lender is not SBA • Prepare a written business plan • Know and understand what the plan says • Talk with SBA Resource Partners and other stakeholders before visiting lender • What happens if the lender says “No” to your loan request? Indiana District SBA Luann Lieurance Lender Relations Specialist Indiana SBA District Office 8500 Keystone Crossing, Suite 400 Indianapolis, IN 46240 317-226-7272 x 114 Luann.lieurance@sba.gov Indiana District SBA