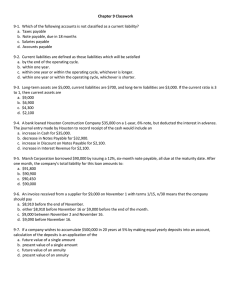

ASSIGNMENT 5 ACCT 201 Q.1When are the current liabilities

advertisement

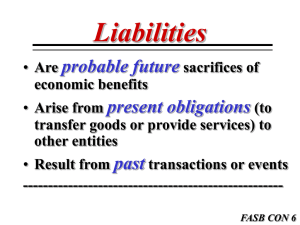

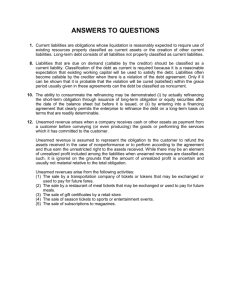

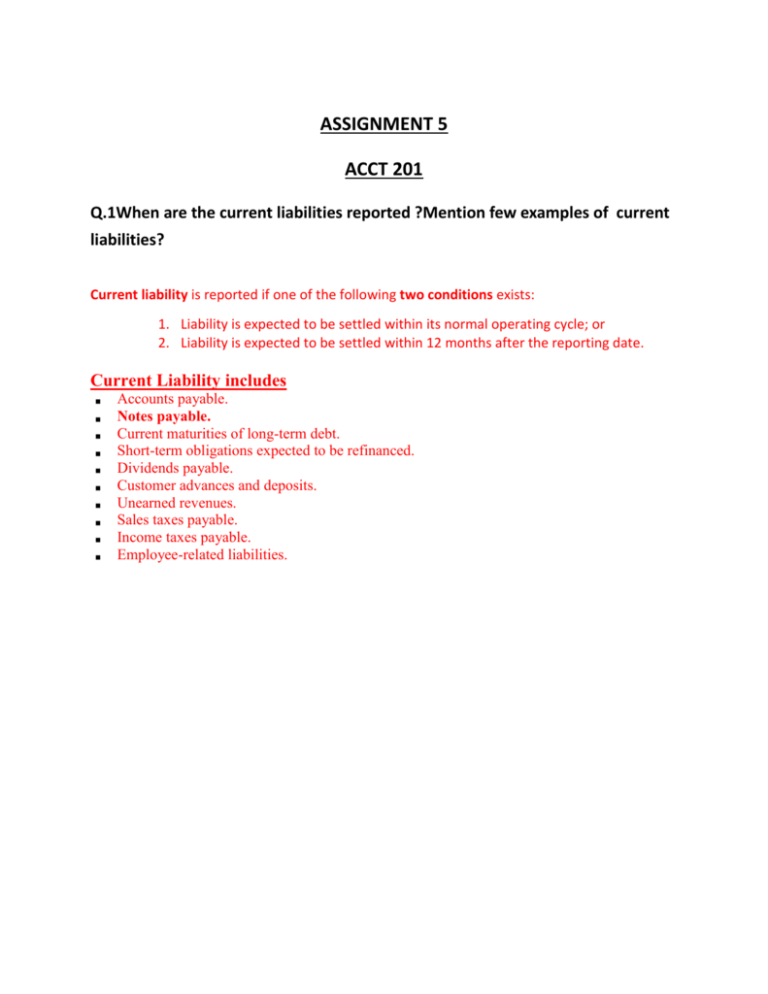

ASSIGNMENT 5 ACCT 201 Q.1When are the current liabilities reported ?Mention few examples of current liabilities? Current liability is reported if one of the following two conditions exists: 1. Liability is expected to be settled within its normal operating cycle; or 2. Liability is expected to be settled within 12 months after the reporting date. Current Liability includes Accounts payable. Notes payable. Current maturities of long-term debt. Short-term obligations expected to be refinanced. Dividends payable. Customer advances and deposits. Unearned revenues. Sales taxes payable. Income taxes payable. Employee-related liabilities. Q2.Castle National Bank agrees to lend $100,000 on March 1, 2011, to Green Landscape Company for which Green Landscape signs a $100,000, 6 percent, four-month note. Green Landscape prepares financial statements semiannually. REQUIRED: Record journal entries in the books of green landscape company for cash receipt from the bank, adjusting entry on 30th June and payment entry on maturity of note payable on july 1st. Date March 1 June 30 July 1 Account Cash Note Payable Interest Expenses (100,000 ×6%×4/12) Interest Payable Interest Payable Note Payable Cash Dr. 100,000 Cr. 100,000 2,000 2,000 2,000 100,000 102,000