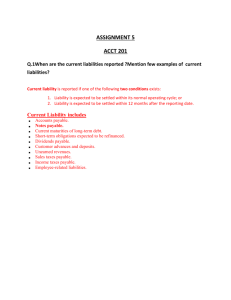

FASB CON 6 Current Liabilities

advertisement

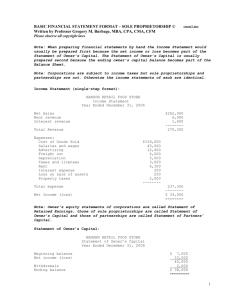

Liabilities • Are probable future sacrifices of economic benefits • Arise from present obligations (to transfer goods or provide services) to other entities • Result from past transactions or events ---------------------------------------------------FASB CON 6 Current Liabilities … are “obligations whose liquidation is reasonably expected to require the use of existing resources properly classified as current assets, or the creation of other current liabilities.” FASB CON 6 11 Types of Current Liabilities • Accounts Payable • Notes Payable • Current maturities of LT Debt • Short-term obligations expected to be refinanced • Dividends payable • • • • Returnable deposits Unearned revenues Sales taxes payable Property taxes payable • Income taxes payable • Employee related liabilities Current Maturities of Long-Term Debt are classified as Current Liabilities ...unless … (1) retired by assets accumulated for this purpose that have not been shown as current assets (2) refinanced, or retired from the proceeds of a new long-term debt issue, or (3) converted into capital stock Short-Term Obligations Expected to be Refinanced on a Long-term basis may be classified as noncurrent if ... Refinancing Criteria (both must be met): (1) it intends to refinance on a long-term basis, & (2) it demonstrates an ability to consummate the refinancing Dividends Payable • Cash dividends payable are always current liabilities (are always paid within 12 mos.) • Preferred dividends in arrears are NOT liabilities ( while they do represent “probable future economic sacrifice” they do not result from a past transaction until after authorized by the board of directors) • Stock dividends are NOT liabilities (do not require future outlays of assets or services) Returnable Deposits Returnable Cash Deposits may be current liabilities (if they will probably be returned within 12 mos.) Unearned Revenues Accounting for unearned revenues: (a) when advance is received: Dr Cash Cr Current Liability (b) when revenue is earned: Dr Current Liability Cr Revenue Sales Tax Payable When collected at point-of-sale: ...if tax is segregated: Dr Cash or Accounts Receivable Cr Sales Cr Sales Tax Payable … if tax is not segregated, prepare a reclassifying JE: Dr Sales Cr Sales Tax Payable When paid: Dr Sales Tax Payable Cr Cash Property Taxes Payable based on assessed value of real & personal property When should property owners record the liability? To which accounting period should the cost be charged? • …accrue monthly on the taxpayer’s books during the taxing authority’s fiscal period when the taxes are paid • …alternative: consistent application from year to year Lein Date May 1 Gov’t fiscal year 0 Gov’t fiscal year 1 Corp. fiscal year 1 Jan 1 Bills assessed May 1 7/1,9/1 Bills Bills Rec’d Paid Apr 31 Corp. fiscal year 2 Dec 31 Income Taxes Payable • Varies with taxable income • Is estimated throughout the fiscal year for corporations (owners of sole proprietorships & partnerships pay the tax, rather than the business entity) • Is covered in detail in Chapter 20 Employee-Related Liabilities • Payroll Deductions – – – – – – Income Tax (Federal, State & Local) Social Security (FICA & Medicare) Unemployment (FUTA & State) Health & Life Insurance Premiums Employee Savings Union Dues, etc. [employee only] [both] [employer only] [possibly both] • Compensated Absences – Vacation Pay -- accrue at current or expected earnings – Sick Leave (accrue generally if vested) • Post-retirement Benefits (Chapter 21) • Bonuses (appendix … skipping) Contingency … “an existing condition, situation, or set of circumstances involving uncertainty as to possible gain or loss to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur.” (FAS 5) Typical Gain Contingencies: Typical Loss Contingencies: • Possible receipts of monies • Litigation, claims & from gifts, donations, bonuses, assessments etc. • Guarantees and warranty • Possible refunds from the costs government in tax disputes • Premiums and coupons • Pending court cases where the • Environmental liabilities probable outcome is favorable • Self-insurance risks • Tax loss carryforwards (Ch 20) Contingent liabilities are obligations that are dependent upon future event(s) to confirm: • • • • Who is to be paid (the payee), How much will be paid, When it is to be paid, &/or If the debt really exists How likely are the future events? • Probable -- the future event(s) are likely to occur • Reasonably possible -- the chance of the future event(s) is more than remote but less than likely • Remote -- the chance of the future event(s) occurring is slight Record a Contingent Loss if both of the following conditions are met: Dr Loss / Cr Liability (1) the information available prior to the issuance of the financial statements indicates that it is probable that a liability has been incurred at the date of the financial statements, (probable future economic sacrifice … arising from present obligations …resulting from past transactions or & (2) the amount of the loss can be reasonably estimated (based on past experience, industry experience, events) an expert opinion, or educated guess) Accounting for Litigation, Claims & Assessments Book the Liability (and Loss) if: (1) The underlying cause for action occurred prior to the end of the reporting period, (2) An unfavorable outcome is probable, & (3) a reasonable estimate on the loss can be made Required Disclosures for Loss Contingencies • If the contingent loss is either probable or estimable (but not both), disclose: – The nature of the contingency – An estimate of the possible loss or range of loss or a statement that an estimate cannot be made • The following other contingent losses are disclosed … even if remote: – Guarantees of indebtedness of others – Obligations of commercial banks under “stand-by letters of credit” – Guarantees to repurchase receivables (or any related property) that have been sold or assigned Accounting for Guarantee & Warrantee Costs • CASH BASIS: – expense in the period incurred – justifiable under some (probably rare) circumstances: • it is not probable that a liability has been incurred, or • the amount of the liability cannot be reasonably estimated • ACCRUAL BASIS: – EXPENSE WARRANTY APPROACH: • expense the total expected costs in the period of sales – SALES WARRANTY APPROACH: • used when the warrantee is sold separately • may defer revenue over the life of the contract using the straight line method over time, or • may defer revenue proportionately based on expected costs Accounting for Compensated Absences • Record the Payroll Expense & the related Liability in the year the benefits are earned Options: – may accrue at current earnings level, or – may accrue at expected future earnings level – accrual for sick pay is optional if it does not vest (that is, if it is not used, it is not paid) – consistency of application from year to year is important