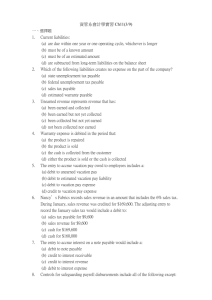

Chapter 13: Current Liabilities and Contingencies

advertisement

Chapter 13: Current Liabilities and Contingencies Sid Glandon, DBA, CPA Assistant Professor of Accounting Liability FASB Concepts Statement #6 – Present obligation – – Probable future transfer or use of cash, goods, or services Unavoidable obligation Transaction or event has already occurred Current Liabilities Obligations whose liquidation will require – – Use of current assets or Creation of other current liabilities Examples of Current Liabilities Accounts payable – Notes payable – – Purchases on open account in the normal course of business Interest bearing Zero-interest-bearing Current maturities of long-term debt Line of Credit (Interest-Bearing Note) Spencer Company took out a line of credit with the Bank of the West on April 1, 2004 for $100,000. The term is six months and the interest rate is 9%. Prepare the journal entries to record: – – The issuance of the line of credit The payment of the line of credit Line of Credit (Interest-Bearing Note) DATE ACCOUNT 4/1/04 Cash Notes payable DEBIT 100,000 CREDIT 100,000 To record the issuance of a line of credit for six months at 9% interest 10/1/04 Interest expense 4,500 Notes payable 100,000 Cash 104,500 To record the payment of principal and interest on the line of credit Analysis of interest expense: Face amount of note Interest rate Annual interest Short period Interest expense 100,000 9% 9,000 6/12 4,500 Noninterest-Bearing Note Spencer Company took out borrowed $100,000 from Bank of the West on April 1, 2004. The instrument was a zero-interest bearing note for six months at 9% interest. Prepare the journal entries to record: – – The issuance of the zero-interest bearing note The payment of the zero-interest bearing notes Noninterest-Bearing Note DATE ACCOUNT DEBIT CREDIT 4/1/04 Cash 95,500 Discount on notes payable 4,500 Notes payable 100,000 To record the issuance of a zero-interest-bearing note for six months at 9% interest Analysis of discount on notes payable: Face amount of note Interest rate Annual interest Short period Discount on notes payable 100,000 9% 9,000 6/12 10/1/04 Interest expense 4,500 Discount on notes payable Notes payable 100,000 Cash To record the payment of the zero-interest-bearing note 4,500 4,500 100,000 Short-Term Obligations Expected to be Refinanced Refinancing criteria – – Must intend to refinance the obligation on a longterm basis, and Must demonstrate an ability to consummate the refinancing Actual refinancing after balance sheet date Entering into a financing agreement Other Current Liabilities Dividends payable Returnable deposits Unearned revenues Sales taxes payable Property taxes payable Income taxes payable Sales Taxes Payable Spencer Company has sales for the month of March 2004 of $150,000. All sales are subject to a 6.5% state sales tax and a 0.5% local sales tax. Prepare the journal entries: – – To record sales To record the payment of sales taxes Sales Taxes Payable DATE ACCOUNT DEBIT CREDIT 3/31/04 Accounts receivable 160,500 Sales 150,000 Sales taxes payable 10,500 To record sales and sales tax collected for the month of March 2004 Analysis of sales taxes payable: Gross sales State sales tax rate Local sales tax rate Combined rate Discount on notes payable 150,000 6.50% 0.50% 4/15/04 Sales tax payable 10,500 Cash To record payment of sales taxes collected in March 2004 7% 10,500 10,500 Contingencies, SFAS #5 “An existing condition, situation, or set of circumstances involving uncertainty as to possible gain or loss to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur” Gain Contingencies Based on the constraint of conservatism gain contingencies are not recorded until resolved Under certain circumstances such contingencies may be disclosed in the notes to the financial statements Loss Contingencies Criteria for recording – – It is probable that a liability has been incurred at the balance sheet date, and The loss is reasonably estimated Contingent Liability On October 2, 2003, a company truck was involved in an accident with a car driven by Alexander. On January 12, 2004 the company was notified that Alexander had filed a lawsuit seeking damages for personal injuries in the amount of $800,000. The company's counsel believes it is reasonably possible that Alexander will be awarded between $250,000 and $500,000 and the $400,000 is a better estimate of potential liability than any other amount. The company's financial statements were issued on March 1, 2004. What amount of loss should the company accrue at December 31, 2003? A.$0 B.$250,000 C.$400,000 D.$500,000 Guarantee and Warranty Costs Cash basis – Not GAAP but used for tax purposes Accrual basis – Expense warranty approach – Integral part of the sale transaction Accrue warranty in year of sale Sales warranty approach Sold as a separate contract Extended warranties-deferred revenue Warranty Expense Spencer Company sells 100 pet video units for $500 per unit during 2003. The video units have a three-year warranty covering parts and labor. Based on past experience management estimates that warranty costs will be $10 in the first year, $20 in the second year and $25 in the third year. During 2003 the company incurs $900 in warranty costs. n a l Prepare the Journal Entry to E n t r Record y Sales and Warranty Expense for 2003 t o ACCOUNT Accounts receivable Sales To record sales for 2003 R e c o r d S a l e s Warranty expense Estimated liability under warranties To record warranty expense on 2003 sales a Analysis of warranty expense: Estimated warranty cost per unit Units sold Warranty expense DEBIT 50,000 CREDIT 50,000 5,500 5,500 n d W a r r a n t y $55 100 $5,500 Prepare the Journal Entry to Record Warranty Costs Incurred During 2003 ACCOUNT DEBIT Estimated liability under warranties 900 Cash, payroll, parts To record warranty costs incurred during 2003 on 2003 sales CREDIT 900 Employee-Related Liabilities Payroll deductions – – Compensated absences – – – – Payroll expense Payroll tax expense Services already rendered Rights vested or accumulated Compensation is probable Amount is reasonably estimated Bonus Agreements Gross Payroll For the month of March 2004 Spencer Company had the following Percentage Gross salaries and wages Income tax withheld Social security tax withheld Union dues withheld Total withheld Net payroll 15.0% 7.5% Amount Totals $100,000 $15,000 7,500 2,500 25,000 $75,000 Journal Entry to Record Gross Payroll ACCOUNT Salaries and wages Income taxes payable Social security payable Union dues payable Cash To record payroll for the month of March 2004 DEBIT $100,000 CREDIT 15,000 7,500 2,500 75,000 Payroll Taxes Employer Payroll Taxes Associated with the March 2004 Payroll Gross salaries and wages Social security (FICA) State unemployment (SUTA) Federal unemployment (FUTA) Workmen's comp. Total payroll taxes Gross Payroll Percentage $100,000 7.50% 9.00% 0.80% 2.75% Totals $7,500 9,000 800 2,750 $20,050 Journal Entry to Record Payroll Taxes ACCOUNT DEBIT 20,050 Payroll taxes Social security payable State unemployment payable Federal unemployment payable Workmen's comp. Payable To record payroll taxes associated with March 2004 payroll CREDIT 7,500 9,000 800 2,750