Tech Leads the Way as Nasdaq Climbs

advertisement

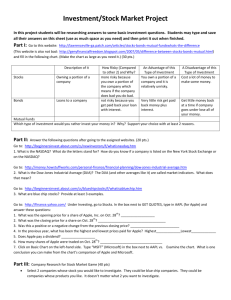

Tech Leads the Way as Nasdaq Climbs Sector’s Robust Earnings, Upbeat Forecasts Put Index Ahead of Other Benchmarks ENLARGE Customers shop in a new Apple Store in Hangzhou, China on Jan. 24, 2015. PHOTO: ZUMA PRESS By CORRIE DRIEBUSCH and DAN STRUMPF Feb. 13, 2015 8:11 p.m. ET 7 COMMENTS The Nasdaq Composite Index rose to a fresh 15-year high, propelled by something that was noticeably absent in the dot-com bubble: earnings. Index heavyweights such as Apple Inc., Amazon.com Inc. and Cisco Systems Inc. surprised Wall Street with bigger-than-expected profits in the fourth quarter, as a number of other sectors of the stock market struggled. Robust earnings and upbeat profit forecasts for many technology companies this year have pushed the Nasdaq ahead, in percentage terms, of the S&P 500 and Dow Jones Industrial Average, which have been weighed down by concerns about global economic growth, falling profits at energy companies and banks still struggling to pay big legal bills that are a legacy of the financial crisis. ENLARGE This year, the Nasdaq has gained 3.3%, besting the 1.9% rise in the S&P 500 and the Dow’s 1.1% gain. But the better performance has lasted longer than that. Over the past year, the Nasdaq has gained 15.3% versus the 14.1% gain in the S&P 500. For the Nasdaq, which is heavily weighted toward technology stocks, it is a far cry from the era of ill-fated Internet blowups like Pets.com. At the time, investors big and small poured money into new public companies devoid of profits, only to see those sky-high valuations collapse after March 2000, when their business models failed to generate the profits needed to justify rich share prices. “This time around, the Nasdaq is supported by earnings and dividends in a way that it wasn’t in March of 2000,” said Gavin Baker, manager of the $12.2 billion Fidelity OTC Portfolio mutual fund, 80% of whose assets trade mainly on Nasdaq or an over-the-counter market. Advertisement On Friday, the Nasdaq rose 36.22 points, or 0.7%, to 4893.84, its highest close since March 27, 2000. However, it remains 3.1% short of its alltime high reached on March 10, 2000. The S&P, meanwhile, hit a new record, rising 8.51 points, or 0.4%, to 2096.99, as did the Russell 2000 index of small-company stocks. The Russell rose 6.86 points, or 0.6%, to 1223.13. The Dow Jones Industrial Average, meanwhile, rose 46.97 points, or 0.3%, to 18019.35, rising above 18,000 for the first time this year. It closed 0.19% below its most recent record. While the Nasdaq has lagged behind both the S&P 500 and the Dow in the chase for new record highs, in recent months it has been chalking up better returns than the S&P 500 and the Dow. The index’s big gains can be attributed to strong earnings from top component companies, such as Apple, which comprises 10% of the Nasdaq Composite index. The stock is up 64% over the past year and 15% year to date. Its shares jumped in January after the company reported a 38% rise in quarterly profit. ENLARGE Amazon.com, the fourth-biggest stock in the index, is up 23% so far this year. But fund managers say that even as the Nasdaq grinds toward the peak set in 2000, the backdrop isn’t the same. “It’s a very different world than it was in 1999, and in a good way,” said Randy Warren, chief investment officer at the $140 million Philadelphia firm Warren Financial. “Risk didn’t matter in 2000, nobody thought about risk. Today everybody thinks about risk.” In particular, investors point to a stark difference in valuations today as compared to 15 years ago. In March 2000, the Nasdaq Composite’s value compared with the last 12 months of earnings was 175. Currently, the index’s trailing price/earnings ratio is 31, not far above the 10-year average of 29.7. The S&P 500, meanwhile, is trading at a trailing P/E of 17.4, which compares to a 10-year P/E of 15.8, according to FactSet. Investors say that while there are pockets of the Nasdaq trading at potentially risky valuations, they are largely isolated to areas such as social media, cloud computing and biotechnology stocks. “If someone were pushing back on the idea that the Nasdaq is still not real, they’d say, look at all the biotechnology companies trading on the Nasdaq,” said Mr. Warren. “I don’t buy it. That’s always been the case for biotech companies.” And while 2014 saw the biggest batch of U.S. initial public offerings since the collapse of the tech bubble in 2000, that corner of the market, too, appears more stable. “If you look at companies going public today, they are significantly more mature, they’re much older,” said Fidelity’s Mr. Baker, noting that in the late-90s many companies went public at sky-high valuations. He added that the technology companies that have recently gone public differ in that they generate cash and have real revenue. In addition, many investors point to relatively low valuations on the index’s big names, such as Apple. Apple shares are trading at a trailing P/E ratio of 17.1. “Valuations on a lot of those companies are low,” said Kevin Landis, chief investment officer of Firsthand Capital Management, referring to long-standing technology firms such as Intel Corp. , Oracle Corp. and Cisco. Each of those stocks are trading at P/E ratios below 19 times for the past 12 months’ worth of earnings. “Cisco has also gone from being really expensive stock in 2000 to being a really cheap stock,” Mr. Landis said. But money managers say even though the Nasdaq has pushed higher, it is nothing like the heart of the tech bubble. Mr. Landis remembers clearly the investor fever around technology stocks in the late-1990s and early 2000. This feels fundamentally different, he says. At the beginning of 2000, Mr. Landis’s Firsthand Technology Value Fund had $1.4 billion in net assets. The fund now manages a little over $200 million. “In 2000, people were putting money into tech stocks because they felt something revolutionary was happening and they didn’t want to miss out,” he said. “Today, there’s still this reluctance to get into tech.” Write to Corrie Driebusch at corrie.driebusch@wsj.com and Dan Strumpf atdaniel.strumpf@wsj.com