Investment/Stock Market Project

advertisement

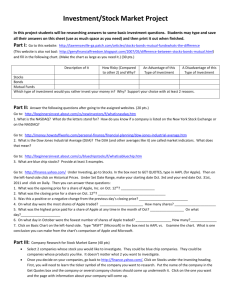

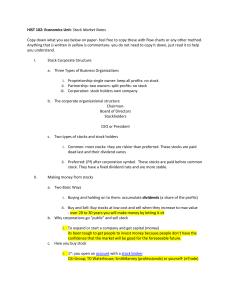

Investment/Stock Market Project In this project students will be researching answers to some basic investment questions. Students may type and save all their answers on this sheet (use as much space as you need) and then print it out when finished. Part I: Go to this website: http://lawrenceville‐ga.patch.com/articles/stocks‐bonds‐mutual‐fundswhats‐the‐difference (This website is also not bad: http://genyfinancialfreedom.blogspot.com/2007/05/difference‐between‐stocks‐bonds‐mutual.html) and fill in the following chart. (Make the chart as large as you need it.) (30 pts.) Description of it How Risky (Compared An Advantage of this A Disadvantage of this to other 2) and Why? Type of Investment Type of Investment Stocks Owning a portion of a more risky because You own a portion of a Cost a lot of money to company you own a portion of company and it is make some money. the company which relatively unrisky. means if the company does bad you do bad. Bonds Loans to a company not risky because you Very little risk get paid Get little money back get paid back your loan back money plus at a time if company with interest. interest. goes under lose all of your money. Mutual Funds Which type of investment would you rather invest your money in? Why? Support your choice with at least 2 reasons. Part II: Answer the following questions after going to the assigned websites. (20 pts.) Go to: http://beginnersinvest.about.com/cs/newinvestors/f/whatisnasdaq.htm 1. What is the NASDAQ? What do the letters stand for? How do you know if a company is listed on the New York Stock Exchange or on the NASDAQ? Go to: http://money.howstuffworks.com/personal‐finance/financial‐planning/dow‐jones‐industrial‐average.htm 2. What is the Dow Jones Industrial Average (DJIA)? The DJIA (and other averages like it) are called market indicators. What does that mean? Go to: http://beginnersinvest.about.com/cs/bluechipstocks/f/whatisabluechip.htm 3. What are blue chip stocks? Provide at least 3 examples. Go to: http://finance.yahoo.com/ Under Investing, go to Stocks. In the box next to GET QUOTES, type in AAPL (for Apple) and answer these questions: 1. What was the opening price for a share of Apple, Inc. on Oct. 28th? __________________ 2. What was the closing price for a share on Oct. 28th? ____________________________________ 3. Was this a positive or a negative change from the previous closing price? __________________________ 4. In the previous year, what has been the highest and lowest prices paid for Apple? Highest_____________Lowest_____________ 5. Does Apple pay a dividend? __________________ 6. How many shares of Apple were traded on Oct. 28th? _________________________________ 7. Click on Basic Chart on the left‐hand side. Type “MSFT” (Microsoft) in the box next to AAPL vs. Examine the chart. What is one conclusion you can make from the chart’s comparison of Apple and Microsoft. Part III: Company Research for Stock Market Game (40 pts) • Select 2 companies whose stock you would like to investigate. They could be blue chip companies. They could be companies whose products you like. It doesn’t matter what 2 you want to investigate. • • • • • Once you decide on your companies, go back to http://finance.yahoo.com/, Click on Stocks under the Investing heading. First, you will need to learn the ticker symbol of the company you want to research. Put the name of the company in the Get Quotes box and the company or several company choices should come up underneath it. Click on the one you want and the page with information about your company will come up. Read about your company. You need to take into consideration the price of a share, the strength of the company and especially demand—Is there anything going on in the US, the world, or within the company itself that will dramatically increase or decrease demand? This is the “guessing” part of buying stock, but you can make an educated guess by looking at trends. All of the headings on the left‐hand side provide more information about your chosen company. I would recommend looking more closely at: Under Company, click on Profile, Key Statistics, and Competitors and Under News & Info, Click on Headlines and Financial Blogs. You might also like to look at Balance Sheet under Financials. After reading/researching about each of your 2 selected companies, write a paragraph for each one. Each paragraph should explain why your chose that company in the first place, what you learned about the company in your research, and explain why you think the stock WOULD OR WOULD NOT be a good investment to make and why (based on your research). Part IV: Stock Market Game (10 pts.) Game Rules 1. Each person will receive $5000 to start the game. 2. The game will run for a little over 3 weeks and end on Nov. 22/23rd right before Thanksgiving. 3. You must buy stock either from NASDAQ or the NYSE. You may buy as many stock as you would like within your money limit. 4. You must purchase stock from at least two companies and you must make your first initial purchase by Nov. 4th. 4. Every time you make a transaction (buying or selling your stocks), you must pay a fee. This will be flat fee of .10/share bought or sold. 5. Everyone must show and turn in their transactions on the sheets provided. 6. The “winner” will be that person who ends up with the portfolio with the greatest market value (minus the original $5000) at the end of the 3 weeks. 7. The winner will receive Mrs. S brownies. ☺ Parts I, II, and III will be due on Nov. 9th. Stock Portfolio Record Buy/Sell Ex: Buy Date 11/1 Stock Kraft # of Shares 10 Price $10 Value $100 Fee $10 $ Remaining $4890 Shares Left 10