File - ROHAN DEV Academic and personal projects

advertisement

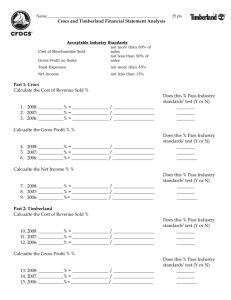

Business @ School 1st Phase Report Crocs™ Love them or hate them, the tremendous popularity of Crocs™ shoes is an undeniable business success story. Rapid growth and global expansion had reached US$847 Million in revenues and US$168 Million of profits in 2007, just six years after launch. In order to reach this result, Crocs strategically attempted to break the shackles of convention and achieve both differentiation and low costs by attacking Crocs’ two crucial customer segments, namely, Corporate Customers and Individual Shoppers. By: Rohan Dev , Justin Goh, Tan Pek Yan, Shawn Teo, Sia Tze Yang Contents 1. Executive Summary 2.History & Organisation 3. Value Chain 4. Customer & Competitor Analysis 5. Financials 6. SWOT Analysis 7. Reflections 7. SWOT Analysis 2 Oganisation Chart 3 Rohan Dev Tan Pek Yan Shawn Teo Part I – Executive Summary 4 Founded in 1999, Crocs Inc entered the Initial Public Offering (IPO) in 2006 with its headquarters located in Niwot, Colorado. With an employee strength of 3560, revenue for Fiscal Year 2010 was 789,695,000 USD while its profit was 81,035,000 USD. What Crocs aims to do is to manufacture and design fashonable which does not only look good, but feels good. Crocs products are catered to everyone: Male and Female, young and old from all walks of life. Based on 1 core models, the Beach, many variations have been given birth to such as CrocBand, Sport, Clogs, Flip-Flops & Sandals, Boots, Slipons, Work & Medical, Prepair™. However, there is intense competiton posed by competitors, Deckers, Timberland and Wolverine World Wide (WWW) which go head on against Crocs in the footwear industry. In addition, other big competitors are Imitation companies. Despite stiff competition, we believe that Crocs is a good comapny that will continue growing. 5 Part II- History & Organisation Organization As of December 31, 2009, Crocs employed approximately 3,560 persons, compared to 3,700 as of December 31, 2008. This included 2,030 employees in the U.S. and Canada, 220 employees in Mexico, 890 employees in Asia, 30 employees in South American and 390 employees in Europe. The main reason why most of the employees are located the States is because there is a larger consumer market in the States. Globally, as of December 31, 2009, Crocs had 2,061 persons employed in our consumer-direct channels. While Crocs’ headcount in the consumer-direct channels grew to accommodate our business, Crocs reduced their non-consumer-direct headcount by approximately 300 persons since 2008, primarily due to consolidation of Crocs’ company-operated distribution centers and other reductions in staffing. Figure 1: The World Map showing how the employees of Crocs are scattered all around the world. 6 History Before assuming its current name, Crocs was originally Western Brands, a Limited Liability Company (LLC), formed in Colorado in 1999. The origins of the Crocs clogs, however, date to 2002, and were the shared inspiration of the company’s three founders: George B. Boedecker, Jr., Lyndon V. Hanson III, and Scott Seamans. All three were Boulder, Colorado, entrepreneurs. Boedecker shared Seaman’s passion for sailing and they spotted the opportunity when they came across a new boating clog produced by a Canadian Company, Foam Creations, Inc. Foam Creations’ closed-cell resin allowed the shoe to be light-weight and lighter than traditional rubber-soled boat shoes. In addition, because it molded to the shape of a person’s foot, it was less likely to slip on a wet boat deck. The material also absorbed a minimum of odors and the clog design ensured that it was wellventilated. (The comfortable material the clogs were made of is now called Croslite) While on a sailing trio from Islas, Mexico, to Ft. Lauderdale, Florida, in May 2002, the two friends discussed improvements on the Foam Creation's design and decided they wanted to market this ideal boat shoe. When they returned home they brought in Hanson and acquired the rights to Foam Creations' manufacturing process through Western Brands. Seamans tweaked the design of the shoe, adding straps to the shoe while Boedecker took over as chief executive officer and lined up a host of small investors. Hanson set up most of the operation and oversaw the running of it. As a name for the shoe they settled on Crocs, an abbreviation of crocodile, because the attributes of the animal fit the product: comfortable both on the land and in the water, strong, and long-living. Because they also wanted to convey a sense of fun, the founders played on the non-slip properties of the shoe to coin an initial marketing tagline: "Get a Grip." This playful attitude would also lead to the various colors in which the clogs were offered. 7 The Crocs clog made its debut in November 2002 at the Ft. Lauderdale International Boat Show with its first model, "The Beach." Attendees snapped up all 1,000 pairs the company had to offer. Even more important to the growth of the brand was the enthusiastic reception the shoes received from the retailers and sales representatives at its first footwear exhibition, the March 2003 Shoe Market of the Americas. During their first full year on the market, 76,000 pairs of Crocs were sold, generating 1.2 million in sales. Just one year later, Western Brands sold 649,000 pairs, resulting in revenues of $12.3 million. Manufacturing to this point had been handled by Foam Creations in Canada. Crocs were proving so successful that in June 2004 Western Brands acquired Foam Creations, picking up the rights to Croslite as well as the manufacturing facilities. In January 2005, the company dropped the Western Brands name, adopting Crocs, Inc. The company prepared to go public, with the first step coming when Boedecker stepped down as CEO in favor of Ronald R. Snyder. In the same year, Crocs also launched its first national marketing campaign to increase the brand's visibility with both consumers and potential investors. Sales for Crocs were already on a sharp upward trend, but the advertising played its part in selling more than 6 million pairs of shoes and achieving $108.8 million in sales in 2005. Crocs expanded into Europe, Japan, Southeast Asia and Australia and Footwear News named Crocs its brand of the year in 2005. In February 2006, Crocs went public on the NASDAQ exchange with the largest footwear initial public offering in history. Recent Events From Crocs’ inception through the year ended December 31, 2007, Crocs experienced rapid revenue growth and had difficulty meeting demand for our footwear products. During this period, Crocs significantly increased production capacity, warehouse space and inventory in an effort to meet demand. This pattern changed in 2008. Crocs’ revenue growth moderated in the three month period ended March 31, 2008 and began to decline through the balance of Crocs’ 2008 fiscal year. This trend continued into 2009. During this time, Crocs’ total revenues declined from $847.4 million in the year ended December 31, 2007 to $645.8 million during the year ended December 31, 2009. 8 Part III- Value Chain Analysis Value-added Business Strategies and Practices Crocs aims to lower the costs of manufacturing the product without compromising its quality. They hope to attract consumers with their unique products and vibrant colors. In order to bring their products to their consumers, there are five main steps. Supply • Internal • External Design • Internal Manufacturing Distribution • Mostly external • Internal • External Supply Croslite is a material found mainly in all Crocs shoes. Croslite is slip and odor resistant, soft, durable and extremely lightweight. Shoes made with the Croslite material have been certified by U.S Ergonomics to reduce peak pressure on the foot reduce muscular fatigue while standing and walking and to relieve the musculoskeletal system It is a patented shoe material that is made by our external partners Finproject SPA. Finproject SPA has certain limited rights to use the Croslite material which were originally negotiated in connection with the purchase of Crocs 9 Canada from Finproject’s parent company. The comfort and utility of our products depend on the properties achieved from the compounding of the Croslite material and constitute key competitive advantage for Crocs. However, Croslite is also made in factories located in the US and Europe. This is to ensure that Crocs have a backup plan in case of emergencies. Design Crocs adopt a unique clog design with perforated holes. Its design is such that it is a product between a slipper and a sandal. Various acquisitions are made by Crocs to help design their products. Furthermore, with the company’s plan for product expansion, more designs are required in order to attract more customers. Acquisitions by Crocs: Foam Creations, Inc. - Foam Creations, Inc. was acquired by Crocs shortly after they were organized as a limited liability company. They produced Crocs’ very first footwear design, the Crocs Beach, which was unveiled in 2002. All 200 pairs produced were sold out. Ocean Minded Inc - Ocean Minded Inc was bought over by the company in 2007. It produces sandals primarily for the beach action and adventure market. It is positioned as an ocean lifestyle brand with deep roots in the beach and surf culture. The brand is also gaining traction within the inland outdoor and mainstream footwear channels. It utilizes recycled materials throughout its entire product line and engages in environmental manufacturing processes whenever possible. Jibbitz LLC - Jibbitz LLC was added by the company in 2006. It produces unique charms specifically suited to fit into Crocs shoes. Crocs extended 10 licensing agreements with Disney, Nickelodeon, Marvel, DC Comics and Warner Bros for Jibbitz shoe charms We also introduced limited edition line of footwear and Jibbitz charms featuring such popular characters as Cinderella, Mickey Mouse, Sponge Bob Square Pants, Dora the Explorer, Spiderman and Batman. These mainly appeals to children. * Other acquisitions such as Fury, Bite and Tagger, have been discontinued due to poor sales. Manufacturing Crocs is under contract with third- party manufacturers located in China and Bosnia. These manufacturers produce our shoes with Croslite material compounded by materials supplied by Finproject. 73% of footwear products from Crocs came from these third party manufacturers in the year ended 31 December 2009. Company-operated manufacturing facilities primarily in Mexico and Italy contribute to the other 27% in 2009. Also, Crocs decide to have both internal and external manufacturers as they believe that their internal manufacturing capabilities enable them to rapidly make changes to production providing us with the flexibility to quickly respond to orders for high demand models and colors throughout the year while outsourcing allows them to capitalize on the efficiencies and cost benefits of using contract manufacturing. They believe that this production strategy will enable them to continue to minimize their production costs, increase overall operating efficiencies and shorten production and development times to better serve their retail customers. 11 Distribution Crocs’ products are sold to retailers located around the world. Crocs currently sell their products throughout the U.S and in more than 100 countries. They sell their products through domestic and international retailers and distributors and directly to end-user consumers through their webstores, Company-operated retail stores outlets. The broad appeal of Crocs footwear has allowed them to market their products to wide range of distribution channels including department stores and traditional footwear retailers as well as variety of specialty and independent retail channels. They strive to drive business to both our wholesale partners and company-owned retail and internet stores. Marketing Strategies Broad appeal leads to larger consumer range Initially Crocs targeted their products to water sports enthusiasts but the comfort and functionality of the products appealed to more diverse group of consumers who used their footwear for wide range of activities. To capitalize on the broad appeal of their footwear, they have expanded their sales infrastructure and have strengthened their senior management team and developed relationships with range of retailers in the U.S. More range of products Crocs have a limited product line with some labelling it as a ‘one-trick pony’. Crocs sales would quickly decline as consumer’s fashion tastes changed. However, Crocs have recently expanded their product line to include other types of outdoor shoes. Although some ventures ultimately failed, Crocs is able to change as the fashion trend goes by. 12 Part IV- Customer & Competitor Analysis Consumer Analysis Crocs created a brand new type of casual shoe, a clog that was not a shoe, not a sandal, but a shoe and a sandal 50-50. It used fun, creativity, and imagination to create the brightly-colored, comfortable and lightweight clogs we know very well. With the perfect balance of functional and eye candy, Crocs managed to rope in huge crowds to its stores. Customers are a very general term and hence, the group has decided to spit them into 2 categories: ‘Corporate Customers’ and ‘Individuals’. ‘Corporate Customers’ are shops or companies that have been offered Crocs contracts while ‘Individuals’ are those shoppers who come into the stores, physically or through online means, to get themselves Crocs for their own personal usage. 13 Distribution Channels In the realm of retailing, Crocs changed the game by allowing corporate customers to order as few as 24 pairs and stock them in a matter of weeks, not months. Crocs delivered colors and styles that customers wanted right away. For Individuals, Crocs designed a broad and extensive distribution system so that its shoes were available in a variety of retail shops. One can go to the online shops like Crocs’ own website and third party websites (such as amazon.com and Zappos). One may also get their footwear physically by just popping into Department and Specialty stores and Crocs’ own specialized stores. This way, a buyer can buy their favourite Crocs whenever and almost wherever they want! Pricing In the pricing sector for corporate customers, it very much depends on the type of contracts signed between the corporate customers and Crocs because dependent factors such as number of shoes, colour of shoes, type of shoes come in. As for the Individuals, Crocs has continuously been trying to, and more often than not, have succeeded in maintaining low and reasonable prices for every pair so that customers walk away with a pair of Crocs in hand feeling that they have bought something value-for-money. An average Crocs shoe costs about $40. Marketing & Promotion Crocs used creative merchandising, out-of-box vertical displays (as shown on the right), in order to attract and lure passing shoppers into their shops. This is not like other shoe shops where they are placed in boring shelves. Crocs’ way of presenting their products is very eye-catching and unique. Furthermore, word-of-mouth marketing was also used to build buzz and momentum without 14 having to spend as much as traditional manufacturers on advertising or paying celebrities for endorsements. Examples include large manufacturers who invest heavily on building their brands and advertising, and the large athletic shoemakers who pay celebrity endorsements from star athletes such as Michael Jordan (Nike). Celebrities like Al Pacino, Jack Nicholson, George Bush, and many others (as shown in the pictures below) were seen wearing the clogs and once the media caught on, Crocs got their free and contagious advertising. But that also does not mean they did not have any ads, they’re just a few (like “Feel the Love” Campaign) Pictures from left to right: George Bush, Jack Nicholson, Morgan Freeman, Steven Tyler, Mario Batali Development & Trends During the recession period, both sectors ‘Corporate Customers’ and ‘Individuals’ suffered quite a bit of losses. However both the sectors’ decline in sales was mainly due to the rise in imitation products. This is because, during the recession, customers started to look out for cheaper alternatives to the original Crocs. The fact is that these imitators are so good at copying our Crocs from head to toe that one may not even see the difference between original Crocs and fake ones. However, seeing is not believing. Almost everyone knows that these imitations have absolutely none of the benefits and features of the genuine Crocs. More about these excellent traits can be seen in the next section: 15 Competitor Analysis For the competitor analysis, there are 2 companies that the group feels is competing with Crocs: Deckers and Wolverine Word Wide (WWW). Going head on with Crocs are brands Teva (Deckers) and Chaco (WWW) as the three of them are centred in the territory of Casual Footwear. devised… 16 To further add on to the details… Light in weight? NO YES NO Anti Bacterial and Anti Fungal NO YES NO Odour and Slip Resistant Odour Resistant: NO Odour Resistant: YES Odour Resistant: NO Slip Resistant: YES Slip Resistant: YES (Complaint: it absorbs odour) Slip Resistant: YES 17 Part V- Financials Section 4-Financial Analysis 4.1 Sales Sales Revenue $1,800,000 Sales (In Thousands) $1,600,000 $1,400,000 $1,200,000 Crocs $1,000,000 Deckers $800,000 Timberland $600,000 WWW $400,000 $200,000 $0 2005 Fig 4.1.1 2006 2007 2008 2009 2010 Sales Revenue of Crocs and Competitors Gross Profit 900000 800000 700000 600000 Crocs 500000 Deckers 400000 Timberland 300000 WWW 200000 100000 0 2005 Fig 4.1.2 2006 2007 2008 2009 2010 Gross Profit of Crocs and Competitors 18 Net Income WWW 2010 2009 Timberland 2008 2007 Deckers 2006 2005 Crocs -300000 -200000 -100000 0 100000 200000 Fig 4.1.3 Net Income of Crocs and Competitors Cash Provided by Operating Activities 200000 150000 Crocs Deckers 100000 Timberland 50000 WWW 0 2005 2006 2007 2008 2009 2010 Fig 4.1.4 Cash Provided from Operating Activities of Crocs and Competitors 19 2005 2006 2007 2008 2009 2010 18,914 208,258 444,113 287,163 287,620 376,106 Fig 4.1.5 Equity of Crocs in USD ‘000 Stock Price Crocs, Inc. ( NASDAQ: CROX) ended trading on Tuesday, 5th April at USD 18.39, lower than its IPO of USD 30.00. However, its stock price went up exponentially in accordance to their increase in revenue. The financial crisis put a stop to this increase and their stock price has been around the USD 20.00 mark. Performance of Crocs The sales revenue of crocs increases exponentially from USD 109 million in FY 2005 to USD 848 million in FY 2007. This represents an increase of USD 739 million or 8 times in a short span of just 2 years and this trend looked to continue further into the future. But, the economic crisis struck in FY 2008 which led to a global recession. This had its repercussions on crocs as their sales revenue declined continuously for the next 2 years, reaching a low of USD 645,767,000 in FY 2009. This was a result of crocs expanding rapidly, causing sales to drop. However, the management was deft and managed to turn this around quickly to arrest the drop in revenue causing it to rebound to USD 790 million in FY 2010. (Fig. 4.1.1) In the same period, all aspects of Crocs rose with its bottom line recovered from a USD 42 million loss in FY 2009 to a profit of USD 68 million in FY 2010. (Fig. 20 4.1.3)Gross profit also rose (Fig. 4.1.2) in addition to Crocs recording a all time high USD 104 million in terms of cash provided from operating activities. (Fig. 4.1.4) Crocs went public in 2006 with an initial public offering (IPO) of USD30.00, the highest ever IPO for a footwear company. It was listed on NASDQ under CROX. This resulted in an increase in total shareholder equity from USD 19 million to USD 209 million in a year. (Fig. 4.1.5)The performance of the company in all aspects follows a similar trend. After its IPO in 2006, Crocs has grown exponentially in every avenue be it gross profit, net profit, shareholder equity or cash provided from operating activities. When the economic crisis stuck, Crocs also suffered in all aspects before bouncing back in FY 2010. Performance of Competitors The closest competitors of crocs experienced similar trends thus showing the market trends. Many footwear companies experienced a dip in sales from FY 2008 onwards due to the economic crisis. Deckers is a standout competitor for it was the only company who managed to continue to increase their sales revenue continuously for 5 years from USD 355 million in FY 2005to USD 813 million in FY 2009 despite the economic crisis. This is also represented in their net income and gross profit. Both Timberland and Wolverine World Wide (WWW) recorded similar results to crocs with all factors decreasing. 21 4.2 Liquidity Quick Ratio 4.50 4.00 3.50 3.00 Crocs 2.50 Deckers 2.00 Timberland 1.50 WWW 1.00 0.50 0.00 2005 2006 2007 2008 2009 2010 Fig 4.2.1 Quick Ratio of Crocs and Competitors Current Ratio 6.00 5.00 4.00 Crocs Deckers 3.00 Timberland 2.00 WWW 1.00 0.00 2005 2006 2007 2008 2009 2010 Fig 4.2.2 Current Ratio of Crocs and Competitors 22 Performance of Crocs The quick ratio expresses the relationship between cash and accounts receivable to the current liabilities. For the past 2 years, the quick ratio of crocs is hovering around the 1.5 mark (Fig. 4.2.1), above the 1 needed to cover the current liabilities. The current ratio which expresses the current assets as a fraction of the current liabilities, stands at 2.77 (Fig. 4.2.2), well above the 1 needed to cover the current liabilities as well. Though the quick and current ratios that Crocs records are the lowest among their competitors, there is sufficient cash available and that’s what matters. Inventory Turnover 2010 2009 WWW 2008 Timberland 2007 Deckers Crocs 2006 2005 0.00 2.00 Fig. 4.2.3 4.00 6.00 8.00 10.00 12.00 Inventory Turnover Crocs records the lowest inventory turnover rate from 3-6. This means that Crocs is able to sell their inventory within a short period of 3-6 days as compared to the 7-9 days the other companies require. This also means that Crocs does not have an obsolete inventory and its assets are good. 23 4.3 Debt Net Debt / Equity 300.00% 250.00% 200.00% Crocs Deckers 150.00% Timberland 100.00% WWW 50.00% 0.00% 2005 2006 2007 2008 2009 2010 Fig 4.3.1 Gearing (Net Debt/Equity) Total Debt/Total Asset 70.00% 60.00% 50.00% Crocs 40.00% Deckers 30.00% Timberland 20.00% WWW 10.00% 0.00% 2005 Fig. 4.3.2 2006 2007 2008 2009 2010 Total Debt/ Total Asset 24 Debt Situation at Crocs In FY 2005, Crocs records a high Net Debt/ Equity and Total Debt/ Total Asset. This is because in 2005, Crocs has not yet gone public and thus has a high amount of debts and a small equity. (Fig. 4.3.1) .However, after Crocs became listed, their Net Debt/ Equity and Total Debt/ Total Asset have dropped to a similar level to that of their competitors 4.4 Profitability Gross Margin 60.00% 50.00% 40.00% Crocs Deckers 30.00% Timberland 20.00% WWW 10.00% 0.00% 2005 Fig.4.4.1 2006 2007 2008 2009 Gross Margin 25 2010 Net Margin 30.00% 20.00% 10.00% Crocs Deckers 0.00% 2005 2006 2007 2008 2009 2010 Timberland WWW -10.00% -20.00% -30.00% Fig.4.4.2 Net Margin ROA 2010 2009 WWW 2008 Timberland 2007 Deckers 2006 Crocs 2005 -60.00% -40.00% -20.00% Fig.4.4.3 0.00% 20.00% 40.00% Return on Asset 26 ROE 100.00% 80.00% 60.00% 40.00% 20.00% 0.00% 2005 -20.00% 2006 2007 2008 2009 2010 -40.00% -60.00% -80.00% Crocs Fig.4.4.4 Deckers Timberland WWW Return on Equity Profitability of Crocs Crocs is a profitable company as it records well in every aspect in this category. Its gross margin currently stands at 54% which means that for every $1 it sells, it makes $0.54. This is relatively higher than the market standard which seems to be around the 47% mark. (Fig. 4.4.1) In addition, it also records a good net margin as it was consistently the highest from FY05-FY07. But, when the economic crisis struck, they went into the red and thus, recorded a negative net margin. But, this has turned around and they are back with a positive net margin as of FY 2010. (Fig. 4.4.2) Crocs records a relatively high return on asset (ROA) at 12% which means that its total asset is able to generate 12% in return. This is higher than Timberland and WWW and only losing to the 19% that Decker records. (Fig. 4.4.3) 27 Finally, Crocs has a return on equity (ROE) of 18% which is around the same range as its competitors. But, before the economic downturn, it was at 38%, way above the rest. (Fig. 4.4.4) From FY 2005 to FY 2006, there was a drop in the ROE from a high of 90% to 31%. This was due to them going public and being listed which resulted in an increase in equity of 9 fold. Conclusion Crocs has been performing well for the past 5 years barring a dip in revenue in FY08-FY09 due to the unforeseen economic crisis. It has a good management who was deft in implementing changes to halt their slide and turn it around. Despite the economic crisis, they were still liquid with both quick and current ratios recording over 1. Their assets are not obsolete as their inventory turnover is 6 days. They are a high profitability company with good gross margins and net margins. Their ROE and ROA is high and the company is still recovering from the losses made in FY08 and FY09. Performance of Crocs The company performed poorly from fiscal years 2008 to 2009, due to the following reasons. The main reason was due to the well-known economic meltdown in 2008. Such poor economic conditions led to a low demand of their shoes, and thus, they experienced lower revenues. Secondly, it was also due to an increase in the number of imitations products, and this posed a huge competition to Crocs. Thirdly, sales of end-of-life and impaired units were sold at much lower prices. Lastly, sales to large corporate company customers were based mainly on contracts. The management, then in light of prevailing economic conditions before the recession, granted certain return requests to its corporate company customers extremely crucial to their business. However, due to the economic crisis, Crocs was unable to get their cash back from these corporate company customers. 28 Investments of Crocs Crocs is in a footwear and fashion industry, and its sales depend greatly on fashion trends. Thus, it needs to invest heavily in their products to ensure that they are up to date with the current fashion trends and that they have the leading products in the market. Presently, Crocs is investing in research and development, tooling equipment and expansion. They have also bought over Ocean Minded, Foam Creation and Jibbitz. In the future, they plan to invest in areas that can enhance their manufacturing capabilities, complement their current products and also expand their market range. Hence, it can be seen that Crocs adopts an aggressive yet focused investment strategy, and this ensures that they will continue to grow. 29 Part VI-SWOT Analysis 30 Acknowledgements We would like to thank the following people who have helped us in our journey in one way or another. 1. Our Teacher Mentor, Mr Raymond Chan, without which this project would not have been possible 2. Our BCG Mentor, Mr Vahid Khamsi, for his invaluable guidance and advice without which our success would not have been possible 3. The other Teacher Mentors for being there when we needed help even though we are not officially under them 4. Parents who have helped us in one way or another 5. Mrs Cheryl Yap, for being our spokeswoman during our presentation 6. Friends who gave us mental support and lent the crocs that we wore during the presentation 7. The Rugger team for giving us advice on our presenation 31 Reflections Shawn Teo It was an enriching journey as my group and I went through Business at School Phase. I have learnt lessons that would most probably not be taught in the school syllabus, for example financial ratios, financial metrics and value chain is. These are valuable knowledge that would be useful in the future. The group landed up analyzing crocs because it was unique and different from other companies. Crocs was not a normal branded footwear company, like Nike and Adidas, it had created a new sensational fashion. However, little did we know that Crocs did not perform as well in the recent years. The group was in a dilemma, wondering if we should analyze another company, which we decided not to in the end as we had put in a lot of effort in researching about Crocs already. Hence, we have learnt that we should first find out the brief performance of a company, before even starting to research in great depth. The strength of our group was in terms of our presentation, it was because we were able to hold an interesting presentation that we impressed the judges. However, I feel that our slides did not look professional and that our presentation slides could have been organized better. We should also have a title that summarizes the whole slide on each slide, so that the audience would be able to get the main point of the slide at once. Hence, I feel that we still have much to improve in even though we managed to achieve first place in Phase I. I think we should practice to present in a serious manner too, and not just in a fun and creative manner. Business at School Phase I one has been an enjoyable start and I look forward to Phase II, hoping that I would be able to familiarize with the topic of business even more. 32 Sia Tze Yang So far, the Biz@Sch programme has been an emotional rollercoaster for me; at least for phase I. We started off very enthusiastic, coming up with many possible companies that we could look into, even some soccer companies like Tottenham. However, many were unrealistic, as they were simply based on our whims and fancies at that particular instant. Finally, we decided on Crocs Inc, which was a shoe company that sold outdoor slip-on sandals. We were quite interested in topics related to footwear, so we accepted it quite readily. As most of us had seen many people wearing Crocs around, we presumed that it would be a strong and interesting company to look into. We started dividing the workloads according to our strengths and interests, as well as informing our Coach Vahid and confirming the company we would be doing. I was asked to work with Justin on the finances. However, to my disbelief, I found out that Crocs actually was a dying shoe company. It went IPO only in 2006 and hence had no time to brace itself for any economic downturns within the next five years. As a result, the company was devastated during the global economic meltdown in 2008. Its net profit had had dropped from $168,288,000 to a low of $185,076,000. It was indeed an astonishing crash, and I realized that Crocs almost went bankrupt then. The revenue further dropped in 2009, but the company was saved by lower operating costs and reduced costs of sales, nevertheless still ending up with a negative net profit of -$42,078,000, but still better than the year before. As we thought that we had to assume the roles of Crocs’s salesmen, it would apparently be tough for us to explain such poor economic performance. We finally admitted that Crocs was not a good company to look into, and were contemplating on changing to another company. However, none of us were prepared to start all over again and spend time researching for information of the new company. Hence, we just decided to stick with Crocs and get prepared to be pounded with condescending questions from the judges regarding Crocs’s poor economic performance. I found that Crocs would be releasing its 2010 financial report in late February. Fortunately, this saved us in the nick of time, as I found out that Crocs’s financial situation had improved drastically, after careful management. They had navigated their way out of the crisis, and their net profit rebounded from the negative realm the year before to $67,726,000 in 2010. I 33 was truly relieved and elated. I think this was a good sign, and quickly told my group mates about it. Coach Vahid was also notified of our recent developments, and guided us thoroughly along the way. He taught us how to explain our parts properly during the presentation. His knowledge was insightful, and I had learned a lot about financials from him through this project. He also told us that we did not have to represent Crocs’ so we need not be responsible for any poor performance on their part. This was another great relief for me. With the help of our teacher-mentor Mr Chan, Biz@Sch teacher I/C Mr Dennis Au and Coach Vahid, we built up magnificent and attractive PowerPoint slides, further boosting my confidence that we would do well. Coach Vahid even came down on the day of the presentation to support us to give us some last-minute tips during the final rehearsal. I was surprising calm, composed and relaxed during the presentation, neither was I afraid during the Q&A session, as I believed we had put in our best efforts. Eventually, we emerged overall first. It was indeed a pleasant surprise, and I am unable to express such emotions in words through this reflection. I was told that I presented my part very well, and we were told to keep up the good work. Overall, I feel that Phase I was absolutely a good experience. I had gained much exposure and knowledge throughout the course of working in the phase. I would like to thank Coach Vahid, Mr Chan and Mr Au for their invaluable guidance and support, and we hope we can do equally well, if not better in phase II. Of course, we must also work on our weaknesses and learn about the strengths of other groups in order to improve. I understand that phase II is the one that kills, so we must not get complacent, instead put in even more effort to secure good grades. 34 Rohan Dev -Once upon a time, there was this guyYes, you’re right. I was that guy, that guy who had to collate ten choices of companies for Phase I of our Business@School Programme where we were tasked to research and analyse a publicly listed company. It was exhilarating in the beginning as our once decomposing brains had started to flicker and explode with ideas. For once, instead of polynomials floating around in our heads, there were actually company names drifting about. The first company that hit me like a brick was HTC. I felt that HTC, being a company with a colourful history with HSPDAs and touch screen gizmos, was THE company for us. Moreover, its recent boom in sales due to the uprising of the Android platform put the icing on the cake. But soon enough I remembered about being open and paying heed to my fellow group members’ choices. After all, our brain works just like a parachute. It works only when it’s open! So keeping our group members in mind, I thought of a more soccer-like company and that was when we came across Tottenham FC. But that fizzled out as Tze Yang was not at all interested in sports and the group found Tottenham relatively unfeasible. So, instead of pushing for something we would not be able to handle very well, we thought of a company which all of us were comfortable with and which was highly unique and fun…Crocs Inc. -That guy was joined by four other guys. After a lot of thinking and deciding, an Iranian guy came along – Our external mentor, Mr Vahid, had already dispatched us to work in our respective departments of the company. Being in charge of Customers and Competitor’s analysis, I found my department to be the most interesting as this really was the brain of the company: Winning over the customers, killing our competitors. This was a real eye-opener as I realized that I was researching on things that all of us were already familiar with. When tackling customers, companies have to really go in depth and think in the perspective of the customer. Small little things like displaying the products in a vertical, out of the box, method make great impact on the consumer’s thinking. These tiny details are the ones that entice consumers into entering the shops as Crocs Inc (so far) seems to be the only company that happens to present their products in such a creative manner. Moreover, things like having a mega-fast replenishment system ensures that a good rapport is built with the corporate 35 customers (the retail shops that sell Crocs) and indirectly with the individual shoppers too. Truly, anyone can purchase crocs anywhere and anytime they want due to the company’s broad and extensive distribution channel. With all these information in hand… -I went to the coffee-addicted, grumpy old financials blokes who were, well, grumpy. That was when they said what they shouldn’t have “Erm, Rohan…Crocs is dying….” I felt like a face-slapping, back-stabbing, hand-clapping, finger-snapping, rope-grappling, dance-tapping, work-slacking, between meal-snacking… (many -ings later)... destroyed noodle, which in other words meant I was shattered. After the bucket loads of researching, this wasn’t the best piece of news I was looking forward to. From a 75-dollar per share price, they dropped to a meager 6-dollar per share price. We were on the crossroads of deciding whether we were game enough to continue fighting our (then) losing battle by just being financial consultants, plainly telling the investors the hard facts or research on another company. But taking the amount of time we had spent on researching into consideration, we remembered a dialogue that went, “Never say never” and we continued trekking. We were exhausted, hunch backed, old senior citizens by then, dogged by the prospect of Crocs dying. But then, things started to pick up and gather steam. From 6-dollar per share price, it leapt on to 19-dollars! It was a pleasant surprise for all of us and then, we were inspired to continue putting in a lot of effort. With the help of Mr Vahid and in-school mentor, Mr Chan, we were guided throughout the whole journey and were taught how to keep our slides prim and proper, how to read the investors’ mind, how to be concise and how to keep one’s cool during the Q&A session. And before we realized it, D-Day came… -I was on stage in my comfy green Crocs, clicking on the green ppt slides and being greenhorns in presenting a company’s good and bad points, I was… Horribly nervous. There were three seasoned pairs of eyes shooting darts at us from the AVT’s audience, the judges. Fortunately, there were two other pairs that kept brimming with encouragements like “Go for it”: our mentors. On the final day, they had helped us in lastminute presentation tips that prepared us mentally for the challenge. Everything finally went according to plan and in the end, we were called out to be the best team for Phase I. But where there are roses, there are always thorns. There were definitely things we could improve on next time such as being serious in the parts when the occasion calls for it. In 36 addition, our slides need to be polished with a professional touch and not full-on fun. We could certainly learn from other groups, especially from our closest competitor, the Hugo Boss team, the way they present their financials (their main strength) and other important facts. All in all, what was most interesting in our first spell at Business@School Programme is the exposure to the various fields of study to which we are totally alien to. We hope to continue striving for the best in our upcoming phases and eventually, learn a lot from this process. Tan Pek Yan Our Business at School programme started off at a wrong note. After the gruelling selection trials during the December Holidays, the dreams of my teammates and I almost got dashed. We barely scraped through the trials and were accepted due to the last minute withdrawal of another team. Nevertheless, we strived to work hard and start our Business at School journey with a bang. For the Phase 1 presentations, we are required to analyse a publicly listed company. We were not able to decide on a suitable company, but our BCG mentor came along and helped us. We shortlisted our choices to ten companies and then decided to put the companies to a vote. So Ta-da, Crocs was chosen through a voting process brilliantly thought up by our mentor, Mr Khamsi Vahid. Mr Vahid guided us through the different stages of the presentation and I was tasked with coming up with the value chain. In the value chain, I was supposed to come up with the ‘juicy’ stuff about Crocs. I faced a tough job as there was nothing juicy about the value chain of Crocs at all. Nevertheless, I toiled through the annual report and came up with four main different stages in the value chain of Crocs—Suppliers, Designers, Manufacturers and Distributors. I realised that Crocs actually do operate internally as well as employing external partners to help with their operations. Stages that are critical to their success were mainly kept internally, such as design and Manufacturing, while Crocs have both contracts with partners as well as internal factories that take care of their Supply and Manufacturing. 37 So I then compiled the interesting information that I piled up into slides, which were immediately rejected by Mr Vahid, claiming that it was too wordy. Then he came up with a brilliant idea, squeezing the information into a table, which I immediately accepted. As our presentation dates edged closer, Mr Chan, our school mentor, drilled us to make our presentation look perfect. Then one sunny day, we came up with an idea from out of this world. During the presentation, we would transform into salesmen from Crocs! On that day, everyone would turn up wearing colorful shirts (depicting the variety of colors that Crocs come in) coupled with (Gasp) boring white pants. And to top it all, we would wear our own Crocs shoes to present a serious but fun presentation to our perfectly serious judges. On our big day, we were all very nervous. We rehearsed endlessly in the wee hours of the morning. Both Mr Vahid and Mr Chan turned up to show us their support. We made some last minute tweaks to our presentation due to the insistence of Mr Vahid. Each of us practised in front of Mr Vahid and he gave us some tips for our presentation. He even took away my crumpled script to prevent me from repeating my script till my voice go hoarse. Our hard work paid off and after a very close fight, we were able to edge out our opponents. Throughout this Phase I presentation, I believe that we were able to learn a lot from the mistakes we made and from other groups. For example, in our Q& A section we should utilise data to answer questions. We should also accept some of the judges comments instead of trying to prove their point wrong. I also learnt more about the strengths of my team members. Rohan had been an inspirational leader and is the creative spark of the team. Justin have been resourceful as well as being the technology guy. Both Shawn and Tze Yang had been able to be serios and keep our team on track. Overall, I would also like to thank Mr Vahid and Mr Chan for their invaluable guidance, as well as my peers who had coped with my misgivings. 38 Justin Goh This 1st phase of the business@school programme taught me many new insights in various aspects. Some of these aspects are content based and some of these are life skills. Firstly, I will provide a brief overview of this journey. We started off barely scraping a place in this programme and the 1st few weeks passed with not much action. Then came the 1st coaches meeting when we met our wonderful coach, Vahid. He started off with a personal introduction session with all the admin settled and no content discussion as of yet. Prior to this, I suspect that most of us already had an idea of what we wanted to do anyway but we allocated people based on their personal strengths and preference. I, for example, had grown up in an environment where both my parents majored in business in their university days and worked in banks. Therefore, I had an interest in the financial aspect and my group felt this so I was put in charge of the finances. We voted and decided on the company crocs as we felt it was an interesting company to research in. Although we were not able to complete all the ideas we had, I was personally still pleased with the outcome. Then came the tiring part. I had to transfer all the financials from the annual reports into an excel spreadsheet for ease of comparison and for the plotting of the graphs. I originally planned on copying straight from the PDF format of the annual reports and typing into the excel document. But I soon found out that was not possible simply due to the formatting of the PDF file. Thus, my dad suggested that I copy the info onto a piece of paper before typing it back into the computer. The road thereafter was quite simple. Mostly, what we did was to put together the PowerPoint slides for our final presentation. We met up with Vahid once more to review our slides and thereafter was just editing and rehearsals. We managed to do well in the end despite our relatively few number of rehearsals and for this, I am pleased. Back to the lessons learnt, there are many major lessons I personally learnt from various people. Firstly, I understood the content in terms of the financial statements. Before this programme, I would have had no idea how to analyse and to even just understand what all the different entries meant. I would have no idea how to use the various financial ratios to express various aspects such as the liquidity or return. I had guidance from sources that were recommended 39 to me from both my dad and Vahid. Websites such as investopedia.com have been a great help and an extremely great help. Secondly, I learnt the strengths and weaknesses of my group members. These allow me to better work and compliment their working style for the future phases. For example, Rohan is an extremely creative person and a great source of energy. This in turn rubs onto us and turns us into an energy filled team that is both fun and gets work done. He has lots of creativity and has a great style of presenting that all of us have picked up in dribs and drabs. Pek Yan and Shawn both produce quality work when tasked and have lots of energy as well. Tze Yang is a serious person, different from Rohan or Pek Yan but his seriousness is sometimes needed when the fun side o f our group takes over and we need someone to bring us back on track. However, I noticed that our group members have some problems meeting deadlines due to our busy schedules. 40 Bibliography 1. Gio, M. (2009). The short history of crocs. Retrieved from 2. 3. 4. 5. 6. http://ezinearticles.com/?The-Short-History-of-Crocs&id=2277943 Crocs, Inc. - Company Profile, Information, Business Description, History, Background Information on Crocs, Inc. Read more: Crocs, Inc. - Company Profile, Information, Business Description, History, Background Information on Crocs, Inc. . Reference for business: encyclopedia of small business. Retrieved April 4, 2011, from http://www.referenceforbusiness.com/history2/25/Crocs-Inc.html O'Rourke, M. (2007). How crocs conquered the world. Retrieved from http://www.slate.com/id/2170301/ Remtom (n.d.). The history of croc shoes. Retrieved from http://hubpages.com/hub/The-History-Of-Croc-Shoes Lynnette(2006). Crocs: those funny-looking shoes everyone's wearing. Retrieved from http://feet.thefuntimesguide.com/2006/06/crocs_shoes.php The history of croc shoes. (2009). Croc shoes news. Retrieved April 4, 2011, from http://www.crocshoesnews.com/the-history-of-croc-shoes/ 41