Lecture 6

advertisement

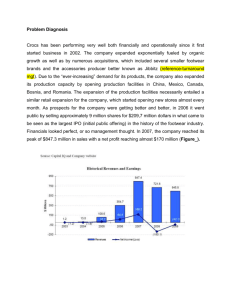

International Operations Management MGMT 6367 Case Study Instructor: Yan Qin Fall 2013 Outline Case study ◦ Case: New Balance ◦ Case: Crocs Case Study: New Balance Please read the case “New Balance Athletic Shoe, Inc.” and think about the following questions: What are the competitive implications of the Adidas/Reebok transaction for New Balance? You may want to refer to figures in Exhibit 2. In what aspects did New Balance see itself differentiated from Nike, Adidas, or Reebok? New Balance – Cont. New Balance placed a disproportionately large emphasis (relative to sales generated) on serving smaller retailers and ensuring timely delivery of products to them. What are the reasons for them to do that? New balance performed 25% of its manufacturing in the United states at a time when nearly all of tis competitors were manufacturing 100% of their products in Asia. What are the primary reasons for them to maintain domestic manufacturing? New Balance – Cont. Suppose the total US volume of athletic shoes per year is 400 million pairs. How much is the cost penalty resulted from New Balance’s domestic manufacturing? The ultimate goal for NB2E was 100% delivery of requested product within 24 hours. The dramatic reduction in lead times mandated under NB2E raises the question of whether the initiative was a critical component of New Balance’s strategy or simply an unrealistically ambitious attempt. What is your opinion? Case study: Crocs Read the case “Crocs (A): Revolutionizing an industry’s supply chain model for competitive advantage” and think about the following questions: What are Croc’s core competencies? How do they exploit these competencies in the future? Consider the following alternatives: Further vertical integration into materials Growth by acquisition Growth by product extension Crocs – Cont. To what degree do the three alternatives in Question 2 fit the company’s core competencies, and to what degree to they defocus the company away from its core competencies? How should Croc’s plan its production and inventory? How do the company’s gross margins affect this decision? What can go wrong?