Demand, Revenue, Cost, & Profit

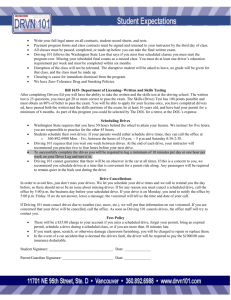

advertisement

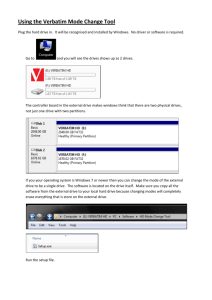

Demand, Revenue, Cost, & Profit Demand Function – D(q) • p =D(q) • In this function the input is q and output p • q-independent variable/p-dependent variable [Recall y=f(x)] • p =D(q) the price at which q units of the good can be sold • Unit price-p • Most demand functions- Quadratic [ PROJECT 1] • Demand curve, which is the graph of D(q), is generally downward sloping – Why? Demand Function – D(q) • As quantity goes down, what happens to price? -price per unit increases • As quantity goes up, what happens to price? -price per unit decreases Example Demand Function y = -0.0000018x2 - 0.0002953x + 30.19 $32 D(q) $24 $16 $8 $0 0 1,000 2,000 q 3,000 Define the demand function to be D(q) = aq2 + bq + c, where a = 0.0000018, b = 0.0002953, and c = 30.19. 4,000 Example problem( Dinner.xls) • Restaurant wants to introduce a new buffalo steak dinner • Test prices (Note these are unit prices) Price $14.95 $19.95 $24.95 $29.95 Number sold per week 2,800 2,300 1,600 300 • If I want the demand function, what is our input/output? • Recall p=D(q) Revenue Function – R(q) • R(q)=q*D(q) • The amount that a producer receives from the sale of q units • Recall p=D(q) • What is p? -unit price per item • Revenue= number of units*unit price Example Revenue Function $50,000 R(q) $40,000 $30,000 $20,000 $10,000 $0 0 1000 2000 q 3000 Sample Data Points q D(q) R(q) 0 $30.19 $0.00 8 $30.19 $241.50 16 $30.18 $482.96 24 $30.18 $724.37 32 $30.18 $965.72 40 $30.18 $1,207.01 4000 Cost Function A producer’s total cost function, C(q), for the production of q units is given by C(q) = C0 + VC(q) =fixed cost + variable cost [here VC(q)-variable cost for q units of a good] . Hence, they assume that there are constants u and v such that VC(q) = uln(q) + v, over a range of values for q between 1,000 and 4,000. • Recall:fixed cost do not depend upon the amount of a good that is produced Example Fixed Cost C0 $9,000.00 Variable Costs Number of Dinners(q) Cost-VC(q) 1,000 $21,000.00 2,000 $30,000.00 3,000 $36,000.00 D, R, C, & P, Expenses & Profit Variable Costs Function $50,000 y = 13581.51Ln(x) - 72929.37 $40,000 VC(q) Note that VC and C are only plotted over the intervals where the logarithmic model is believed to apply. $30,000 $20,000 $10,000 $0 0 Cost Function $50,000 C(q) $40,000 $30,000 $20,000 $10,000 $0 0 1000 2000 q 3000 4000 1,000 2,000 q 3,000 4,000 Cost function • The total weekly cost function, over that range, for the buffalo steak dinners is • C(q) = C0 + VC(q) = 9,000 + 13,581.51ln(q) 72,929.37 = 63,929.37 + 13,581.51ln(q) Profit Function • let P(q) be the profit obtained from producing and selling q units of a good at the price D(q). • Profit = Revenue Cost • P(q) = R(q) C(q) D, R, C, & P, Expenses & Profit Revenue Revenue and Cost Function $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0 0 1000 2000 q 3000 4000 Profit Function $6,000 $4,000 $2,000 P(q) Dollars Cost $0 -$2,000 0 1000 2000 -$4,000 -$6,000 q 3000 4000 Project Focus • How can demand, revenue,cost, and profit functions help us price 12-GB drives? • Must find the demand, revenue and cost functions Important – Conventions for units • Prices for individual drives are given in dollars. • Revenues from sales in the national market are given in millions of dollars. • Quantities of drives in the test markets are actual numbers of drives. • Quantities of drives in the national market are given in thousands of drives. Projected yearly sales – -National market • We have the information about the Test markets & Potential national market size national sales ( K ' s) for test market 1 [test market 1 sales ] size of national market( K ' s ) [ size of test market 1] • Show marketing data.xls (How to calculate) Demand function-Project1 D(q) • D(q) –gives the price, in dollars per drive at q thousand drives • Assumption – Demand function is Quadratic • The data points for national sales are plotted and fitted with a second degree polynomial trend line • Coefficients- 8 decimal places Demand Function (continued) Price Demand Data $500 $400 $300 $200 $100 $0 2 y = -0.00005349x - 0.03440302x + 414.53444491 0 400 800 1,200 1,600 2,000 2,400 2,800 Quantity (K's) D(q) =-0.00005349q2 + -0.03440302q + 414.53444491 Marketing Project Revenue function- Project1 R(q) • R(q) is to give the revenue, in millions of dollars from selling q thousand drives • Recall D(q)- gives the price, in dollars per drive at q thousand drives • Recall q – quantities of drives in the national market are given in thousand of drives Revenue function-R(q) • Revenue in dollars= D(q)*q*1000 • Revenue in millions of dollars = D(q)*q*1000/1000000 = D(q)*q/1000 • Why do this conversion? Revenue should be in millions of dollars Revenue function Revenue Function $500 R (q ) (M's) $400 $300 $200 $100 $0 0 400 800 1,200 1,600 q (K's) 2,000 2,400 2,800 Total cost function-C(q) • C(q)-Cost, in millions of dollars,of producing q thousand drives Fixed Cost (M's) $135.0 Variable Costs (M's) 1 2 3 Batch Size (K's) First 800 Second 400 Further Marginal Cost $160.00 $128.00 $72.00 Total cost function-C(q) • Depends upon 7 numbers – q(quantity) – Fixed cost – Batch size 1 – Batch size 2 – Marginal cost 1 – Marginal cost 2 – Marginal cost 3 Cost Function The cost function, C(q), gives the relationship between total cost and quantity produced. 160q 135 if 0 q 800 1,000 128( q 800 ) C( q ) 263 if 800 q 1,200 1,000 314.2 72( q 1,200 ) if q 1,200 1,000 User defined function COST in Excel. Marketing Project How to do the C(q) in Excel • We are going to use the COST function(user defined function) • All teams must transfer the cost function from Marketing Focus.xls to their project1 excel file • Importing the COST function(see class webpage) Revenue & Cost Functions Revenue & Cost Functions $500 (M's) $400 Revenue $300 Cost $200 $100 $0 0 400 800 1,200 1,600 q (K's) 2,000 2,400 2,800 Main Focus-Profit • Recall P(q)-the profit, in millions of dollars from selling q thousand drives • P(q)=R(q)-C(q) Profit Function The profit function, P(q), gives the relationship between the profit and quantity produced and sold. P(q) = R(q) – C(q) P (q ) (M's) Profit Function $70 $60 $50 $40 $30 $20 $10 $0 -$10 0 -$20 400 800 1,200 q (K's) 1,600 2,000 Goals • 1. What price should Card Tech put on the drives, in order to achieve the maximum profit? • 2. How many drives might they expect to sell at the optimal price? • 3. What maximum profit can be expected from sales of the 12-GB? • 4. How sensitive is profit to changes from the optimal quantity of drives, as found in Question 2? • 5. What is the consumer surplus if profit is maximized? 29 Goals-Contd. • 6. What profit could Card Tech expect, if they price the drives at $299.99? • 7. How much should Card Tech pay for an advertising campaign that would increase demand for the 12-GB drives by 10% at all price levels? • 8. How would the 10% increase in demand effect the optimal price of the drives? • 9. Would it be wise for Card Tech to put $15,000,000 into training and streamlining which would reduce the variable production costs by 7% for the coming year? 30 What’s next? • So far we have graphical estimates for some of our project questions • We need now is some way to replace graphical estimates with more precise computations