Open - Adam Dell

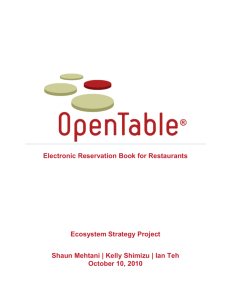

advertisement

Business, Law, and Innovation Mechanics of Building Value Lecture 4 Spring 2014 Professor Adam Dell The University of Texas School of Law Basics: Every company that is NOT cash flow positive is on it’s way to going “OUT OF BUSINESS”. Only the $ provided by VCs (and other sources) keep these companies alive. So, the goal is to find a way to get an investment CF positive as quickly as possible. This is why VCs look for business that are “capital efficient” (software, services, etc.) and for the losers to “fail fast”. How do you get Cash Flow positive? Growth…. Exponential, non-linear growth that yields positive cash flow…..fast! Growth is necessary, but it isn’t necessarily sufficient….you also need a business model How Do You Get There? Crossing the Chasm – When a new innovation moves beyond “early adopters” and becomes widely accepted. Critical Mass – Enough participation in a system such that its growth becomes self-sustaining. Often occurs when a product or service reach mass market. Tipping Point – Point at which a new innovation achieves critical mass. Can occur through word of mouth, contagiousness, connectors & experts. New adopters Critical Mass Tipping Point Crossing the Chasm - Malcolm Gladwell - Geoffrey Moore Time When Selling to Businesses..there is a “HYPE CURVE” 5 Case Study: OpenTable Electronic reservation book, table management and Internet reservation system for the restaurant industry. x 6 OpenTable: State of the Nation, circa 1999 10-15 competitors, many venture backed All doing essentially the same thing (Expedia for restaurants) Some giving away the terminals for free Lots of noise in the space Very few restaurant reservations flowing through the system Mechanics of Building Value So, once you decide to invest what do you do? 1) Ensure sufficient capital to get to the next milestone 2) Ensure the right management team / board 3) Access to the right relationships / partnerships 4) Ensure the right strategy is pursued. 8 Mechanics of Building Value MONEY: Benchmark Capital, Impact Venture Partners ($5mm) BOARD: Restaurateur Danny Meyer PARTNERS: American Express, Zagat, IAC, AOL, CitySearch STRATEGY: Own the restaurant relationship, focus on delivering value independent of the rest of the world. TEAM: President of MICROS, then Thomas Layton PATIENCE / COMMITMENT: We doubled down in 2002 with very little achieved in 3 years. 9 OT.com: State of the Nation, circa 2008 10 OT.com: State of the Nation, circa 2007 14,000 restaurant customers Dominant, global position Great team (Matt Roberts) Great partners (Amex, AOL, Zagat) Great business model …Perhaps a natural legal monopoly 11 3 Outcomes in every VC investment: Shutdown Sale / Merger IPO 12 3 Outcomes in every VC investment: 13 Tipping Point ;) ""If you can book dinner on OpenTable or a flight on Southwest or United online, then why shouldn't you be able to make an appointment at your local Social Security office the same way?" President Barak Obama, Jan 14th 2010. Jeff Jordan, CEO of OpenTable: Steve Ballmer was in the audience and came over, gave me a high five and said “What did you pay for THAT placement?!" 14 Risk & Reward HIGHLY RISKY HIGHLY REWARDING HIGHLY FUN 15