EIS_OpenTable_v3

advertisement

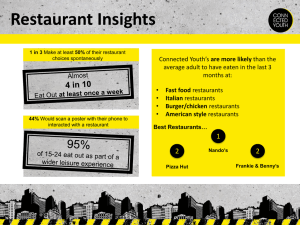

Electronic Reservation Book for Restaurants Ecosystem Strategy Project Shaun Mehtani | Kelly Shimizu | Ian Teh October 10, 2010 Company Background In October 1998, Chuck Templeton, a former US Army ranger and veteran of the restaurant industry, put his plans for an MBA on hold to start OpenTable.com in San Francisco, California.1 After raising $750,000 initial funding from family and friends, Templeton was able to obtain $36 million in funding from venture capitalists interested in tech start-ups during the dot-com boom.2 OpenTable is an on-line real time restaurant reservation service that manages a proprietary Electronic Reservation Book (ERB) for restaurants. It allows users (restaurant diners) to search for reservations at specific restaurants or in a geographical region based on parameters including date, time, party size, cuisine, and price range. Restaurants pay a one-time installation fee (on average: $600) for onsite installation and training, a monthly subscription fee for the use of the software and hardware (on average: $300) and a fee for each guest seated through the website or mobile application ($1 per person for reservations made on the OpenTable and $0.25 per person for reservations made on the restaurant’s website integrated with OpenTable software). Reservations made by the restaurants are made at no-charge.3 The Electronic Reservation Book streamlines many business-critical functions and processes for restaurants, including reservation management, table management, guest recognition and email marketing. This enables restaurants to manage all of their reservations—those booked by phone or online as well as walk-in diners— in one unified system.4 Diners appreciate the convenience of being able to secure a reservation at any time, even when the restaurant is closed, and the time savings of being able to instantly find and reserve available tables. Diners sign-up online for free by entering their information, which is then provided to restaurants. A reward system has been created so customers receive points for dining at an OpenTable establishment. The approximate cost of the reward system is $1 per reservation, thus OpenTable makes a higher margin on larger parties. Diners only receive these points when they 1 http://restaurant-hospitality.com/top_chefs/rh_imp_12464/ http://www.kellogg.northwestern.edu/news_articles/2009/chuck_templeton.aspx 3 http://files.shareholder.com/downloads/ABEA-2TKK09/1033732504x0x371218/36e08b31-bcec-481d-88b1c08d0a73ce05/OpenTable_Annual_Report_Posting_PDF.pdf 4 Ibid 2 Page 1 check-in at the restaurant, and diners that frequently no-show (make a reservation that they do not fulfill) are suspended from the site.5 Because the foundation of the OpenTable network is building a critical mass of computerized reservation books, the company enhances its offering to diners by adding new restaurant customers. In turn, as more diners use OpenTable to make their dining decisions and book their reservations, the company delivers more value to the restaurant customers by helping them fill more of their seats. In this process, OpenTable grows the value of its business.6 As wonderful as the platform has proven to be, the company did not have immediate success. The restaurant industry proved to be a difficult to break into. First and foremost, Templeton had to deal with the fact that restaurateurs tended to be technophobic, with a majority of restaurants at the time not even having a computer. “At first the company tried to grow as a consumer dotcom, paying online restaurant reviewers for links to its site and targeting national chains for fast expansion. By 2001 it was in 50 cities but wasn't making money; it was spending $1 million a month to bring in $100,000 in revenue.”7 At this point, Templeton brought in angel investor and board member Thomas Layton, founder of CitySearch.com, as Chief Executive Officer. Layton slashed the staff, shut down spending on 5 Ibid Ibid 7 http://tech.fortune.cnn.com/2009/08/14/opentable-the-hottest-spot-in-town/ 6 Page 2 consumer outreach, and pulled the company out of all but four markets. The company fine-tuned its terminals and software to make them easy for staff to use (restaurants have a lot of employee turnover) and deployed a door-to-door sales force to woo high-end restaurants. Layton’s focus on forging relationships with restaurateurs proved to be crucial to the company's success, although it was a much slower expansion process than the company was use to. Five years later, Layton announced his intention to step down. In June 2007 the Board hired Jeffrey Jordan, who brought public company experience from his days as president of PayPal.8 Jordan's pushed ahead with the IPO despite the collapse of the economy and the unfriendly financial markets. Over the last five years, the company has been quick to respond to market changes. OpenTable allows restaurants to offer more points to potential diners to entice them to dine at less desirable times. Furthermore with the popularity of Yelp.com and other review websites, diners can provide valuable feedback to the restaurant as well as other OpenTable customers. The company has also launched multiple mobile versions of the software for smart phones (e.g. Apple iPhone app).9 Currently, Open Table has $55.8 million in annual revenue and $1.44 billion market capitalization. The restaurant has approximately 12,000 restaurant customers throughout the Unites States and select International regions. The company states that its seats more than 4 million diners per month. OpenTable is listed on the NASDAQ as OPEN, and its stock is up 136% year-to-date (data as of October 10, 2010).10 Restaurant Reservations As previously mentioned, the restaurant industry is difficult to break into. There are two main problems. First and foremost, restaurants are known for being “technophobic” and secondly, the restaurant industry is highly fragmented, with independent restaurants and small, local restaurant groups comprising a significant majority of restaurant locations. Unlike other industries in which companies can cater to customers around the world, the restaurant industry is very local. “These conditions make it time-consuming and costly to aggregate the breadth of local restaurant table 8 Ibid http://www.bizjournals.com/sanfrancisco/othercities/sanjose/stories/2008/11/17/daily2.html?s=smc:3 10 http://www.wikinvest.com/wiki/OpenTable_(OPEN) 9 Page 3 inventory required to attract a critical mass of diners to make reservations online and to create an online restaurant reservation network.”11 Traditionally, reservations for restaurants have been made by using the telephone. A potential diner would call a restaurant during the restaurant’s business hours to make a reservation. In the instance that a reservation was not available, the diner had to start the process again, calling a new restaurant. If a diner wanted to make a reservation while the restaurant was closed, they would often have to leave a voicemail message and wait for the restaurant to call back. Early restaurant review sites (e.g., zagat.com) allowed customers to make online reservations; however, the reservation was not confirmed. The website would simply send an automated fax of the form the diner had filled out to the restaurant. The restaurant maitre-de would have to check the restaurant’s availability during regular business hours and call the customer back to accept or deny the reservation based on availability. OpenTable.com allows customer to take the human interaction out of the reservation process. Within seconds a customer can see which restaurants have availability and at what time slots. The Electronic Reservations Book is also useful in solving another major problem that restaurants have: “no-shows.” Because OpenTable protects restaurants by suspending accounts of users with more than three “no-shows” during a certain period of time, OpenTable users tend to complete their reservation more often; thus, there are less tables being held for groups that do not intend to show up to the restaurant. Profitability in the restaurant industry is dependent on filing seats, and anything that makes it either easier to fill seats or allows a restaurant to increase the number of filled seats contributes to the restaurant’s bottom line. The overall value vision that OpenTable seeks to deliver is to bring diners to meet the capacity provided by restaurants. This would involve directing diners to the right restaurants and streamlining the reservation process between diners and restaurants. 11 http://files.shareholder.com/downloads/ABEA-2TKK09/1033732504x0x371218/36e08b31-bcec-481d-88b1c08d0a73ce05/OpenTable_Annual_Report_Posting_PDF.pdf Page 4 OpenTable Ecosystem OpenTable Ecosystem Media Tech Providers Electronic Reservation Booking Restaurants Diners Payment System CRM Data & Inventory Infrastructure Reservations Recommendations Network Security, Firewall, Anti-Virus, Backup Systems Infrastructure Management Rewards Staff Engagement Widespread internet and home PC enhancements and adoption Co-Innovation Risk – Technology Providers As a web-enabled reservation system, OpenTable’s infrastructure is supported by several technology partners. In order for the website to function, back end systems had to be in place, including: Payment System Customer Relationship Management Network Security Firewall Anti-Virus Data Backup In 1998, all of these systems were fully functional, therefore diminishing the co-innovation risk. Nevertheless, OpenTable’s co-innovation challenges diminished overtime as the performance of its infrastructural ecosystem improved. For example, the internet became faster, PCs got faster and cheaper, payment and security systems became more secured and computer performance Page 5 improved and fell in price. However, the main challenge for OpenTable was to get the right contracts and to ensure technical integration between these systems and the OpenTable platform. As web technology improved, it only helped OpenTable, allowing them to further improve their web interfaces to restaurants and customers. Initiative Risk – OpenTable Electronic Reservation Book In the case of OpenTable, the initiative risk was also low. In terms of functionality and technology, OpenTable is little different from the many online systems that pervade the internet today. The website was built proprietarily with the risks mitigated by established links to the support systems, such as the database providers (co-innovators). The most risky aspect for Chuck Templeton was funding – ensuring they had enough investment and venture funds to support the development and launch of the site. Fortunately, Templeton was able to secure funding to sustain OpenTable’s launch and initial growth, therefore reducing this risk as well. Adoption Risk – Restaurants The adoption risk of the restaurants presented one of the most important challenges for OpenTable. In order for the system to be viable for both diners using OpenTable and restaurant clients, it required a critical mass of restaurants to adopt and use the system. When OpenTable first launched in the late 1998, the majority of restaurants did not have computers or internet access, as they mostly operated on manual reservation systems. The up-front installation costs and monthly subscription fee presented an additional and significant fixed cost without reasonable indications that the investment would pay-off over the long run. Additionally, the cost of internet access represented an additional expense, all of which were not core to the business of delivering a good food and dining experience to diners. Moreover, restaurants faced the challenges of process change and organizational inertia that generally accompanies such change. Hostesses and wait staff needed to learn to use the online system – many of who had limited experience with computer systems – requiring significant training. It was important that these staff members bought into and understood the new system, as they would be the ones managing diners’ reservations and managing seating flows. Page 6 OpenTable needed to ensure that these additional costs would be outweighed by the benefit of increased marginal diners at the restaurants on the OpenTable system. However, in order to convince restaurants that OpenTable could provide new visitors to them, it was important for OpenTable to have a critical mass of online visitors. In order to have a critical mass of online visitors, it was important for OpenTable to attract the marquee names to its system. As such, OpenTable made an initial concerted effort to ensure they got a core group of popular restaurants onboard prior to their launch. Although information is not available about the means by which these partnerships were made, we hypothesize that special deals and incentives were in place for this initial group. OpenTable provided incentives by reducing costs and providing reservation guarantees. In one instance, OpenTable signed a contract stating that they would not bill for the monthly subscription cost until the restaurant received 50 diners from the website. With sufficient investor funding, OpenTable had flexibility to offer promotions to entice restaurants to join, lowering the risk to restaurants new to or nervous about the ERB. Getting this original group on board was critical, as buy-in from marquee restaurants was imperative to building the critical mass in order to develop the momentum OpenTable needed. OpenTable still uses this tactic today through seating / reservation guarantees for new restaurants. Another way OpenTable mitigate the prospect of increased costs or lost reservation opportunities is through OpenTable’s strategy of maintaining high levels of customer service to the restaurants – ensuring they can provide training, technical support, hardware replacements and upgrades, and a 24-hour issues hotline. These restaurant support mechanisms lower the adoption barriers to the restaurants by removing management anxiety and operational risk. Adoption Risk – Diners Making reservations online was a new experience that customers were not familiar with when OpenTable first launched. Travel sites (e.g., Priceline.com), which helped lead the online reservation movement, were simultaneously being introduced.12 A significant source of adoption risk stemmed from that fact that that many homes did not have personal computers or stable internet connections. Going “online” at all, let alone to do personal tasks, was still a relatively 12 http://phx.corporate-ir.net/phoenix.zhtml?c=72780&p=irol-faq Page 7 unfamiliar venture for the masses. However, the late 1990s marked the rapid rise of PC purchases and internet penetration.13 Internet channels such as America Online (AOL) and Amazon.com14 that were gaining traction in the late 1990s conditioned consumers to internet retailing and to look to the internet for information and e-commerce. With such participants distributing offerings of larger scale suppliers, opportunities emerged to serve niche, independently-owned businesses (like many restaurants).15 Templeton was able to take advantage of this trend as he had secured sufficient funding to exploit this opportunity. This reflected Templeton’s informed expectations and his good planning as a result. OpenTable launch OpenTable targeted “foodies” to begin with. These eople seek out higher-end dining opportunities and make fine dining and exploring new eateries a priority. Gaining this audience’s attention was important for OpenTable, as these were the customers who would be most interested in the targeted group of initial restaurants, thus fulfilling their role as an intermediary between the two groups. To increase the probability of adoption, OpenTable collected customer information upon account creation. This allowed them to gain insights on their diners, which led to improved intelligence and opportunities for further promotions and marketing, keeping OpenTable’s site relevant to the minds of diners. 13 http://www.sociosite.org/demography.php http://en.wikipedia.org/wiki/Amazon.com 15 http://tech.fortune.cnn.com/2010/09/23/behind-opentable%E2%80%99s-success/ 14 Page 8 As the internet became a key channel for restaurant marketing, sites like Yelp.com began launching in the early part of the new millennium.16 OpenTable took the opportunity to expand the company’s offerings to integrate recommendations based on location, price, type of food, and personal OpenTable dining history. Furthermore, it implemented a rewards system to incentivize diners to continue making reservations through OpenTable by earning points redeemable for free meals. This helped OpenTable become a “one-stop shop” for many diners, relying on OpenTable to give and receive recommendation, make reservations, and earn free meals for site loyalty. This allowed OpenTable to combine momentum and all encompassing functionality secure its competitive advantage against recommendation sites looking to enter the reservations category. Ecosystem Relationships Strategy The initiation OpenTable’s story is to a large extent one that has been supported by increasing development and adoption of home PCs and internet technologies. While this trend was widely predicted, the exact timing was largely unknown. OpenTable demonstrated foresight in this regard in that it set informed expectations both amongst management and amongst investors. As a result, the company had sufficient capital to wait. The other main challenge faced by OpenTable was the adoption risk posed by the restaurants and diners. The whole concept relied on the right restaurants adopting the system, interested diners joining, leading a virtuous cycle of increased restaurants and diners. To begin this virtuous cycle, OpenTable knew that they had to target the opinion leaders – that is the “foodie” diners. In order to attract these diners, it was critical that OpenTable could attract the marquee restaurants to its platform. Again, OpenTable demonstrated foresight in this regard as it had secured enough capital to reduce the adoption costs and risks for these restaurants. Maintaining the momentum With the virtuous cycle now in motion, OpenTable has looked to include other members in the ecosystem for added momentum. The media has played a role in this regard. Local media, especially city “lifestyle” websites (e.g., Chicago’s Metromix),17 began collaborating with 16 17 http://en.wikipedia.org/wiki/Yelp,_Inc. http://www.opentable.com/info/partners.aspx Page 9 OpenTable as “third-party marketers”. This allowed OpenTable to serve customers beyond just the opinion leaders and expand its reach to the mass diners and restaurants. Furthermore, OpenTable is pursuing new innovations that work for the mass market. The most recent example is OpenTable’s website extension Spotlight, which mimics the fast-hit Groupon (deal of the day coupon site).18 This initiative capitalizes on the emerging coupon-craze, allowing OpenTable to provide the one-stop shop to more diners and thus more restaurants. Going forward OpenTable’s strategy to align the actors of the ecosystem is validated by its positive cash flows from operating activities. Indeed, it generated $17.7M in 2009 and has generated $12.9M in the first half of 2010. The difficulty of assessing OpenTable’s ecosystem strategy going forward is that it is hard to assert that the ecosystem will not change, particularly in the dynamic field of online technologies. However, OpenTable has developed an asset as serving as the meeting place for both restaurant owners and diners. The momentum it has developed is self perpetuating. Overtime, OpenTable will be able to relax the subsidies it provides to restaurant owners, since the risks associated with adoption will diminish and the benefits of subscribing to OpenTable becomes increasing evident. This will allow OpenTable to fully capitalize on the innovation and value that it has delivered to the ecosystem. 18 http://www.businessweek.com/magazine/content/10_41/b4198037763659_page_2.htm Page 10