Porsche

advertisement

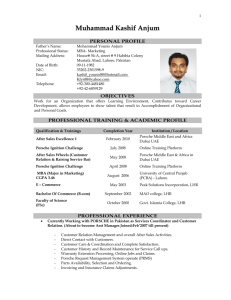

Porsche Porsche Changes Tack Case Study May 8th, 2013 Marius Zechner Dominik Backs Lili Nottrott Pia Freitag Risk Management and Derivatives 723G33 Index 1.History / Family background 2. Statistics 3.Strategies 4.Marketing 5.Creation of competitive advantages 6.Risks 7.Shareholder Wealth vs. Stakeholder Capitalism Risk Management and Derivatives 723G33 History and Family Background Ferdinand Porsche, Founder of the Porsche Company (1931) Louise Piech Ferry Porsche History and Family Background Wolfgang Porsche, Former boardmember of Porsches directorate Wendelin Wiedeking, former CEO of Porsche GmbH Ferdinand Piech, Chairman of VW´s supervisory board Risk Management and Derivatives 723G33 Statistics Risk Management and Derivatives 723G33 Statistics Risk Management and Derivatives 723G33 Strategy 2018 “We‘ve always been ambitious. And we‘ll make sure it stays that way.“ Risk Management and Derivatives 723G33 Marketing (Portfolio) Exclusive Sports Car Manufacturer 911 - Presenting the brand - Growing old; replacement needed - Sales peak in 2001/02; 15% decrease after - Prices high; highest margin - Not price elastic Boxster - Introduced in 1996 - Entering low price market - Less sensitive for business cycle - Sales peaked in 2000/01 - had to compete with BMW Risk Management and Derivatives 723G33 Marketing (Portfolio) Exclusive Sports Car Manufacturer Cayenne - Entering sports utility vehicle (SUV) - Very quick success - Criticism; Comparable to VW Touareg Panamera - Premium class, four door, four-seats coup sportscar - Price between $125.000 – $175.000 - Premium product market segment Risk Management and Derivatives 723G33 Marketing (Positioning) Exclusive Sports Car Manufacturer High Price and High Quality Risk Management and Derivatives 723G33 Marketing (Marketing Mix) Exclusive Sports Car Manufacturer Product : high quality high performance exclusive Price: high price elite status Promotion: comsumer focused advertising (TV, direct mail) Place: Europe (911) North America (Cayenne) Risk Management and Derivatives 723G33 Marketing (Segmentation) Exclusive Sports Car Manufacturer Top Guns: driven, ambitious Elitists: blue blood, not price sensitive Proud Patrons: ownership is goal, trophy for hard work Bon Vivants: Jet-setters, thrill seekers, adventures Fantasists: car is escape, Everyday users: enjoy, younger drivers Risk Management and Derivatives 723G33 Creation of competitive advantage Risk Management and Derivatives 723G33 Risks Currency: - Production base in Euro-area, therefore risk only at sales - demand focuses on global markets FOREX trading (exchange rates variations) against risk they apply hedging (derivatives, forwards, futures) Political uncertainty: affects any MNE, political decisions can destroy corporate strategy. EU is relatively free of political uncertainty. However: - Lex VW (law of VW), that no shareholder may have more than 20% of voting rights, despite the number of shares - 2009, country of Lower Saxony publicly opposed the takeover of Porsche - Friendly joint venture was soon considered as hostile takeover by Porsche management Lack of social relations or good PR Risk Management and Derivatives 723G33 Risks Outsourcing: decay of quality of manufactured products and control in general lack of knowledge and industry country becomes less desirable for investors Porsche fights against this risk by investing in human capital (their biggest asset) Credit: Porsche increases external liabilities for takeover of VW & inhouse construction of Panamera this high liabilities in connection with the financial crisis brought down the company in the end Risk Management and Derivatives 723G33 Shareholder wealth vs. stakeholder capitalism How to get capital? In general: Anglo-Saxon-Model vs. Continental-German-BankModel Porsche: - preference shares and ordinary shares different voting rights stakeholder orientated (stakeholders = family) - dividend was not issued to shareholders cashflow of high profitable car sector was used to takeover VW Risk Management and Derivatives 723G33 Shareholder wealth vs. stakeholder Capitalism Porsche refuses to make quarterly reports (rational strategy – less information for potential competitors) Not listed at a german stock exchange They gain capital from outside at London Stock Exchange Risk of scaring shareholders, because management ignores shareholder‘s will Scare off capital of investors Risk Management and Derivatives 723G33 sources http://www.porsche.com/middleeast/_ghana_/aboutporsche/overview/strategy2018/ http://www.iei.liu.se/fek/frist/723G33/yinghongfiles/1.460514/Porsche_Changes_Tack.pdf http://www.porsche.com/ https://www.youtube.com/watch?feature=player_embedded&v=WWR A1ABlFnw#! Risk Management and Derivatives 723G33 Thank you for your attention!! We hope you all have read the case and do not have any questions!