module code & title - University of St Andrews

advertisement

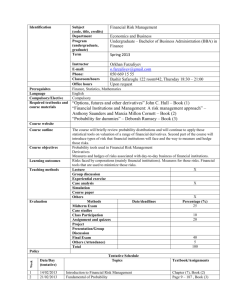

MN5608: RISK MANGEMENT MODULE TYPE/SEMESTER: Option (20 credits), Semester 1 MODULE CO-ORDINATOR: Dr Manouchehr Tavakoli CONTACT DETAILS: mt@st-andrews.ac.uk 01334 (46)2810 AIM: The last two decades have witnessed a spectacular change and growth in financial markets (equity markets, foreign exchange markets, Euromarkets and international bond markets). This has brought a new breed of investors that see the role of managers as enhancing their shareholder value and protecting their wealth from potential risk. One of the challenging tasks of managers in recent years has been to manage the exposure to risks arising from the ever expanding financial markets and the use of derivatives markets. Recent years have witnessed a resurgence of further deregulation, mergers, acquisitions and take-overs. This brought about new ways of innovating financing, hedging and funding. The principal aim of this module is to provide an introduction to managing the exposure to risk and to apply relevant theories to realistic financial decision problems. This course will also deal with risk management in private organisations and their importance in the decision making process. METHOD OF TEACHING AND LEARNING: One two-hour lecture per week, supplemented by tutorials and seminars. LEARNING OUTCOMES: By the end of the course, participants should be able to: Understand the conceptual building blocks of financial derivatives Analyse and measure Market Risk To Hedge Market Risk with Derivatives Use Value at Risk INDICATIVE TOPIC OUTLINE: Options, Futures and Other Derivatives Futures Markets Futures Valuation Options markets Option Valuation Swaps Hedging market risk with derivatives Analysing risk Value-at-Risk UNIVERSITY OF ST ANDREWS 2014/15 School of Management ASSESSMENT: (i) Two hour written examination in the December exam diet (50%) (ii) One class test in Week 6 (25%) (iii) One essay to be submitted in Week 10 on the following topics (25%): (a) Did derivatives markets and risk management techniques contribute to the liquidity crisis that began in 2007? Explain. (17%) (b) Are there any comparisons to be made with the stock market crash of 1987? (8%) READING LIST: Hull, H C. (2005). Fundamentals of Futures and Options Markets, Pearson. (Main Text) Kolb, Robert W., Rodriguez, R L. (1996) Financial Markets, Blackwell. Christopher Marrison (2002) The Fundamentals of Risk Measurements, MaGraw-Hill, ISBN0071386270 Sharpe, W., Alexander, G.J., Bailey, J V. (1999), 6th Edition Investments, Prentice Hall. Glyn A Holton (2003) Value at Risk: Theory and Practice, Academic Press, ISBN 0123540100 Further reading will be provided in the class. UNIVERSITY OF ST ANDREWS 2014/15 School of Management