is a true opportunity

advertisement

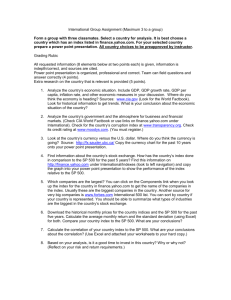

ENTREPRENEURSHIP & INNOVATION SOUTHERN TAIWAN UNIVERSITY MEMBERS OF “AMBITION NANTAI” Bousquet Alexandra MA1N0243 Mouaci Anissa MA1N0244 Pawel Pretkiewicz MA1N0224 INTRODUCTION Was an Internet site that provided a hierarchically organized list of links to sites on the world wide web. It offered a way for the general public to easily navigate and explore the Web. It is one of the most heavily visited sites on the Web. The strategy of the company is to concentrate on promoting the brand and not on revenues. The company need to build the product, so that it has reliability and credibility. COMPANY OVERVIEW: “The world’s largest global online network of integrated services” Wide range of services Achieved to reach out for more than 21 million local/ regional users in the U.S. and 90 million globally Works as a trade of information; “you give me and I’ll give you” Founded by David Filo and Jerry Yang in 1994 Initially called "Jerry and David's Guide to the World Wide Web,” Name later changed to Yahoo, which stands for "Yet Another Hierarchical Officious Oracle” Now, it would inspire people to produce a positive impact on their communities CASE DESCRIPTION Jerry Yang & David Filo => Founders of Yahoo! In 1995. They were graduated from “Stanford School of Engineering”. They transform their Internet hobby into a viable business. Yahoo! Has been fund by Michael Moritz at Sequoia Capital=> a leading venture capital firms in Silicon Valley. Sequoia Capital offer to Yahoo! $1 million in venture funding in exchange for 25% share of Yahoo! Sequoia also invested in success stories such as… -Cisco -Oracle -Apple QUESTIONS AND ANSWERS Q1) What makes Yahoo! An attractive opportunity (and not just a good idea)? At that time, the use of Internet increased rapidly and it was estimated that by 2000: 40% of homes and 70% of all businesses in the U.S. would have access to the Internet. The trend is the same in Europe and Japan. The businesses needed to use Internet to do their commerce by managing information and to communicating, and the individuals would use it for entertainment and learning. As an early-entry company, Yahoo! provided the related services for all of them. According to their analysis, there was a huge potential market for them. Hence, it is a true opportunity. Its vision was to remain the most popular and widely used guide to information on the Internet. Its value was to help individuals easily find useful information from millions of pieces of information scattered globally on the Internet. Q2) How will Yahoo! Make money (i.e., business model)? Yahoo! use the web advertising model which is an extension of the traditional media broadcast model. The broadcaster, in this case, a web site, provides content (usually, but not necessarily, for free) and services (like email, IM, blogs) mixed with advertising messages in the form of banner ads. A high volume of user traffic makes advertising profitable and permits further diversification of site services. About 88% of revenues for the fiscal year 2009 came from marketing services. Video link : https://www.youtube.com/watch?v=j02vAjhdG-k BY EXAMPLE YAHOO CAN MAKE MONEY … Generating following through its strong brand and momentum created The interest-area based structure of Yahoo! made it an easier and more enjoyable way for users to find relevant information, generate following Through its editorial efforts, it provided a combination of comprehensiveness and high quality Through : Through targeted advertising based on enormous following (see the video New premium service Explore broad-band service (what they actually did from 2004) Q3) Identify the major risks in each of these categories: technology, market, team, and financial. Rank order them. 1) Technology : As the digital world move quickly Yahoo will be able to face considerable substitutes for all of his product offerings and services. Such substitutes include search engines (primarily Google, as well as MSN and Ask), as well as niche players like Amazon.com, Ebay, Monster.com, MySpace, Facebook, and YouTube. 2) Market : In 1995, the threat could have been considerable as Aol and the others competitors could have developed the same products and services. Nowadays, the sheer scale of products and services that are offered by Yahoo, combined with its market dominance, makes the threat of comparable new entrants low, especially new entrants who are trying to compete head-on with Yahoo.. However, the threat of new, customized portals is always considerable as new players that focus on niche markets can easily take away online advertising and retail and auction sales revenues away from Yahoo. 3) Financial: As the investments are colossal in this domain, the risk are at the level of their amount. 3) Team : It could constitute a threat for the founders at the beginning that may have seen their responsibilities and shares decreasing in this project. Of course the team should be aware of all the market and make decision in harmony (see the departure of the cofounder). Q4) What are the advantages and disadvantages of each of the funding option they could pursue? Which one do you recommend? Two different outcomes can emerge from this crucial decision. Indeed, for successful ventures we have an established, independent enterprise versus merger or acquisition with another firm. The schema on the next page can give us a picture of the disadvantages and advantages the founders are facing : THE 1995 ‘S THREE OPTIONS DISADVANTAGES - Reuters was a London-based media service, which could help publicize Yahoo! - It wanted to integrate Reuter’s news service into Yahoo!, which would prevent its free development ADV/DISADV TABLE ADVANTAGES/ DISADVANTAGES TABLE John Taysom ADVANTAGES - Yahoo! was in a poor negotiating position since it did not generate revenues Randy Adams - Yahoo! would get a chance to generate - Yahoo! would become some revenue associated with a shopping network Netscape - Netscape was planning its IPO and had - Yahoo! would be tremendous publicity and momentum purchased by Netscape behind it, which would help Yahoo! generate revenue - Netscape’s company culture was in tune with the founders of Yahoo! Partners AVDANTAGES DISADVANTAGES - The companies offered money, stock and possible management positions. - The potential taint that came with such sponsorship - Lack of control KPCB - Excellent reputation - They invest just 0.5M - Successful investments Architext Sequoia Capital -Increasing press coverage - Venture capital partners - Yahoo! had to merge with Architext - - 25% of stock share to Sequoia Capital Money (1million), Management Our personal opinion: Since its vision was to remain the most popular and widely used guide to information on the Internet, Yahoo! should not choose those who had the potential of preventing its free development. Hence, it should choose one from KPCB and Sequoia Capital. Because the latter would invest more money and help them complete their management team, we think Sequoia Capital would be a better choice.