International - Bellevue College

advertisement

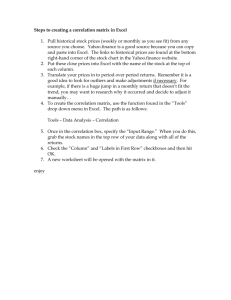

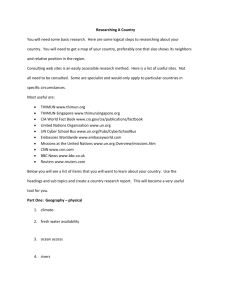

International Group Assignment (Maximum 3 to a group) Form a group with three classmates. Select a country for analysis. It is best choose a country which has an index listed in finance.yahoo.com. For your selected country prepare a power point presentation. All country choices to be preapproved by instructor. Grading Rubic All requested information (8 elements below at two points each) is given, information is indepth/correct, and sources are cited. Power point presentation is organized, professional and correct. Team can field questions and answer correctly (4 points). Extra research on the country that is relevant is provided (5 points). 1. Analyze the country’s economic situation. Include GDP, GDP growth rate, GDP per capita, inflation rate, and other economic measures in your discussion. Where do you think the economy is heading? Sources: www.cia.gov (Look for the World Factbook). Look for historical information to get trends. What is your conclusion about the economic situation of the country? 2. Analyze the country’s government and the atmosphere for business and financial markets. (Check CIA World Factbook or use links on finance.yahoo.com under International). Check for the country’s corruption index at www.transparency.org. Check its credit rating at www.moodys.com. (You must register.) 3. Look at the country’s currency versus the U.S. dollar. Where do you think the currency is going? Source: http://fx.sauder.ubc.ca/ Copy the currency chart for the past 10 years onto your power point presentation. 4. Find information about the country’s stock exchange. How has the country’s index done in comparison to the SP 500 for the past 5 years? Find this information on http://finance.yahoo.com under International/Indexes (look to left navigation) and copy the graph into your power point presentation to show the performance of the index relative to the SP 500. 5. Which companies are the largest? You can click on the Components link when you look up the index for the country in finance.yahoo.com to get the name of the companies in the index. Usually these are the biggest companies in the country. Another source for very big companies is www.forbes.com International 500 list. You can sort by country if your country is represented. You should be able to summarize what types of industries are the biggest in the country’s stock exchange. 6. Download the historical monthly prices for the country indices and the SP 500 for the past five years. Calculate the average monthly return and the standard deviation (using Excel) for both. Compare your country index to the SP 500. What are your conclusions? 7. Calculate the correlation of your country index to the SP 500. What are your conclusions about the correlation? (Use Excel and attached your worksheets to your hard copy.) 8. Based on your analysis, is it a good time to invest in this country? Why or why not? (Reflect on your risk and return requirements.)