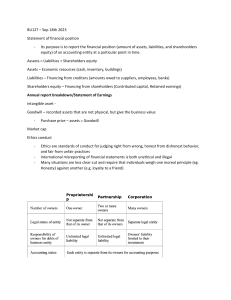

Financial Statements What is a financial statement?

advertisement

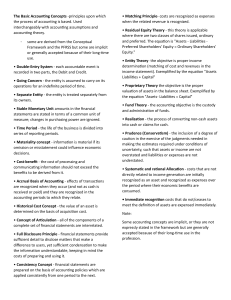

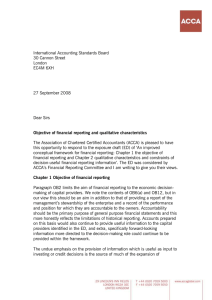

FINANCIAL STATEMENTS WHAT IS A FINANCIAL STATEMENT? Records that outline the financial activities of a business, an individual or any other entity. Financial statements are meant to present the financial information of the entity in question as clearly and concisely as possible for both the entity and for readers. Financial statements for businesses usually include: income statements, balance sheet, statements of retained earnings and cash flows, as well as other possible statements. -investopedia.com BALANCE SHEET A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders. The balance sheet must follow the following formula: Assets = Liabilities + Shareholders' Equity -investopedia.com INCOME STATEMENT A financial statement that measures a company's financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how the business incurs its revenues and expenses through both operating and non-operating activities. It also shows the net profit or loss incurred over a specific accounting period, typically over a fiscal quarter or year. Also known as the "profit and loss statement" or "statement of revenue and expense.” -investopedia.com FINANCIAL RATIOS Financial performance ratios are comparisons of a company’s financial elements that indicate how well the business is performing. Current Ratio Current assets compared to current liabilities. Return on Equity Ratio The net profit of the business compared to the amount of owners’ equity Debt to Equity Ratio The company’s liabilities divided by the owners’ equity ratio Net Income Ratio The total sales compared to the net income for a period such as six months or one year THE END