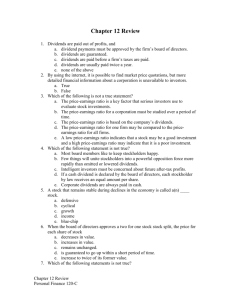

Treasury Stock

advertisement

Chapter 9 Special Acquisitions: Financing A Business with Equity Copyright 2003 Prentice Hall Publishing Company 1 The Business Cycle: Basic Business Processes The Cycle Starts Here: But We Started Here: Chapters 8 & 9: Obtain Financing: Debt and Equity Chapter 5: Acquisition/Payment: PPE Return to Owners Chapters 7: Sales/Collection: Cash, Accounts Receivable Copyright 2003 Chapters 6: Acquisition/Payment: Inventory and Human Resources Prentice Hall Publishing Company 2 Equity in Corporations The equity section for a corporation is divided into two parts: Contributed Capital (a.k.a. paid-in- capital)--this is the amount that owners have contributed Capital Stock Additional paid-in-capital Retained Earnings--this is what the company has earned over its whole life, less any dividends paid out Copyright 2003 Prentice Hall Publishing Company 3 Authorized, Issued, and Outstanding Capital Stock Authorized Shares Owned by stockholders Outstanding Shares Issued Shares Unissued Shares Treasury Shares Reacquired by corporation Copyright 2003 Prentice Hall Publishing Company 4 Common Stock Basic voting stock of the corporation Ranks after preferred stock for dividend and liquidation distribution. Dividend rates are determined by the board of directors based on the corporation’s profitability. Copyright 2003 Prentice Hall Publishing Company 5 Preferred Stock Has dividend and liquidation preference over common stock. Cumulative preferred stock has a preference for all past dividends over any paid to common shareholders. Generally does not have voting rights. Usually has a par or stated value. Usually has a fixed dividend rate that is stated as a percentage of the par value. Copyright 2003 Prentice Hall Publishing Company 6 Special Features of Preferred Stock Convertible preferred stock may be exchanged for common stock. Callable preferred stock may be repurchased by the corporation at a predetermined price. Copyright 2003 Prentice Hall Publishing Company 7 Par Value and No-par Value Stock Par value Is a nominal value per share of capital stock specified in the charter. Has no relationship to market value. Serves as the basis for legal capital. Legal capital is the amount of capital, required by the state, that must remain invested in the business. It serves as a cushion for creditors. Copyright 2003 Prentice Hall Publishing Company 8 Par Value and No-par Value Stock No-par value is capital stock that does not have an amount per share specified in the charter. When no-par stock is issued by a corporation, the amount of legal capital is defined by the state. Stated value is an amount per share that is specified by the corporation when it issues no-par stock. Copyright 2003 Prentice Hall Publishing Company 9 Accounting for Capital Stock Transactions Two primary sources of stockholders’ equity: Contributed capital Par or stated value of issued stock. Additional paid-in capital in excess of par or stated value. Retained earnings The cumulative net income earned by the corporation less the cumulative dividends declared by the corporation. Copyright 2003 Prentice Hall Publishing Company 10 Accounting for the Issue of Common Stock When stock is issued, the equity account Common Stock is credited for the par or stated value of the stock. If the stock sold for more than par, the additional amount is credited to the equity account Paid in Capital in Excess of Par, Common Stock. Copyright 2003 Prentice Hall Publishing Company 11 Accounting for Cash Dividends Dividends must be declared by the board of directors before they can be paid. The corporation is not legally required to declare (and subsequently pay) dividends. Once a dividend is declared, a liability is created. Cash dividends require sufficient cash and retained earnings to cover the dividend. Copyright 2003 Prentice Hall Publishing Company 12 Dividends on Preferred Stock Current preferred dividends must be paid before paying any dividends to common stock. If a preferred dividend is not paid, the unpaid amount is either cumulative (a dividend in arrears) or noncumulative. Cumulative: Unpaid dividends must be paid before common dividends. Noncumulative: Unpaid dividends are lost. Copyright 2003 Prentice Hall Publishing Company 13 Treasury Stock A corporation’s own stock that had been issued but was subsequently reacquired and is still being held by that corporation. Why would a corporation reacquire its own stock? To reduce the shares outstanding. Because the market price is low. To increase earnings per share. To use in employee stock option programs. Copyright 2003 Prentice Hall Publishing Company 14 Treasury Stock is considered issued stock but not outstanding stock. has no voting or dividend rights. is a contra-equity account. reduces total stockholders’ equity on the Balance Sheet. Copyright 2003 Prentice Hall Publishing Company 15 Treasury Stock Transactions Treasury stock is recorded at cost. The account, Treasury Stock, is contra to all of Equity and subtracted at the end of the section on the Balance Sheet. If the treasury stock is subsequently resold for more than the cost, another equity account, PIC Treasury Stock, would be credited for the excess over cost NO gains or losses are recorded on the purchase or on the reissue of treasury stock. Copyright 2003 Prentice Hall Publishing Company 16 Accounting for Stock Dividends Stock dividends are distributions to stockholders of additional shares of stock. Why issue a stock dividend? Low on cash. To decrease market price of stock. To increase number of stockholders (assuming some of the newly issued stock will be sold). Copyright 2003 Prentice Hall Publishing Company 17 Accounting for Stock Dividends All stockholders receive the same percentage increase in the number of shares they own (pro rata basis). No change in total stockholders’ equity. No change in par values. Effect on financial statements? Copyright 2003 Prentice Hall Publishing Company 18 Accounting for Stock Splits Distributions of 100% or more of stock to stockholders. Decreases par value of stock. Increases number of outstanding shares. No change in total stockholders’ equity. Copyright 2003 Prentice Hall Publishing Company 19 Retained Earnings What affects Retained Earnings? net income cash dividends stock dividends prior period adjustments Appropriating Retained Earnings Board of Directors can restrict portions of retained earnings (a communication device) Copyright 2003 Prentice Hall Publishing Company 20